Content

- Week in Review

- Winners & Losers

- Macro Environment

- FTX & Alameda Research’s Downfall

- Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi

- Innovation

- Altcoins

- NFTs & Metaverse

- What to Watch

- Disclaimer

- FAQs

- What were the main developments in the FTX & Alameda Research's downfall?

- How did the macro environment affect the crypto market in the week of 14th November 2022?

- What were the winners and losers in the crypto market during the week of 14th November 2022?

- What were the key technicals and order flow in the crypto market during the week of 14th November 2022?

- What were the key developments in the DeFi and Altcoins market during the week of 14th November 2022?

15 Nov, 22

Weekly Crypto Market Wrap, 14th November 2022

- Week in Review

- Winners & Losers

- Macro Environment

- FTX & Alameda Research’s Downfall

- Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi

- Innovation

- Altcoins

- NFTs & Metaverse

- What to Watch

- Disclaimer

- FAQs

- What were the main developments in the FTX & Alameda Research's downfall?

- How did the macro environment affect the crypto market in the week of 14th November 2022?

- What were the winners and losers in the crypto market during the week of 14th November 2022?

- What were the key technicals and order flow in the crypto market during the week of 14th November 2022?

- What were the key developments in the DeFi and Altcoins market during the week of 14th November 2022?

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

Week in Review

- Zerocap Article: Read our official statement on the recent FTX situation.

- Main FTX developments over the week, at the time of writing:

- Concerning balance sheet leaks, Binance liquidates FTT tokens;

- Binance CEO announces plan to acquire FTX in aid against liquidity crunch – backs away from acquisition a day later, insolvency fears grow stronger;

- FTX files for bankruptcy, first announced through a tweet – CEO resigns;

- FTX allegedly hacked, investigating $515 million in “abnormal transactions.”

- Disclosure of “Proof of Reserves” following FTX bankruptcy: Binance holds $74B in crypto, while Crypto.com’s reserves reveal a surprising 20% in meme coin Shiba Inu (SHIB).

- Ethereum turns deflationary for the first time, following Merge update.

- Meta lays off more than 11,000 employees, on growing concerns of its metaverse division.

- Australian regulator ASIC warns investors to look for signs of potential crypto scams.

- Crypto.com accidentally sends 320,000 ETH to Gate.io – “stay away, ” Binance CEO states.

- US Department of Justice seizes $3.36 billion BTC connected in 2012 Silk Road theft.

- US inflation at lowest levels since January, consumer prices rise below expectations.

- UK’s GDP report shows shrinking economy, BoE expects longest recession since the 1920s.

Winners & Losers

Macro Environment

- Global markets, seeking some long overdue inflationary relief, rebounded on the heels of Thursday’s softer-than-expected United States (US) Consumer Price Index (CPI) reading. The print saw the pace of headline inflation slow for a 4th consecutive month to +7.7% in October, paving the way for a lesser 50 bps hike in December’s FOMC meeting. The reduction in magnitude was spearheaded by slower rises in the cost of gasoline, electricity, and energy – up 17.5%, 14.1%, 17.6% respectively for the month of October. US midterm elections saw an unsure Dollar (DXY) trace lower over the potential for a 2 year period of legislative gridlock which would arise with a Republican victory in congress – in response, Thursdays CPI print triggered a steep -2.15% daily retracement, sending the DXY to a weekly low of 106.281 on Friday. Major currency pairs flourished in the midst of a weaker dollar, the AUD and JPY were standout performers. The AUD/USD pair gained +4.04% WoW hovering $0.67 heading into the weekend. A newly confident Japanese Yen regained much of its lost ground, up +3.11% on the day. The USD/JPY pair plummeted from its closely watched ¥145 USD/JPY support level and ended the week lower -4.99% at ¥139.519. US Treasury yields fell sharply, as surging demand for government bonds pushed US treasuries for their greatest daily rally in 13 years – in excess of 30 bps for both 2 & 10 Year Treasury yields. Both lower at 3.84%, and 4.34% at week-end.

