Content

- What is the Ethereum Shanghai Upgrade?

- How will it affect Ethereum stakers?

- What is expected to happen after the fork?

- 1) The Classification of Current Stakers

- 2) The Staking Ratio & Sidelined Investors

- 3) The Exit and Withdrawal Queues

- The system has been constructed to keep price volatility limited.

- Zerocap's View

- Express your view on the Shanghai fork with Zerocap:

- Disclaimer

- FAQs

- What is the Ethereum Shanghai Upgrade?

- How will the Ethereum Shanghai Upgrade affect Ethereum stakers?

- What is expected to happen after the Ethereum Shanghai Upgrade?

- What is the significance of the Ethereum Shanghai Upgrade for Ethereum's staking ratio?

- What is Zerocap's view on the Ethereum Shanghai Upgrade?

11 Apr, 23

The Ethereum Shanghai Fork and Zerocap’s Tailored Notes for the Upgrade

- What is the Ethereum Shanghai Upgrade?

- How will it affect Ethereum stakers?

- What is expected to happen after the fork?

- 1) The Classification of Current Stakers

- 2) The Staking Ratio & Sidelined Investors

- 3) The Exit and Withdrawal Queues

- The system has been constructed to keep price volatility limited.

- Zerocap's View

- Express your view on the Shanghai fork with Zerocap:

- Disclaimer

- FAQs

- What is the Ethereum Shanghai Upgrade?

- How will the Ethereum Shanghai Upgrade affect Ethereum stakers?

- What is expected to happen after the Ethereum Shanghai Upgrade?

- What is the significance of the Ethereum Shanghai Upgrade for Ethereum's staking ratio?

- What is Zerocap's view on the Ethereum Shanghai Upgrade?

What is the Ethereum Shanghai Upgrade?

The Ethereum Shanghai (or Shapella) upgrade is a hard fork that is anticipated to go live on 13th April 2023 (AEST). The upgrade includes many improved features. Most importantly, the fork will allow stakers and validators to withdraw their staked principal and rewards, which are currently locked on the Beacon Chain. Moreover, it will instil more confidence in sidelined investors and institutions to participate in staking Ethereum.

*For wholesale investors only.

How will it affect Ethereum stakers?

Prior to this proposal, Ethereum stakers suffered from suboptimal conditions that prevented the withdrawal of any Ethereum that had been staked to the Beacon chain from December 2020. This included the 32 ETH principle that is required to run an Ethereum node, in addition to any execution and consensus layer rewards earned since they began staking their ETH.

- Full withdrawals will involve a validator exiting the beacon chain and stopping their node. The entire balance is submitted into an exit queue mechanism, which is designed to regulate the exit of the validator set and preserve the stability of the network.

- Partial withdrawals involve an automatic sweep of accumulated rewards in excess of 32 ETH, which can be withdrawn after entering the withdrawal queue. This process represents the most near-term risk to Ethereum’s price.

What is expected to happen after the fork?

There are some common misinterpretations of the fork and its expected impact on Ethereum’s price. These assumptions centre around the amount & timing of staked Ethereum that will be unlocked.

The argument against all unlocked Ethereum being sold on the market can be isolated to a few critical elements.

