Content

- What Is MEV?

- What Is Inter-Blockchain Communication (IBC)?

- MEV On IBC

- How Is MEV Extracted On IBC?

- How Cosmos-Based Blockchains Are Uniquely Positioned to Mitigate MEV

- Skip Protocol

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What is Maximum Extractable Value (MEV) and how does it work in the Cosmos ecosystem?

- What is the Inter-Blockchain Communication (IBC) protocol and how does it facilitate MEV?

- What are some common methods of interchain MEV extraction in the Cosmos ecosystem?

- How are Cosmos-based blockchains mitigating the negative effects of MEV?

- What is the role of Skip Protocol in managing MEV within the Cosmos ecosystem?

27 May, 23

The Operation of MEV in Cosmos’ Interconnected Ecosystem

- What Is MEV?

- What Is Inter-Blockchain Communication (IBC)?

- MEV On IBC

- How Is MEV Extracted On IBC?

- How Cosmos-Based Blockchains Are Uniquely Positioned to Mitigate MEV

- Skip Protocol

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What is Maximum Extractable Value (MEV) and how does it work in the Cosmos ecosystem?

- What is the Inter-Blockchain Communication (IBC) protocol and how does it facilitate MEV?

- What are some common methods of interchain MEV extraction in the Cosmos ecosystem?

- How are Cosmos-based blockchains mitigating the negative effects of MEV?

- What is the role of Skip Protocol in managing MEV within the Cosmos ecosystem?

Maximum Extractable Value (MEV) is an untapped reservoir of digital oil hidden within every block of a blockchain. With the increased adoption of layer 0 protocols, cross-chain block space markets have begun to emerge. As application-specific blockchains are launched on layer 0 protocols such as Cosmos and its Inter-Blockchain Communication (IBC) protocol, a whole new landscape of MEV extraction has emerged; interchain MEV. However, within this landscape, much like drilling for oil, MEV extraction can cause collateral damage. In response, a number of blockchains connected to IBC have implemented novel strategies to extract MEV in Cosmos and mitigate its harmful effects.

What Is MEV?

