24 May, 24

What is the CBDC Anti-Surveillance State Act?

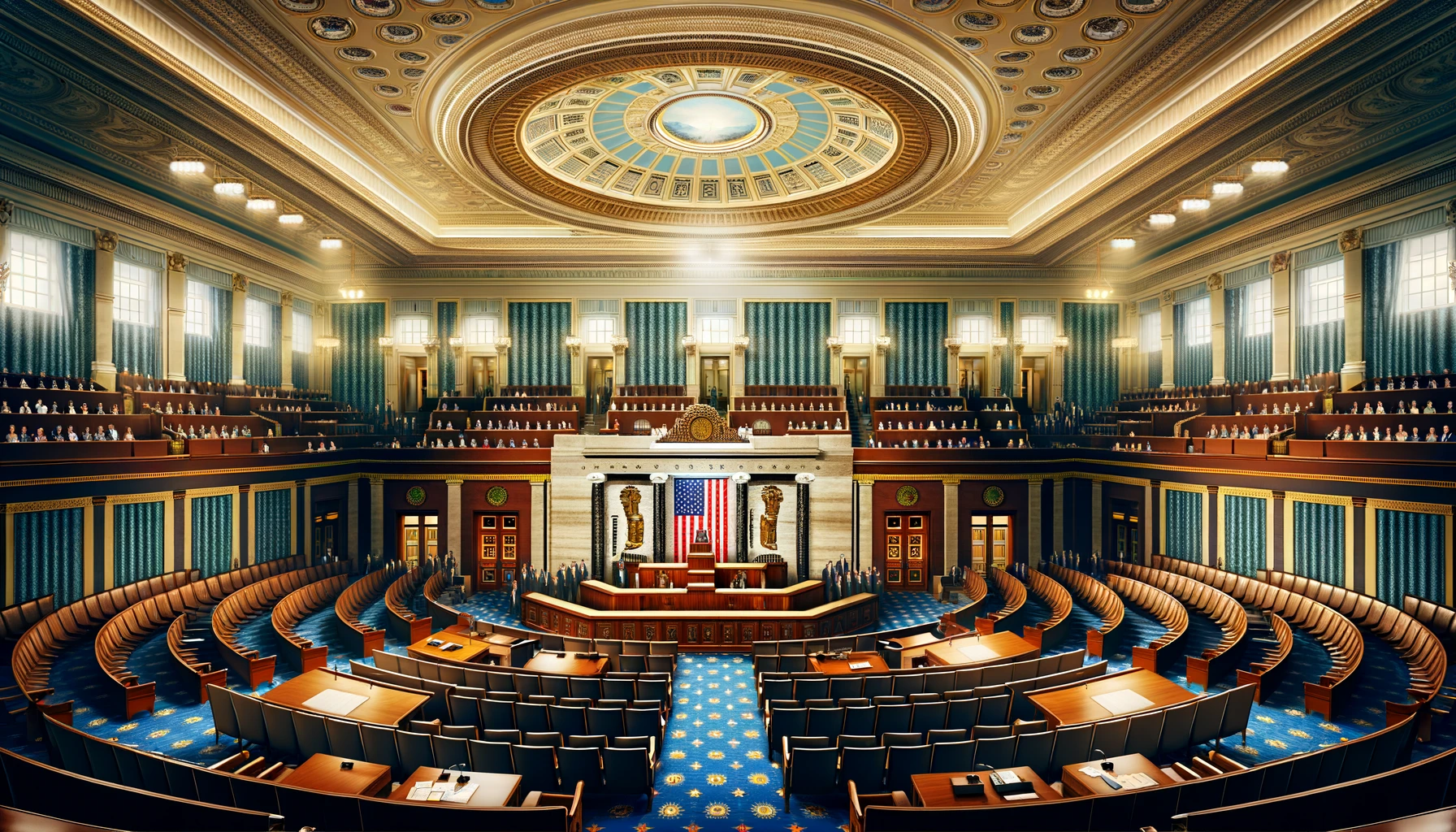

On May 23, 2024, the U.S. House of Representatives passed the CBDC Anti-Surveillance State Act. This legislation, introduced by Congressman Tom Emmer, aims to prevent the Federal Reserve from issuing a Central Bank Digital Currency (CBDC) directly to individuals. The bill addresses concerns over privacy, financial surveillance, and the potential misuse of digital currencies by government entities. This article explores the Act’s key provisions, its implications, and the broader context surrounding CBDCs in the United States.

