17 Feb, 21

What is Crypto Market Making?

Crypto market making is a critical function that underpins the efficient operation of crypto financial markets. It involves buying and selling securities on behalf of clients to provide continuous quotes and ensure liquidity. Market makers act as intermediaries between buyers and sellers, which helps to keep the market stable and efficient. The role of the market maker is especially important in highly volatile or illiquid markets, where there may be few buyers or sellers available.

In this article, we will explore the concept of crypto market making in more detail, including definitions, key features, and benefits. We will also discuss the role of market makers in various financial markets and their impact on trading efficiency. Whether you are a crypto trader, investor, or a financial institution dealing with digital assets, understanding the basics of crypto market market making is essential for success in today’s fast-paced financial environment.

Learn about Crypto Market Making Services with Zerocap in the section below, our CMM landing page or by reaching out to one of our many expert team members at [email protected]

What is Crypto Market Making?

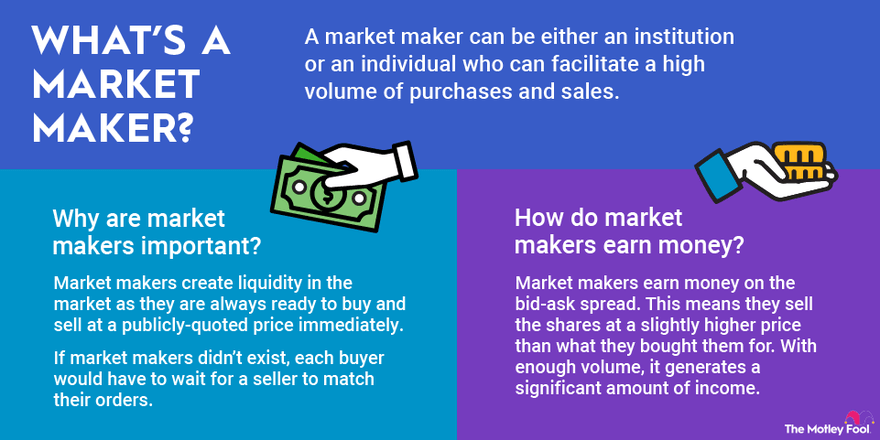

First things first, let’s look at the definition of market making:

“Market makers are crucial to the success of cryptocurrency exchanges, providing liquidity and stability to the market.” – Michael Moro, CEO of Genesis Trading

Market making is the process of providing liquidity to financial markets by buying and selling securities on behalf of clients. Market makers act as intermediaries between buyers and sellers, providing continuous quotes to ensure that there is always a buyer or seller available. They do this by maintaining an inventory of securities that they can buy or sell at any time. Market making is important because it helps to prevent market manipulation, ensures a stable and efficient market, and provides traders with the ability to buy and sell securities quickly and at a fair price. The role of the market maker is especially crucial in highly volatile or illiquid markets, where there may be few buyers or sellers available. In short, market making is a critical function that underpins the efficient operation of financial markets.

The same applies for crypto market making. Just like in traditional markets, market makers in the crypto space provide liquidity and facilitate trading by buying and selling crypto for their customers. The crypto market is particularly challenging due to its high volatility and the relatively low trading volume of some cryptocurrencies. This makes it difficult for traders to find buyers and sellers at a fair price. By providing continuous quotes and buying and selling cryptocurrencies as needed, market makers ensure that there is always a buyer or seller available, which improves trading efficiency and helps prevent price manipulation. As the cryptocurrency industry continues to grow and evolve, the role of market makers is becoming increasingly important for the success of the market.

Therefore, the same applications for market making in traditional finance also apply to cryptocurrencies.

How does Market Making work?

Market making works by providing continuous quotes for securities to ensure that there is always a buyer or seller available in the market. Market makers use a variety of strategies to determine the bid-ask spread, which is the difference between the price at which they are willing to buy a security (the bid) and the price at which they are willing to sell it (the ask). The bid-ask spread represents the profit that the market maker makes on each transaction. Market makers typically hold an inventory of securities, which they use to buy and sell as needed to maintain a stable market. They may also use algorithms or other automated tools to monitor the market and adjust their quotes accordingly. By providing liquidity and ensuring that there is always a buyer or seller available, market makers help to prevent price manipulation, improve trading efficiency, and make it easier for traders to buy and sell securities.

Market Making vs. Liquidity Providing

Market making and liquidity providing are two related concepts that are often confused. While they share some similarities, there are also key differences between the two.

Market making involves buying and selling securities on behalf of clients to provide continuous quotes and ensure liquidity. Market makers act as intermediaries between buyers and sellers, which helps to keep the market stable and efficient. They do this by providing a bid-ask spread, which represents the profit that they make on each transaction. Market makers typically hold an inventory of securities, which they use to buy and sell as needed to maintain a stable market. Their goal is to facilitate trading by providing liquidity and ensuring that there is always a buyer or seller available.

Liquidity providing, on the other hand, is a broader concept that encompasses a range of activities designed to ensure that financial markets are liquid. This can include market making, but it also includes other activities such as trading and arbitrage. The goal of liquidity providing is to ensure that there is always sufficient liquidity in the market to meet the needs of traders.

To learn more about our Crypto Market Making services for token projects or any of our other market-leading services, contact one of our expert team members at [email protected]

About Zerocap

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at [email protected] or visit our website www.zerocap.com

This material is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any digital asset. Investments in digital assets can be risky and you may lose your investment. Past performance is no indication of future performance. Zerocap Pty Ltd carries out regulated and unregulated activities. Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001). Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799)

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 12 January 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 22nd December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 15th December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post