1) The Classification of Current Stakers

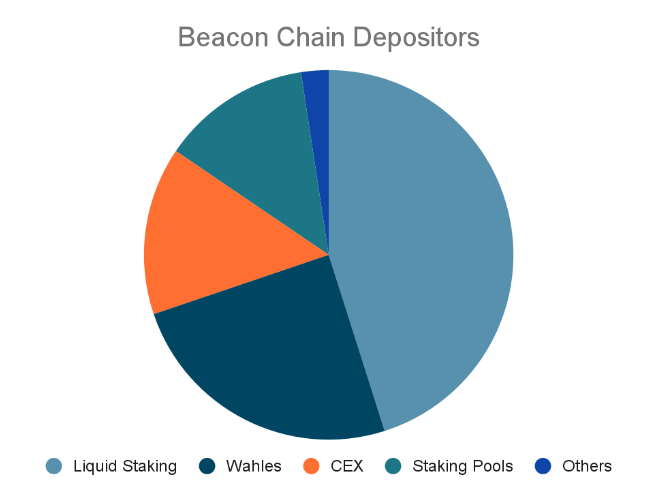

As of writing, the liquid staking segment contributes ~45% of the total Ethereum that is staked. This makeup consists of Lido (stETH), Rocketpool (rETH), Coinbase (cbETH) & Binance (bETH). With ‘liquid’ staking primitives growing in popularity, largely due to the 32Ξ bonding restriction, we can argue that a significant proportion of Ethereum stakers are agnostic to this upgrade. Whilst different in their mechanics, each token represents a tokenised share of staked ETH and typically trades close to 1:1 depending on market conditions and liquidity.

These users already have access to liquidity, and thus have no incentive to sell their ETH at the upgrade.

Upon the fork, the attention will be focused on the non-liquid (~55%) proportion of Ethereum stakers. Early contributors and believers stake their Ethereum and validate the network because of their overarching belief of where the network can grow to. A sizable (~15%) amount of ETH is staked via centralised exchanges, which is largely constructed of pooled retail holders that are unexpected to sell.

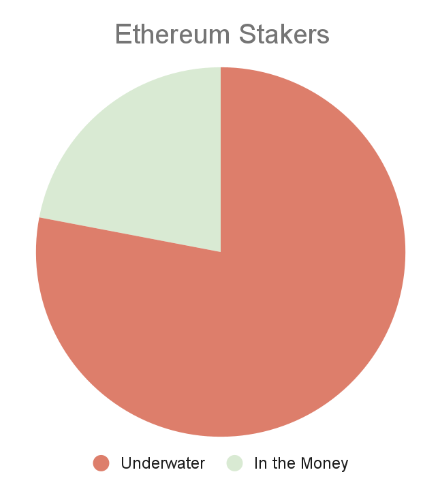

We note that a significant portion (78%) of Ethereum stakers are currently underwater, and view it unlikely that these holders use the Shanghai fork to liquidate their holdings and sell at a loss.

2) The Staking Ratio & Sidelined Investors

With sidelined institutions and investors now having increased capacity to stake and withdraw their principal and rewards, we expect distinct supply imbalances to occur after the fork. We have seen strong interest from investors who are willing to operate a node post-Shanghai due to alleviated liquidity concerns, deflationary supply mechanics and ESG benefits. Staking-as-a-service firms have experienced rapid growth, and as a result, staking has become much easier for investors to execute than ever before.

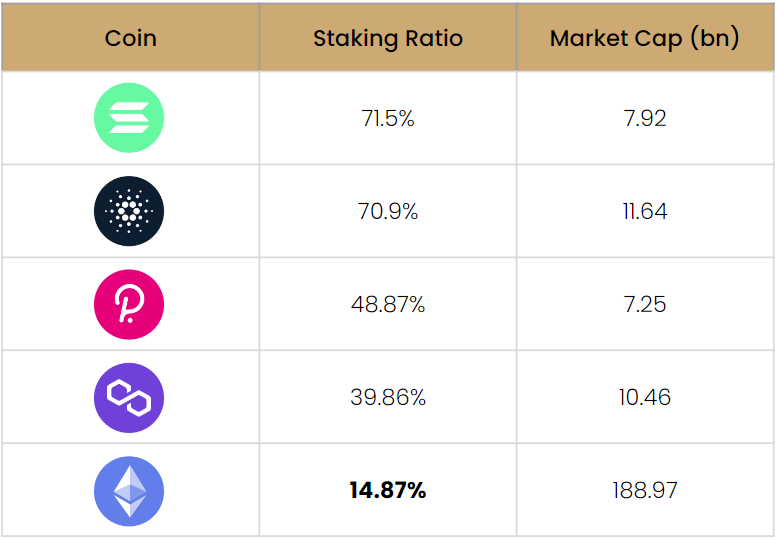

Relative to other proof-of stake networks, Ethereum’s ratio of staked assets versus the circulating supply is the lowest of this bracket.

Following the upcoming changes, we expect that Ethereum’s staking ratio will increase to above 30% over 2023. New primitives such as liquid staking and Eigenlayer are expected to play a crucial role in driving further growth in this segment.

