Content

- The Genesis of Asset Tokenisation

- Traditional Assets vs Tokenised Assets

- The Underlying Technology: Blockchain

- The Process of Asset Tokenisation

- Step 1: Verification of Asset Ownership

- Step 2: Token Creation

- Step 3: Asset Valuation

- Step 4: Token Distribution

- Advantages of Asset Tokenisation

- Increased Liquidity

- Greater Market Efficiency

- Lowered Entry Barriers

- Regulatory Landscape

- Legal Framework

- Compliance and Standardisation

- Real-world Examples of Asset Tokenisation

- The Future of Asset Tokenisation

- Upcoming Developments

- Challenges and Solutions

- The Future Landscape: Liquidity in a Maturing Market

- Conclusion

- FAQs

- What is asset tokenisation?

- How does asset tokenisation work?

- What are the benefits of asset tokenisation?

- What is the role of blockchain in asset tokenisation?

- What are some real-world examples of asset tokenisation?

- About Zerocap

- DISCLAIMER

10 Oct, 23

What is Asset Tokenisation?

- The Genesis of Asset Tokenisation

- Traditional Assets vs Tokenised Assets

- The Underlying Technology: Blockchain

- The Process of Asset Tokenisation

- Step 1: Verification of Asset Ownership

- Step 2: Token Creation

- Step 3: Asset Valuation

- Step 4: Token Distribution

- Advantages of Asset Tokenisation

- Increased Liquidity

- Greater Market Efficiency

- Lowered Entry Barriers

- Regulatory Landscape

- Legal Framework

- Compliance and Standardisation

- Real-world Examples of Asset Tokenisation

- The Future of Asset Tokenisation

- Upcoming Developments

- Challenges and Solutions

- The Future Landscape: Liquidity in a Maturing Market

- Conclusion

- FAQs

- What is asset tokenisation?

- How does asset tokenisation work?

- What are the benefits of asset tokenisation?

- What is the role of blockchain in asset tokenisation?

- What are some real-world examples of asset tokenisation?

- About Zerocap

- DISCLAIMER

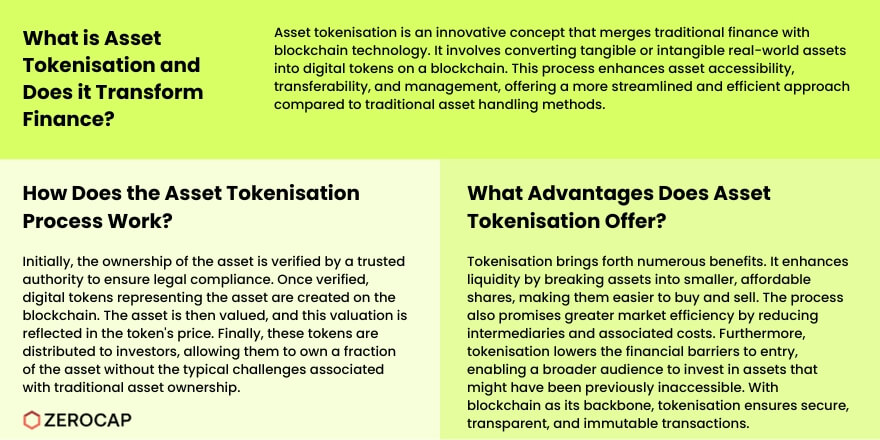

Asset tokenisation is a cutting-edge concept that’s fusing the traditional financial sector with modern-day blockchain technology. At its core, asset tokenisation is the process of converting real-world assets into digital tokens on a blockchain. This innovative approach offers a plethora of advantages over traditional asset management methods, making assets more accessible, easier to transfer, and simpler to manage.

The Genesis of Asset Tokenisation

The inception of asset tokenisation can be traced back to the growing need for better asset liquidity and the advent of blockchain technology. The blockchain, with its inherent traits of immutability and transparency, provides the perfect platform to create and manage digital representations of tangible or intangible assets.

