Content

- What is the Role of a Central Bank?

- A Brief History of Central Banking

- Can Blockchains Replace Central Banks?

- Exploring the Potential of Blockchains in Relation to Central Banks

- Can Blockchain Technology Replace the Role of Central Banks?

- The Political and Economic Fallout of a World Governed by Digital Currencies

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What is the role of a Central Bank in a country's economy?

- How can blockchain technology potentially replace Central Banks?

- What are the political and economic implications of a world governed by digital currencies?

- What are Central Bank Digital Currencies (CBDCs) and how can they help Central Banks adapt to the rise of digital currencies?

- What are the potential risks and challenges posed by the rise of digital currencies to the global financial system?

30 May, 23

The Role of Central Banks in the Age of Digital Currencies

- What is the Role of a Central Bank?

- A Brief History of Central Banking

- Can Blockchains Replace Central Banks?

- Exploring the Potential of Blockchains in Relation to Central Banks

- Can Blockchain Technology Replace the Role of Central Banks?

- The Political and Economic Fallout of a World Governed by Digital Currencies

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What is the role of a Central Bank in a country's economy?

- How can blockchain technology potentially replace Central Banks?

- What are the political and economic implications of a world governed by digital currencies?

- What are Central Bank Digital Currencies (CBDCs) and how can they help Central Banks adapt to the rise of digital currencies?

- What are the potential risks and challenges posed by the rise of digital currencies to the global financial system?

Blockchain technology is a rising tide, on a trajectory to gradually subsume certain operations of the traditional financial (TradFi) industry. At the heart of TradFi systems is the central bank, governing the operations of a nation’s own currency. However, with the spread of blockchain-controlled cryptocurrencies, the necessity of fiat currencies and their associated institutions has come under question. After all, the multitude of advantages enabled by blockchain technology may prove a more attractive medium of control and exchange. Nevertheless, the labyrinth of existing systems that rely on central banks would make unseating them challenging and in some cases undesirable. Therefore, as blockchain technology integrates with TradFi structures, the role of the central bank is poised to change, possibly causing immense political and economic fallout.

What is the Role of a Central Bank?

A central bank is an essential financial institution that holds the primary responsibility for a country’s monetary policy and financial system. It is the backbone of a nation’s economy, ensuring the stability of the national currency and the smooth functioning of the banking system. Central banks serve as the main authority in the implementation of monetary policy, the management of interest rates, and the control of the money supply. They also function as the government’s bank, handling its accounts, issuing sovereign debt, and providing support to other banks during financial crises by serving as the lender of last resort. Furthermore, central banks oversee the broader banking sector to ensure stability, transparency, and adherence to regulations. By performing these functions, central banks aim to maintain low inflation, control unemployment, and foster sustainable economic growth, all of which contribute to economic development and improvements in living standards for the population.