3) The Exit and Withdrawal Queues

To prevent validators from exiting the system all at once, a “churn limit” was created for full withdrawal submissions. This limit allows only a limited number of validators to exit the system each day. When estimating the total number of active validators expected to be validated around the time of the Shanghai fork, we anticipate that the expected churn limit value will be 8 (rounded down).

Churn Limit = Estimated Number of Active Validators / Churn Limit Quotient

= 575,000 / 65,636 = 8.22 = ~8

Using this limit, we can calculate the expected max amount of validators that can execute full withdrawals each day, assuming the average epoch time is 6.4 minutes.

Max Validators Per Day = Avg Minutes Per Epoch x Churn Limit

= 225 x 8 = 1,800

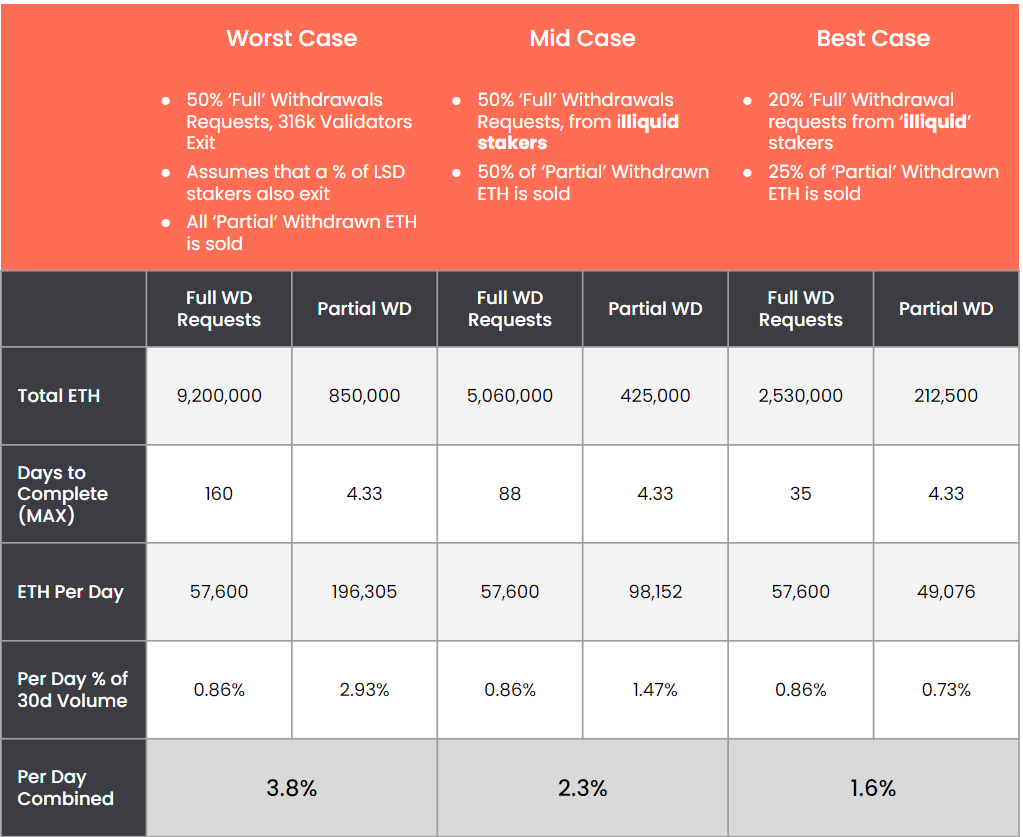

With the principal amounts fixed to 32 ETH, this means that the peak selling pressure that can be generated per day by full withdrawals is 57,600 ETH (32 ETH x 1800 validators) – representing $92m USD (assuming ETH price of 1,600), and less than 0.2% of average daily volume (30d).

The system has been constructed to keep price volatility limited.

The exit queue only applies to validators who opt in for full withdrawals. Partial withdrawals are allowed to bypass the exit queue and go directly to the withdrawal queue as long as their validators are still operational.