- The unprecedented deceleration in inflation sparked the largest rally in equities since 2020, seeing the SPX gain 1.97% on the day, while the riskier NASDAQ 100 composite snatched gains in excess of 2.2%. Both indexes carried gains into the weekend, the SPX up 5.5% and NASDAQ at 8.4% on Friday’s close – renewed strength in markets driving the VIX lower -12% WoW.

- According to the Energy Information Administration, US crude oil inventories “rose by 3.9 million barrels in the last week,” marking the largest increase since July 2021. Onshore oil production further increased by 200,000 barrels per day, contrasting the fall in gasoline production of approximately 900,000 barrels per day. WTI dropped as low as $84.02 on Thursday, however was quick to push upwards on news that China would be reducing covid quarantine periods, and airline restrictions – market participants expecting future demand for Oil to increase as a result. WTI closed the week lower by just -1.99%, Brent falling -3.19%.

- Friday’s University of Michigan consumer sentiment index came out at 54.7 for November, down from October’s 59.9. The result fell significantly short of market expectations of 59.5. A notable contributor to the fall was the slide in projected spending on durable goods (those goods with long periods between repurchases i.e cars, televisions etc) – that particular index falling 21%. It appears as though October’s CPI print came a day too late, with consumers still begrudgingly coming to terms with higher inflation, steeper borrowing costs clamping down on household discretionary spending, and whilst bolstering inflationary expectations.

FTX & Alameda Research’s Downfall

- On November 2nd, 2022, Coindesk released an article outlining that much of Alameda Research’s US$ 14.6 billion in assets (June 30th) consisted of FTX Tokens, FTT. This token accounted for $3.66 billion ‘unlocked FTT’, $2.16 billion ‘FTT collateral’, and $292 million of ‘locked FTT’. Following, the industry began to speculate whether this was cause for concern.

- On November 7th, amidst growing FUD (fear, uncertainty and doubt) Binance’s CEO Changpeng Zhao (CZ) tweeted that Binance intended to liquidate its FTT holdings. In light of CZ’s statement which outlined Binance’s intention to gradually sell its holdings, the wider community began selling off their FTT. In response, Alameda Research’s CEO Caroline Ellison, tweeted that the trading firm would purchase Binance’s FTT for $22. This restored some confidence and FTT consequently stabilised.

- Later that day, on-chain analysts reported that FTX’s reserves were running low. The resulting spark of fear initiated a bank run and FTX endured substantial withdrawal volumes. Correspondingly, FTT’s price action suffered. In response, Sam Bankman-Fried, the CEO of FTX, stated that the exchange is processing billions of dollars of monetary flows; this has later been understood to be an attempt to placate market concerns and abate the withdrawal demand. The following day, Bankman-Fried tweeted that “FTX is fine”, with the exchange having “enough to cover all client holdings”. Further, the CEO stated that FTX does not “invest client assets”. Bankman-Fried has since deleted this Tweet.

- Bankman-Fried’s remarks failed to entirely subdue panic and participants implored the exchange to provide on-chain data or its balance sheets as evidence of reserves. On the 8th of November, the BitDAO community accused Alameda of dumping its BIT token, despite a 3-year mutual no-sale public commitment. Many extrapolated that Alameda was seeking liquidity to provide to FTX in order to facilitate withdrawals. That evening’s restrictions were made on FTX withdrawals as the exchange could not keep up with the outflows it was experiencing.

- Early the next morning, Bankman-Fried and CZ announced that Binance had signed a non-binding Letter of Intent to acquire FTX in the face of its liquidity crunch. Fear in the market reached new heights as users of FTX found themselves blocked from withdrawing their funds. Concerns regarding contagion and its effects began to run rampant.

- Around this time, Alameda Research’s website went private, Sequoia alerted its LPs that it had written its $213.5 million investment into FTX down to $0 and USDT began to depeg from $1. FTX resignations began, sparking Bankman-Fried to issue a public apology. With the revelation that FTX’s balance sheet hole equated to $10 billion after the exchange gave its customers’ deposits to Alameda, Binance withdrew from the acquisition deal. In combination with the $16 billion FTX owed its customers and insight into how Bankman-Fried’s leadership regime blurred the lines of personal and professional ties, most could speculate on the next steps for the insolvent exchange. Shortly after, FTX filed for Chapter 11 Bankruptcy and Bankman-Fried resigned as the exchange’s CEO, later filing for personal bankruptcy. The CEO role was filled by restructuring lawyer, John J. Ray, III; Ray was previously the Chief Restructuring Officer at FTX and was involved in cleaning up Enron after the accounting scandal.