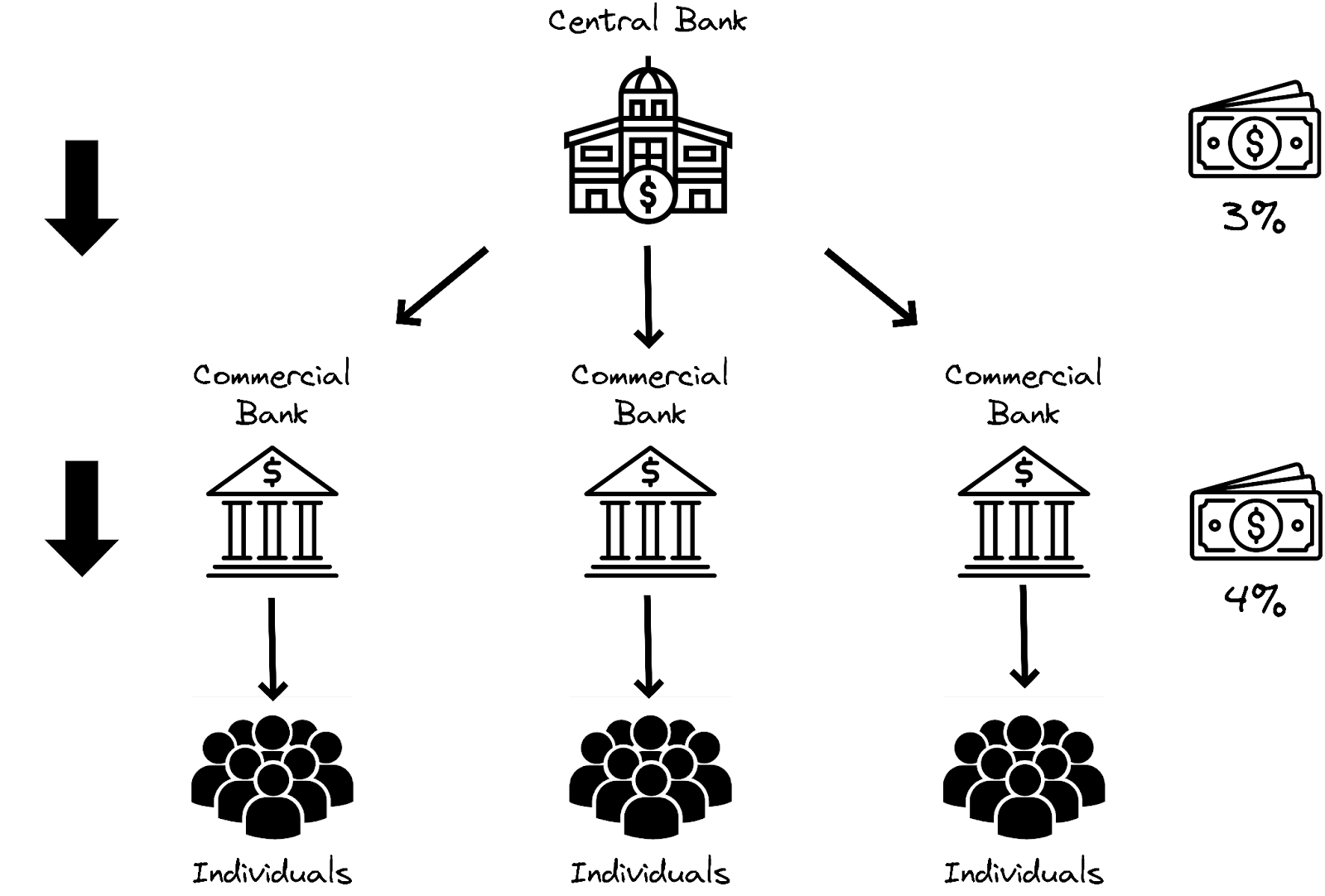

Central banks play a crucial role in managing the economy through various mechanisms and tools. One of the most critical functions is the implementation of monetary policy that is designed to achieve specific macroeconomic objectives, such as price stability, full employment, and stable economic growth. To do this, central banks use tools such as open market operations, where they buy and sell government securities to control the money supply and influence short-term interest rates. By adjusting the policy rate, central banks influence the cost of borrowing for banks and consumers, which in turn impacts consumer spending, investment, and inflation, as displayed in the infographic below. Another important function of central banks is to ensure the stability of the financial system by supervising and regulating commercial banks and other financial institutions. This involves setting reserve requirements, dictating the minimum amount of reserves that banks must hold relative to their deposit liabilities, and monitoring the financial system for risks and vulnerabilities that could lead to crises.

In addition to their role in monetary policy and financial stability, central banks have increasingly taken on the responsibility of promoting sustainable economic growth by addressing issues such as income inequality, climate change, and financial inclusion. While traditionally focused on price stability and employment, central banks are now recognizing the importance of broader socio-economic objectives, which can impact the overall health of the economy. For example, central banks may encourage financial institutions to adopt more environmentally sustainable practices, such as the European Central Bank’s climate change initiative, or support the development of innovative financial products that help underserved communities. Furthermore, in times of economic uncertainty or crisis, central banks may implement more exotic monetary policy tools to stimulate growth and stabilise the economy. Such measures could include quantitative easing, negative interest rates, or targeted lending programs. As the global economy continues to evolve, central banks are adapting their roles and tools to effectively respond to new challenges and maintain their vital functions in safeguarding economic stability and fostering growth.

