Content

- The SEC Appeal against Ripple

- Judicial Ruling

- Court Decision Impact on XRP's Value

- SEC vs Ripple Implications for the Crypto Industry

- Future Projections

- Conclusion

- FAQs

- Why did the SEC appeal?

- How did the market react to the ruling?

- What does this mean for Ripple?

- What could be the long-term impact on the crypto industry?

- When is the trial set for the next hearing?

- About Zerocap

- DISCLAIMER

6 Oct, 23

SEC Loses Ripple Court Appeal: A Ripple Effect on the Crypto Waters

- The SEC Appeal against Ripple

- Judicial Ruling

- Court Decision Impact on XRP's Value

- SEC vs Ripple Implications for the Crypto Industry

- Future Projections

- Conclusion

- FAQs

- Why did the SEC appeal?

- How did the market react to the ruling?

- What does this mean for Ripple?

- What could be the long-term impact on the crypto industry?

- When is the trial set for the next hearing?

- About Zerocap

- DISCLAIMER

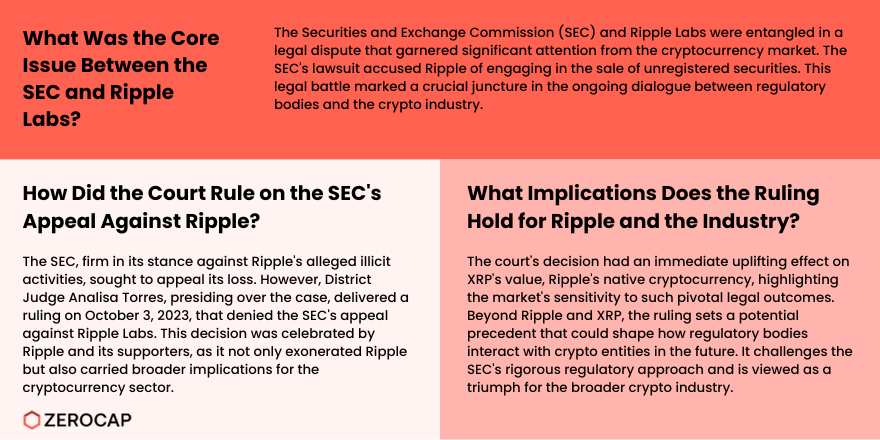

SEC Loses Ripple Court Appeal – The Securities and Exchange Commission (SEC) and Ripple Labs have been embroiled in a legal tussle that has caught the eye of the cryptocurrency market. The lawsuit lodged by the SEC alleged that Ripple engaged in the sale of unregistered securities. However, the recent turn of events has seen a federal judge deny the SEC’s request to appeal its loss against Ripple, marking a significant chapter in this ongoing legal drama.

The SEC Appeal against Ripple

The SEC’s motion to appeal was rooted in its staunch stance against Ripple’s alleged illegal activities. On the other side, Ripple Labs, known for its XRP token, has remained resolute in its defense. The legal wrangling reached a pivotal point when the SEC sought to appeal its loss, a move that was seen as a means to uphold the regulatory standards in the burgeoning crypto industry.

Judicial Ruling

Presiding over the case, District Judge Analisa Torres delivered a ruling on October 3, 2023, that dismissed the SEC’s bid to appeal its loss against Ripple Labs. This decision was a breath of fresh air for Ripple and its supporters, as it not only vindicated Ripple but also had broader implications for the crypto space1.

Court Decision Impact on XRP’s Value

The ruling had an immediate positive impact on the value of XRP, Ripple’s native cryptocurrency. The market reaction was a testament to the symbiotic relationship between regulatory developments and crypto asset values. The lift in XRP’s value following the ruling underscores the market’s positive reception and perhaps, its optimism towards Ripple’s ongoing legal journey.

SEC vs Ripple Implications for the Crypto Industry

The ripple effect (pun intended) of this ruling extends beyond Ripple Labs and XRP. It sets a precedent that could influence how regulatory bodies engage with crypto entities. The ruling is seen as a victory not just for Ripple but for the crypto industry, challenging the SEC’s stringent regulatory stance.

Future Projections

With a trial date set for the next year, as per one of the reports2, the future holds more chapters in this legal saga. The market, legal experts, and crypto enthusiasts will be keenly following the developments as they unfold. The potential market dynamics post-trial could reshape the crypto regulatory landscape, fostering a more conducive environment for crypto innovations.

Conclusion

The denial of the SEC’s appeal against Ripple marks a pivotal moment in the broader narrative of crypto regulation. It not only underscores the evolving legal landscape but also the market’s sensitivity to such high-profile legal developments. As the story continues to unfold, the crypto community will be watching with bated breath.

FAQs

Why did the SEC appeal?

The SEC appealed to uphold its regulatory stance against what it deemed as illegal activities by Ripple.

How did the market react to the ruling?

The market reacted positively with an immediate jump in XRP’s value following the ruling.

What does this mean for Ripple?

It’s a significant victory that vindicates Ripple, at least for now, until the trial set for next year.

What could be the long-term impact on the crypto industry?

The ruling could set a precedent that may influence future regulatory engagements with crypto entities.

When is the trial set for the next hearing?

The trial is set for the next year, but the exact date is yet to be announced.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 21st October 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

CoinDesk Spotlights Zerocap | Bitcoin-Dollar Correlation Shaken Ahead of U.S. Election

Read more in a recent article in CoinDesk. 21 October, 2024: As the U.S. presidential election on November 5 approaches, financial markets are shifting rapidly, with

The Defiant Featured Zerocap | Bitcoin Breaks $65K as Short Traders Face Liquidations

Read more in a recent article in The Defiant and our 14th October Edition Weekly Wrap. 16 October, 2024: The cryptocurrency market experienced a significant

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post