Content

- Understanding Proprietary Trading

- Crypto Proprietary Trading vs. Traditional Proprietary Trading

- Decentralization and 24/7 Market Operation

- Volatility

- Regulatory Landscape

- Strategies in Crypto Proprietary Trading

- Arbitrage

- Scalping

- Swing Trading

- Holding Long-Term

- The Role of Technology in Crypto Proprietary Trading

- Risks and Rewards

- Final Thoughts

- FAQs

- About Zerocap

- DISCLAIMER

31 Oct, 23

What is Crypto Proprietary Trading?

- Understanding Proprietary Trading

- Crypto Proprietary Trading vs. Traditional Proprietary Trading

- Decentralization and 24/7 Market Operation

- Volatility

- Regulatory Landscape

- Strategies in Crypto Proprietary Trading

- Arbitrage

- Scalping

- Swing Trading

- Holding Long-Term

- The Role of Technology in Crypto Proprietary Trading

- Risks and Rewards

- Final Thoughts

- FAQs

- About Zerocap

- DISCLAIMER

In today’s fast-paced financial ecosystem, crypto proprietary trading has emerged as a pivotal and intriguing facet. Diving into its intricacies can offer a comprehensive understanding of how seasoned traders leverage this strategy to maximize their returns in the digital currency sphere.

Understanding Proprietary Trading

At its core, proprietary trading refers to financial institutions or individual traders buying and selling financial instruments, including cryptocurrencies, using their own funds rather than their clients’. This strategy allows these entities to reap the entire benefit of any profits, but it also means they absorb all potential losses.

Crypto Proprietary Trading vs. Traditional Proprietary Trading

While proprietary trading is not exclusive to the crypto realm, its application within the digital currency landscape bears certain distinct characteristics:

Decentralization and 24/7 Market Operation

Unlike traditional markets that have set trading hours, the crypto market operates 24/7. This continuous operation offers proprietary traders more flexibility and opportunities but also demands vigilant monitoring.

Volatility

The crypto market is renowned for its high volatility. This poses both a risk and an opportunity for proprietary traders, as rapid price fluctuations can lead to significant profits or losses in a short span.

Regulatory Landscape

The regulatory framework governing cryptocurrencies is still evolving. Proprietary traders need to remain updated on the latest guidelines to ensure compliance and avoid potential legal pitfalls.

Strategies in Crypto Proprietary Trading

Several strategies can be employed within the scope of crypto proprietary trading:

Arbitrage

Traders leverage price discrepancies across different exchanges. By simultaneously buying low on one exchange and selling high on another, traders can lock in profits.

Scalping

This involves making a multitude of small trades throughout the day, capitalizing on minute price differences. The goal is to accumulate small profits that collectively amount to a significant return.

Swing Trading

Traders leverage technical analysis to predict price swings in cryptocurrencies. By identifying potential upward or downward trends, they can enter and exit the market at optimal points.

Holding Long-Term

Some proprietary traders adopt a long-term perspective, purchasing cryptocurrencies with the anticipation that their value will significantly appreciate over the years.

The Role of Technology in Crypto Proprietary Trading

With the digital nature of cryptocurrencies, technology plays a pivotal role. Sophisticated algorithms and trading bots are now employed to monitor market trends and execute trades at lightning speeds. This automation offers traders an edge, allowing them to tap into profitable opportunities that might be missed during manual trading.

Risks and Rewards

While crypto proprietary trading offers an avenue for substantial profits, it’s not devoid of risks. The market’s inherent volatility, potential regulatory changes, and technological vulnerabilities (like exchange hacks) are challenges traders must contend with. It’s imperative for traders to continuously refine their strategies, stay updated on market news, and employ sound risk management practices.

Final Thoughts

Crypto proprietary trading presents an exciting frontier for traders, blending the traditional tenets of proprietary trading with the unique nuances of the digital currency world. As with all trading endeavors, success hinges on a blend of strategy, vigilance, and continuous learning.

FAQs

- What is proprietary trading in the context of cryptocurrencies?

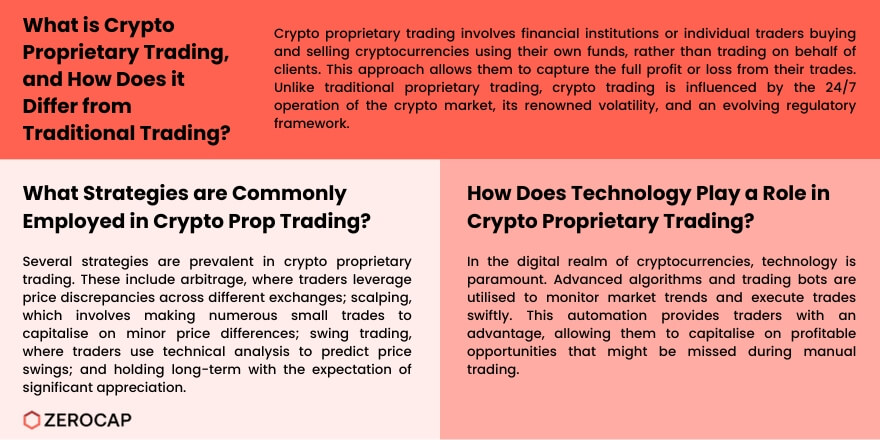

- Proprietary trading in the crypto realm refers to financial institutions or individual traders buying and selling cryptocurrencies using their own funds, rather than trading on behalf of clients. This allows them to capture the full profit or loss from their trades.

- How does crypto proprietary trading differ from traditional proprietary trading?

- While the core concept remains the same, crypto proprietary trading is distinct due to the 24/7 operation of the crypto market, its renowned volatility, and the still-evolving regulatory framework governing cryptocurrencies.

- What are some common strategies employed in crypto proprietary trading?

- Traders use various strategies, including arbitrage (leveraging price discrepancies across exchanges), scalping (making numerous small trades to capitalise on minor price differences), swing trading (using technical analysis to predict price swings), and holding long-term with the expectation of significant appreciation.

- How has technology influenced crypto proprietary trading?

- Technology plays a crucial role in crypto proprietary trading. Advanced algorithms and trading bots monitor market trends and execute trades at rapid speeds, providing traders with an advantage in capturing profitable opportunities.

- What are the risks associated with crypto proprietary trading?

- Crypto proprietary trading, while offering potential for substantial profits, comes with risks such as market volatility, regulatory changes, and technological vulnerabilities like exchange hacks. Traders need to employ sound risk management practices and stay updated on market developments.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post