Content

- Introduction To Auction Theory

- Risks Associated With Prevalent Auction Designs

- English Auction

- Dutch Auction

- Sealed Bid Auction

- How Does This Relate To Liquidations?

- The Problems With Cryptocurrency Liquidation Markets

- The Solution

- Designing Liquidation Markets To Maximise User Wellbeing

- The Mechanism Itself

- Enhancing User Experience

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What is Auction Theory and how does it impact the design of marketplaces?

- What are the different types of auction formats and how do they influence bidder behaviour?

- What is the credible mechanism trilemma in auction design?

- How does Auction Theory apply to cryptocurrency liquidation markets?

- What solutions are being proposed to address the challenges in cryptocurrency liquidation markets

1 Jun, 23

Designing Marketplaces for User Safety: The Auction Theory

- Introduction To Auction Theory

- Risks Associated With Prevalent Auction Designs

- English Auction

- Dutch Auction

- Sealed Bid Auction

- How Does This Relate To Liquidations?

- The Problems With Cryptocurrency Liquidation Markets

- The Solution

- Designing Liquidation Markets To Maximise User Wellbeing

- The Mechanism Itself

- Enhancing User Experience

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What is Auction Theory and how does it impact the design of marketplaces?

- What are the different types of auction formats and how do they influence bidder behaviour?

- What is the credible mechanism trilemma in auction design?

- How does Auction Theory apply to cryptocurrency liquidation markets?

- What solutions are being proposed to address the challenges in cryptocurrency liquidation markets

Auctions are a high-stakes poker game with bidders placing their bets in the hopes of walking away with a prize. However, certain auction designs facilitate more advanced actors to outcompete all competitors, being dealt an advantageous hand that allows them to outcompete all competitors. Without effective measures to foster an egalitarian marketplace, players may continually win auctions and utilise their winnings to obtain centralised power as an authority with insight into the auction’s internal workings. Hence, the importance of ensuring a democratised auction system within which users are able to compete fairly.

Introduction To Auction Theory

Dating back to ancient civilisations such as Rome, Greece and even Babylon, auctions were used in marketplaces to sell spoils of war, slaves and property. Most of these auctions were performed via simplistic, transparent, ascending bid systems. While auctions have been a common method of trade and resource allocation throughout history, the theoretical analysis of auctions as an economic mechanism gained traction with the development of modern economic theory. Early economists during the 18th and 19th centuries laid the foundation for auction theory as a distinct field of study. For example, William Stanley Jevons, an English economist, was one of the first to discuss auctions in a formal economic context. In his 1871 book, “The Theory of Political Economy,” Jevons used the English auction as a means to illustrate the concept of marginal utility, laying the groundwork for future studies on auction dynamics. Additionally, James Vickrey, developed the Vickrey auction, also known as a second-price sealed bid auction. His system, which promotes truthful bidding and allocates resources efficiently, led him to receive the Nobel prize for Economics. Auction theory gained significant traction in the 20th century, as economists and mathematicians began to formalise the study of auctions and develop mathematical models to analyse bidding behaviour and market outcomes.

Central to the study of auction theory is the assumption that all actors will behave in accordance with their own best interests, potentially at the detriment of others in the system. As such, auction theory seeks to understand how different auction systems affect the behaviours of bidders and sellers as well as how alternative designs can affect market outcomes such as efficiency, revenue, allocation of goods and several other endpoints. In large part, this consists of examining how bidders formulate strategies to maximise returns under different auction rules. Therefore, one of the key concepts in auction theory is the notion of auction format, which refers to the rules and procedures of the auction. Different auction formats can have a significant impact on the behaviour of buyers and sellers, the final price of the goods being sold, and the efficiency of the auction. Some common auction formats include English auctions, Dutch auctions and sealed bid auctions.

Another important concept in auction theory is bidder behaviour. Bidders are often faced with uncertainty about the fair value of the goods being sold and the behaviour of other bidders. This absence of definitive knowledge necessitates the implementation of strategic behaviour, such as bidding less to avoid overpaying or bidding more to vexatiously prevent others from acquiring the goods. The behaviour of bidders in large part is contingent on the availability of information. In auctions, buyers and sellers often have asymmetric information, meaning that one party may have more or better information about the goods being sold than the other party. This asymmetry of information impacts bidder strategy. For example, if buyers have better information about the value of the goods being sold, they may be willing to bid higher, leading to a higher final price; notably, a single buyer with an insight that only they possess can make this outcome a reality. To help forecast and understand the behaviour of bidders and sellers, auction theorists make use of game theory, a branch of mathematics that studies strategic decision-making.