A Brief History of Central Banking

Tracing the history of central banking takes us back several centuries, revealing an evolution that has been shaped by various economic, political, and societal changes. Precursing modern central banking was the governmental administration of national currencies. Dating back as early as the Egyptian old kingdom, governmental control of the money supply has been documented, with governments themselves carrying out the duties of modern central banks. With the establishment of professional banks during the Medieval and Renaissance periods, a network of public exchange was established with a high degree of government control via coinage prerogatives. These notable milestones and innovations have marked the development of central banking and the banking industry as a whole, moulding the roles and functions of central banks as we know them today.

Central banking’s origins can be found in the early modern period, with institutions like the Swedish Riksbank and the Bank of England serving as prototypes for forthcoming central banks. Initially, these banks primarily financed wars and managed public debt. Over time, they assumed additional responsibilities, such as issuing banknotes and acting as lenders of last resort. As the 19th and early 20th centuries witnessed an increasingly interconnected and industrialised global economy, the necessity for stable monetary systems and financial regulation became more apparent. Consequently, central banks were formed in numerous countries, each adapting to the unique economic and political circumstances of their respective nations. During this period, central banks increasingly focused on maintaining financial system stability and ensuring the smooth functioning of domestic economies.

Major economic events and crises during the 20th century led to further transformations in central banking. For instance, the Great Depression exposed the shortcomings of the gold standard and resulted in a shift in central banking philosophy, with monetary authorities adopting more active roles in managing their economies. Following World War II, the Bretton Woods system was established, which linked national currencies to the US dollar and created a new international monetary order. Central banks then concentrated on maintaining exchange rate stability and managing inflation. As concerns over inflation escalated in the latter half of the 20th century, central banks prioritised price stability, and the adoption of inflation targeting became a widespread strategy. The Global Financial Crisis of 2008 marked another turning point for central banks, as they employed unconventional monetary policy tools to combat the downturn and stimulate economic recovery. Post-crisis, central banks have placed a renewed emphasis on financial stability and macroprudential regulation, aiming to prevent future crises and maintain public confidence in the financial system.

Can Blockchains Replace Central Banks?

Central banks and blockchains are analogous in several different ways. For example, while central banks control the operations of their nations’ native currency, blockchains control the operations of their own native cryptocurrency. The potential for blockchains to replace central banks lies in their ability to offer decentralised, transparent, and secure financial systems. While it is unlikely that blockchains will completely replace central banks in the near future, the technology’s growing influence and adoption may drive these banks to adapt and integrate blockchain-based solutions into their operations, fostering a more efficient and innovative financial ecosystem.

Exploring the Potential of Blockchains in Relation to Central Banks

A blockchain is a decentralised digital ledger that securely records transactions across a network of computers, using cryptographic techniques to ensure data integrity and security. Each transaction is grouped with others in a data block, and once verified, the block is added to the chain of previous blocks, creating a permanent and transparent record. Cryptocurrencies, such as Bitcoin and Ethereum, are digital assets that utilise blockchain technology as their underlying infrastructure. They enable peer-to-peer transactions without the need for intermediaries, such as banks or financial institutions. Cryptocurrencies rely on consensus mechanisms, like Proof of Work (PoW) or Proof of Stake (PoS), to validate and confirm transactions, ensuring that the network remains secure and trustworthy.

Blockchains and cryptocurrencies share several key features with central banks and traditional monetary systems. First and foremost, they both serve as intermediaries to facilitate transactions and ensure the secure transfer of funds, primarily between commercial banks within their jurisdiction. They also provide mechanisms to maintain transparency, enabling users to trace and verify transactions, a quality that is lacking in many central banks. Additionally, both systems are involved in managing the monetary supply, either by issuing cryptocurrencies or fiat currencies. In terms of security, blockchains and central banks employ different approaches to safeguard transactions and prevent fraud, with blockchains leveraging cryptography and decentralised attestation from a diverse set of validators, while central banks rely on centralised control and regulations.