Traditional Assets vs Tokenised Assets

While traditional assets are often bogged down by cumbersome regulatory processes, high transaction costs, and a lack of transparency, tokenised assets promise to alleviate these pain points. They offer a more streamlined, efficient, and transparent process for asset ownership and transfer.

The Underlying Technology: Blockchain

Blockchain technology forms the backbone of asset tokenisation. It ensures the authenticity and ownership of the tokenised assets, making transactions secure, transparent, and immutable.

The Process of Asset Tokenisation

The journey of asset tokenisation begins with the verification of asset ownership, followed by the creation of digital tokens, asset valuation, and finally, the distribution of these tokens.

Step 1: Verification of Asset Ownership

Before an asset can be tokenised, its ownership must be verified by a trusted authority to ensure legal compliance.

Step 2: Token Creation

Once ownership is verified, digital tokens representing the asset are created on the blockchain.

Step 3: Asset Valuation

The asset is then valued, and this value is reflected in the price of the digital tokens.

Step 4: Token Distribution

The tokens are distributed to investors, who can now own a share of the asset without having to deal with the traditional hurdles associated with asset ownership.

Advantages of Asset Tokenisation

Tokenisation comes with a slew of benefits including increased liquidity, greater market efficiency, and lowered entry barriers for investors.

Increased Liquidity

By breaking down assets into smaller, more affordable shares, tokenisation boosts liquidity, making it easier for individuals to buy and sell assets.

Greater Market Efficiency

The streamlined process of buying and selling tokenised assets can lead to more efficient markets with fewer intermediaries and lower costs.

Lowered Entry Barriers

Tokenisation lowers the financial barrier to entry, allowing more people to invest in assets that were previously out of reach.

Regulatory Landscape

Navigating the regulatory landscape is crucial for the adoption of asset tokenisation. A well-defined legal framework and standardisation are essential for its success.

Legal Framework

Establishing a legal framework for asset tokenisation is crucial to ensure its legitimacy and foster trust among investors.

Compliance and Standardisation

Standardising the process of tokenisation and ensuring compliance with local and international regulations is pivotal for the growth of asset tokenisation.

Real-world Examples of Asset Tokenisation

Various sectors like real estate, art, and commodities are already exploring the benefits of asset tokenisation.

The Future of Asset Tokenisation

The road ahead for asset tokenisation is laden with both challenges and opportunities. Upcoming developments promise to further refine and popularise this innovative concept.

Upcoming Developments

As the technology matures, we can expect to see more refined processes and broader adoption of asset tokenisation.

Challenges and Solutions

Despite the potential, challenges like regulatory hurdles and technological limitations need to be addressed to harness the full benefits of asset tokenisation.

The Future Landscape: Liquidity in a Maturing Market

As the crypto market matures, the expectation is that liquidity will stabilize, reducing the chances of market manipulations and ensuring smoother trading experiences.

Conclusion

Asset tokenisation is poised to revolutionize the way we handle and invest in assets. By bridging the gap between traditional finance and modern technology, it promises to bring about increased liquidity, greater market efficiency, and lowered entry barriers for investors.

FAQs

What is asset tokenisation?

Asset tokenisation is the process of converting real-world assets into digital tokens on a blockchain.

How does asset tokenisation work?

It involves verifying asset ownership, creating digital tokens, valuing the asset, and distributing the tokens to investors.

What are the benefits of asset tokenisation?

It offers increased liquidity, greater market efficiency, and lowered entry barriers for investors.

What is the role of blockchain in asset tokenisation?

Blockchain ensures the authenticity and ownership of tokenised assets, making transactions secure, transparent, and immutable.

What are some real-world examples of asset tokenisation?

Real estate, art, and commodities are sectors where asset tokenisation is being explored.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap selects Pier Two to offer institutional staking yields

Institutional clients gain secure, non-custodial access to native crypto yields with top-tier infrastructure Leading digital asset firm Zerocap has selected global institutional staking provider Pier

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post