Game theory provides a framework for analysing how individuals or groups of individuals interact strategically in situations where the outcome depends on the actions of all players. Game theory is particularly relevant to auction theory, as auctions can be seen as a type of game where bidders compete against each other to win the item being sold. Auction theory uses game theory to analyse how bidders formulate their strategies and how these strategies affect the outcome of the auction. In addition to analysing the behaviour of bidders in different auction formats, game theory can also help to design more efficient and fair auction mechanisms, an area of study referred to as mechanism design.

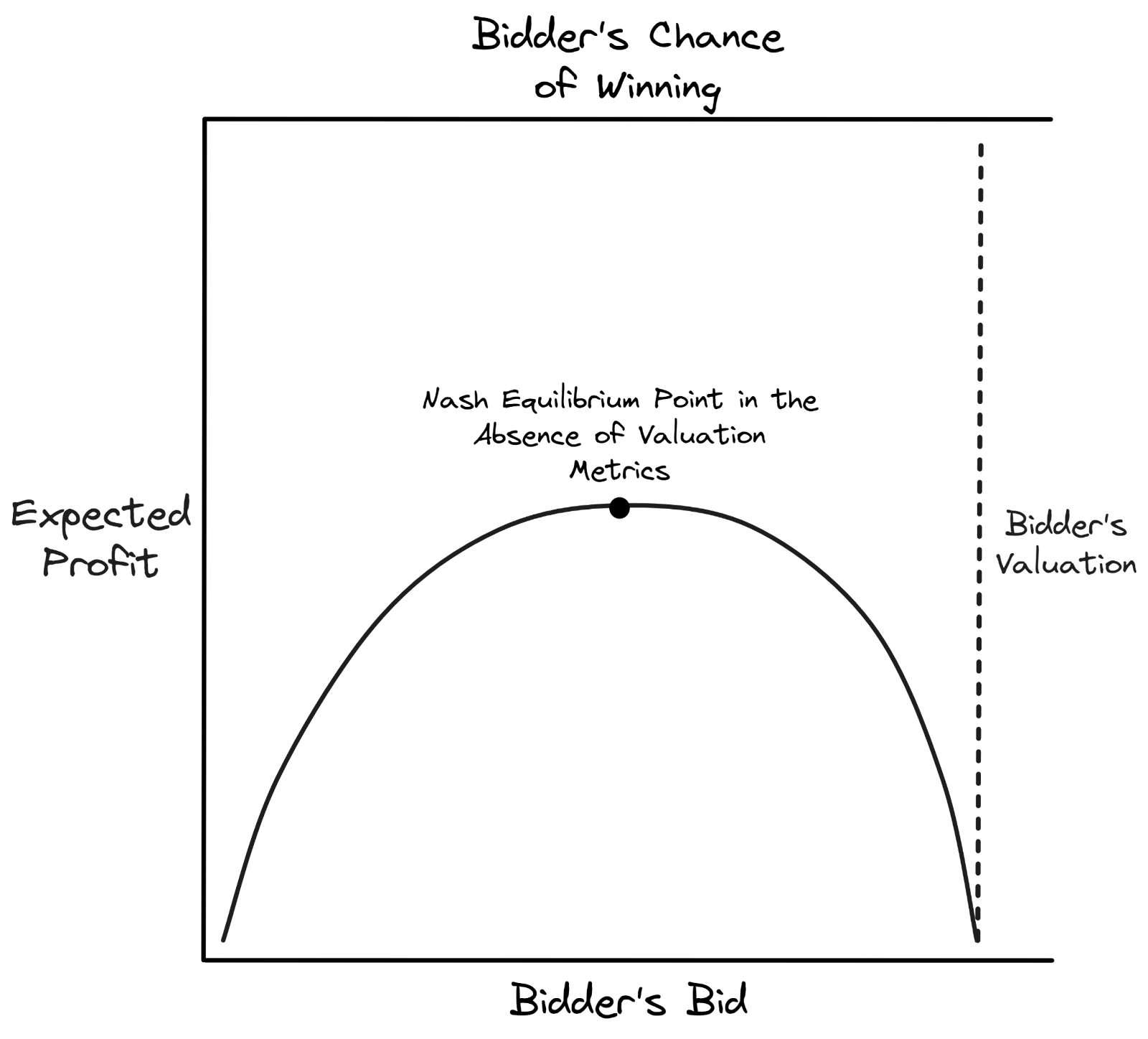

One of the foundational concepts in game theory is the Nash equilibrium, named after the mathematician John Nash. A Nash equilibrium is a set of strategies where, in the absence of knowledge of the opposing players’ strategies, no player has the incentive to change their strategy given the strategies of the other players. In other words, each player’s strategy is optimal, assuming the other players maintain their strategies.