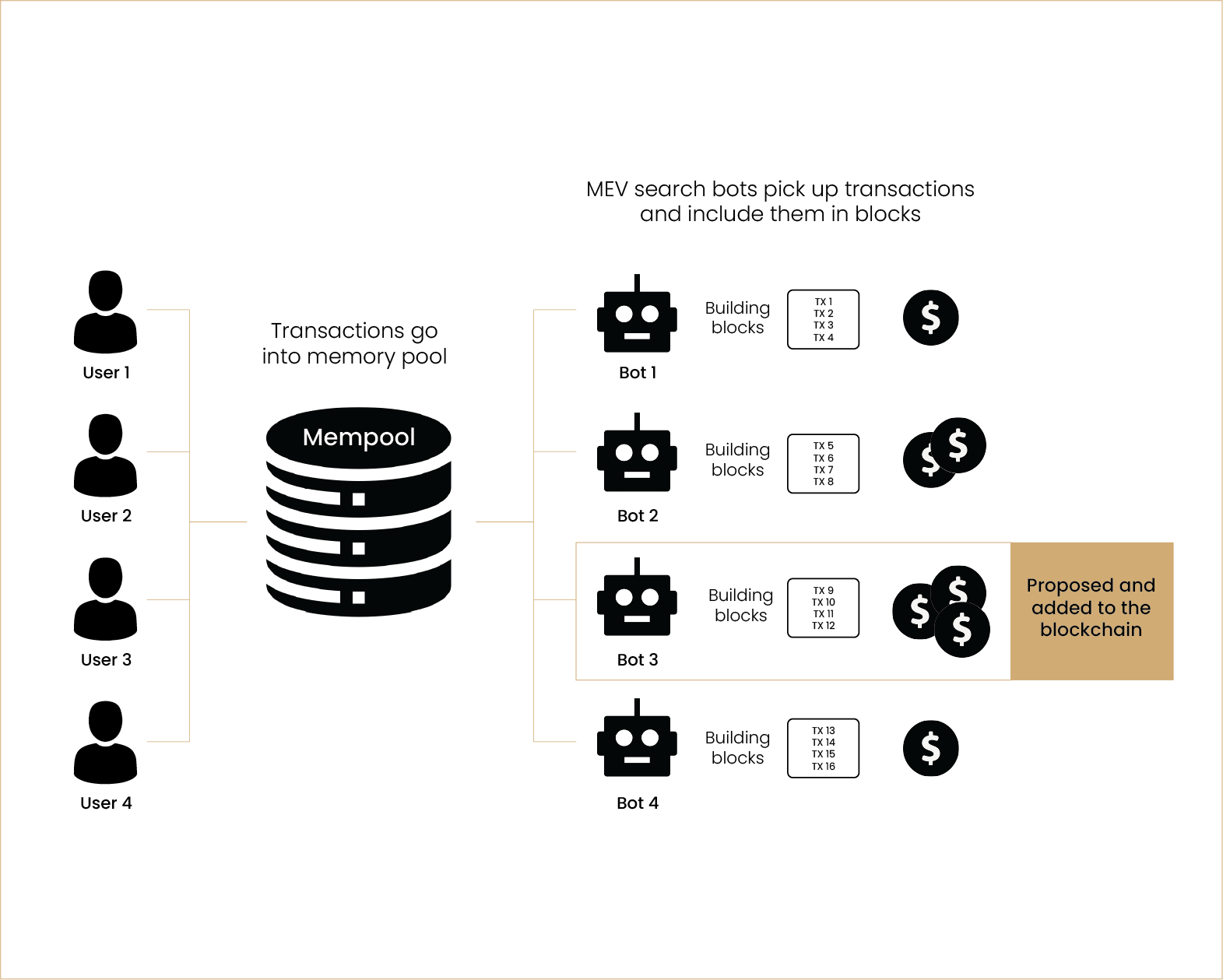

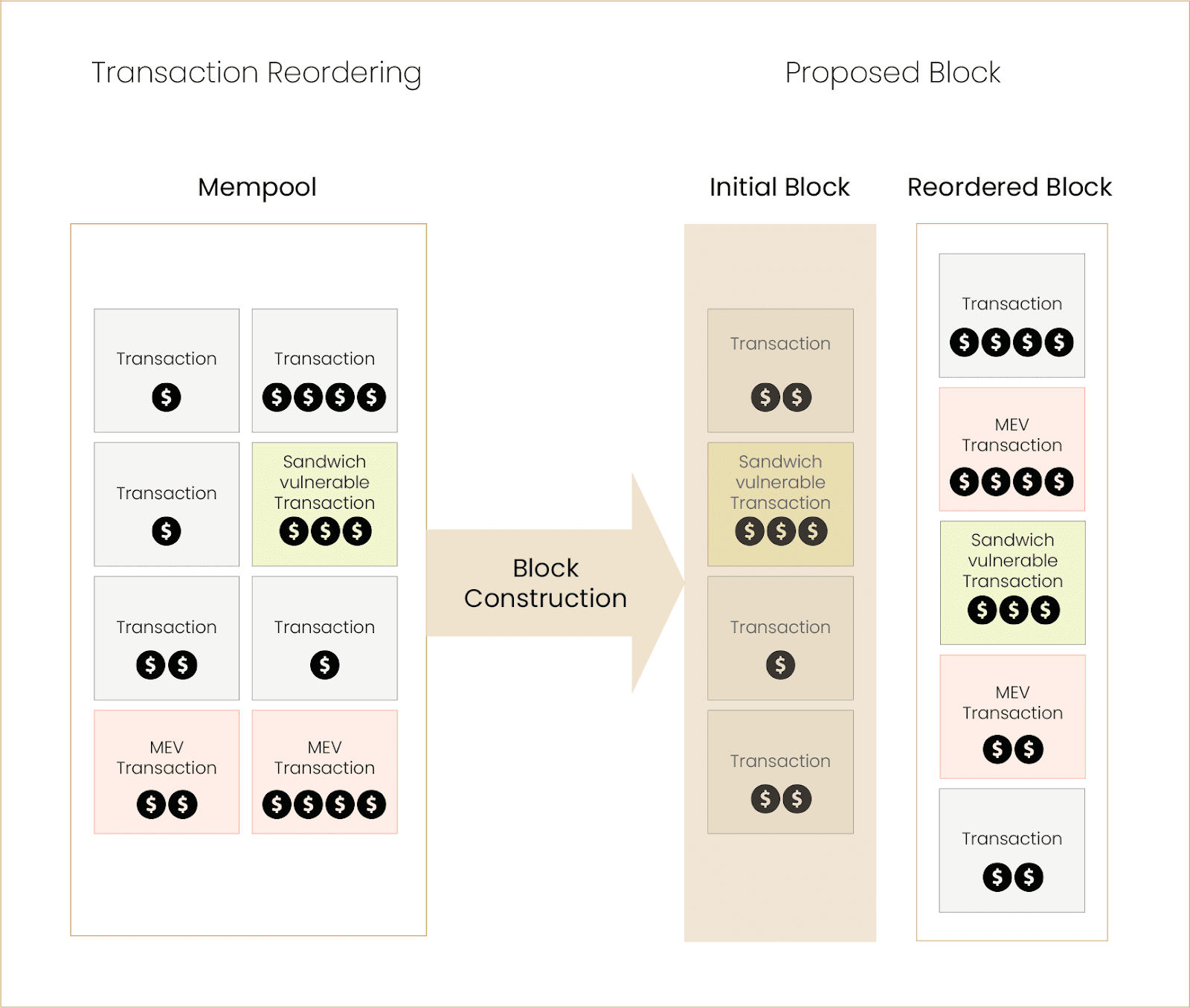

Blockchains are built around a digital ledger consisting of blocks that store transaction data. Given that transactions are executed in the order they were included in a block it is possible to earn additional value by rearranging the order of transactions in a block. This reward is referred to as MEV and is the maximum profit earned in addition to gas fees and block rewards. First referenced in relation to Proof of Work (PoW) blockchains, MEV was initially dubbed Miner Extractable Value due to the participation of miners. However, the introduction of Proof of Stake (PoS) on the Ethereum network eliminated miners, thus the change from ‘miner’ to ‘maximal’. MEV extraction theoretically should be accrued entirely by validators who have the ability to propose blocks, hence guaranteeing the execution of profitable MEV opportunities. However, a large portion of MEV extraction is performed by individual transactors, referred to as searchers who capitalise on profitable MEV opportunities usually using automated trading bots.

Since the inception of the MEV phenomena, searchers have developed several strategies to manipulate the gas auction system on blockchains such as Ethereum and extract MEV. Arbitrage trading is the most common, in its simplest form involving the exploitation of price differences between homogenous tokens on heterogeneous Decentralised Exchanges (DEXs). For example, a searcher may recognise TokenA is priced at $1.00 on DEX 1 and $1.20 on DEX 2. By buying TokenA on DEX 1 and selling it on DEX 2 within the same block, the searcher earns a riskless profit. This is a very straightforward form of arbitrage trading referred to as atomic arbitrage. However, it can involve the implementation of long and complex trading strategies between heterogeneous tokens and DEXs to ultimately exploit price differentials.