Understanding the CBDC Anti-Surveillance State Act

The CBDC Anti-Surveillance State Act (H.R. 5403) was created to ensure that any development of a CBDC in the U.S. adheres to principles of financial privacy and individual freedom. Specifically, the Act prohibits:

- Direct Issuance: The Federal Reserve is forbidden from offering products or services directly to individuals or maintaining accounts for them.

- Indirect Issuance: The Federal Reserve cannot issue a CBDC through intermediaries, such as commercial banks.

- Monetary Policy Use: The Act prohibits the use of a CBDC as a tool for implementing monetary policy, thus preventing potential government overreach into individuals’ financial lives.

Motivations Behind the Act

The primary motivation for the CBDC Anti-Surveillance State Act is to protect Americans’ financial privacy. Congressman Emmer and supporters argue that a government-controlled CBDC could lead to unprecedented financial surveillance and control over personal spending habits. They cite examples from other countries, such as China’s use of digital currency to monitor and regulate citizens’ behavior, as cautionary tales.

In addition, the Act aims to prevent scenarios where a CBDC could be used to target politically unpopular activities or individuals, drawing parallels to incidents like the freezing of bank accounts during the 2022 Canadian trucker protests.

The Role of the Federal Reserve

The Federal Reserve, as the central banking system of the United States, has been exploring the potential benefits and risks of issuing a CBDC. Proponents argue that a CBDC could enhance financial inclusion and efficiency. However, the CBDC Anti-Surveillance State Act ensures that any such digital currency must align with American values of privacy and free-market principles, rather than becoming a tool for government surveillance.

Reactions and Controversies

The passage of the CBDC Anti-Surveillance State Act has sparked significant debate. Supporters, including various financial and political groups, laud the bill as a necessary safeguard against government overreach and a protector of individual liberties. Organizations like the Heritage Action and the Club for Growth have publicly endorsed the Act, emphasizing the need to prevent the Federal Reserve from turning into a retail bank that collects personal financial data.

Opponents, however, argue that the legislation could hinder the technological advancement and global competitiveness of the U.S. financial system. They contend that by restricting the Federal Reserve’s ability to innovate with CBDCs, the U.S. might fall behind other nations that are actively developing their digital currencies.

Broader Implications for Digital Currencies

The CBDC Anti-Surveillance State Act is part of a larger conversation about the future of digital currencies in the United States. While decentralized cryptocurrencies like Bitcoin operate on open, permissionless networks, a CBDC would be a sovereign digital currency controlled by the government. This fundamental difference raises critical questions about privacy, control, and the role of government in the digital economy.

Future Outlook

As the bill progresses through Congress, its fate will significantly impact the direction of digital currency policy in the U.S. If enacted, the legislation will set strict boundaries on how a U.S. CBDC can be developed and used, prioritizing privacy and limiting government surveillance capabilities. The debate surrounding this Act highlights the delicate balance between embracing technological advancements and protecting fundamental freedoms.

Conclusion

The CBDC Anti-Surveillance State Act represents a crucial legislative effort to address the potential risks associated with central bank digital currencies. By prohibiting the Federal Reserve from issuing a CBDC directly or indirectly to individuals and using it for monetary policy, the Act aims to safeguard Americans’ financial privacy and prevent government overreach. As digital currencies continue to evolve, this legislation will play a pivotal role in shaping the future landscape of digital finance in the United States.

FAQ

- What is the main goal of the CBDC Anti-Surveillance State Act?

- The primary goal is to protect Americans’ financial privacy by preventing the Federal Reserve from issuing a CBDC directly to individuals and using it for surveillance or monetary policy.

- Why was this Act introduced?

- The Act was introduced to prevent potential government overreach and ensure that any U.S. CBDC adheres to principles of privacy and individual freedom, avoiding scenarios seen in other countries.

- What are the key prohibitions in the Act?

- The Act prohibits the Federal Reserve from issuing a CBDC directly to individuals, indirectly through intermediaries, and using it for implementing monetary policy.

- Who supports the CBDC Anti-Surveillance State Act?

- The Act is supported by various financial and political groups, including the Heritage Action and the Club for Growth, who emphasize the need to protect individual liberties.

- What are the potential drawbacks of this legislation?

- Critics argue that the Act could hinder technological advancement and global competitiveness by restricting the Federal Reserve’s ability to innovate with CBDCs.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap selects Pier Two to offer institutional staking yields

Institutional clients gain secure, non-custodial access to native crypto yields with top-tier infrastructure Leading digital asset firm Zerocap has selected global institutional staking provider Pier

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post