30 Jan, 24

Dollar CBDC Pros and Cons: The US Controversy

As we enter 2024, the debate around Central Bank Digital Currencies (CBDCs) has intensified, particularly in the United States. This article examines the CBDC pros and cons, also considering the recent viewpoints of US politicians and financial experts.

The Growing Interest in CBDCs

CBDCs are becoming a critical topic in global finance. In the U.S., the Federal Reserve is exploring the potential of a digital dollar but remains cautious due to the dollar’s global financial importance. Meanwhile, other countries, such as those in the European Union, are moving forward with their digital currency initiatives, potentially setting a precedent for the U.S..

Political Perspectives

In the U.S., the political stance on CBDCs varies significantly. Conservative politicians, including Florida Governor Ron DeSantis and presidential candidate Vivek Ramaswamy, have expressed strong opposition, citing privacy and surveillance concerns. Conversely, Democratic representatives like Stephen Lynch and Wiley Nickel advocate cautiously exploring CBDCs, emphasizing the need for consumer protection and privacy.

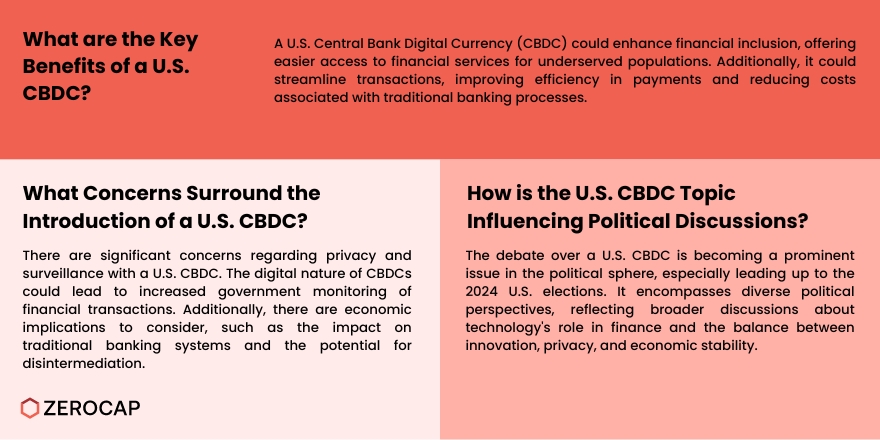

Financial Inclusion

One of the argued benefits of CBDCs is enhanced financial inclusion. Proponents believe that digital currencies could provide more accessible financial services to unbanked populations. However, the actual effectiveness of CBDCs in achieving this goal remains debated.

Privacy and Surveillance Concerns

Privacy is a significant concern regarding CBDCs. Critics fear that a government-issued digital currency could lead to increased surveillance and control over financial transactions. This concern has led to the introduction of the CBDC Anti-Surveillance State Bill by Congressman Tom Emmer, reflecting a growing apprehension about government oversight in financial activities.

Economic Impact

The introduction of a CBDC could have a profound impact on the economy. It could alter the financial sector’s structure, affect credit availability, and raise questions about monetary policy’s efficacy. These implications necessitate a thorough evaluation before adopting a CBDC.

Conclusion

As the 2024 U.S. election cycle heats up, CBDCs will likely remain a contentious topic. The potential benefits of improved financial inclusion and efficient transactions must be weighed against significant privacy and economic concerns. The path the U.S. will take regarding CBDCs will depend heavily on political will and public sentiment.

FAQs

- What are the main advantages of CBDCs?

- CBDCs could enhance financial inclusion, streamline transactions, and potentially reduce costs associated with money handling and distribution.

- What are the primary concerns regarding CBDCs?

- The main concerns include privacy, increased government surveillance, the potential impact on the banking sector, and the implications for monetary policy.

- How are U.S. politicians reacting to the idea of a CBDC?

- Opinions vary: Some conservative politicians strongly oppose it due to privacy concerns, while some Democrats are open to exploring it with a focus on consumer protection and privacy.

- Could CBDCs impact Bitcoin or other cryptocurrencies?

- CBDCs are not seen as a direct threat to cryptocurrencies like Bitcoin. In fact, they could strengthen the value proposition of decentralized digital currencies.

- Is the U.S. close to implementing a CBDC?

- As of now, the U.S. is exploring the concept but has not made a definitive move towards implementing a CBDC. The Federal Reserve is conducting research and considering public opinions on the matter.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap selects Pier Two to offer institutional staking yields

Institutional clients gain secure, non-custodial access to native crypto yields with top-tier infrastructure Leading digital asset firm Zerocap has selected global institutional staking provider Pier

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post