11 Dec, 20

Why Millennials like Bitcoin

In the broad context of asset classes, cryptocurrencies and digital assets are a relatively recent addition, with the Bitcoin whitepaper released in October of 2008. Many financial commentators argue that Bitcoin’s disruptive frameworks and attachment to digital modernity is what drove millennials to adopt the cryptocurrency initially. Even though we have recently seen broader adoption by our high net worth baby boomer and gen-x clientele, millennials have been a significant driving force in the space. In this article, we provide the historical context of why millennials like bitcoin, what the future of crypto holds for the generation and how that translates to younger age-groups.

The hows and the whys

In January 2020, American investor Tim Draper commented during a Fox Business Interview that generation Y should be focused on investing their funds in bitcoin to guarantee their financial future. He argues that bitcoin is the most accessible way for the generation to secure enough value to generate interests into retirement, because the banking system is no longer a trustworthy option for long-term investments. Regardless of his reasoning behind that conclusion, Draper is statistically preaching to the choir as most bitcoin adopters have been people born between 1981 and 1996, which is also called the millennials.

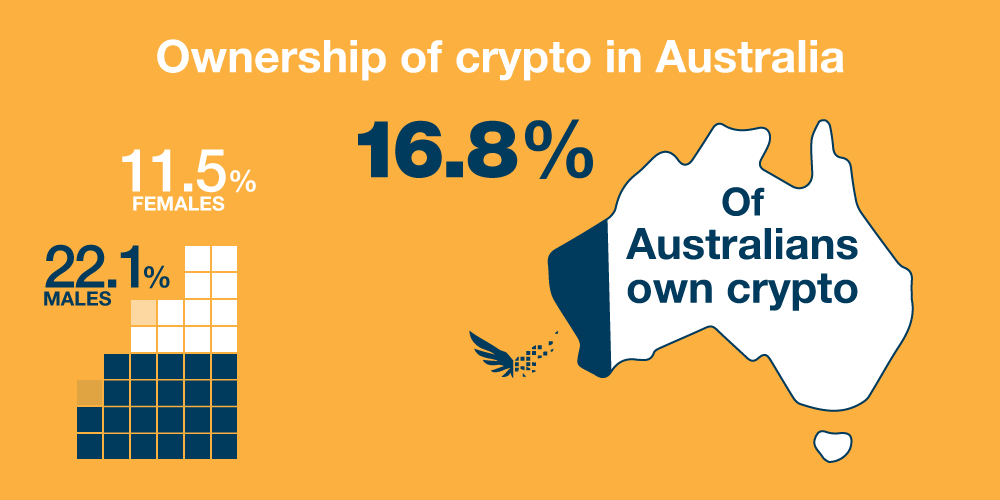

A survey conducted earlier this year by TAP Global has shown that 20 to 29% of millennials in the United Kingdom have invested in the cryptocurrency, provided they had invested funds of at least £25 thousand. That number is significantly larger for millennials than the overall national average investing in the crypto space; merely 3%. The results are also similar for the United States, showing a great deal of interest in Bitcoin from the generation. A research submitted by The Harris Poll displays that 48% of people aged between 18 to 34 believe everyone in the next 10 years will use bitcoin. The same millennial trend goes for Australia; a November 2019 survey by the Independent Reserve Index has shown that 17% of Australians own bitcoin or another cryptocurrency, with 39% of those Australians being millennials. The research also forecast that over 50% of adults aged 44 or younger will own bitcoin by 2024.

Those numbers show that the younger generations are more interested in new ways of investing their money as opposed to the options such as gold, government bonds and real estate. But why would they prefer to invest in cryptocurrencies rather than traditional assets? In a nutshell, because of a loss of trust in the market. When Tim Draper said that millennials are “having a hard time” with the current economy, it was an understatement on the generation’s struggle to acquire financial stability through a weakening market with lower employment rates, exploitative loans and depreciative currencies. Things are not looking great for them, compared to previous generations, and it’s fueling their mistrust on the banking and finance system.

