Content

- What is Post Trade Settlement?

- The Importance of Settlement in Trading

- The Settlement Process

- The Role of Central Counterparties (CCPs)

- Confirmation, Clearing, and Settlement

- The Evolution of Settlement

- From Physical to Electronic

- Globalization of Trade and Settlement

- Advantages of Efficient Settlement

- Risk Reduction

- Operational Efficiency

- Enhanced Market Liquidity

- Cost Savings

- Improvements in Technology and Automation

- Post Trade Settlement Challenges

- Current Challenges in Settlement

- Addressing the Challenges

- Regulatory Changes

- Technological Innovations

- Future of Settlement

- Predictions and Emerging Trends

- Conclusion

- FAQs

- About Zerocap

- DISCLAIMER

7 Nov, 23

Post Trade Settlement: Concept and Advantages

- What is Post Trade Settlement?

- The Importance of Settlement in Trading

- The Settlement Process

- The Role of Central Counterparties (CCPs)

- Confirmation, Clearing, and Settlement

- The Evolution of Settlement

- From Physical to Electronic

- Globalization of Trade and Settlement

- Advantages of Efficient Settlement

- Risk Reduction

- Operational Efficiency

- Enhanced Market Liquidity

- Cost Savings

- Improvements in Technology and Automation

- Post Trade Settlement Challenges

- Current Challenges in Settlement

- Addressing the Challenges

- Regulatory Changes

- Technological Innovations

- Future of Settlement

- Predictions and Emerging Trends

- Conclusion

- FAQs

- About Zerocap

- DISCLAIMER

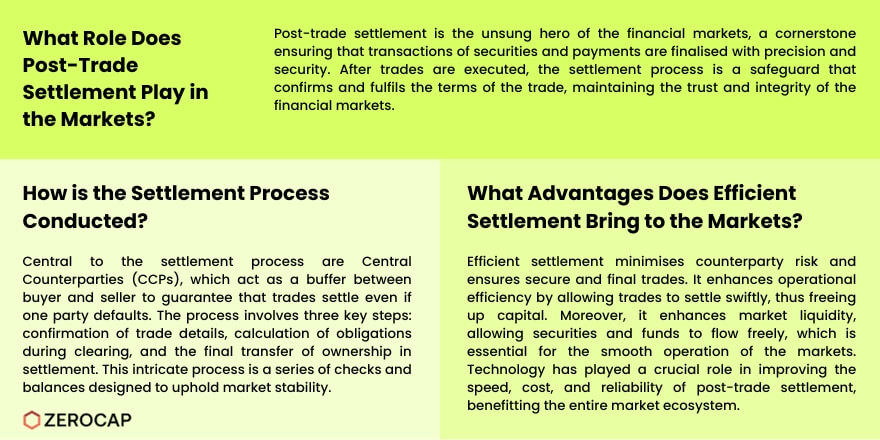

The financial markets are a whirlwind of transactions, with billions changing hands every day. But what happens after a trade is executed? Enter the world of post trade settlement, the unsung hero of the financial markets, ensuring that the exchange of securities and payments is conducted with precision and security. This vital process, though often overshadowed by the more glamorous trading phase, is the cornerstone of market integrity and efficiency.

What is Post Trade Settlement?

Imagine a world where trades are executed, but there’s no guarantee they will be finalised. That’s where post-trade settlement comes in. It’s the proverbial handshake after a deal, the binding agreement that ensures the seller delivers the securities and the buyer completes the payment. Without this process, the trust and reliability of financial transactions would crumble.

The Importance of Settlement in Trading

Settlement is not just a formality; it’s a safeguard. It ensures that what is traded is indeed exchanged, mitigating the risk of one party defaulting. In the fast-paced world of finance, it’s the settlement that slows things down just enough to ensure everything is as it should be.

