19 Jan, 24

What are Prediction Markets?

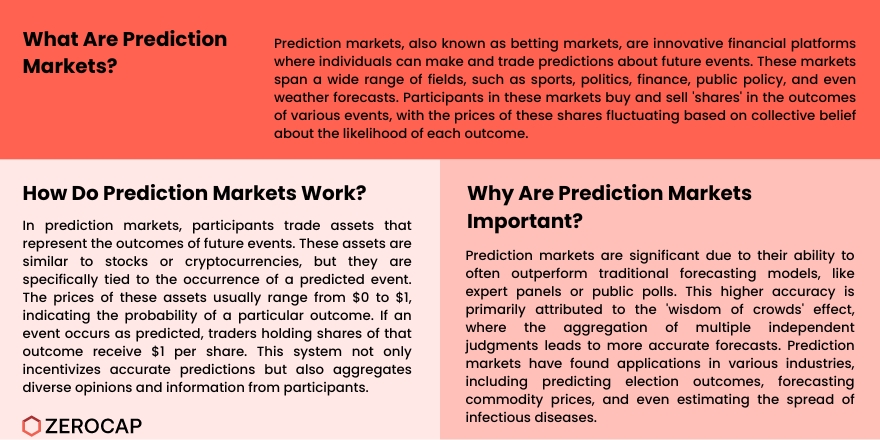

Prediction markets, also known as betting markets, are fascinating financial platforms where predictions about future events are made and traded. These markets offer a unique approach to forecasting, combining finance, probability, and crowd wisdom to predict outcomes ranging from election results to corporate earnings.

Understanding Prediction Markets

Prediction markets are exchange-traded markets where individuals bet on the outcome of various events with uncertain futures. This betting isn’t limited to sports or politics; it spans a wide range of fields including finance, public policy, and even weather forecasts. The core idea is simple: participants buy and sell ‘shares’ in the outcomes of these events, with prices fluctuating based on collective belief about the likelihood of each outcome.

The Mechanics of Prediction Markets

In a prediction market, participants trade assets not unlike stocks or cryptocurrencies, but these assets represent outcomes of future events. Prices typically range from $0 to $1, reflecting the probability of a given outcome. If an event occurs as predicted, traders holding shares of the correct outcome receive $1 per share. This mechanism not only incentivizes accurate predictions but also allows the market to aggregate diverse opinions and information.

The Accuracy and Application of Prediction Markets

One of the most significant aspects of prediction markets is their ability to outperform traditional forecasting models like expert panels or public polls. This is primarily due to the ‘wisdom of crowds’ effect, where the aggregation of multiple, independent judgments often results in more accurate forecasts. Prediction markets have been successfully applied in various industries, from predicting election outcomes to forecasting commodity prices and even the spread of infectious diseases.

Decentralized Prediction Markets: A New Era

With the advent of blockchain technology, decentralized prediction markets have emerged, providing a transparent and tamper-proof platform. These markets operate on smart contracts, allowing participants globally to bet on outcomes, thereby enhancing liquidity and market efficiency. Platforms like Polymarket are leading this wave, creating markets on various topics and relying on decentralized oracles to feed external data into the blockchain.

Conclusion

Prediction markets are not just about betting; they are powerful tools for decision-making and forecasting. They harness collective intelligence to provide insights that are often more accurate than conventional methods. As they continue to evolve, especially with the integration of blockchain technology, their impact on various sectors is likely to grow significantly.

FAQs

- What are prediction markets? Prediction markets are financial platforms where participants bet on the outcome of various future events, from elections to commodity prices. Prices in these markets reflect the collective belief about the likelihood of each outcome.

- How do prediction markets work? Participants buy and sell shares representing outcomes of future events. The price of these shares fluctuates based on the collective belief about the likelihood of each outcome. If an event occurs as predicted, traders holding shares of that outcome receive a payout.

- Are prediction markets accurate? Yes, prediction markets have been shown to consistently outperform traditional forecasting methods. This is due to the aggregation of diverse opinions and information, which often leads to more accurate predictions.

- What is the difference between traditional and decentralized prediction markets? Traditional prediction markets are centrally managed and often subject to regulatory constraints. Decentralized prediction markets, on the other hand, operate on blockchain technology, offering transparency, global accessibility, and resistance to tampering.

- Can prediction markets be used for purposes other than betting? Absolutely. Prediction markets have applications in decision-making and forecasting across various sectors, including finance, healthcare, and public policy. They are not just gambling tools but valuable platforms for aggregating collective intelligence.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post