Consider the graph below demonstrating two bidders bidding against each other in a first-price sealed auction. Given neither bidder is informed regarding their opponent’s strategy, their best option is to bid just below their assumed opponent’s valuation of the product up until their own valuation. Without access to information regarding their opponent’s strategy, the bidder’s best strategy is to maximise the intersection between potential profit and chance of winning, leading to a uniform bidding strategy and a Nash equilibrium at 50% of their valuation. It is important to note however that during most auctions valuation methods are readily available to all participants, meaning the curve and equilibrium point (the most potentially profitable bid) will likely skew more toward the right in order to account for the non-uniform chance to win.

Risks Associated With Prevalent Auction Designs

Auctions have been used for centuries to determine the prices of goods and services in a competitive market. From antiques and artwork to government contracts and the telecommunications spectrum, auctions have proven to be an effective method for setting prices and allocating resources. However, not all auctions are created equal, and the auction format used can have a significant impact on the outcome. For example, some auction designs may aim to maximise the seller’s revenue, while others may prioritise the buyer’s welfare. Additionally, different auction designs may be more appropriate for certain types of goods or services, depending on their characteristics and market conditions.

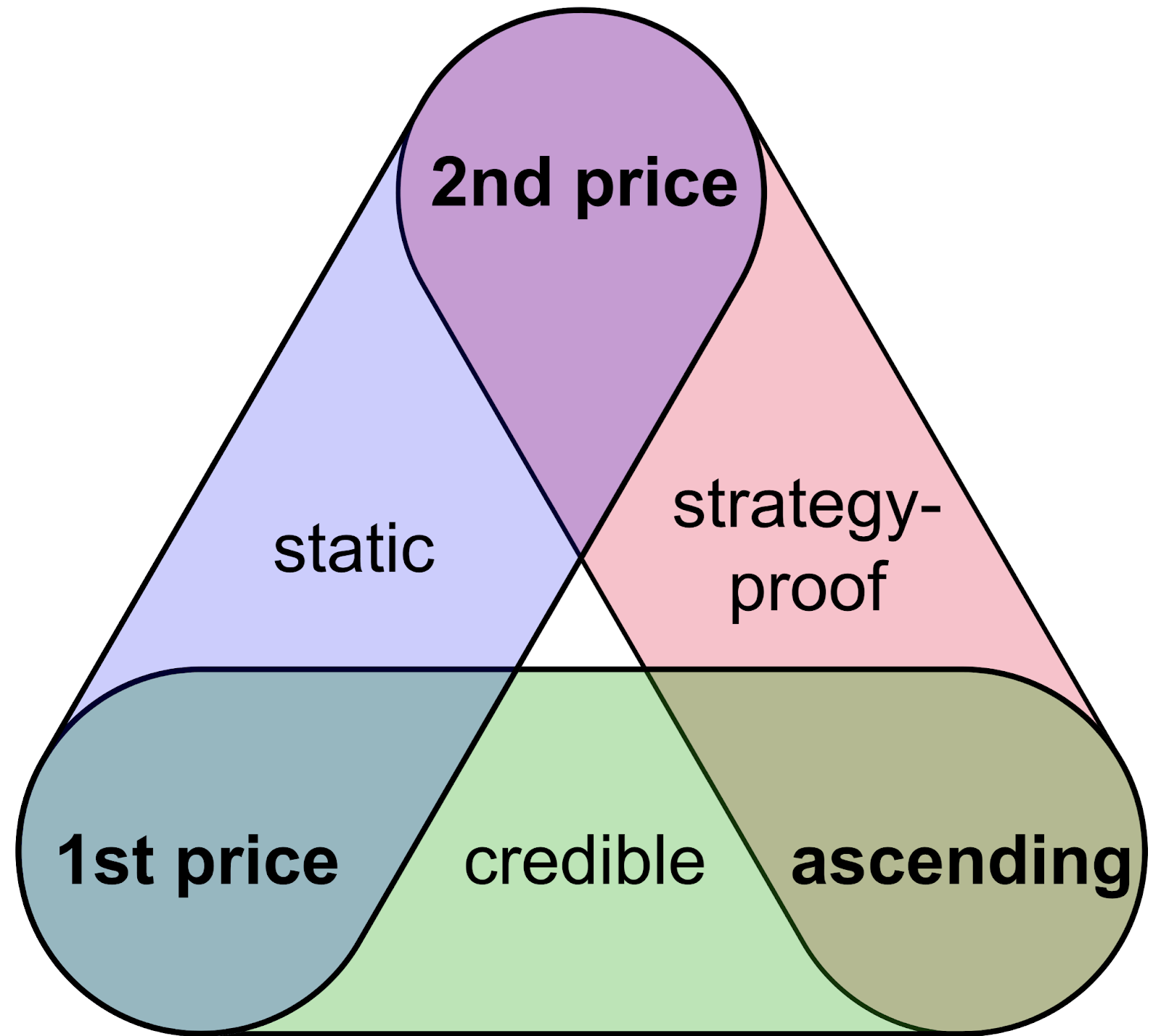

The difficulty involved in designing auction mechanisms is highlighted by the “credible mechanism trilemma” that demonstrates the tradeoffs required to achieve three primary objectives; simplicity, full surplus extraction, and credibility. This concept, developed by Mohammad Akbarpour and Shengwu Li, emphasises the difficulty in simultaneously optimising these objectives in auction design.

- Static: A static auction is one where bidders submit sealed bids, and the auction mechanism determines the allocation and payments based solely on these bids. Static auctions are simple and easy to implement, as they do not involve multiple rounds or iterative processes. Additionally, they tend to have lower information and communication requirements, as bidders only need to determine and submit their valuations for the items being auctioned.

- Strategy-proof: An auction mechanism is strategy-proof if it is in every bidder’s best interest to submit a bid that truthfully reflects their valuation of the item, regardless of the actions taken by other bidders. In other words, a strategy-proof auction eliminates incentives for bidders to misrepresent their valuations or engage in strategic behaviour to manipulate the outcome. Strategy-proof auctions lead to more efficient outcomes and promote fairness, as they prevent bidders from gaining an advantage through dishonesty or strategic manipulation.

- Credible: A credible auction is one where the auctioneer commits to the rules of the auction and follows them transparently, without any possibility of deviation or manipulation. Credibility is crucial in building trust among the bidders, as they need to be confident that their bids will be treated fairly and that the auctioneer will not use their information to their advantage or manipulate the outcome.

Source: Credible Auctions: A Trilemma