- Subsequent to these events, many revelations have emerged, the most notable being that due to Alameda’s exposure to Terra/Luna, FTX bailed them out when Bankman-Fried transferred $10 billion to the quantitative trading firm without alerting FTX executives. It was also discovered that FTX lied about an order from regulators in the Bahamas; the exchange tweeted that it was facilitating withdrawals of Bahamian funds as per regulations its Bahamian headquarters faced. The Securities Commission of The Bahamas later stated that it had not directed or suggested the prioritisation of such withdrawals.

- The disaster worsened after remaining user funds on FTX were exploited off the exchange through the use of a backdoor. An estimated $600 million was drained from FTX’s wallets.

Technicals & Order Flow

Bitcoin

- Last week, Bitcoin opened at the 20,900 level before downward bias took hold of action. Facing continued and aggressive selling, the 19,650 support faltered. Significant long liquidations on Tuesday acted to catapult the price through 18,700, a key psychological level having formed since Terra’s capitulation. By mid-week, BTC hit multi-year lows of 15,632. While a late-week shift in sentiment lifted action, the 18,000 level was rejected, suggesting its relevance as short-term resistance. Price reverted lower into the weekend closing -21.96% WoW.

- Early week action was dictated by risk-off and fear spun up from FTX’s bankruptcy. Bitcoin’s move below weekly lows was fueled by the unwinding of long futures positions with long liquidations totalling 550m on Tuesday.

- Broader market sentiment uplifted off the back of U.S. inflation data coming in lower than expectations on Thursday. Alongside equities, Bitcoin moved higher, gaining 7.3% in less than 30 minutes following the print. However, overarching fear and the rumours of further insolvencies saw BTC lower into the weekend.

- Amid the current market turmoil, concerns regarding counterparty risk and the security of funds have arisen. Initially prompted by the bankruptcy of FTX, fears of further insolvency have led to significant amounts of BTC being drained from exchanges in favour of self-custody solutions.

- Concerns of further miner capitulation have reentered the spotlight. Reflected by Bitcoin’s mining difficulty, network security is at an all-time high. However, due to Bitcoin’s diminished price, miners operate at a higher cost than the block rewards and transaction fees earned from operations. Last week, outflows from miner addresses showed a notable uptick, behaviour that is suggestive of miners selling BTC to fund operations. A continuation of this narrative could result in sustained increased selling pressure.

- Since July, Bitcoin’s implied volatility has gradually diminished. However, in the presence of extreme uncertainty, we saw volatility get bid up as investors moved to hedge downside exposure.

- Bitcoin’s action was primarily dictated by the impact of FTX’s bankruptcy. While initially proving favourable, inflation data out of the U.S. acted only as a temporary bolster. Overarching and persisting fears acted to push Bitcoin’s price lower into the week’s close. Participants are clearly moving out of exchanges in favour of relatively more secure custody solutions like those offered by Zerocap. Correspondingly, the cost of mining operations continues to increase, while revenues remain confined by Bitcoin’s diminished price. As participants await any lagged effects of FTX’s fall, we’ll likely see downside protection strategies continue to be valued.

Ethereum

- Ethereum initiated last week’s action with a prompt retest of topside resistance placed at 1,610. However, market-wide risk-off sentiment flowed into Ethereum pushing the price lower and below the 1,330 support. Notably, the 1,072 support was firmly protected, affirming its strength as support moving forward. Later, alongside Bitcoin, Ethereum lifted higher but found resistance at the previous support level of 1,330. Moving forward we’ll likely see action remain range bound with any further insolvencies prompting volatility.

