Content

10 Apr, 20

Venezuela and Crypto – Interview with a savvy user Pt. 1

In this article we travel into the mind, the history and background of a crypto savvy user in Venezuela, that for privacy reasons we shall call Carlos (which according to a non-descript website during a quick Google, is widely regarded as Venezuela’s most popular boy’s name). Carlos is widely travelled, an early investor, trader and educator in BTC and other alternative assets, and is an avid believer in individual sovereignty.

In part one of the interview we will be kicking into some stories of Carlos’ upbringing in Venezuela and some of the differences in living in Australia as well; the Venezuelan economy and hyperinflation; bitcoin, the fundamentals and why Carlos is a believer; his diversification into other forms of value and wealth preservation; and in part two of the interview, we’ll expand on how Carlos and other Venezuelans not only diversify and hedge against inflation, but also the creative ways in how they do it; some other stories from Carlos’ life in Venezuela; the plundering of Venezuela’s resources and riches; and finally, which is absolutely crazy, how the President, Nicolas Maduro made the DEA’s hitlist, and made otherworldly wealth frontrunning the cocaine cartel Cártel de Los Soles, or “Cartel of the Suns”.

Lots of interesting stories, that makes living in Australia through COVID-19 seem like a holiday!

Before launching into it, and to get a brief understanding of Venezuela, here is some important information and trivia for further pondering:

- Venezuelans are typically found in Venezuela, and they’re actually named after the country they live and/or were born in;

- They have a population of roughly 28.5 million;

- Venezuela’s biggest export is cocaine, which is shipped to America by direct order of ‘President’ Maduro and the ‘Cartel of The Suns’’. There is currently a $15 million reward for information leading to his arrest — https://www.dea.gov/press-releases/2020/03/26/nicolas-maduro-moros-and-14-current-and-former-venezuelan-officials

- Venezuela’s second biggest export is oil and they are a founding member of OPEC. They also have the world’s largest oil reserves;

- Their third biggest export is without a doubt, Beauty Pageant Queens. They are the undisputed Queen of the Beauty Pageant world — they have won 7 Miss Universe titles and 6 Miss World titles. You can’t argue with science;

- They have the world’s highest uninterrupted waterfall — Angel Falls. If you’ve seen the remake of Point Break, then you would have seen Bodhi and Grommet as part of the Ozaki 8 (8 extreme ordeals), free solo climb Angel Falls with Johnny Utah in close pursuit. Grommet really should not have attempted it — he died. In the spirit of life, Grommet should have trained harder. Bodhi soldiers on and ends up completing this ordeal. Utah rads out with his blonde locks. Pro Tip: Watch the original.

- Venezuela is regularly listed as one of the most dangerous countries to live in and has one of the highest murder rates in the world. The Venezuelan Violence Observatory states that there were 16,506 murders last year — that is basically 45.22 murders a day.

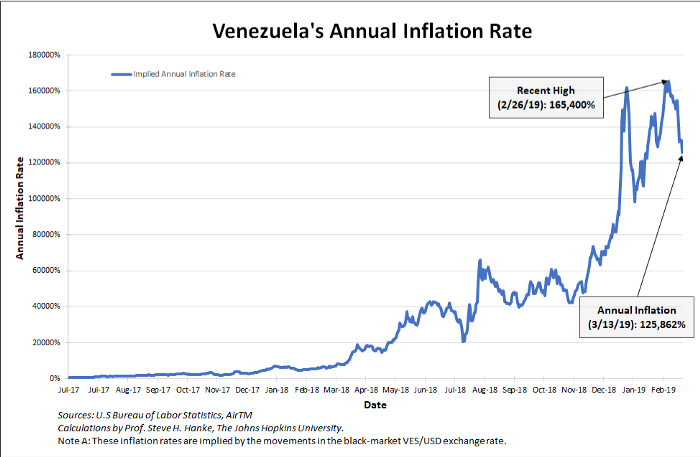

- According to the IMF (that benevolent virus that just keeps giving) Venezuela had the highest inflation rate in the world in 2019 — just check the graph below. Good times!

Much of Venezuela’s meteoric economic rise and fall can be traced back to 1922 where it found its own version of Black Gold / ‘Texas Tea’ which was nationalised in the 70s. Black Gold, which is typically seen as the escalator to economic prosperity for forward-thinking, US-friendly nation states, in hindsight has been reflected on as a resource curse for Venezuela, who with a heavy reliance on oil has gone from being one of the richest countries in South America pre-80s to being one of the poorest and most dangerous in the current age. With a poverty rate estimated by the UN at 94%, there are millions who have fled to greener pastures overseas to escape the economic and social collapse of their homeland. One such fellow is Carlos.

So Carlos, I grew up in NZ and Australia, you grew up in Venezuela, what’s that all about?