Additionally, MEV can also be extracted by buying liquidated collateral from lending protocols. Liquidations involve the forced sale of a borrower’s collateral to repay their outstanding debt and help maintain a lending protocol’s solvency. Searchers will monitor these protocols for under-collateralized positions and submit transactions to purchase the collateral. When a position is liquidated, the protocol initiates an auction to sell the borrower’s collateral to the highest bidder, who in turn receives the collateral at a discounted price. Typically, the MEV is earned via liquidation fees paid by the borrower and the protocol selling the collateral for under market value, in effect creating an arbitrage opportunity.

Another form of MEV extraction is frontrunning, an umbrella term used to describe several strategies which involve participating in gas bidding to manipulate transaction ordering. Notably, frontrunning is occurring increasingly off-chain via services such as FlashBots that enable traders to implement their MEV-extraction strategies in a controlled environment. Sandwich trading is the most common form of frontrunning. It involves searching for large transactions and placing two transactions at the beginning and end of a block to exploit the price differential created as a result of the large transaction. Put more specifically, a sandwich attack creates profit by maximising the allowed and unused slippage of larger trades.

Conversely, validators can also extract MEV by manipulating the order of transactions within the block they propose. MEV extraction by validators is different from individual transactors as they have a much broader perspective on the transaction pool, and they can evaluate the best strategy to maximise MEV from a higher level. They can use specialised tools and algorithms to optimise the transaction order based on various factors such as transaction fees, the current network state, and other MEV extraction strategies. However, presently validators get a large portion of the MEV extracted by searchers due to the high gas fees they are willing to pay in exchange for the inclusion of their profitable transactions in a block. Assuming searchers are economically rational, these gas fees can be up to 100% of the MEV profit. The most common and competitive methods of MEV extraction such as arbitrage, frontrunning and liquidations frequently necessitate searchers to pay 90% or more of their MEV revenue in gas fees. Therefore, validators capture a large portion of MEV revenue via gas fees.

