Content

- Week in Review

- Winners & Losers

- Macro, Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi & Innovation

- What to Watch

- Insights

- FAQs

- What significant events occurred in the crypto market during the week of 14th June 2021?

- How did Bitcoin and Ethereum perform during the week, and what were the key factors influencing their price?

- What are the details of Bitcoin's Taproot update, and when is it expected to be released?

- What were the major winners and losers in the crypto market for the week?

- What are the potential implications of El Salvador officially adopting Bitcoin as legal tender?

- Disclaimer

14 Jun, 21

Weekly Crypto Market Wrap, 14th June 2021

- Week in Review

- Winners & Losers

- Macro, Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi & Innovation

- What to Watch

- Insights

- FAQs

- What significant events occurred in the crypto market during the week of 14th June 2021?

- How did Bitcoin and Ethereum perform during the week, and what were the key factors influencing their price?

- What are the details of Bitcoin's Taproot update, and when is it expected to be released?

- What were the major winners and losers in the crypto market for the week?

- What are the potential implications of El Salvador officially adopting Bitcoin as legal tender?

- Disclaimer

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Our investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security. To learn more, contact the team at hello@zerocap.com or visit our website www.zerocap.com

Week in Review

- US inflation climbs to the highest rate since 2008, with consumer prices surging 5% in May alone.

- S&P 500 registers turbulent week closing at record-highs, with the Dow Jones Index fluctuating to a circa 1% loss for the week.

- Bitcoin’s first update in four years is approved for November release. “Taproot” is set to unlock higher network efficiency, scaling technology and privacy improvements.

- Texas allows state-chartered banks to provide crypto custody services.

- Goldman Sachs invests in blockchain firm Blockdaemon.

- El Salvador officially becomes the first country to use bitcoin as legal tender, and plans to mine crypto using volcanoes as the IMF sets meetings to update regulatory measures.

- Jack Dorsey: Twitter’s integration of bitcoin’s lightning network is “only a matter of time.”

- Berkshire Hathaway invests $500 million in Nubank, a Brazilian digital bank that will soon provide crypto investments following its Easynvest acquisition.

- CoinBase partners with retirement providers for crypto 401k options.

- Central banks of France and Switzerland to trial the first cross-border CBDC system.

- Hong Kong Monetary Authority plans CBDC development.

- Square seeks to develop a bitcoin hardware wallet.

Winners & Losers

- The week began with BTC tumbling out of its previous range to a low of US$31,025 before a significant bid was found on the back of news that El Salvador had successfully amended their law to recognise BTC as legal tender. After regaining support within the aforementioned range, the asset continued to gain momentum, closing the week at US$39,015 to record an 8.94% gain.

- Despite bitcoin’s surge this week, ETH headed the other way, as further correlation de-coupling occurred. A BTC focused news cycle this week drove the negative correlation, but it is indicative of a broader trend as both assets gain traction on very different use-cases. Overall, ETH recorded a -7.42% loss, closing the week at US$2,510.

- The US10Y dropped to its lowest in three months this week at 1.43, recording a -9.68% loss., despite record inflation numbers.

- Gold held its range for the majority of the week. US consumer price data showed the country’s largest annual spike in nearly 13 years, however, general market sentiment is holding the stance that this is transitory. As such, hedge driven flows into gold are muted as a result. Overall, a -0.88% loss was recorded WoW.

- Equity markets continued their slow bid – with the S&P 500 and the NASDAQ recording new ATH’s. Overall, they recorded 0.39% and 1.19% respectively. Notably the Dow did not follow suit.

Macro, Technicals & Order Flow

Bitcoin

- BTC held its range this week after a false break below 34,000. Key levels are 34,000 support and 40,000 resistance.

- The move back into the range has largely been driven by El Salvador’s news that they are accepting BTC as legal tender. This is a massive event, and if BTC was on a run to the topside, this could very well have been the impetus to break above all-time highs again. We are still in a fairly volatile environment with the recent blow-off, so the reaction to the news has been rather muted.

- The market was nondescript at our last weekly update from a fundamental and on-chain perspective. We are continuing to see widening divergent data points this week.

- On-chain data is showing a marked reduction in the number of active bitcoin addresses which is normally a bearish indicator. Conversely, we are seeing reductions (slight) in the amount of Bitcoin on exchanges, which generally indicates less selling pressure.

Number of Active Bitcoin Addresses

Bitcoin Net Transfer Volume from/to Exchanges

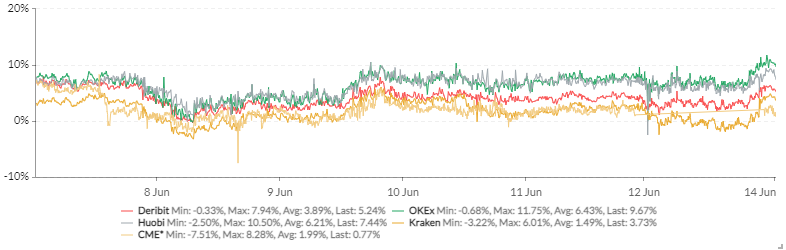

- In derivatives markets, the futures basis curve has been steepening throughout the week, however the perpetual funding rates have been negatively weighted. These are contradicting signs.