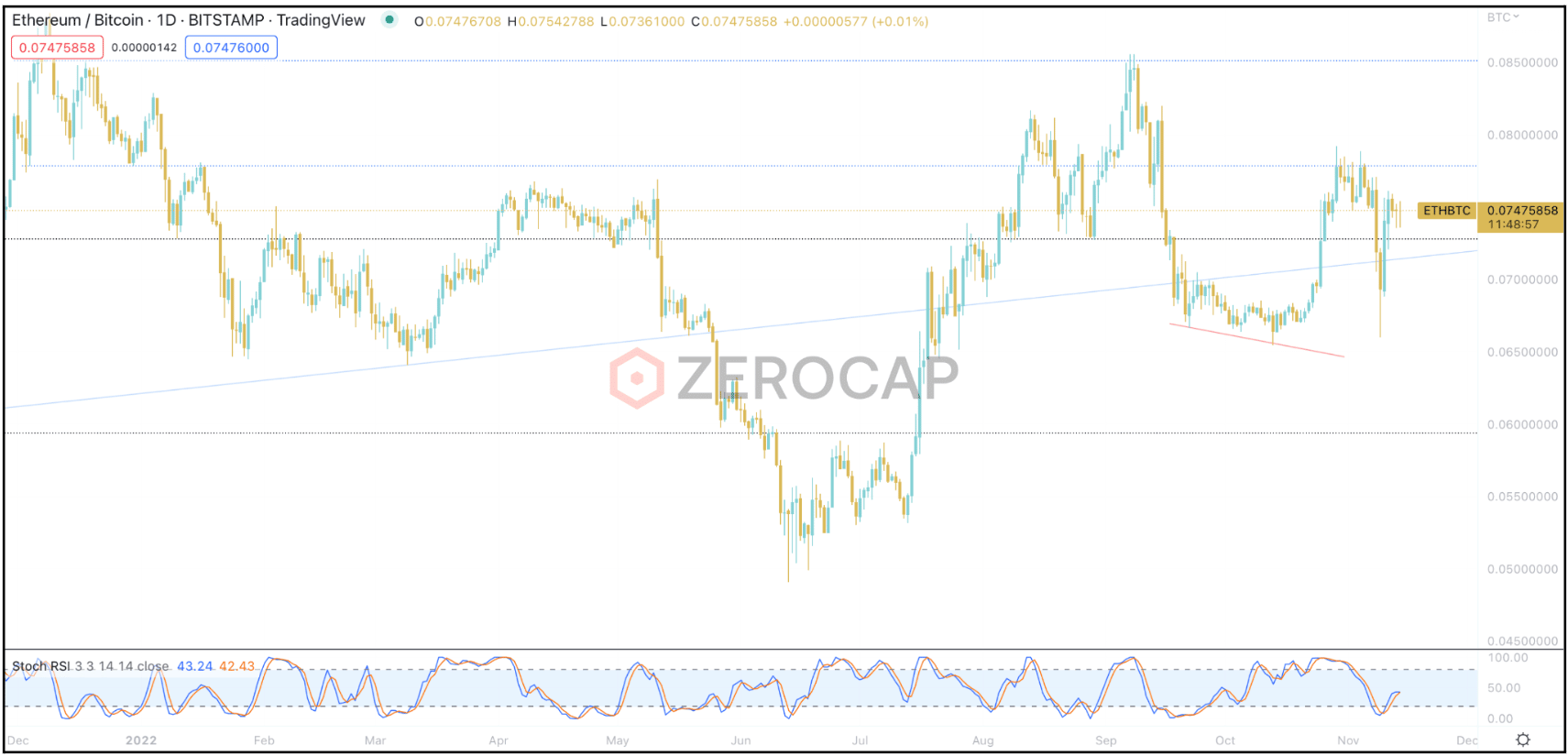

ETHBTC Daily Chart

- Behaving inline with its expected behaviour in periods of risk-off sentiment, the ETH/BTC pair edged lower. We saw price breakdown to the 0.0664 support before reverting higher off the back of improved sentiment. Into the later parts of the week, action found resistance at 0.0758. The pair is now consolidating around the 0.075 level. It is likely that we see the pair continue sideways in the short term with any further drivers of risk-off causing the pair to continue lower.