Certain methods of MEV extraction can have harmful effects on blockchains, causing what is referred to as the MEV problem. Of the harmful practices, frontrunning is amongst the most impactful, causing slippage for larger trades on DEXs; however, slippage is not the root of the MEV problem. Rather, as small groups of searchers become more effective they capture an increasing portion of MEV revenue. This in turn allows them to set up more validator nodes to increase their likelihood of being chosen to propose a block and increase their MEV revenue further, effectively causing a snowball effect. This can lead to a centralisation of power in the hands of a few and undermine the decentralised nature of the blockchain. Hence the MEV problem and the effort within the blockchain community to negate certain harmful methods of MEV such as frontrunning.

What Is Inter-Blockchain Communication (IBC)?

Typically, separate layer 1 networks are unable to natively communicate with one another. Given that distinct blockchains possess different underlying architectures, sending and receiving data, let alone transactions in a secure manner is highly challenging. To overcome this challenge, bridges and trusted intermediaries are often used. However, these intermediaries frequently introduce security risks with one report noting that 50% of all DeFi exploits result from bridge hacks. Therefore, there have been several instances of blockchains turning to cross-chain communication protocols as their solution for inter-blockchain connectivity.

The Inter-Blockchain Communication Protocol (IBC) is one such example of a cross-chain communication protocol used to authenticate and transport data between blockchains. Employed by Cosmos, IBC provides a permissionless method for relaying data between blockchains, unlike traditional bridges which require a degree of trust. This trustless model is achieved via a set of agreed-upon standards for communication between blockchains. In doing so, IBC solves the problem of cross-chain communication, enabling the blockchains operating on it to participate in an inter-blockchain ecosystem or an internet of blockchains as dubbed by Cosmos.

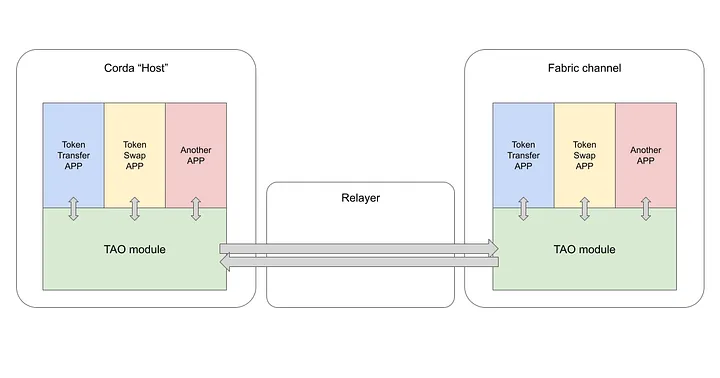

To ensure the secure transfer of data packets between different blockchains, IBC leverages the near-instant finality provided by the Tendermint BFT consensus engine. IBC protocol itself consists of two layers; the transport layer (IBC/TAO) and the application layer (IBC/APP). The transport layer defines the standards for the transport, authentication, and ordering of data packets, while the application layer defines standards for the application handlers of data packets. When an interchain transaction is initiated, data packets are transmitted via dedicated channels that run on internal protocol modules and are secured by light clients that verify the validity of the state sent by either party. This ensures that the transaction is executed in a secure and transparent manner. IBC’s design enables the transfer of value, as well as metadata, between distinct blockchain networks.

To illustrate how IBC relays data between blockchains, consider the example of a user initiating a cross-chain transaction between two layer 1 networks. Blockchain A initiates a cross-chain message, looking to send digital assets to Blockchain B. Data packets are sent from Blockchain A’s dedicated channel via a relay layer to Blockchain B’s dedicated channel. The relay layer is responsible for transferring data between specified channels. Each channel consists of a smart contract connection at either end responsible for proving data was received from a particular sender. Once received by Blockchain B’s channel, the data is relayed to Blockchain B’s IBC/TAO module. IBC/TAO module facilitates the order of operations, ensuring that the data is received properly. Once received, the data is authenticated by a light client operating on Blockchain B in the order that it was sent by IBC/TAO module. If the presented state of Blockchain A is confirmed by the light client, the data is validated and accepted by Blockchain B.

