Content

- Week in Review

- Winners & Losers

- Macro, Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi & Innovation

- What to Watch

- FAQs

- Q: What were the significant developments in the crypto market for the week ending 10th May 2021?

- Q: How did Bitcoin and Ethereum perform during the week?

- Q: What were the major events in the DeFi and innovation space for the week?

- Q: What are the key aspects to watch in the crypto market?

- Q: What services does Zerocap provide?

- Disclaimer

10 May, 21

Weekly Crypto Market Wrap, 10th May 2021

- Week in Review

- Winners & Losers

- Macro, Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi & Innovation

- What to Watch

- FAQs

- Q: What were the significant developments in the crypto market for the week ending 10th May 2021?

- Q: How did Bitcoin and Ethereum perform during the week?

- Q: What were the major events in the DeFi and innovation space for the week?

- Q: What are the key aspects to watch in the crypto market?

- Q: What services does Zerocap provide?

- Disclaimer

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Our investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security. To learn more, contact the team at [email protected] or visit our website www.zerocap.com

Week in Review

- The Dow Jones Index and S&P 500 rises to new highs once again.

- S&P 500 Dow Jones Indices establishes an S&P Bitcoin Index, S&P Ethereum Index and S&P Crypto Mega Cap Index.

- Goldman Sachs launches Bitcoin derivatives offering to Wall Street and leads a $15 million funding round for Coin Metrics.

- Citibank considers offering crypto trading, custody and financing services.

- Galaxy Digital agrees to acquire BitGo, a digital asset custody provider, for $1.2 billion.

- The Digital Currency Group authorises an additional $500 million in GBTC shares.

- eBay is reviewing cryptocurrency as a form of payment and potentially integrating NFTs on its platform.

Winners & Losers

- Bitcoin continued to recover from its flash crash in recent weeks, with a slight slip back to support around the US$53,000 level before continuing to climb higher at a steady pace. Despite bullish news coming out of Goldman Sachs, adoption fundamentals had a less than expected impact on the price action seen in Bitcoin this week.

- Ethereum is leading the way as the protocol with the most capital inflows. The continued price appreciation has gone parabolic at the conclusion of the week – increasing the weekly gain by a whopping 33.07%. BTC recorded a 3.01% gain WoW.

- With mixed messages in Janet Yellen’s briefing, the US10Y had a negative week. Yellen insisted that inflation is under control. Negative US jobs data also contributed to suppressed yield this week, leading to a -2.44% drop WoW.

- On the back of dropping yields, the opportunity cost of bullion ownership was lowered, forcing a notable amount of institutional investors into the asset this week. The longer US10Y rates stay down, gold’s appeal could continue to increase. Overall, the asset recorded a 6.35% gain WoW.

- Equity markets continued their climb to new highs, with the S&P recording US$4,238 before the weekly close. The VIX saw a few spikes this week, primarily due to macroeconomic news flow surrounding US jobs data and vaccines. The VIX ended the week -10.51% down.

Macro, Technicals & Order Flow

Bitcoin

- Bitcoin edges higher this week, closing above the pivotal 58,000 level. The asset is holding its range after a pinbar pattern was rejected at the ascending trendline from Dec 2020. Given ETH’s moves, and newsflow out of Goldman Sachs and associated instos, we expect BTC to test 62,000 this week and make a play for new highs in the coming weeks.

- Goldman Sachs’ listing of Bitcoin derivatives on Wall Street is a definitively bullish catalyst. This said, the trillion-dollar asset is maturing, making it increasingly difficult to rally based on newsflow alone. Ultimately we forecast dampening volatility in the longer-term for this reason.

