19 Feb, 24

What is ERC 404? The Hybrid NFTs

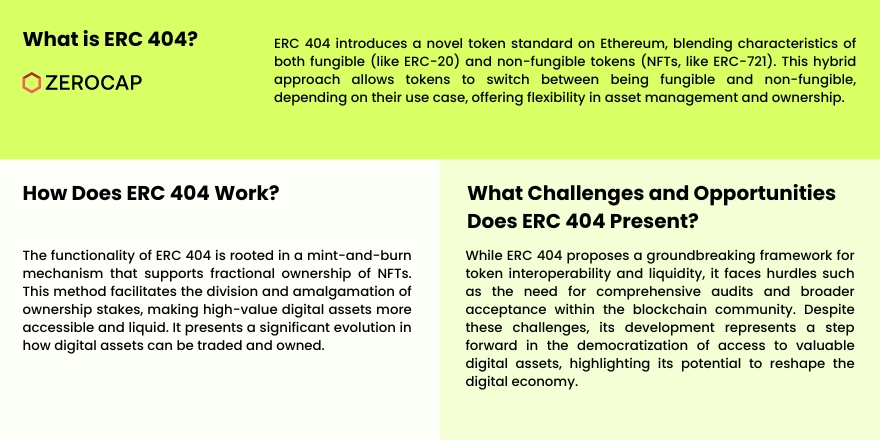

ERC 404, an emerging token standard on the Ethereum blockchain, represents a significant innovation in the realm of digital assets. It uniquely combines the characteristics of ERC-20 (fungible tokens) and ERC-721 (non-fungible tokens) to create semi-fungible tokens. This hybrid nature allows tokens to switch between being fungible and non-fungible, depending on their use case or context, thereby enhancing their utility and offering fresh opportunities in the digital token space.

Introduction to ERC 404

The introduction of ERC 404 marks a pivotal moment in the evolution of token standards on the Ethereum blockchain. Developed by pseudonymous creators “ctrl” and “Acme,” ERC 404 aims to bridge the gap between fungible and non-fungible tokens, offering a novel category of digital assets known as semi-fungible tokens. These tokens can serve dual purposes, acting as fungible assets under certain conditions and as unique, non-fungible assets under others.

How ERC 404 Works

At its core, ERC 404 operates on a mint-and-burn mechanism that facilitates the fractional ownership and transfer of non-fungible tokens (NFTs). This mechanism allows for the division of NFTs into smaller, manageable pieces, thus democratizing access to valuable digital assets and enhancing their liquidity in the market. For instance, owning a fraction of an ERC 404 token linked to an NFT enables a form of shared ownership, and accumulating enough fractions can lead to the minting of a new, complete NFT in the holder’s wallet.

The Significance of ERC 404

The significance of ERC 404 lies in its ability to introduce native fractionalization and liquidity to the NFT market. This not only opens up new avenues for asset management and trading but also fosters innovation and engagement within the digital asset ecosystem. By blending the advantages of ERC-20 and ERC-721 tokens, ERC 404 sets the stage for a more inclusive and dynamic digital asset landscape.

Projects Utilizing ERC 404

Several projects have already begun exploring the possibilities offered by ERC 404, with Pandora leading the charge. This initiative and others like DeFrogs, Monkees, Punks404, and EtherRock404 are pioneering the use of ERC 404, demonstrating its potential to transform the NFT market through enhanced liquidity and fractional ownership. These early adopters highlight the growing interest and confidence in the semi-fungible token standard.

Challenges and Future Prospects

Despite its promising features, ERC 404 faces challenges, including the need for thorough auditing, official recognition, and integration with existing blockchain infrastructure. Its experimental nature means that it is still evolving, with potential security vulnerabilities and compatibility issues yet to be fully addressed. However, the ongoing development and community interest suggest a bright future, as it seeks to redefine the boundaries of digital ownership and asset liquidity on the Ethereum blockchain.

Conclusion

ERC 404 represents a groundbreaking advancement in blockchain technology, offering a versatile solution that merges the benefits of fungible and non-fungible tokens. While challenges remain, the active development and growing adoption of ERC 404 projects underscore its potential to significantly impact the digital asset space. As it continues to evolve, ERC 404 stands poised to usher in a new era of token standards, characterized by enhanced liquidity, fractional ownership, and innovative asset management possibilities.

FAQs

- What is ERC 404? ERC 404 is an experimental token standard on the Ethereum blockchain that combines features of ERC-20 (fungible tokens) and ERC-721 (non-fungible tokens) to create semi-fungible tokens, allowing them to be both fungible and non-fungible based on context.

- How does ERC 404 work? It uses a mint-and-burn mechanism for fractional ownership and transfer of NFTs, enabling shared ownership of digital assets and enhancing their liquidity.

- What makes ERC 404 significant? ERC 404 introduces native fractionalization and liquidity to NFTs, fostering innovation and widening access to valuable digital assets.

- Which projects are using ERC 404? Projects like Pandora, DeFrogs, Monkees, Punks404, and EtherRock404 are pioneering the use of ERC 404, demonstrating its utility and potential in the digital asset market.

- What challenges does ERC 404 face? ERC 404 is experimental and unaudited, lacking official recognition. It faces challenges related to security, integration, and market acceptance as it continues to develop.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

InvestorDaily Spotlights Zerocap | Bitcoin to IBIT Swap: How Institutions Are Converting BTC Into ETF Exposure

Read more in a recent article in InvestorDaily. 18 February, 2026: Institutional sentiment toward Bitcoin remains constructive, but the way exposure is held is evolving. With

Weekly Crypto Market Wrap: 16 February 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 9 February 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post