Source: How Cosmos’s IBC Works to Achieve Interoperability Between Blockchains

By facilitating an environment within which application-specific blockchains can communicate and send transactions between one another, users’ needs can be filled comprehensively in a manner similar to that of a generalised blockchain. A composable network of application-specific blockchains can be set up via an interchain communication protocol such as IBC with a degree of interoperability comparable to that of a general-purpose blockchain. Thus, layer 0 networks and cross-chain communication protocols enable the network effect, a phenomenon whereby the value and utility of a blockchain increase as more people begin to use it, to be harnessed by a network of application-specific blockchains similar to ecosystems of decentralised applications (DApps) on a generalised blockchain. In doing so, interchain communication protocols such as IBC enable novel cross-chain trading opportunities that give rise to interchain MEV.

MEV On IBC

Overall, the majority of MEV extraction on Cosmos-based blockchains occurs similarly to that on more traditional blockchains. While the introduction of IBC allows for the transfer of assets and data across chains, searchers and validators tend to participate in arbitrage, liquidations, etc. Nevertheless, the ubiquity of application-specific blockchains linked through the IBC framework has given rise to several innovative techniques to extract and manage MEV. These mechanisms, unique to the Cosmos ecosystem, are opening new perspectives on MEV extraction, offering potential paths to streamline processes and mitigate its negative consequences.

How Is MEV Extracted On IBC?

Interchain MEV is enabled by IBC, which facilitates seamless transactions and interactions between different blockchains within the Cosmos ecosystem. By connecting these disparate chains, IBC fosters an environment that facilitates cross-chain communication and value transfer. This interchain MEV unlocks new possibilities by allowing sophisticated arbitrage opportunities and value extraction across multiple blockchains simultaneously. Unlike traditional MEVs, interchain MEVs can be used to capture value from multiple chains simultaneously, increasing the potential rewards for MEV actors.