The Settlement Process

The Role of Central Counterparties (CCPs)

Central Counterparties stand at the heart of the settlement process, a buffer between buyer and seller. They ensure that even if one party cannot fulfil their obligations, the trade will still settle. This is the linchpin of the system, creating a web of safety and trust.

Confirmation, Clearing, and Settlement

First comes confirmation, where the details of the trade are verified. Then clearing, the calculation of obligations. And finally, settlement – the transfer of ownership. Each step is a dance of checks and balances, choreographed to maintain market stability.

The Evolution of Settlement

From Physical to Electronic

There was a time when settlement meant the physical exchange of paper. Now, it’s a digital handshake, a transfer of electronic entries. This evolution has been transformative, slashing the time and cost of settlement, while simultaneously reducing errors.

Globalization of Trade and Settlement

As trade barriers fell and markets became global, settlement processes had to adapt. Different time zones, currencies, and regulations added layers of complexity that only robust, global settlement practices could manage.

Advantages of Efficient Settlement

Risk Reduction

Every investor fears the counterparty risk: the chance that the other party won’t hold up their end of the deal. Efficient settlement practices squash this risk, ensuring that trades are final and funds are secure.

Operational Efficiency

Time is money, and nowhere is this truer than in settlement. Efficient systems mean that trades are settled swiftly, freeing up capital and allowing markets to move with agility.

Enhanced Market Liquidity

When settlement is efficient, securities and funds flow freely, enhancing market liquidity. This is the oil that greases the financial markets, allowing them to operate smoothly and efficiently.

Cost Savings

Every step of settlement comes with a cost. Streamline the process, and those costs plummet. This isn’t just good for the traders; it’s good for the market as a whole, reducing overheads and increasing profitability.

Improvements in Technology and Automation

The rise of fintech has been a boon for settlement. Automation and smart technologies have revolutionized this once cumbersome process, making it faster, cheaper, and more reliable.

Post Trade Settlement Challenges

Current Challenges in Settlement

Despite the leaps in efficiency, settlement is not without its challenges. The complexity of global trading means that the system must constantly evolve to keep up, balancing speed with security, efficiency with thoroughness.

Addressing the Challenges

Regulatory Changes

Regulators worldwide are keenly aware of the importance of post-trade settlement. They sculpt the landscape, ensuring it is robust enough to withstand market stresses while flexible enough to adapt to new challenges.

Technological Innovations

Blockchain, AI, machine learning – these are not just buzzwords. They are the frontier technologies shaping the future of settlement, offering solutions that could once only be imagined.

Future of Settlement

Predictions and Emerging Trends

What does the future hold? If current trends are anything to go by, it will be one of greater integration, faster settlement times, and continued innovation, driven by the relentless march of technology.]

Conclusion

In conclusion, post-trade settlement may not have the allure of trading, but it is just as vital. It is the foundation upon which the trust in the financial markets is built. As technology advances, we can expect this foundation to become only stronger, supporting the ever-growing edifice of global finance.

FAQs

- What is post-trade settlement? Post-trade settlement is the process that finalises a trade, involving the exchange of securities for payment between the buyer and the seller.

- Why is settlement important in trading? Settlement ensures the completion and legitimacy of financial transactions, mitigating the risk of default and maintaining market stability.

- How has the settlement process evolved over time? The settlement process has evolved from a manual, paper-based system to a highly efficient, electronic one, greatly reducing the time and cost involved.

- What are the main challenges in post-trade settlement? The primary challenges include dealing with the complexities of global trade, managing risk, and keeping up with technological and regulatory changes.

- How is technology shaping the future of settlement? Technology is making settlement faster, more cost-effective, and secure through innovations such as blockchain, artificial intelligence, and automation, which promise to revolutionize the process even further.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap selects Pier Two to offer institutional staking yields

Institutional clients gain secure, non-custodial access to native crypto yields with top-tier infrastructure Leading digital asset firm Zerocap has selected global institutional staking provider Pier

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post