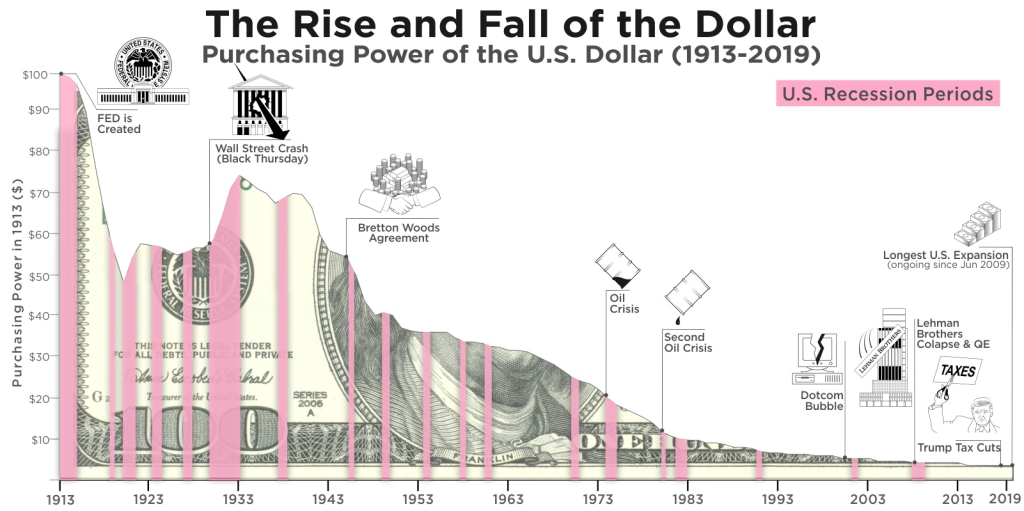

In June of this year, Investopedia released an article on how American millennials invest and what their main concerns are, and they are very straightforward: debt and low employment benefits. It’s no wonder those are the problems that are front of mind, as credit bills and student loans are the main ways in which millennials accumulate debt in the country. As for low employment benefits, it basically comes down to the purchasing power of the US dollar. Using US$100 in 1913 as reference for inflation, the value at the time could purchase the same as US$32 to US$22 in the 1960s and 70s, showing an extensive depreciation of the dollar. In those two decades, the average household income fluctuated around US$55,000 in 2020 values. Yet in nearly six decades since, that average has barely moved. The average household income in 2019 was recorded at US$68,000, which seems like a decent improvement before you consider that a 100 dollar bill in 1913 now gets Americans 3.87 dollars worth of purchasing power. Being born in the 1980s and 90s, millennials grew up in an economy where their money and time has gradually diminished in value, as they work more hours to make ends meet. Once stable assets like housing and property have been pushed out of reach for a large portion of millennials.

For financial purposes, such data translates to younger workers seeing investments in property, bonds and stocks as unattainable or not worth their focus due to the low return in comparison with alternatives such as digital assets. The 2008 Global Financial Crisis (GFC) also contributed to the generation’s mistrust on banking institutions and signing up for loans. Not only did the GFC drastically reduce employment rates and savings account balances, it also made millennials less likely to commit to long-lasting contracts such as getting a mortgage or even buying a car. In our article about Collateralized Loan Obligations, we covered how the GFC might be repeating itself through different loan-packagings and how cryptocurrencies emerged as an anti-risk hedge against central control and financial abuse. Those circumstances have made them more acceptable of investments with higher risks and high-rewards, while free from long-term commitment. Hence, Bitcoin.

In his book “Handbook of Digital Currency”, financial researcher David Chuen makes a sociological approach to why millennials were drawn to the digital asset. He states that the economic crisis of the last decade resulted in an appeal for a collaborative market of autonomous participation through technological integration. After the recession, millennials reevaluated their values towards assets that benefit society and brought power to individuals rather than centralised systems. Along with the rise in social media, people began to see themselves as users and producers instead of consumers, and that reflected in their financial choices. Add that to bitcoin’s unforeseen growth in its first years of existence and millennials were looking at an opportunity to join an autonomous market. It is their chance at investing into a disruptive and yet-emerging currency, an asset that gives them full control over their funds and serves as a haven from inflation. Of course, given bitcoin’s rapid growth, they also see it as an opportunity to have funds that will potentially appreciate significantly in value during their lifetime.

Where will they take the crypto?

How do millennials’ interest in bitcoin since its early stages actually translate to the market? The younger members of the generation are 24 years old, which means they are still reaching their investment maturity and stable financial independence. That opens up opportunities for bitcoin to still grow substantially throughout their generation, as the asset rises in popularity and adoption. What is noteworthy about that trend is that it applies to all layers of the age group; from middle-class investors to the young entrepreneurs and billionaires that became spokespersons for the cryptocurrency. They are gradually inserting themselves in the market by realising the benefits of bitcoin and their digital counterparts.

One of the earliest examples of mainstream entrepreneurs of the generation that adopted bitcoin are the Winklevoss brothers. Co-founders of the Facebook prototype, the twins invested US$11 million to purchase bitcoin in early 2013. The brothers claimed to be very surprised with the fast upside that bitcoin brought in the upcoming years after their investment since the main goal was to have a foolproof hedge against a centralised market. There are also those in the generation implementing the technology into their own businesses. The most notorious millennial of that category is Winklevoss’ former business partner, Mark Zuckerberg. In June 2019 Zuckerberg, along with Facebook, announced the upcoming launch of their own digital currency Libra, which recently changed its name to Diem as rebrand strategy. Millennials also tend to be more in touch with entertainment media and popular culture. Hence, as more celebrities become mainstream speakers for crypto, it also leverages the trend for them and younger generations to adopt the digital currency.

So millennials are still a growing demographic in the crypto market, and the tendency is for it to grow as they acquire financial literacy and further develop projects that improve the Bitcoin network and the Blockchain. How will this generation drive Bitcoin forward? Despite the data, it really comes down to their financial mindset and how they want to experience the world. It is a generation that relies heavily on the fluidity of an app or software to make their routine choices, and that includes finances.