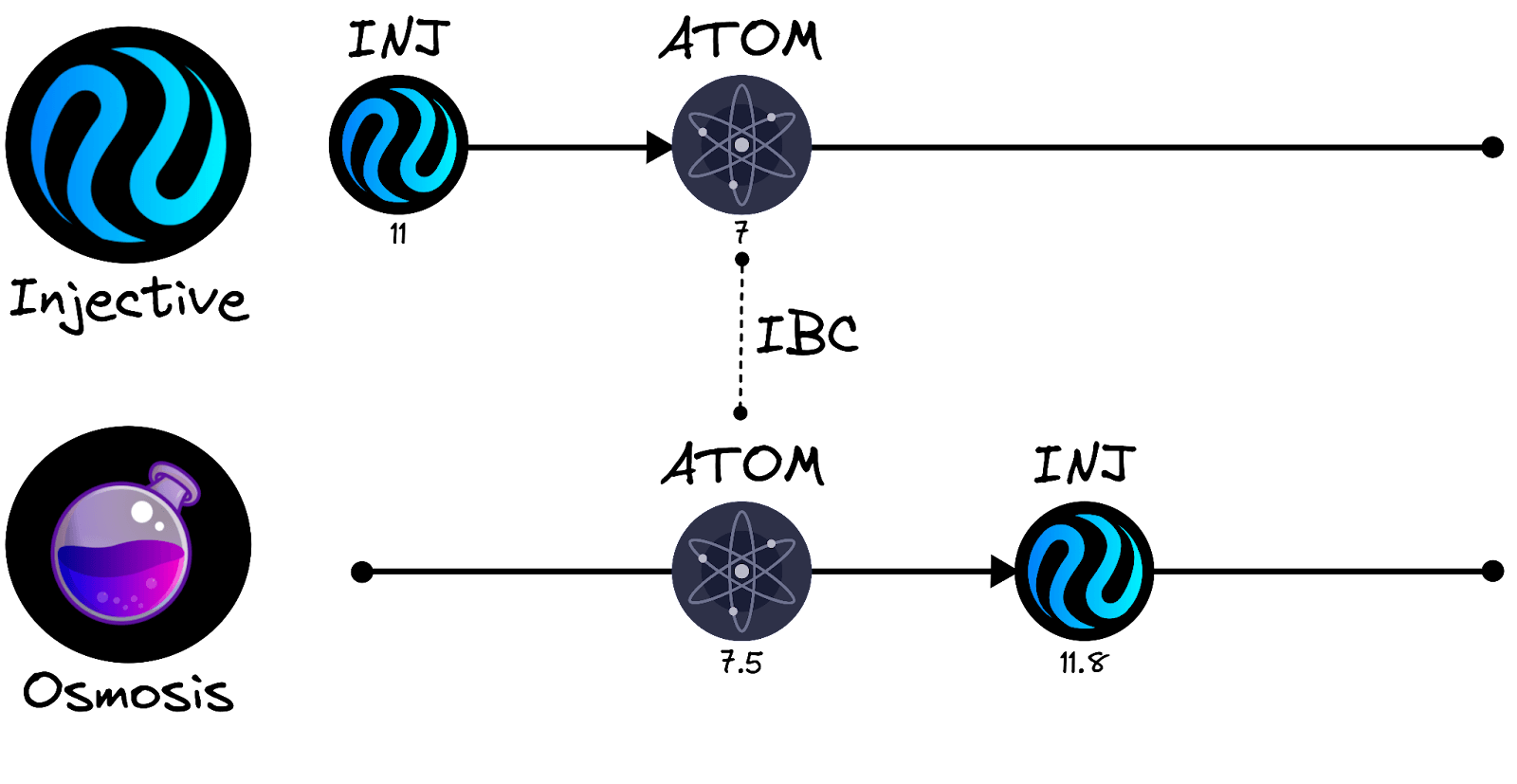

Interchain arbitrage, displayed between two Cosmos chains in the infographic below, is one of the most common methods of interchain MEV extraction. This trading strategy involves searchers taking advantage of price discrepancies between different blockchain networks. Interchain arbitrage has become more prevalent in recent years as the number of blockchain networks operating within the Cosmos ecosystem has increased. A searcher will identify price discrepancies between assets on DEXs that operate on separate blockchains and capitalise on these discrepancies by buying the asset and selling it for a higher price. This type of arbitrage trading isn’t limited to two chains; a trader could operate across three or more chains to achieve similar outcomes. This type of arbitrage trading over the IBC protocol has the potential to increase market efficiency and liquidity. By aligning prices across multiple blockchain networks, capital can be transferred more efficiently, incentivising the flow of liquidity between blockchains. This in turn promotes the development of interoperability solutions and promotes collaboration between different blockchain communities.

As mentioned above, the majority of MEV extraction within the Cosmos ecosystem takes place similarly to that on traditional blockchains. Protocols including Kujira facilitate liquidations while DEXs connected to IBC like Osmosis enable seamless interchain arbitrage trading. However, being that the majority of Cosmos chains are application specific with greater means of customizability, many attempts to implement mechanisms to mitigate harmful forms of MEV on their network.

How Cosmos-Based Blockchains Are Uniquely Positioned to Mitigate MEV

Due to its enabling of seamless interoperability, Cosmos hosts an ideal ecosystem for the development of application-specific blockchains. Since these blockchains are only required to serve a specific niche, they possess more freedom to customise their infrastructure for their specific use case than monolithic chains. Layer 1s built on the Cosmos stack frequently optimise their underlying Cosmos infrastructure to enable their DApps to achieve better performance and user experience. By extension, application-specific blockchains in the Cosmos ecosystem, particularly those in the DeFi space, are pursuing a range of solutions to mitigate the MEV in Cosmos problem. Since these blockchains are highly customisable and tailored they are uniquely positioned to implement a range of MEV solutions for Cosmos, a task which may be more difficult on a generalised blockchain such as Ethereum.

Osmosis, for example, is planning to implement threshold encryption on its mempool. This approach enables a private mempool, whereby transactions sent are encrypted and unable to be accessed by network participants until they have been executed. Transactions remain encrypted until their block is executed, after which validators decrypt each transaction in the block, verify their validity and finalise the block. While this process negates the extraction of harmful MEV, the process of continually decrypting transactions each time a block is settled can lead to longer block times. Similarly, certain edge cases which are impacted by the ordering of transactions such as sandwich attacks become more difficult to execute within a private mempool.

