9 Nov, 23

What are the Major Fiat Currencies?

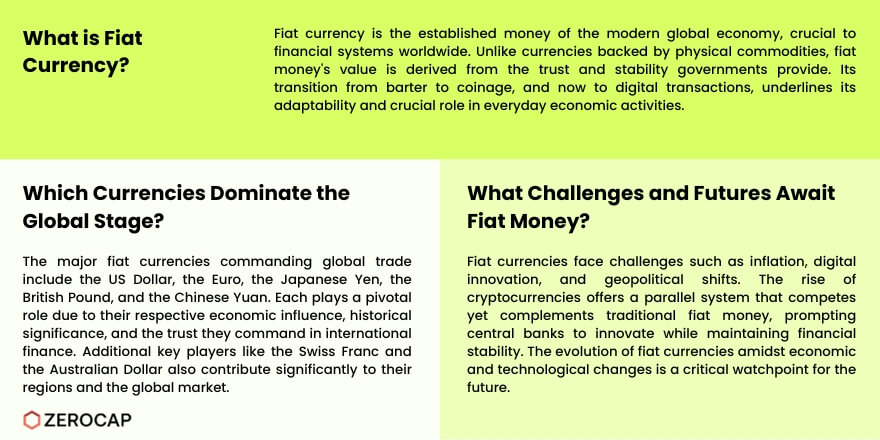

Fiat currencies are the lifeblood of our global economy, acting as the cornerstone of modern-day financial systems. Unlike commodity-based currencies, which are valued by the material they’re made from, fiat money derives its value from the trust and stability provided by governments.

The Concept of Fiat Money

Throughout history, the transformation from barter systems to coinage and then to paper money has been pivotal. Today, fiat money is the norm, used universally in a plethora of transactions.

- Historical Context: The leap from precious metals to paper notes signified a monumental shift in trust and convenience, paving the way for economic expansion and the notion of credit.

- Modern-Day Use: Fiat currency has evolved with technology, embracing digital forms and transactions, which speaks volumes about its adaptability and enduring relevance.

Major Fiat Currencies in the World A handful of currencies dominate the world stage, influencing global trade and finance.

- The US Dollar

- Characteristics & Global Influence: The US dollar reigns supreme as the primary reserve currency, underpinning international trade and finance.

- The Euro

- Usage & Economic Impact: The Euro stands as a symbol of European unity, playing a critical role in the European and global markets.

- The Japanese Yen

- Role in Asian Markets: The yen holds significant sway in Asia, reflecting Japan’s economic stature and industrial prowess.

- The British Pound

- Historical Significance: The pound carries a legacy of the British Empire, maintaining its status as a major currency despite geopolitical changes.

- The Chinese Yuan

- International Expansion: The yuan is a newer player on the global field but is quickly gaining traction as China’s economic influence grows.

- Other Notable Fiat Currencies

- Other currencies, like the Swiss Franc and the Australian dollar, also play key roles in their respective regions and beyond.

Factors Influencing Fiat Currencies

Fiat money is not without its vulnerabilities; it’s influenced by a myriad of factors.

- Economic Policies Governmental economic policies can bolster or weaken a currency, depending on their effectiveness and public perception.

- Political Stability The stability of a nation’s government can have immediate effects on the strength and reliability of its currency.

- Market Sentiment The collective mood of investors can cause currency values to fluctuate, sometimes irrationally.

- Inflation and Interest Rates These are critical economic indicators that directly impact the purchasing power of money and its attractiveness to investors.

The Future of Fiat Currencies

The horizon is filled with both promise and challenges for fiat money.

- Potential Challenges: Inflation, digital innovation, and geopolitical shifts all pose significant questions for the future of fiat currencies.

- Digital Currencies and Fiat Money: The rise of cryptocurrencies presents a new paradigm, offering both competition and complementary mechanisms to traditional fiat money.

- The Role of Central Banks: Central banks around the world are grappling with these changes, balancing the need for innovation with financial stability.

Conclusion

Fiat currencies are more than just paper; they’re a network of trust, underpinning nearly every financial transaction in the world today. As we navigate through economic turbulence and technological advancements, the evolution of fiat money will be a critical area to watch.

FAQs

- What makes a currency “fiat”? A currency is termed ‘fiat’ when it has no intrinsic value and is not backed by physical commodities, like gold or silver. Instead, its value comes from the trust that individuals and governments place in it. Fiat currencies are legal tender by government decree and maintain their value through economic systems and monetary policies.

- Why is the US dollar considered the world’s primary reserve currency? The US dollar is considered the world’s primary reserve currency due to its widespread acceptance for trade and financial transactions globally. Its dominance is anchored in the size and strength of the US economy, the stability of its political system, and the trust in its financial institutions. Additionally, major commodities, like oil, are priced in dollars, reinforcing its reserve status.

- How does political stability affect the value of a fiat currency? Political stability is crucial for maintaining the value of a fiat currency. A stable political environment reassures investors and foreign governments in the stability and reliability of the currency, which can attract investment and bolster the currency’s value. Conversely, political unrest or uncertainty can erode trust and lead to currency devaluation.

- Can fiat currencies coexist with digital currencies like Bitcoin? Yes, fiat currencies can coexist with digital currencies like Bitcoin. While digital currencies offer an alternative financial system and embody different principles, fiat currencies continue to be underpinned by traditional economic structures and government support. Both systems have their advantages and can operate in parallel to serve different needs and preferences in the market.

- What role do central banks play in managing fiat currencies? Central banks play a critical role in managing fiat currencies. They implement monetary policy, regulate the money supply, set interest rates, and strive to maintain financial stability and public confidence in the currency. Central banks also act as lenders of last resort during financial crises, further ensuring the stability and functionality of the fiat currency system.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap selects Pier Two to offer institutional staking yields

Institutional clients gain secure, non-custodial access to native crypto yields with top-tier infrastructure Leading digital asset firm Zerocap has selected global institutional staking provider Pier

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post