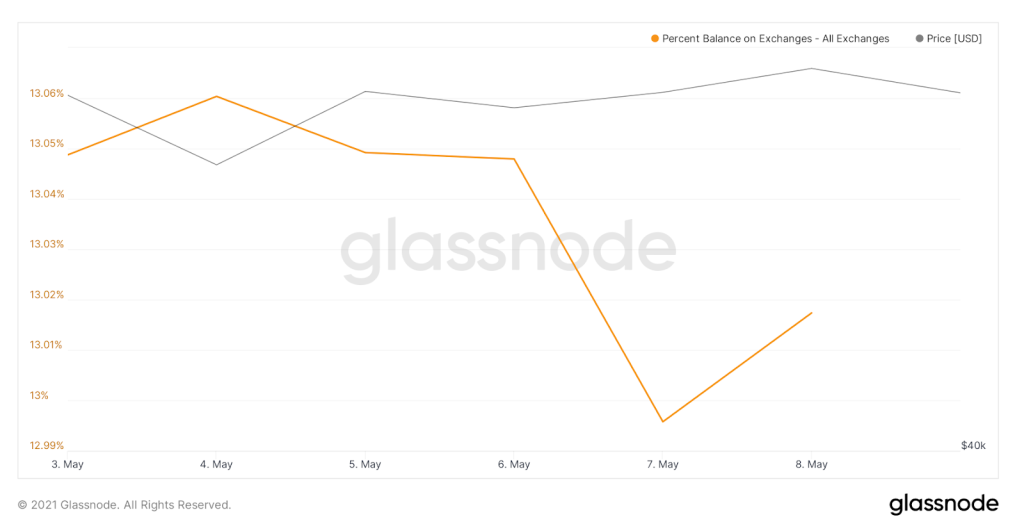

- BTC outflows from exchanges trended lower this week and the futures basis continues to edge higher, indicating more topside.

- Notably, the CME futures and Crypto futures continue to diverge in annualised return spreads. This is a function of more institutional interest shorting CME features to earn premiums and increasingly leveraged longs hitting the crypto exchanges. ETFs and index products will continue to drive divergence here, and ultimately compress the market-wide basis in the long-term.

Ethereum

- We mentioned last week the break of highs was done on limited open interest and leverage, and that this could indicate a sustainable break. This certainly seems to be the case with ETH pumping through 4,100 as I write this. The asset has no prior order levels up here, and it’s tough to pick any levels until we get some consolidation. I would not be shorting or taking any profits at these levels – there is some weight behind this move.

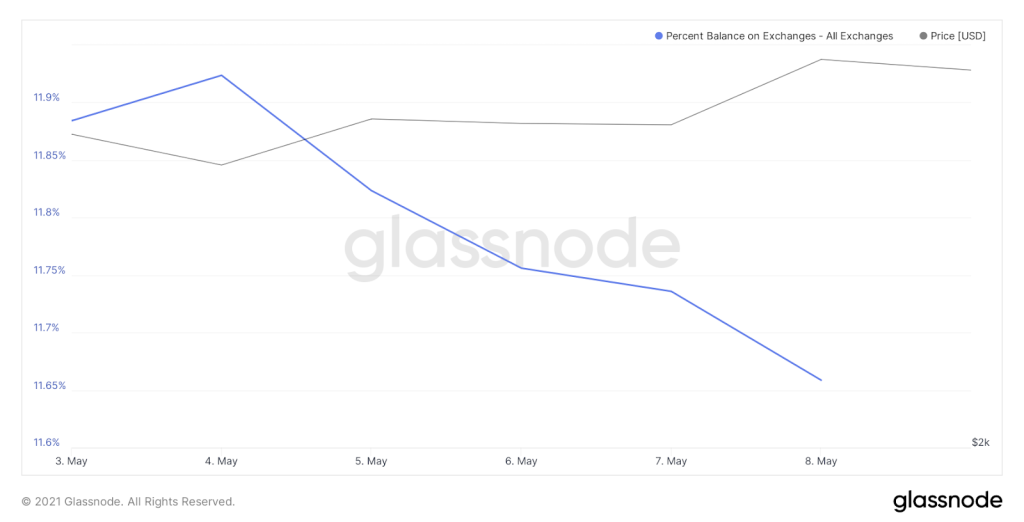

- ETH outflows persist on exchanges, and is accelerating, indicating short-term supply compression. Futures basis is up and rising.

- The amount of USDC issued crosses $15 billion and the total value locked in DeFi projects rose again to $83.44 billion, a 22.2% increase from last week, continuing to cement Ethereum as the base layer for the crypto economy.