Osmosis also implements a protocol-owned arbitrage module that executes arbitrage trades to ensure an efficient market and allow the protocol itself to capture MEV. This mechanism, referred to as ProtoRev, has been built by the team at Skip Protocol. Protocol-owned MEV mechanisms such as this can be implemented within protocols that control their whole stack. Such blockchains can enforce custom transaction ordering and self-executing code that captures MEV generated by its application(s). In this framework, the network can run code to identify MEV opportunities derived from user transactions in each block. After the user transactions are executed, the block producer is able to insert their own arbitrage transactions at the end of the block. Any revenue generated is then sent to a protocol-managed account. This approach enables the allocation of captured MEV toward the protocol itself. However, this approach is only effective within single applications and can cause increases in block times.

Sei, a sector-specific blockchain purpose-built for DeFi, is working with Skip Protocol to build an alternative to PBC. Referred to as the x/builder module, Sei aims to capture and control MEV on-chain by leveraging this piece of infrastructure. Built using the programmable version of the Application BlockChain Interface (ABCI) dubbed ABCI++, x/builder allows developers to have more control over block building and empowers them to redirect MEV created by their applications by programming MEV-awareness into block production and consensus. Specifically, the x/builder module provides new application mempool and consensus primitives for chains and validators, enabling application developers to enforce more expressive preferences about their blockspace and redistribute MEV revenue to chain stakeholders. It offers various primitives, such as top-of-block auctions, bundler transactions, bundled transactions, consensus-enforced fee markets, and application-aware fee markets. These features aim to improve user experience, reduce manipulation, and prevent censorship.

Sei Network also implements Frequent Batch Auctioning (FBA), an approach to processing transactions simultaneously. FBA auctioning works by executing transactions that do not impact the state of others together in a batch without the order revealed until the auction is closed. This approach reduces the surface of potentially harmful MEV extraction and provides significant benefits to chain performance. However, validators could still include their own transactions in a block and harmful MEV may still be extracted via transactions that do not affect the same state.

Skip Protocol

Of the MEV solutions operating within the Cosmos ecosystem, Skip is one of the most notable. The protocol itself is a sovereign MEV solution that offers app chains and validators within the Cosmos ecosystem a high degree of control over their blockspace markets and order flow. By enabling developers to leverage MEV while maintaining sovereignty over their blockchain, Skip empowers them to protect users from the negative consequences of MEV and improve user experience. The core philosophy behind Skip is to provide a set of tools and mechanisms that allow developers to establish protocol-owned block building (POB) and multiplicity within their blockchain ecosystems. POB enables protocols to express their block-building preferences given the transactions, while multiplicity ensures the right transactions make it into the block. The result is a blockchain ecosystem where developers can tailor their MEV solutions according to the specific needs of their applications and communities.

The key component of Skip is its sovereign MEV toolkit designed to give developers a comprehensive set of options for managing and controlling the MEV generated within their blockchains. Consensus-enforced block validity rules over transaction ordering and inclusion, for instance, allow non-proposing validators to safely accept or reject blocks based on the transactions within them and their relative ordering. This could entail mandating that valid blocks order transactions by descending gas price, contain at least one oracle transaction, or limit the number of a special top-of-block transaction type. Similarly, consensus-enforced block validity rules over state enable non-proposing validators to accept or reject blocks based on whether the state transitions within them satisfy particular outcomes, such as a zero frontrunning condition across all DEXs or the burning of a specific amount of gas.

In addition to these consensus-enforced rules, Skip also provides builder primitives built into both node clients and the state machine to facilitate more efficient block production. Enhancing validator node clients with features such as simulating blocks prior to proposing them and removing failing transactions, maintaining reputation tracking and rate limiting systems for searchers, and supporting mempools capable of running single pay auctions for state slots can streamline the block production process. Similarly, enriching the state machine with new state and state transition functions that model functionality commonly provided by off-chain builders enables greater control over block construction. Examples include special transaction types that require significantly higher bids than the gas fee to be included, meta-transactions that can bundle multiple transactions together, and meta-transactions that impose requirements on preceding or subsequent transactions.