The millennial mindset that seeks fluidity in daily experiences also applies to banks. The generation is steering away from the bureaucracy and slow performance of traditional banks and migrating to platforms that prioritise easy navigation and non-complicated interactions. The trend in demand for easier and less constrained banking led to the global rise of neobanks; banks whose client operations and customer support are fully virtual, without the need for clients to ever go into physical agencies. The biggest neobank in the world by valuation and funding is NuBank, founded in Sao Paulo, Brazil. Despite the appealing specs for millennials it is still, nonetheless, a centralised banking system where users are susceptible to their control and mistakes. In July of this year, NuBank suffered a security lapse where millions of user data leaked online, including people’s full names, emails and national identification numbers.

But most importantly, millennials are more financially-aware than any other generation. According to a study from Chase Generations, millennials start saving up for their retirement around the age of 23, as opposed to 30-39 for generation X and 40-49 for baby boomers. Of course, that is also related to the lowering value of the dollar and the steady decline in power of purchase throughout the last few decades, as mentioned earlier. But younger millennials have also been shown to save more money than past generations, with 60% of adults aged between 18 to 29 saving more than 5% of their monthly income for investments. They are less likely to use their retirement savings before the planned age.

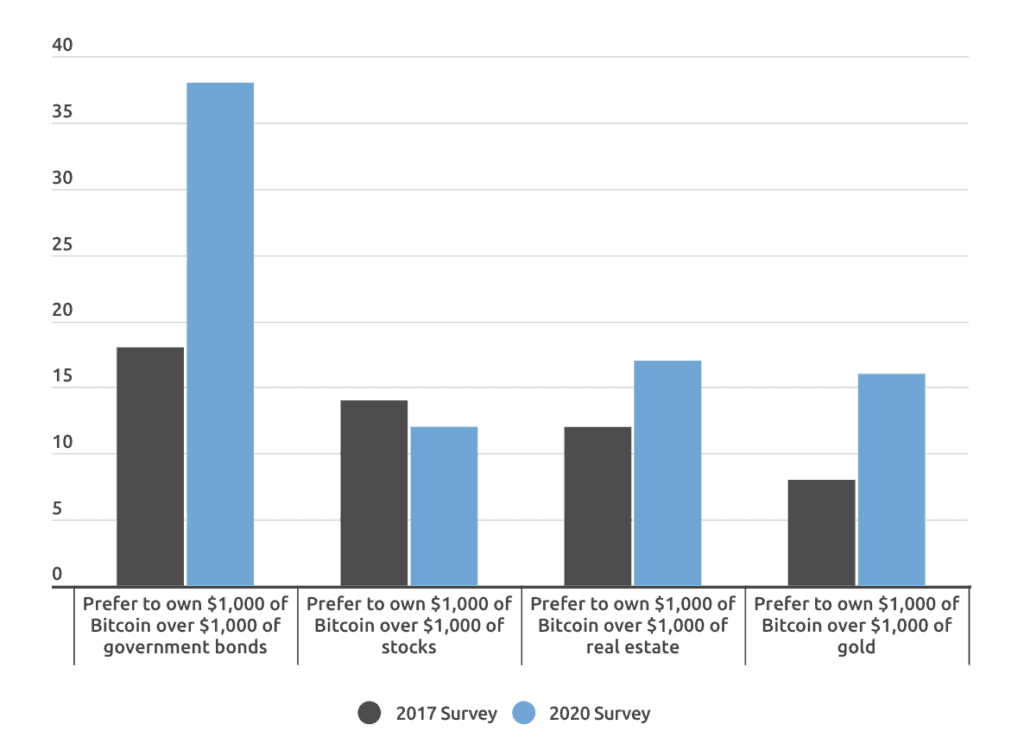

The fact that they not only acquire financial awareness at such an early age but are also great at saving up shows that the generation is making more educated choices when it comes to their investment portfolios. They are diversifying their assets and using bitcoin as a hedge against potential risks from an unstable market. In a recent interview with CNN, JPMorgan head of emerging markets Ruchir Sharma stated that millennials now prefer to invest in bitcoin than gold, a substantial disparity in interest for new markets compared to past generations. That statement became more engrossing recently as the firm released a report on November 6th affirming that family offices also see bitcoin as an alternative to gold. In one for our recent articles about gold and bitcoin in 2020, we compared the similarities and differences between the assets and what makes bitcoin stand out.

Are millennials the future of Bitcoin?

The interest from millennials for digital assets such as bitcoin is simply the start of a direction that is bound to maintain its course with younger generations. Generation Z, teenagers and those in their early twenties, are also more engaged in seeking financial maturity and autonomous investments, even more so than millennials. The millennial generation was simply the kickstart for bitcoin to reach the masses, but the interest for a deflationary hedge against centralised systems will not go away. New generations are consistently introduced into the financial sphere and, as data shows, the crypto trend is only growing stronger.

Date of births

Baby boomers: 1946 – 1964

Generation X: 1965 – 1980

Millennials (Generation Y): 1981 – 1996

Generation Z: 1997 – 2010

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post