If we anticipate that 20% of validators will request a full exit, this would represent 287,500 validators assuming that the active validator set is in line with our above estimate of 575,000.

If only 1,800 validators can request an exit per day, it would take roughly 63 days to complete the process. It’s worth noting that as the number of active validators declines, the churn limit will also decline, which means fewer validators can submit full withdrawals over time (for simplicity, we assume a fixed limit of 8 in our below table).

As of 08/03, there is 833k Ethereum in excess of 32 ETH reflected as partial withdrawals. This is expected to be closer to 850k at Shanghai, depending on the date of the fork.

Est Partial Withdrawals = 850,000 total; est 180,000 per day for a max of 3.4 days

We can assess the impact by applying the above logic to potential scenarios at the upgrade.

In our worst-case scenario, we assume that 50% of active validators will submit requests to exit. However, this does not take into account that only 55% of validators are in the illiquid bracket that is most likely to submit full withdrawal requests. Both the mid and best-case scenarios assume that the 55% bracket is the most likely to submit full withdrawal exits due to the liquidity constraints they currently face.

Overall, we expect the selling pressure resulting from the upgrade to be limited, even in a worst-case scenario. We anticipate a neutralising effect of new validators joining and current ones exiting in the short term, and thus most impactful selling pressure will come from partial withdrawals rather than full exits.

Zerocap’s View

Although the 32Ξ node requirement remains for native staking post-Shanghai, the easing of liquidity concerns is expected to lead to an increase in staked Ethereum relative to its circulating supply. However, any validators unable to fulfil the remaining amount of Ethereum required to run an additional node may turn to liquid staking alternatives such as Lido. In recent months, liquid staking derivative tokens have surged in popularity as there are no minimum staking requirements or unbinding periods. In addition, these derivatives themselves can now facilitate redemptions for physical Ethereum, thus alleviating any peg concerns that were present previously.

Our scenario analysis of potential outcomes from the upgrade indicates that the potential selling pressure is far lower than initially predicted. Therefore, we believe that the Shanghai event will be a net positive for Ethereum and contribute to long-term price appreciation. Supply flows are likely to be net negative as institutions can stake without liquidity concerns, and we anticipate that some long-term holders will re-stake their rewards rather than sell them to show their commitment to the network.

Express your view on the Shanghai fork with Zerocap:

1. Ethereum PPN

*For wholesale investors only.

Disclaimer

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

FAQs

What is the Ethereum Shanghai Upgrade?

The Ethereum Shanghai Upgrade, also known as Shapella, is a hard fork scheduled to go live on 13th April 2023. The upgrade includes many improved features, most importantly, it will allow stakers and validators to withdraw their staked principal and rewards, which are currently locked on the Beacon Chain.

How will the Ethereum Shanghai Upgrade affect Ethereum stakers?

Prior to this upgrade, Ethereum stakers couldn’t withdraw any Ethereum that had been staked to the Beacon chain from December 2020. This included the 32 ETH principle required to run an Ethereum node, in addition to any execution and consensus layer rewards earned since they began staking their ETH. The upgrade will allow full and partial withdrawals, which could lead to some price volatility.

What is expected to happen after the Ethereum Shanghai Upgrade?

There are some common misinterpretations of the fork and its expected impact on Ethereum’s price. These assumptions center around the amount and timing of staked Ethereum that will be unlocked. However, the system has been constructed to keep price volatility limited, and the selling pressure resulting from the upgrade is expected to be far lower than initially predicted.

What is the significance of the Ethereum Shanghai Upgrade for Ethereum’s staking ratio?

With sidelined institutions and investors now having increased capacity to stake and withdraw their principal and rewards, it’s expected that Ethereum’s staking ratio will increase to above 30% over 2023. New primitives such as liquid staking and Eigenlayer are expected to play a crucial role in driving further growth in this segment.

What is Zerocap’s view on the Ethereum Shanghai Upgrade?

Zerocap believes that the Shanghai event will be a net positive for Ethereum and contribute to long-term price appreciation. Supply flows are likely to be net negative as institutions can stake without liquidity concerns, and it’s anticipated that some long-term holders will re-stake their rewards rather than sell them to show their commitment to the network.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post