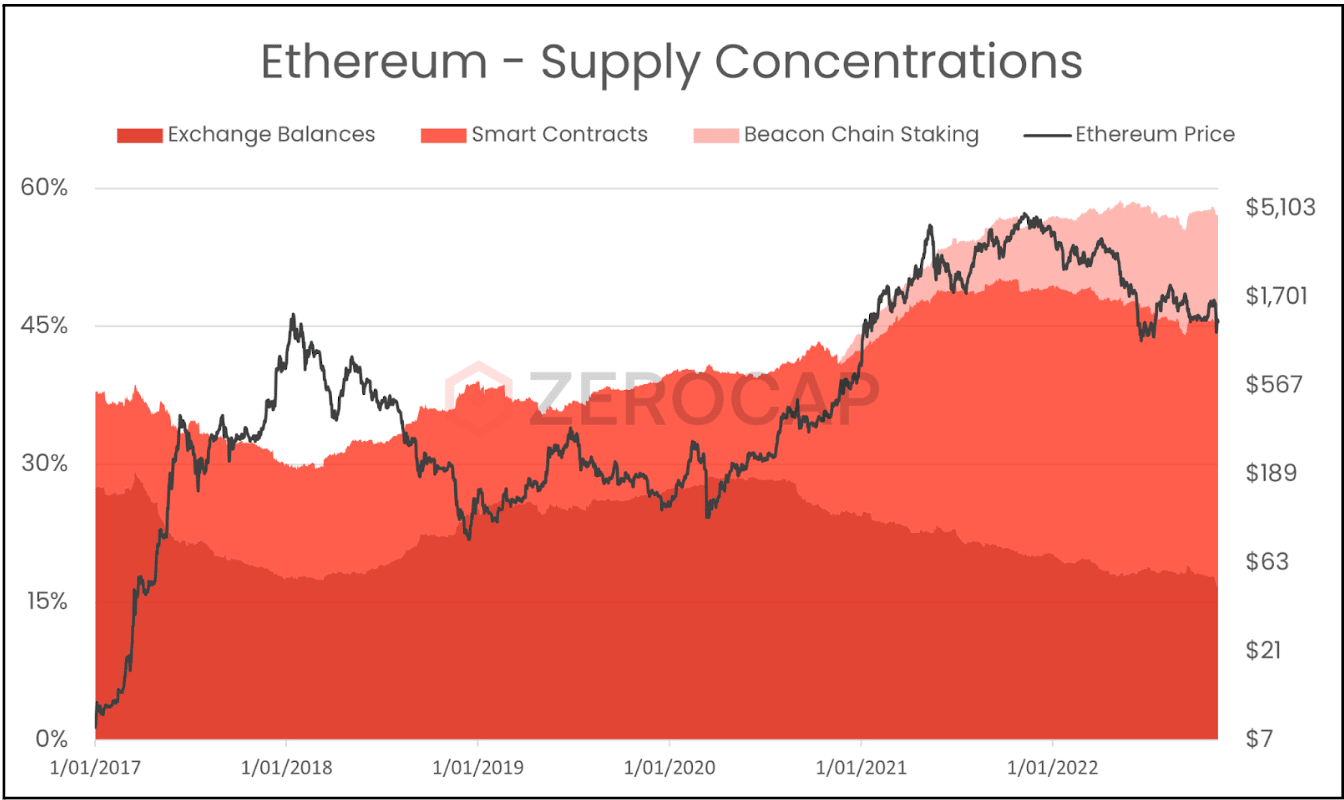

- During last week, the proportion of ETH in supply concentrated in smart contracts reached an all time high since the Merge. Notably, it is surprising that usage of Ethereum-based smart contracts is rallying to new heights amidst the bear market. Traditionally, during these phases of the market, transaction volume falls alongside concentration of ETH in smart contracts as the number of profitable trades shrink. However, it appears that in this bear market, due to the financial instruments accessible through DeFi protocols, many are putting their ETH into smart contracts to leverage these instruments and generate profits.