Skip’s suite of products further enhances its role within the Cosmos ecosystem. Skip Select, for instance, is a blockspace auction system that enables the construction of the top of the block from tipped bundles submitted by traders. These bundles are guaranteed to be included on chain in the order specified by the trader, ensuring that MEV-sensitive transactions are executed as intended. This not only enhances the security and efficiency of the network but also promotes a fair and transparent trading environment. Another product, ProtoRev, is an on-chain module that captures MEV by back-running transactions at execution time, allowing for the recapture of “good” MEV and enhancing overall network efficiency. This mechanism helps maintain the integrity of the network by mitigating the negative impact of MEV exploitation.

Conclusion

IBC is providing an additional avenue of MEV extraction, an alternative to that which takes place on traditionally siloed layer 1s. The cross-chain interoperability facilitated by IBC provides an avenue for the extraction of MEV between blockchains connected to it. While it operates as an additional avenue for potentially harmful MEV extraction, certain features planned to be implemented on IBC such as the interchain scheduler and its blockspace market enable the extraction of interchain MEV in a democratised manner. Fortunately, the prevalence of application-specific blockchains on IBC fosters the implementation of features to mitigate MEV. Ultimately, IBC accommodates a new landscape for the extraction of MEV, with additional features to alleviate its harmful side effects and promote constructive approaches.

About Zerocap

Zerocap provides digital asset liquidity and custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

All material in this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any digital asset. Investments in digital assets can be risky and you may lose your investment. Past performance is no indication of future performance.

FAQs

What is Maximum Extractable Value (MEV) and how does it work in the Cosmos ecosystem?

Maximum Extractable Value (MEV) is a concept that refers to the maximum profit that can be earned by rearranging the order of transactions in a block, in addition to gas fees and block rewards. In the Cosmos ecosystem, with the introduction of the Inter-Blockchain Communication (IBC) protocol, a new landscape of MEV extraction has emerged, known as interchain MEV. This allows for sophisticated arbitrage opportunities and value extraction across multiple blockchains simultaneously.

What is the Inter-Blockchain Communication (IBC) protocol and how does it facilitate MEV?

The Inter-Blockchain Communication (IBC) protocol is a cross-chain communication protocol used to authenticate and transport data between blockchains. It provides a permissionless method for relaying data between blockchains, unlike traditional bridges which require a degree of trust. By connecting disparate chains, IBC fosters an environment that facilitates cross-chain communication and value transfer, enabling the extraction of interchain MEV.

What are some common methods of interchain MEV extraction in the Cosmos ecosystem?

Interchain arbitrage is one of the most common methods of interchain MEV extraction in the Cosmos ecosystem. This trading strategy involves taking advantage of price discrepancies between different blockchain networks. A trader will identify price discrepancies between assets on Decentralized Exchanges (DEXs) that operate on separate blockchains and capitalize on these discrepancies by buying the asset on one chain and selling it for a higher price on another.

How are Cosmos-based blockchains mitigating the negative effects of MEV?

Application-specific blockchains in the Cosmos ecosystem are pursuing a range of solutions to mitigate the negative effects of MEV. For instance, Osmosis is planning to implement threshold encryption on its mempool, which enables a private mempool where transactions sent are encrypted and inaccessible by network participants until they have been executed. Another example is Sei Network, which implements Frequent Batch Auctioning (FBA), an approach to processing transactions simultaneously, reducing the surface of potentially harmful MEV extraction.

What is the role of Skip Protocol in managing MEV within the Cosmos ecosystem?

Skip Protocol is a sovereign MEV solution that offers app chains and validators within the Cosmos ecosystem a high degree of control over their blockspace markets and order flow. It provides a set of tools and mechanisms that allow developers to establish protocol-owned block building (POB) and multiplicity within their blockchain ecosystems. Skip’s suite of products, such as Skip Select and ProtoRev, further enhances its role within the Cosmos ecosystem by providing a blockspace auction system and an on-chain module that captures MEV, respectively.

Like this article? Share

Latest Insights

Zerocap Launches Institutional OTC Desk for Tokenized Gold Trading

Zerocap’s institutional OTC desk enables investors to access tokenized gold efficiently, supporting portfolio diversification and inflation hedging strategies. The core objective is to provide seamless

Weekly Crypto Market Wrap: 23 February 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

InvestorDaily Spotlights Zerocap | Bitcoin to IBIT Swap: How Institutions Are Converting BTC Into ETF Exposure

Read more in a recent article in InvestorDaily. 18 February, 2026: Institutional sentiment toward Bitcoin remains constructive, but the way exposure is held is evolving. With

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post