The credible mechanism trilemma suggests that it is challenging to create an auction mechanism that optimises all three objectives simultaneously. In practice, trade-offs must be made depending on the specific context and goals of the auction. For example, to ensure strategy-proofness, many auction designs rely on dynamic or iterative mechanisms, where bids are updated in response to information revealed during the auction. This conflicts with the desire for a static auction, as static auctions typically lack the flexibility needed to prevent strategic manipulation. Furthermore, to ensure credibility, an auctioneer might need to hide certain information, such as the submitted bids, to prevent manipulation. However, this can conflict with strategy-proofness, as hiding information may create opportunities for bidders to engage in strategic behaviour, knowing that their true valuations won’t be revealed. These are just two examples of the conflict created when attempting to balance the facets of the credible auction trilemma. Auction designers need to carefully balance these objectives to create mechanisms that effectively allocate resources and achieve desired market outcomes while maintaining credibility and ease of participation for bidders.

English Auction

Arguably the most widespread and well-known auction system is the English auction, also referred to as an open ascending price auction. In an English auction, the auctioneer starts with a low initial price and gradually raises it while bidders openly compete against each other by placing progressively higher bids. The auction continues until no bidder is willing to place a higher bid, at which point the highest bidder wins the item and pays the final bid price. English auctions are commonly used for selling valuable goods such as art, antiques, and real estate.

There are several advantages to English auctions, including transparency and price discovery. The open bidding process allows all participants to observe the bids of others, making the auction process transparent and easy to understand. This transparency encourages competition, which can lead to higher final prices for the seller. Moreover, the ascending price mechanism helps in efficient price discovery, as bidders incrementally reveal their valuations for the item. Despite this, there are also limitations to English auctions, such as the potential for collusion among bidders and the “winner’s curse,” where the winning bidder may overpay for the item due to incomplete information or overly aggressive bidding.

In the context of the credible mechanism trilemma, English auctions excel in the facet of credibility. They are open, as well as simple to understand and participate in, making them credible. Nevertheless, English auctions fall short in terms of strategy proofness. Bidders will frequently employ rudimentary strategies such as continually bidding in small increments until their valuation is reached. Furthermore, English auctions by their nature completely fail in terms of being static. Bids are submitted openly, with several rounds of bidding taking place until the auction closes.

Dutch Auction

The Dutch auction is the inverse of the English auction, representing an open descending bid auction format, where the auctioneer starts with a high price and then gradually lowers the price until a bidder is willing to buy. At that point, the auction ends, and the bidder who accepted the price wins the item and pays the agreed-upon price. Dutch auctions are commonly used for selling perishable goods, such as produce, and certain financial transactions, such as initial public offerings (IPOs) of stocks.

