Content

- What is Liquidity?

- The Role of Crypto Exchanges

- The Positive Outcomes of High Liquidity

- The Risks of Low Liquidity

- How Crypto Exchanges Can Improve Liquidity

- Real-world Examples of Liquidity Issues

- The Future Landscape: Liquidity in a Maturing Market

- Conclusion

- FAQs

- Why is liquidity crucial for crypto exchanges?

- What happens when an exchange has low liquidity?

- How can exchanges boost their liquidity?

- Do all assets on an exchange have the same liquidity?

- Will the liquidity problem ever be completely resolved in the crypto space?

- About Zerocap

- DISCLAIMER

6 Oct, 23

The Importance of Liquidity for Crypto Exchanges

- What is Liquidity?

- The Role of Crypto Exchanges

- The Positive Outcomes of High Liquidity

- The Risks of Low Liquidity

- How Crypto Exchanges Can Improve Liquidity

- Real-world Examples of Liquidity Issues

- The Future Landscape: Liquidity in a Maturing Market

- Conclusion

- FAQs

- Why is liquidity crucial for crypto exchanges?

- What happens when an exchange has low liquidity?

- How can exchanges boost their liquidity?

- Do all assets on an exchange have the same liquidity?

- Will the liquidity problem ever be completely resolved in the crypto space?

- About Zerocap

- DISCLAIMER

Ever wondered what makes a cryptocurrency exchange tick? Why do some exchanges seem to thrive while others falter? One word – liquidity. Dive into this pivotal factor in the crypto space and understand the importance of liquidity for crypto exchanges.

Liquidity, a term frequently tossed around in financial conversations, is crucial for the successful functioning of cryptocurrency exchanges. But what exactly is it, and why does it matter?

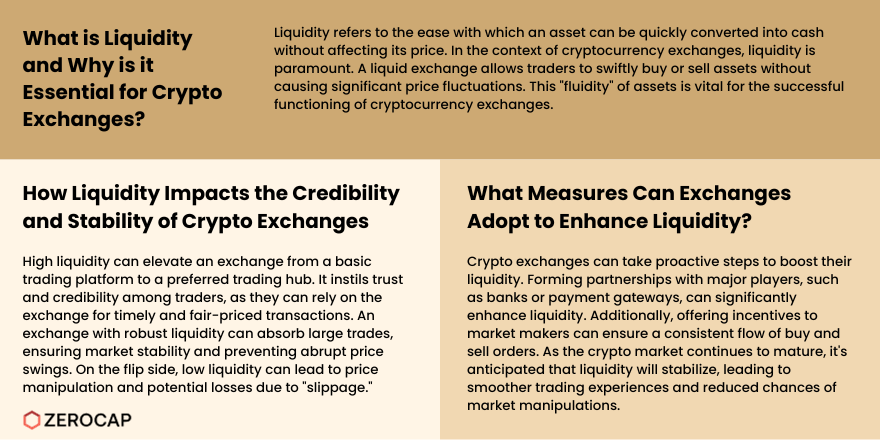

What is Liquidity?

Liquidity refers to the ease with which an asset can be quickly converted into cash without affecting its price. Think of it as the “fluidity” of assets – the more liquid, the better.

- Factors affecting liquidity

- Volume: A higher trading volume often indicates more liquidity.

- Order book depth: A thick order book can suggest high liquidity, reflecting a multitude of buy and sell orders.

The Role of Crypto Exchanges

Crypto exchanges serve as platforms for trading digital assets. Their effectiveness, largely, depends on their liquidity.

- Ensuring smooth transactions If an exchange is liquid, traders can quickly buy or sell assets without drastic price changes.

- Attracting investors and traders High liquidity tends to draw more users, which in turn boosts the exchange’s volume and profitability.

The Positive Outcomes of High Liquidity

High liquidity can transform an exchange from a basic platform to a preferred trading hub.

- Increased trust and credibility Traders trust exchanges that offer timely and fair-priced transactions.

- Market stability An exchange with good liquidity can absorb large trades without causing abrupt price swings.

The Risks of Low Liquidity

However, not all is rosy. Low liquidity can spell doom for exchanges.

- Price manipulation With few orders on the book, prices can be easily manipulated, leading to artificial inflation or deflation.

- Potential for “slippage” The difference between the expected price of a trade and the executed price can widen, leading to potential losses.

How Crypto Exchanges Can Improve Liquidity

Ensuring liquidity for crypto exchanges isn’t a passive process. Exchanges must be proactive.

- Partnerships with major players Tying up with major banks or payment gateways can boost liquidity.

- Offering incentives for market makers Incentivizing these players can ensure a consistent flow of buy and sell orders.

Real-world Examples of Liquidity Issues

Consider the flash crashes recently experienced by certain exchanges due to sudden withdrawals by major players. Such events underscore the value of consistent liquidity.

The Future Landscape: Liquidity in a Maturing Market

As the crypto market matures, the expectation is that liquidity will stabilize, reducing the chances of market manipulations and ensuring smoother trading experiences.

Conclusion

Liquidity is the lifeblood of cryptocurrency exchanges. Ensuring it is vital for the overall health and credibility of the crypto ecosystem. Traders and investors, always keep an eye on it!

FAQs

Why is liquidity crucial for crypto exchanges?

Liquidity ensures timely and fair-priced transactions, attracting more traders and maintaining market stability.

What happens when an exchange has low liquidity?

Low liquidity can lead to price manipulation, potential for slippage, and reduced trust in the exchange.

How can exchanges boost their liquidity?

Partnerships, incentivizing market makers, and facilitating ease of trading can help improve liquidity.

Do all assets on an exchange have the same liquidity?

No, the liquidity can vary based on the popularity and demand for the asset.

Will the liquidity problem ever be completely resolved in the crypto space?

While complete resolution is uncertain, as the market matures, liquidity is expected to stabilize.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post