- After the public discovered that FTX had been transferring client withdrawals to Alameda Research, many began the shift to custodying their crypto on a web3 wallet, rather than relying on exchanges. Subsequently, prior to FTX halting their withdrawals, its users, along with the users of other popular exchanges, began selling their tokens for USDT and transferring them into self-custody wallets, including MetaMask and Trust Wallet. Accordingly, the total stablecoin transfer volume increased by over 100% WoW, reaching over $305 billion in the last 7 days.

- Looking at option data out to the 25th November expiry, we can see a concentration of open interest between the 1,600 and 2,000 strikes for calls. Expiry below these strikes would result in significant pain for traders making bullish plays. It will be important to analyse the growth of open interest for puts around current levels as it will provide clarity on market sentiment and the desire for downside protection strategies.

- The token supply of Ethereum became deflationary over the past week, officially falling below the supply of ETH at the time of The Merge. Since the event, the supply of ETH has decreased by over 5.7k as a result of the gas fees burnt per transaction under EIP-1559. Notably, if it were not for the issuance reduction heralded by The Merge, the supply of ETH would have increased by more than 703k in the last 59 days. In the last 7 days, the extrapolated issuance rate was as low as -0.005%. If gas fees remain above 15 Gwei, this issuance rate will remain negative.

DeFi

- Amid FTX’s bankruptcy, FUD has spread to tokens that FTX Ventures and Alameda Research had invested in – most notably, Solana. Last week, the total value locked (TVL) into Solana-based DeFi protocols plummeted 63% from $1 billion to just over $370 million. The decrease in TVL is reflected in the price action of SOL, which is down more than 33% in the same period. Throughout the year, Solana has faced numerous outages, exploits and other attacks; the impact of FTX might be the nail on the coffin which mitigates token and DeFi ecosystem growth.

- Serum, a DeFi liquidity protocol created and funded by Bankman-Fried, has been forked for the benefit of Solana’s DeFi ecosystem due to the platform’s TVL falling after FTX became insolvent. Developers and Anatoly Yakovenko, co-founder of Solana, forked Serum, altering upgrade authority and fee revenues, managing all value with a multi-sig wallet. With many protocols relying on Serum’s markets for liquidity, value and liquidations, a fork of the DeFi platform was necessary given that a relevant private key was connected to FTX, hence compromised. Subsequent to the fork, liquidity providers, including Solana’s Jupiter, turned off Serum as a liquidity source.

Innovation

- After it was revealed that FTX was transferring customer deposits to Alameda Research, CZ tweeted that all centralised exchanges should create Merkle Tree inspired Proofs to depict their reserves. Further, CZ wrote that exchanges should additionally provide details of their hot and cold addresses. In response, Chainlink Labs, the company behind the decentralised oracle network, Chainlink, outlined that its Chainlink PoR product verifies off-chain assets and relays the reserve amounts on-chain. Given that this product has already been launched, centralised exchanges can simply plug this into their system and have it verifiable by its users.

Altcoins

- As previously noted, most tokens with exposure to FTX, Alameda Research and its other firms, have faced substantial sell pressure over the past week. Among these tokens, include FTX’s own FTT, SRM and SOL, which are respectively down 94%, 77% and 33%. Moreover, other projects that have received funding from these firms’ venture arms are scrambling to avoid problems relating to FTX and Alameda dumping tokens to increase liquidity. One solution has been for projects to buy back its stake – LayerZero has voted to respond this way, reaching an agreement with FTX Ventures and Alameda Research to purchase 100% of their stake.

- Crypto.com’s CRO token also endured meaningful downward selling pressure throughout last week as many of its customers sought to withdraw their tokens from the exchange. Portions of the fears relating to FTX’s crisis extended to Crypto.com due to the exchange “accidentally” transferring over 300k ETH, worth over $360 million, to Gate.io – another cryptocurrency exchange. Despite Crypto.com’s CEO, Kris Marszalek, tweeting that this mistake had been rectified and processes were being established to prevent it from occurring again, many in the community were reminded of when Crypto.com intended to refund one of its users $100 but instead transferred just under $10.5 million. In light of the FTX crisis and information regarding Crypto.com, the exchange’s token, CRO, has fallen over 30%.