The Dutch auction format has several advantages, including speed and simplicity. The descending price mechanism can lead to quicker resolution of the auction compared to the ascending price mechanism of an English auction. This can be especially beneficial for goods that need to be sold quickly or in situations where time is a crucial factor. Additionally, Dutch auctions can discourage collusion among bidders, as the first bidder to accept the price wins the item, reducing the opportunity for bidders to coordinate their actions. However, there are also limitations, such as the possibility of suboptimal price discovery due to bidders’ fear of losing the item if they wait too long to bid. This may result in less competitive bidding and lower final prices compared to other auction formats.

In relation to the credible mechanism trilemma, Dutch auctions offer similar benefits to English auctions, excelling in terms of credibility. They are simple to understand and participate in, making them accessible to a wide range of bidders. Dutch auctions may not always achieve full surplus extraction, as the price discovery process could be less competitive than in English auctions, potentially leading to lower revenues for the seller. Yet, the descending price mechanism can still provide a reasonably efficient allocation of goods, especially in situations where speed is a priority. Regarding credibility, the transparent nature of Dutch auctions allows bidders to observe the price reduction process, ensuring that the auction results reflect the true preferences of the participants.

Sealed Bid Auction

First-price and second-price sealed bid auctions are two distinct types of sealed bid auctions, where bidders submit their bids secretly without knowing the bids of other participants. In a first-price sealed bid auction, the highest bidder wins the item and pays the price they bid. In a second-price sealed bid auction, also known as a Vickrey auction, the highest bidder wins the item, but they pay the price submitted by the second-highest bidder. The sealed bids are opened simultaneously after the submission deadline, and the auction outcome is determined.

Sealed bid auctions offer several advantages, including the potential for increased bidder participation due to the confidentiality of bids, which can encourage more competitive bidding. They also prevent certain types of collusion among bidders, as participants cannot observe others’ bids during the auction. Nevertheless, sealed bid auctions have some limitations. Bidders may struggle to determine their optimal bidding strategy, especially in first-price auctions, due to uncertainty about the valuations of other bidders. This can lead to overbidding or underbidding, potentially resulting in inefficient allocation of goods and the “winner’s curse.” Second-price sealed bid auctions can mitigate this issue by encouraging bidders to submit their true valuations, but they may still face challenges related to information asymmetry and bid shading, as multiple bidders may excessively overbid in order to win the auction with the expectation that the second bid will be a true valuation.

Sealed bid auctions offer a different balance among simplicity, full surplus extraction, and credibility compared to other auction formats. While sealed bid auctions can be simple to understand and participate in, first-price auctions may require more complex bidding strategies due to uncertainty, potentially increasing the barrier to entry for some bidders. In terms of full surplus extraction, first-price auctions may result in lower revenues for the seller compared to second-price auctions, as bidders may shade their bids to avoid overpaying. Second-price auctions can achieve better surplus extraction by encouraging truthful bidding, but they may still be vulnerable to bid shading if bidders possess asymmetric information. Finally, the confidential nature of sealed bid auctions can provide credibility by preventing certain types of collusion and ensuring that the auction results reflect the true preferences of the participants.

How Does This Relate To Liquidations?

DeFi has revolutionised the financial landscape by offering decentralised, permissionless and transparent alternatives to traditional financial services, such as lending and borrowing. Lending protocols, such as MakerDAO, Compound, and Aave, have emerged as prominent players in the DeFi space, allowing users to deposit cryptocurrencies as collateral to borrow assets or earn interest on their deposits. These lending protocols rely on smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. To maintain the stability and solvency of the system, DeFi lending protocols implement liquidation mechanisms to manage the risk associated with collateralized loans. When the value of the collateral drops below a specified threshold, known as the liquidation ratio, the borrower’s position becomes undercollateralized and is subject to liquidation.

Liquidations involve the forced sale of the borrower’s collateral to repay their outstanding debt and help maintain the protocol’s solvency. The liquidation process aims to minimise the risk of loss for the protocol and its users, protecting the overall health of the ecosystem. Auctions are a common mechanism used in DeFi lending protocols to facilitate the liquidation process. When a position is liquidated, the protocol initiates an auction to sell the borrower’s collateral to the highest bidder, who in turn receives the collateral at a discounted price. This process ensures price discovery by allowing the market to determine the value of the collateral being liquidated, promoting efficient allocation of resources. Furthermore, the auction system encourages bidders to participate in the liquidation process by offering the possibility of acquiring collateral at discounted prices, which helps maintain the protocol’s solvency and stability. However, in the present landscape, this process is neither fair nor efficient.