BTC Futures Annualised Rolling 1 Mth Basis

BTC Perpetual Swaps Funding

- From the global macro perspective – we’ve just had an unexpected pop in US wage growth figures, and the fastest consumer inflation jump since 2008. We’ve held that BTC will perform as a hedge in an inflationary environment. Over the course of the last year, BTC has been well bid as a hedge against QE, but has also been the benefactor of liquidity (stimulus) driven flows – pushing it higher than it may otherwise would have sailed in such a short period. The challenge with liquidity-driven flows and leverage is that it also allows short-term speculators and ‘weak hands’ to exacerbate downside moves. I believe at the moment we are seeing a three-participant market in Bitcoin – unleveraged institutional buyers that have patience, passive hedge driven flows (that have not yet fully participated on sustained inflation data) and speculative flows (leveraged, or otherwise). The run-up to 60K saw all these participants on the same side of the fence, and now we are seeing divergence. Combine this with mad speculative hype in the broader altcoin market, this has led to a fairly aggressive correction, and now – divergent cues as to the next short-medium term move.

- The Fed meets this coming week, and will likely attempt to alleviate fears that QE will slow down, whilst at the same time alluding to future tapering, all while telling everyone that inflation is transitory. It’ll be interesting to see how Bitcoin reacts to the broader market sentiment during and after this meeting. Ongoing elevated inflation figures, what this does to the taper timeframe and equity markets, and importantly, how bitcoin reacts to this could be the impetus for the next move. Keep an eye on it!

Bitcoin Dominance vs Whole Crypto Market

Grayscale Bitcoin Trust (GBTC) Premium

Bitcoin Percent Balance on Exchanges – All Exchanges

BTC Futures Annualised Basis – Current

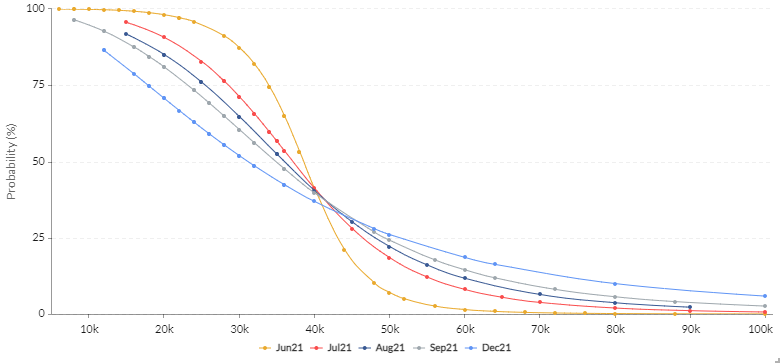

Probability of BTC being above x$ per maturity

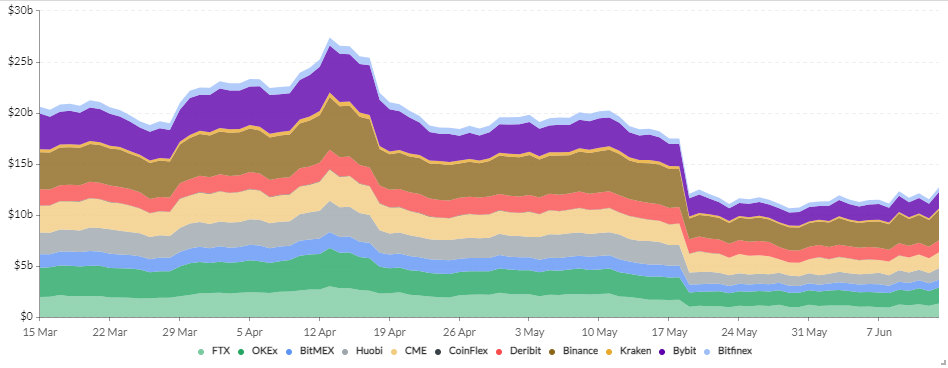

BTC Futures – Aggregated Open Interest

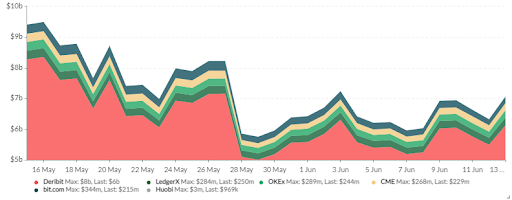

Total BTC Options Open Interest

Ethereum

- ETH is forming an ascending channel, holding support at 2,250. The key resistance level to the topside is 3,000 the figure. A break and hold above here is inherently bullish.

- 1% of Bitcoin supply is now locked Wrapped onto Ethereum, a huge milestone. We believe we’ll be seeing more use cases for BTC in the Defi ecosystem in the near future – with the Bitcoin Taproot upgrade and sophisticated side-chains working on new and interesting ways to cross-leverage blockchains. This is interesting, because El Salvador could be a use case for state-wide Dapps using BTC as the functioning currency.