As blockchain technology matures and becomes more widely adopted, it has the potential to take over some functions of central banks. The decentralised nature of blockchains can facilitate faster, more secure, and cost-effective transactions, reducing the need for intermediary institutions. The transparent and tamper-proof features of blockchain also enhance trust and facilitate cross-border transactions, further challenging the traditional roles of central banks. Moreover, as cryptocurrencies gain more traction, they could influence the way central banks manage monetary policy, potentially leading to the development of central bank digital currencies (CBDCs). Although it is improbable that blockchain technology and cryptocurrencies will completely supplant central banks, their growing prominence could prompt central banks to integrate blockchain-based solutions and adapt their operations to accommodate this emerging paradigm. This adaptation could lead to a more streamlined and innovative financial ecosystem.

Can Blockchain Technology Replace the Role of Central Banks?

One of the primary strengths of blockchains lies in their capacity to provide enhanced security and cost efficiency in financial transactions. As decentralised systems, they allow for direct peer-to-peer transactions without the need for centralised parties to verify payments, thereby reducing transaction costs and time. The security of blockchain networks is maintained through the use of cryptographic techniques and consensus algorithms that make it extremely difficult for malicious actors to compromise the system. This high level of security and trust could potentially replace the need for central banks to act as intermediaries and guarantors of transactional safety. Furthermore, the cost efficiency provided by blockchain technology could lead to lower fees for end-users and financial service providers, offering a lower barrier to entry into the financial system. This in turn helps to foster increased financial inclusion, particularly in developing countries where traditional banking services are often unaffordable or inaccessible.

Blockchains have the potential to improve transparency and financial stability – the essential functions of central banks. The public and transparent nature of blockchain transactions enables real-time auditing, making it easier for regulators to monitor and enforce compliance with financial rules and regulations. Moreover, blockchain’s tamper-proof design makes it difficult for bad actors to manipulate the system, reducing the risk of fraud and corruption. This increased level of transparency could reduce the need for central banks to intervene in financial markets as frequently, as the risk of economic shocks caused by fraudulent activities may be mitigated. Additionally, blockchains could play a role in managing the money supply by issuing stablecoins or CBDCs with adjustable parameters that would allow for more responsive and precise monetary policy implementation.

Cross-border transactions, another area dominated by central banks, could be made faster and more efficient via blockchain technology. The global nature of blockchain networks enables the seamless transfer of funds across borders, eliminating the need for multiple intermediaries and reducing transaction times from days to minutes. By facilitating faster and more cost-effective cross-border transactions, blockchains can potentially replace or supplement central banks’ traditional roles in managing international financial flows. Furthermore, blockchain technology can spur financial innovation by providing a platform for the development of new financial products and services, such as decentralised finance (DeFi) applications. This increased innovation could lead to the democratisation of finance, providing people worldwide with access to advanced financial instruments and services that are presently the exclusive domain of central banks and large institutions.

The Political and Economic Fallout of a World Governed by Digital Currencies

As digital currencies continue to gain prominence and reshape the financial landscape, the traditional order is challenged. Profound political and economic consequences may await in a world within which digital currencies play a dominant role. As blockchain-controlled cryptocurrencies take market share from traditional fiat currencies, governments and central banks will face a loss of control over monetary policy, leading to decentralised power and authority in the financial system. This shift could have far-reaching implications for political and economic stability, as well as for the balance of power between governments, central banks, and non-state actors.

Politically, a world governed by digital currencies may lead to the erosion of state sovereignty in the realm of monetary policy. The borderless and decentralised nature of digital currencies makes it difficult for governments to enforce capital controls or manage exchange rates effectively. This could result in increased capital flight, undermining of national currencies, and ultimately, a loss of monetary autonomy. As governments struggle to maintain control over their financial systems, they may face increased competition and rivalry with non-state actors, such as large technology companies and decentralised networks that control digital currencies. This power struggle could lead to increased tensions and potential conflicts between governments and the private sector, as both parties vie for control over the future of finance. Moreover, the regulatory landscape will need to evolve to address the unique challenges posed by digital currencies, as traditional oversight mechanisms may prove inadequate or ill-suited to the task.