The Problems With Cryptocurrency Liquidation Markets

Cryptocurrency liquidation markets serve a crucial function in the decentralised finance (DeFi) landscape by facilitating the liquidation of undercollateralized positions to preserve the stability of lending protocols. However, these markets are not without several challenges that hinder their overall effectiveness as well as the safety of bidders and sellers. Cryptocurrency markets have been hit by the same cycle of margin calls and liquidations familiar to traditional finance, exacerbated by the unique characteristics of the crypto market. When investors sell holdings to meet a margin call, the liquidated collateral is often sold at a large discount, causing prices to drive down further, leading to more margin calls and liquidations, thereby perpetuating what is referred to as a liquidation cascade.

These liquidations are usually triggered automatically by smart contracts that turn positions over to bots, incentivized with a liquidation bonus. Automated bots have become an integral part of the DeFi liquidation ecosystem. Bots are automated software programs designed to participate in liquidation markets, executing trades faster and more efficiently than human participants. These bots constantly monitor a blockchain’s memory pool for undercollateralized positions and participate in liquidation auctions, seeking to profit from the discounted collateral. While bots can contribute to the efficiency and speed of liquidations, they also present challenges.

Since bots compete for positions primarily based on speed, bot-dominated liquidation markets can lead to a lack of fairness and equal opportunity for human participants. Bots can outperform human traders in terms of speed and efficiency, allowing them to snatch profitable liquidation opportunities before humans have a chance to act. Moreover, advanced bots can continually outperform their competition, including other bots, enabling them to dedicate funds toward further development. This inevitably leads to a small number of sophisticated players controlling the liquidation market, potentially leading to centralisation, collusion, price manipulation, and reduced fairness. Therefore, an uneven playing field emerges whereby human traders and retail bots struggle to compete against more advanced bots funded by whales and institutional investors.

Another issue associated with bots in cryptocurrency liquidation markets is the potential for increased network congestion and higher transaction fees. Bots often engage in aggressive bidding wars during liquidation events, rapidly submitting competing transactions to secure profitable liquidations. This behaviour can clog the network, delaying other transactions and driving up fees as users try to outbid one another. The increased fees can create a negative feedback loop, where higher fees lead to even more aggressive bidding, further exacerbating the problem and causing a race to zero. This dynamic not only affects liquidation markets but can also impact the broader DeFi ecosystem by making it more expensive and less efficient for all participants.

The Solution

Given that traditionally bot-dominated cryptocurrency liquidation markets can cause congestion and centralisation, solutions are required. Without effective solutions, advanced bots may cause market manipulation, producing further centralisation until retail traders are permanently edged out of liquidation markets. Without competition, liquidated collateral will face inefficient price discovery, likely producing excessive discounts and market instability. To counteract the negative effects of bot-dominated liquidation markets, various measures have been proposed and some implemented by platform developers and the DeFi community. These initiatives aim to level the playing field, reduce network congestion, and promote fairness in the liquidation process.

One approach to mitigate the impact of bots is the introduction of decentralised liquidation mechanisms that incorporate randomisation and fair distribution of opportunities. By randomising the assignment of liquidation tasks or incorporating time delays, these protocols reduce the advantages that bots have in terms of speed and efficiency, giving human participants a fair chance to compete. Another measure is the implementation of gas-efficient liquidation solutions to alleviate network congestion and reduce transaction fees. By reducing the gas costs and network load associated with liquidations, these optimizations can alleviate the bidding wars that drive up transaction fees and clog the network, leading to a more efficient liquidation process for all participants. Lastly, fostering collaboration and information sharing within the DeFi community can help create a more inclusive environment for liquidation market participants. By developing open-source tools, educational resources, and transparent reporting on liquidation activities, the community can empower users to better understand the liquidation process and make informed decisions.

One such approach to mitigating the harmful effects of bots is Orca, a protocol built on the Kujira network, designed to provide a public marketplace for bidding on liquidated collateral. Established to bring fair, decentralised community liquidations to the entire Cosmos ecosystem, Orca includes a number of measures to give human traders the opportunity to act. Traditional bot-dominated cryptocurrency liquidation markets often lead to congestion, centralisation, and market manipulation, causing inefficient price discovery and market instability. The Orca Protocol, however, leverages Dutch auction mechanics and a specific, anti-bot approach to transform the liquidation process into a more transparent and equitable experience. By empowering community members, who frequently have a long-term interest in partner platforms, to acquire liquidated assets at competitive discounts, Orca aims to prevent immediate selling and damage to the market caused by bot operators. This system is aimed at fostering a healthier and more stable ecosystem that negates liquidation cascades and other harmful phenomena.