- The shorter-term derivatives markets are showing a ranging futures basis curve. In the medium-term on-chain data is pointing to a relatively bullish environment with exchange outflows on longer timeframes are continuing. However, from a fundamental perspective, we’ve seen some huge investments recently in layer 1 competitors. Solana, for example, has recently closed an equity round injecting $314M into the treasury. This said, the EIP 1559 upgrade is just around the corner, which could bring the next wave of activity on the incumbent smart-protocol.

- All of this points to a less certain shorter-term market sentiment, but strong positive convexity in the medium to long-term.

- The total value locked in DeFi projects saw a -9.31% decrease this week to $60.81 billion as the sector struggled to bounce back after the BTC led drop earlier in the week.

- The amount of ETH in the ETH 2.0 staking contract currently sits at 5,528,322, an increase of 3.54% from last week. This represents 4.75% of the total supply estimated to remain locked for ~ one year, continuing to constrict supply.

Ether Percent Balance on Exchanges – All Exchanges

ETH Futures Annualised Rolling 1 Mth Basis

Probability of ETH being above x$ per maturity

DeFi & Innovation

- Nvidia CEO claims society is on the verge of a virtually connected “metaverse” based on blockchain networks and NFTs.

- Curve Finance releases the first heterogeneous asset pool, yield-pairing assets from different networks.

- Solana raises $314 million in funding round towards faster blockchain development.

- Yearn.Finance’s founder Andre Cronje provides $10 million in funding round for Instadapp.

- Alpha Finance announces incubator program to host DeFi projects within Alpha network.

- Synthetix hosts design challenge for users to improve protocol’s UI/UX.

What to Watch

- The US inflation peaks, with consumer prices rising rapidly. The Fed and White House maintain the stance that such levels are expected, transient, and part of the economic recovery. As the market shrugs off inflationary concerns and budget plans stay on track, is the administration right?

- Bitcoin’s Taproot update seeks to optimise the network’s efficiency, scaling technology and privacy. It will also improve the blockchain with smart contracts functionality, allowing for more complex contracts and lower transaction costs. Could this bring new market interest in bitcoin?

- As bitcoin officially becomes legal tender in El Salvador, several questions arise on monetary policies and regulations worldwide. Will nations change their definition of bitcoin, now that it can be treated as a country’s national currency? Will it open doors for bitcoin to be used in international trade? Important updates may come soon from the IMF, who are currently holding several meetings with El Salvador to optimise economic governance measures.

Insights

- Central Bank Digital Currencies: Advantages, impact and privacy concerns – Several nations are announcing their CBDC projects, which will certainly leave a mark on the financial markets and our routines. We address what CBDCs are, the sociopolitical pros/cons for such digital currencies and their potential impact on the crypto ecosystem.

FAQs

What significant events occurred in the crypto market during the week of 14th June 2021?

US inflation reached its highest rate since 2008, Bitcoin’s Taproot update was approved, El Salvador became the first country to use Bitcoin as legal tender, and Texas allowed state-chartered banks to provide crypto custody services. Other notable events include Goldman Sachs investing in Blockdaemon and Berkshire Hathaway investing in Nubank, a Brazilian digital bank planning to provide crypto investments.

How did Bitcoin and Ethereum perform during the week, and what were the key factors influencing their price?

Bitcoin recorded an 8.94% gain, closing the week at $39,015, influenced by El Salvador’s decision to recognize BTC as legal tender. Ethereum, on the other hand, recorded a -7.42% loss, closing at $2,510. The divergence in performance was driven by different use-cases and a BTC-focused news cycle.

What are the details of Bitcoin’s Taproot update, and when is it expected to be released?

The Taproot update for Bitcoin is set to unlock higher network efficiency, scaling technology, and privacy improvements. It will also enhance the blockchain with smart contract functionality, allowing for more complex contracts and lower transaction costs. The update has been approved for release in November.

What were the major winners and losers in the crypto market for the week?

Bitcoin was a major winner, recording an 8.94% gain, while Ethereum recorded a loss of 7.42%. The US 10-year yield dropped to its lowest in three months, recording a -9.68% loss. Gold recorded a -0.88% loss, and equity markets like the S&P 500 and NASDAQ recorded gains.

What are the potential implications of El Salvador officially adopting Bitcoin as legal tender?

El Salvador’s adoption of Bitcoin as legal tender raises questions about monetary policies and regulations worldwide. It may lead to changes in the definition of Bitcoin by other nations and open doors for Bitcoin to be used in international trade. The IMF is currently holding meetings with El Salvador to optimize economic governance measures, and important updates may come soon.

Disclaimer

This document has been prepared by Zerocap Pty Ltd, its directors, employees and agents for information purposes only and by no means constitutes a solicitation to investment or disinvestment. The views expressed in this update reflect the analysts’ personal opinions about the cryptocurrencies. These views may change without notice and are subject to market conditions. All data used in the update are between 7 Jun. 2021 0:00 UTC to 13 Jun. 2021 23:59 UTC from TradingView. Contents presented may be subject to errors. The updates are for personal use only and should not be republished or redistributed. Zerocap Pty Ltd reserves the right of final interpretation for the content herein above.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | CRBQX | U.S. 10Y |

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 4th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post