- Volumes on ETH CME Futures pick up steam, going from <$100 million in daily volume to daily highs of >$500 million, signalling increasing institutional interest in the global settlement layer.

- The amount of ETH in the ETH 2.0 staking contract currently sits at 4,420,738, an increase of 7.57% from last week. This represents 3.82% of the total supply estimated to remain locked for ~ one year, continuing to constrict supply.

- The increasing amount of staked ETH illustrates ETH’s triple point asset narrative: a yield generating store of value that creates economic value on its global settlement layer.

- Despite ETH’s value and potential, retail attention has shifted towards altcoins, such as Dogecoin, as influencers and retail traders market them as a potential 100x on their money. The market has a concerning level of ‘froth’ at the moment. For those holding altcoin positions, be wary. We are lightening up non-core altcoins that we’ve held for a long period. We are however continuing to hold DeFi related projects with strong fundamentals.

DeFi & Innovation

- Uniswap V3 launches, showcasing its capital efficiency throughout the week, with the ratio of volume over liquidity sitting at 85%.

- Thorchain’s guarded launch raises its liquidity pool caps by ~$25 million, filled in hours.

- AAVE captures a total of $17 billion in liquidity after launching its liquidity mining program.

- Yearn Finance smashes through $4 billion in AUM.

- Sushiswap introduces new tokenomics that incentivise holding.

- Nick Chong explains MakerDao.

- Consensys publishes Q1 DeFi report.

- IDEX introduces hybrid liquidity, combining AMMs and order books.

What to Watch

- Bitcoin continues to consolidate prices from February 2021. With positive newsflow coming through each week, is the asset winding up to crush new highs with Ethereum soon?

- Ethereum continually breaks all-time highs with low leverage throughout the first two weeks of the run, a very positive sign for the asset. Will we see this continue as leveraged positions build in the coming weeks?

FAQs

Q: What were the significant developments in the crypto market for the week ending 10th May 2021?

A: The Dow Jones Index and S&P 500 reached new highs, and S&P 500 Dow Jones Indices established Bitcoin, Ethereum, and Crypto Mega Cap Indices. Goldman Sachs launched Bitcoin derivatives, Citibank considered offering crypto services, Galaxy Digital agreed to acquire BitGo, and eBay reviewed cryptocurrency as a payment form.

Q: How did Bitcoin and Ethereum perform during the week?

A: Bitcoin continued to recover from its flash crash, with a slight slip back to support around the US$53,000 level before climbing higher. Ethereum led the way with capital inflows, with its price appreciation going parabolic, increasing the weekly gain by 33.07%. BTC recorded a 3.01% gain WoW.

Q: What were the major events in the DeFi and innovation space for the week?

A: Uniswap V3 launched, showcasing its capital efficiency. Thorchain raised its liquidity pool caps, AAVE captured $17 billion in liquidity, Yearn Finance reached $4 billion in AUM, and Sushiswap introduced new tokenomics. There were also developments in hybrid liquidity and reports on MakerDao and DeFi.

Q: What are the key aspects to watch in the crypto market?

A: Key aspects to watch include Bitcoin’s consolidation and potential to reach new highs, Ethereum’s continued break of all-time highs with low leverage, and the market’s concerning level of ‘froth’ with attention shifting towards altcoins like Dogecoin.

Q: What services does Zerocap provide?

A: Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. They offer frictionless access to digital assets with industry-leading security and have sections for trading, prime services, and innovation & technology.

Disclaimer

This document has been prepared by Zerocap Pty Ltd, its directors, employees and agents for information purposes only and by no means constitutes a solicitation to investment or disinvestment. The views expressed in this update reflect the analysts’ personal opinions about the cryptocurrencies. These views may change without notice and are subject to market conditions. All data used in the update are between 03 May. 2021 0:00 UTC to 09 May. 2021 23:59 UTC from TradingView. Contents presented may be subject to errors. The updates are for personal use only and should not be republished or redistributed. Zerocap Pty Ltd reserves the right of final interpretation for the content herein above.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | CRBQX | U.S. 10Y |

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post