Economically, the rise of digital currencies poses new challenges and risks to the global financial system. As digital currencies increasingly supplant traditional currencies, the ability of central banks to implement and execute monetary policy may be weakened. Traditional tools, such as interest rate adjustments and open market operations, rely on central banks’ control over the money supply and the banking system, which may be undermined if a significant portion of transactions and savings occur outside the traditional system. Additionally, the volatility of digital currencies could introduce new risks and instabilities into the global economy. Without a central authority to manage these risks, the burden of addressing financial crises may increasingly fall upon individual governments passing regulations and decentralised protocols implementing policy, inevitably leading to a more fragmented and less coordinated global response.

Despite these challenges, central banks have the opportunity to adapt to the rise of digital currencies with the emergence of CBDCs. CBDCs represent a digital form of a country’s sovereign currency and are issued as well as managed by the central bank. CBDCs could enable central banks to maintain control over monetary policy while capitalising on the benefits of digital currencies, such as lower transaction costs, increased financial inclusion, and enhanced payment efficiency. By proactively embracing and shaping the future of digital currencies, central banks can retain their relevance and continue to fulfil their mandates in a rapidly changing financial landscape. As digital currencies become an increasingly integral part of the global financial system, central banks must evolve, incorporating new technologies and strategies to ensure they remain effective stewards of political stability and economic growth. Otherwise, they may face their own obsolescence, eventually being supplanted by decentralised blockchain networks.

Conclusion

As blockchain technology takes its place as a prominent actor on the international financial stage, the role of central banks and analogous institutions will have to change and evolve to preserve the stability of existing political and economic systems. Being a centuries-old institution with millennia of prehistory, integral for managing national economies, any changes must be implemented with caution. Nevertheless, blockchain technology’s inherent benefits, such as trustlessness, transparency, security, and decentralisation, will likely bring about its eventual integration into national finances. This could lead to a shift in state control over monetary policy and a transformation of traditional economic systems. Although the potential scope of blockchain technology remains uncertain, its integration into macroeconomic systems may cause a financial revolution comparable to the invention of central banks themselves.

About Zerocap

Zerocap provides digital asset liquidity and custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

All material in this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any digital asset. Investments in digital assets can be risky and you may lose your investment. Past performance is no indication of future performance.

FAQs

What is the role of a Central Bank in a country’s economy?

A central bank is a key financial institution that holds the primary responsibility for a country’s monetary policy and financial system. It ensures the stability of the national currency and the smooth functioning of the banking system. Central banks serve as the main authority in the implementation of monetary policy, the management of interest rates, and the control of the money supply. They also function as the government’s bank, handling its accounts, issuing sovereign debt, and providing support to other banks during financial crises.

How can blockchain technology potentially replace Central Banks?

Blockchain technology, with its decentralized, transparent, and secure financial systems, has the potential to take over some functions of central banks. The decentralized nature of blockchains can facilitate faster, more secure, and cost-effective transactions, reducing the need for intermediary institutions. The transparent and tamper-proof features of blockchain also enhance trust and facilitate cross-border transactions, further challenging the traditional roles of central banks.

What are the political and economic implications of a world governed by digital currencies?

As digital currencies continue to gain prominence and reshape the financial landscape, the traditional order is challenged. Profound political and economic consequences may await in a world within which digital currencies play a dominant role. As blockchain-controlled cryptocurrencies take market share from traditional fiat currencies, governments and central banks will face a loss of control over monetary policy, leading to decentralised power and authority in the financial system.

What are Central Bank Digital Currencies (CBDCs) and how can they help Central Banks adapt to the rise of digital currencies?

Central Bank Digital Currencies (CBDCs) represent a digital form of a country’s sovereign currency and are issued and managed by the central bank. CBDCs could enable central banks to maintain control over monetary policy while capitalising on the benefits of digital currencies, such as lower transaction costs, increased financial inclusion, and enhanced payment efficiency.

What are the potential risks and challenges posed by the rise of digital currencies to the global financial system?

The rise of digital currencies poses new challenges and risks to the global financial system. As digital currencies increasingly supplant traditional currencies, the ability of central banks to implement and execute monetary policy may be weakened. Traditional tools, such as interest rate adjustments and open market operations, rely on central banks’ control over the money supply and the banking system, which may be undermined if a significant portion of transactions and savings occur outside the traditional system. Additionally, the volatility of digital currencies could introduce new risks and instabilities into the global economy.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post