Orca operates using a Dutch auction system, whereby the price of the asset being auctioned decreases until the highest bid is filled. The auction works on a queue based first come, first served basis, with bids being filled in order from the smallest discount to the largest. To bid on liquidated collateral, Orca users select their desired market premium and input the amount they want to bid. The premium refers to the percentage above the liquidation value that the user is willing to pay to obtain the rights to purchase liquidated collateral. For example, if the liquidation value of an asset is $100 and the user sets a premium of 10%, they are willing to pay up to $110 for the asset, which may still be significantly discounted from the market price. Once the user places their bid, it is added to the auction queue. As bids are filled, the price of the asset decreases until it reaches a point where all the available liquidated collateral has been sold. At this point, the auction closes, and the winning bidders receive the liquidated assets at the price they bid. This queue-based approach negates the competitive advantage possessed by bots in more traditional liquidation markets. Furthermore, by filling bids from smallest discount to largest, the seller can obtain an optimal discount rate, preventing damage to the market. As such, the auction system behind Orca’s public liquidations marketplace provides greater safety for buyers and sellers alike.

Designing Liquidation Markets To Maximise User Wellbeing

Delving deeper into the possibilities of designing liquidation markets that serve users’ best interests, zero-knowledge proofs (ZKPs) stand out as a promising technology in this regard. Leveraging ZKPs to construct blockchain-based sealed bid auctions can bring significant improvements to DeFi liquidation markets. ZKPs allow one party (the prover) to demonstrate to another party (the verifier) that they know a value, without conveying any information apart from the fact that they know the value. In the context of auctions, this technology can serve to verify bids without revealing the exact bid value, maintaining the secrecy essential to the sealed bid auction mechanism.

The Mechanism Itself

Consider the auction of a single item with multiple participants. Each participant formulates a bid based on their valuation of the item. When submitting the bid, they concurrently create a ZKP demonstrating the validity of their bid without revealing the bid itself. The auction platform, likely smart contract based, in this case, acts as the auctioneer, receiving the bids and ZKP from all participants. The auctioneer does not know the values of the bids, only that they are valid, thanks to the ZKPs. When the bidding period ends, the auctioneer opens all bids, verifying them against their corresponding ZKPs. The participant with the highest valid bid wins the auction.

A key aspect of this mechanism is the generation and verification of ZKPs. This process is mathematically complex and computationally intensive, as it involves the use of cryptographic algorithms to create proofs that can verify the correctness of information without revealing the information itself. However, with ongoing advancements in the field of cryptography and the advent of more efficient ZKP systems, the computational burden is being continually reduced, paving the way for practical implementations of such ZK-based auction systems.

An equally vital part of the mechanism is the verification of the ZKPs by the auction platform. This involves the use of the same cryptographic algorithms to check the validity of the proof against the actual bid, ensuring that the proof correctly represents a valid bid. This process, much like the generation of ZKPs, is computationally demanding, but the costs are outweighed by the potential benefits it brings to the auction process, namely in terms of fairness and transparency. Given these layers of complexity, the implementation of a ZK-based sealed bid auction system requires a robust infrastructure. The underlying smart contract must provide the necessary security features to ensure the confidentiality of bids and the integrity of the ZKPs.

In terms of the auction mechanism itself, the ZK-based sealed bid auction system could operate on a standard, descending, or Vickrey auction model. In a standard sealed bid auction, the highest bidder wins the auction and pays their bid amount. In a descending auction, the auctioneer starts from a high price and lowers the price until a bidder accepts the current price. In a Vickrey auction, the highest bidder wins but pays the second-highest bid amount. The choice of auction model would depend on the specific goals and circumstances of the liquidation market. The key feature of this system is not the auction mechanism, but the sealed bid system, as the inherent transparency of blockchains has made this difficult to achieve.

To ensure user well-being, it is crucial that the system provides adequate educational resources and user support. Despite the inherent complexity of ZKPs, the user interface of the auction platform should be designed in a way that abstracts this complexity, making the process of participating in an auction as straightforward as possible. In addition, the platform should provide comprehensive guides and tutorials on how to participate in a ZK-based sealed bid auction, and offer robust customer support to assist users with any difficulties they may encounter.

Enhancing User Experience

By integrating ZK proofs into sealed bid auctions, it is possible to create a more equitable and efficient auction system for liquidation markets. Bidders would no longer have to contend with the possibility of their bids being observed or manipulated by others, leading to a fairer process where bids truly reflect the bidders’ valuations of the collateral. Furthermore, it can be reasonably anticipated that this approach would discourage some of the aggressive bidding wars that escalate transaction fees and clog the network, especially those caused by front-running bots in the final stage of bidding, leading to a more efficient and cost-effective process. It may also mitigate some of the issues related to bot domination seen in current liquidation markets, as the secrecy of bids would make it more challenging for bots to outperform human participants based on speed alone.