NFTs & Metaverse

- With FTX users looking for roundabout ways to withdraw their funds from the insolvent exchange, FTX has halted withdrawals via its NFT marketplace. Purchasing and selling NFTs on the marketplace had given non-Bahamian residents a means to withdraw their funds. As such, the marketplace tracked over $50 million in volume in a 24-hour time window. Although bids are still being placed on FTX’s NFT marketplace, using the platform as an exit ramp is no longer available.

- Developers in the Optimism ecosystem released a tool last week called Magic Mirror which allows NFT holders to mirror their Optimism-based NFTs on the Ethereum mainnet. The motivation behind this product was to enable Optimism NFTs to be used on web2 platforms, like Twitter and Facebook, that have integrated Ethereum NFTs. The creation of Magic Mirror was pushed by the Optimism Foundation in an attempt to capture more demand relating to layer 2, scaling solutions for Ethereum.

What to Watch

- The FTX chaos – reputable firms with large exposures to the failing exchange and its token, global regulators eyeing their crackdown moves, bankruptcy procedures begin; the ripple effect is nowhere near its end, so what comes next?

- UK and Australia’s monetary policy report and meeting minutes, on Monday.

- US’ Manufacturing Index and PPI, on Tuesday.

- UK’s CPI and US’ Core Retail Sales, on Wednesday.

Disclaimer

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

FAQs

What were the main developments in the FTX & Alameda Research’s downfall?

The downfall of FTX and Alameda Research was marked by several key events. These include balance sheet leaks leading to Binance liquidating FTT tokens, Binance’s CEO announcing plans to acquire FTX to aid against a liquidity crunch, FTX filing for bankruptcy, and FTX being allegedly hacked with $515 million in “abnormal transactions”. Additionally, the disclosure of “Proof of Reserves” following FTX’s bankruptcy revealed that Binance holds $74B in crypto, while Crypto.com’s reserves revealed a surprising 20% in meme coin Shiba Inu (SHIB).

How did the macro environment affect the crypto market in the week of 14th November 2022?

The macro environment had a significant impact on the crypto market during this week. The pace of headline inflation slowed for a 4th consecutive month to +7.7% in October, leading to a lesser 50 bps hike in December’s FOMC meeting. This, along with other factors, led to a weaker dollar, which in turn affected major currency pairs. The AUD/USD pair gained +4.04% WoW hovering $0.67 heading into the weekend. A newly confident Japanese Yen regained much of its lost ground, up +3.11% on the day. The USD/JPY pair plummeted from its closely watched ¥145 USD/JPY support level and ended the week lower -4.99% at ¥139.519.

What were the winners and losers in the crypto market during the week of 14th November 2022?

The article does not provide specific details on the winners and losers in the crypto market for the week of 14th November 2022. However, it does mention that the week was marked by significant market turmoil, with Bitcoin and Ethereum experiencing substantial price drops.

What were the key technicals and order flow in the crypto market during the week of 14th November 2022?

During this week, Bitcoin opened at the 20,900 level before downward bias took hold of action. Significant long liquidations on Tuesday acted to catapult the price through 18,700, a key psychological level. By mid-week, BTC hit multi-year lows of 15,632. Ethereum initiated last week’s action with a prompt retest of topside resistance placed at 1,610. However, market-wide risk-off sentiment flowed into Ethereum pushing the price lower and below the 1,330 support.

What were the key developments in the DeFi and Altcoins market during the week of 14th November 2022?

Amid FTX’s bankruptcy, FUD has spread to tokens that FTX Ventures and Alameda Research had invested in – most notably, Solana. Last week, the total value locked (TVL) into Solana-based DeFi protocols plummeted 63% from $1 billion to just over $370 million. The decrease in TVL is reflected in the price action of SOL, which is down more than 33% in the same period. Crypto.com’s CRO token also endured meaningful downward selling pressure throughout last week as many of its customers sought to withdraw their tokens from the exchange.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post