2 Dec, 23

Listing on Exchanges for Crypto Projects

Navigating the world of cryptocurrencies can be as exciting as it is complex, especially when it comes to understanding how crypto projects get listing on exchanges. This process, known as ‘listing on exchanges’, is a crucial step for any crypto project, as it not only increases the project’s visibility but also enhances its accessibility to a wider audience of investors and users. In this article, we will delve into the intricate process of how crypto projects achieve listing on exchanges, exploring the various aspects and requirements that come into play.

Criteria for Listing on Exchanges

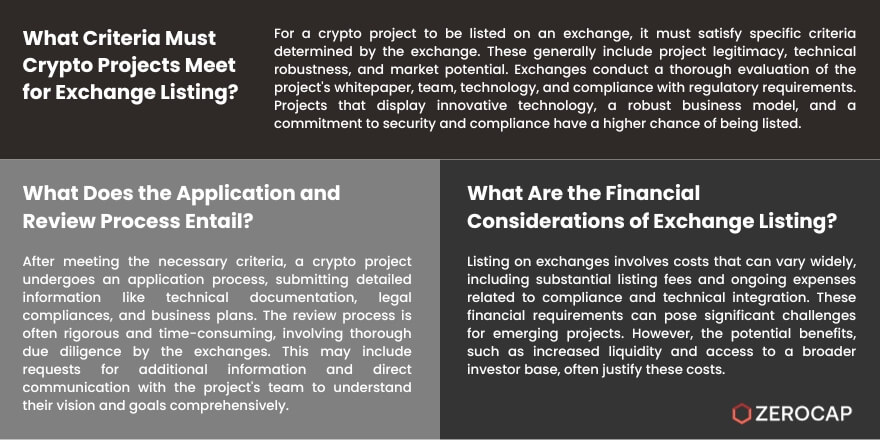

The journey to listing on exchanges begins with meeting specific criteria set by the exchanges themselves. These criteria can vary significantly but generally include aspects like project legitimacy, technical robustness, and market potential. Exchanges meticulously evaluate the project’s whitepaper, the team behind it, and the underlying technology to ensure it meets their standards. Moreover, they assess the project’s compliance with regulatory requirements, which is increasingly important in today’s evolving regulatory landscape. Projects that showcase innovative technology, a strong business model, and a commitment to security and compliance stand a better chance of being listed.

Application and Review Process

Once a crypto project believes it meets the necessary criteria, the next step is the application process. This involves submitting detailed information about the project, including technical documentation, legal compliances, and business plans. The review process can be rigorous and time-consuming, with exchanges conducting thorough due diligence. They may require additional information or clarification on various aspects of the project. Some exchanges also engage in direct communication with the project’s team to better understand their vision, goals, and the technical specifics of their cryptocurrency.

Costs and Financial Considerations When Listing on Exchanges

Listing on exchanges often comes with a cost, which can vary widely depending on the exchange. These costs might include listing fees, which can be substantial, and ongoing costs associated with compliance and technical integration. For many emerging projects, these financial requirements can be a significant hurdle. However, it’s important to weigh these costs against the potential benefits of increased liquidity and access to a broader investor base that listing on a reputable exchange can offer.

Marketing and Community Building

An often overlooked but critical aspect of getting listed on exchanges is marketing and community support. Exchanges are more likely to list projects that have a strong, engaged community and a solid marketing strategy. This is because a vibrant community often translates into higher trading volumes and sustained interest, which are key considerations for exchanges. Effective marketing efforts not only raise awareness of the project but also help in building a loyal user base, which in turn increases the project’s appeal to exchanges.

Maintaining Standards and Compliance

Once listed, crypto projects must maintain certain standards and comply with ongoing regulatory and technical requirements. Exchanges continuously monitor listed projects for compliance with their rules and the broader regulatory environment. Projects need to keep their technology up-to-date, ensure the security of their platforms, and provide regular updates to their investors and the exchange. Failure to adhere to these standards can result in delisting, which can significantly impact the project’s credibility and market presence.

Conclusion

Listing on exchanges is a multifaceted process that requires crypto projects to meet stringent criteria, undergo a rigorous review process, and manage financial, marketing, and compliance aspects effectively. While challenging, successful listing can provide significant benefits, including enhanced visibility, credibility, and access to a larger pool of investors. As the crypto landscape continues to evolve, understanding and navigating the process of listing on exchanges remains a vital component for the success and longevity of crypto projects.

FAQs

- What is the most important factor for a crypto project to get listing on exchanges? The most important factor is meeting the exchange’s criteria, which typically includes project legitimacy, technical robustness, market potential, and compliance with regulatory standards.

- How long does the review process for listing on an exchange usually take? The review process can vary greatly, ranging from a few weeks to several months, depending on the exchange and the complexity of the project.

- Are there any risks associated with listing a crypto project on an exchange? Yes, risks include the potential for delisting if the project fails to maintain required standards, market volatility, and the financial burden of listing fees and ongoing compliance costs.

- Can a small or new crypto project get listed on major exchanges? While challenging, it is possible for small or new projects to get listed on major exchanges if they demonstrate unique value, robust technology, a strong team, and a committed community.

- What role does community support play in getting listing on exchanges? Community support is crucial as it indicates sustained interest and potential for higher trading volumes, making the project more attractive to exchanges.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post