In terms of the credible mechanism trilemma, a sealed bid auction enhanced by ZKPs could potentially achieve a more balanced outcome. The system would still remain simple to understand – participants need only to submit their highest valuation bid and a ZKP to validate their bid. This process could also improve full surplus extraction, as the sealed nature of the bidding would encourage participants to bid their true valuations, potentially leading to higher revenues for the protocol. Finally, the integration of ZKPs would further enhance the credibility of the auction by maintaining the secrecy of the bids while still allowing for independent verification of the auction process.

Incorporating ZKPs into the liquidation market could also foster a healthier DeFi ecosystem. By ensuring the fairness of auctions, this technology could make liquidation markets more attractive to a wider range of participants, diversifying the ecosystem and reducing the risk of centralisation. Moreover, it could help protect the value of liquidated assets and the stability of the broader DeFi market. A fairer auction process that discourages over-aggressive bidding and promotes bid accuracy could result in less drastic price drops for liquidated assets, helping to maintain overall market stability.

Conclusion

Ultimately, in the pursuit of equitable liquidation marketplaces, the practical implementation of auction theory will inform the next generation of auctions designed to be both trustless and safe. With bots having long dominated the liquidation process due to their superior speed and efficiency, individual users have lost, unable to capitalise in an unfair marketplace. While platforms like Orca and innovations such as ZKPs present transformative solutions to decentralise power and democratise participation, they do not eradicate all issues inherent in current liquidation markets. Therefore, marketplace designers should remain grounded in the ethos of DeFi, fostering decentralisation, promoting transparency, and empowering users in pursuit of an ideal mechanism for user safety.

About Zerocap

Zerocap provides digital asset liquidity and custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

All material in this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any digital asset. Investments in digital assets can be risky and you may lose your investment. Past performance is no indication of future performance.

FAQs

What is Auction Theory and how does it impact the design of marketplaces?

Auction Theory is a branch of economics that studies how people act in auction markets and the properties of auction markets. It seeks to understand how different auction systems affect the behaviours of bidders and sellers, and how alternative designs can affect market outcomes such as efficiency, revenue, allocation of goods, and several other endpoints. The design of marketplaces, particularly those that rely on auction mechanisms, can be significantly influenced by Auction Theory, as it provides insights into bidder behaviour, auction formats, and the strategic interactions between bidders.

What are the different types of auction formats and how do they influence bidder behaviour?

There are several auction formats, each with its own set of rules and procedures that can significantly impact bidder behaviour and the final price of the goods being sold. Some common auction formats include English auctions, Dutch auctions, and sealed bid auctions. English auctions are open ascending price auctions, Dutch auctions are open descending price auctions, and sealed bid auctions involve bidders submitting their bids secretly. The choice of auction format can influence the strategies bidders use, the level of competition, and the efficiency of the auction.

What is the credible mechanism trilemma in auction design?

The credible mechanism trilemma is a concept that highlights the tradeoffs required to achieve three primary objectives in auction design: simplicity, full surplus extraction, and credibility. Simplicity refers to the ease of understanding and participating in the auction, full surplus extraction refers to the ability of the auction to capture the maximum possible value from the sale of goods, and credibility refers to the trustworthiness of the auction process. It is challenging to optimise all three objectives simultaneously, and trade-offs must be made depending on the specific context and goals of the auction.

How does Auction Theory apply to cryptocurrency liquidation markets?

Cryptocurrency liquidation markets, particularly those in the DeFi space, often use auction mechanisms to facilitate the liquidation process. Auction Theory can provide valuable insights into how these markets function and how they can be improved. For instance, understanding bidder behaviour and auction formats can help in designing more efficient and fair liquidation mechanisms. However, these markets also face unique challenges, such as the dominance of bots, which can lead to issues like network congestion, centralisation, and market manipulation.

What solutions are being proposed to address the challenges in cryptocurrency liquidation markets

Various measures have been proposed to address the challenges in cryptocurrency liquidation markets. These include the introduction of decentralised liquidation mechanisms that incorporate randomisation and fair distribution of opportunities, implementation of gas-efficient liquidation solutions to alleviate network congestion and reduce transaction fees, and fostering collaboration and information sharing within the DeFi community. For example, Orca, a protocol built on the Kujira network, is designed to provide a public marketplace for bidding on liquidated collateral, with measures to give human traders the opportunity to act.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post