Haha, I did grow up there.

You know, the one feeling I remember having always as a child was fear. I was always scared.

The economy was always worsening, everyone around seemed to be getting kidnapped. It felt like a catastrophe was one mistake away.

I was always worried about getting shot. I have some vivid memories of the first time I saw a shooting.

It was my eighth birthday and my godmother took me out to buy my first cake. All of a sudden I started hearing gunshots outside the bakery and I dropped my f*cking cake.

Someone pushed me behind the counter so I could hide, dropping my cake. I was so angry because all along I thought they were just fireworks (and I wasn’t allowed to eat cake very often). At the end of it all I remember everyone just went about their business as soon as the gunshots stopped like nothing had happened.

We walked outside and I remember seeing a few bodies laying on the ground and thinking ‘Oh, so those weren’t fireworks’.

I had 3 kidnapping attempts happen to me before I was 18 and I was shot at over 3 times by the time I was 20. Bare in mind I’m probably the most boring Venezuelan you’ll ever meet. I wasn’t a tough guy and lived in one of the nicest parts of Caracas.

So you can imagine what things were like for those who grew up in less fortunate conditions than me.

Now that you have spent some time in different countries around the world, and in particular, in Australia, what differences do you see from growing up in Venezuela to growing up here?

Well, for starters nobody here ever gets shot, which is pretty cool.

Other than that, I think Aussie politics are somewhat similar to Venezuelan ones in the way they act and splurge tax payers money. People get offended when I bring that up in conversation and usually respond with a loud ‘But this is Straya, mate’.

I usually laugh, because we used to say ‘Aqui hay petroleo, mi pana’ (‘We have oil here, mate’) when people used to compare Venezuela to Cuba back in the day.

Sometimes it’s a bit scary when I talk to ‘highly educated’ Aussies and they think that these things only happen in movies.

Don’t get me wrong, some people here do understand that it is a reality and things can change. But not the majority.

Venezuela used to be South America’s bread basket. There was so much money being thrown around that our neighbouring countries used to call it ‘La Venezuela Saudi’ (‘The Saudi Venezuela’).

Now look at us, we’re in similar living conditions to Nigeria. No offense to all my Nigerians out there. I’ve actually spent some time there and had a good time… until my brother caught malaria.

Australia is different in the sense that there is a solid middle class here. It’s the greater majority of the population. That’s a great thing, because when the middle class disappears the gap between the rich and the poor grows. And that’s where resentment breeds violence and politicians start playing the ‘divide and conquer’ game.

That’s a dangerous game to play part of. I mean, look at America: ‘The Land of Opportunity’.

Don’t get me wrong, this place is my home and I love being here. In my experience, everything has a shelf life. Especially in times of bonanza.

The cosmetic surgery industry is booming thanks to the devaluation of the Bolívar and the demand for USD, which has heavily driven down the cost, and made Venezuela the cheapest country in the world to get plastic surgery. How else have you seen the economy change over that time?

The economy in Venezuela hasn’t changed too much from when I was a kid, I think.

The country has radically changed and the standards of living have dropped massively. But the economic practices remain the same at a higher level.

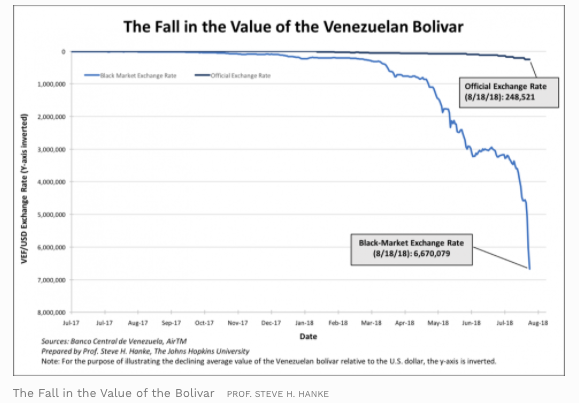

You might think that sounds crazy provided I mentioned we went from ~15% yearly inflation in 1998 to ~9,500% per annum last year. Hyperinflation on steroids!

It’s all the same bad practices, just more heavily accentuated.

Money printing, capital controls, etc.

If you paid close attention you could have seen it coming. That’s part of the reason I left as soon as I got the chance and never looked back.

That is nuts, we talk about hyperinflation without understanding the seriousness of the numbers — 9,500% inflation is crazy — that sounds like early bitcoin returns. What would you say is the reason for Venezuela’s hyperinflation?

We could state the obvious and say it was excessive money printing. But that’s just one part of the equation.

It’s very clear to anyone who lives in Venezuela, or has family living there, that this is a way for the government to control the people.

The government there works in a very Orwellian fashion. I’ll explain.

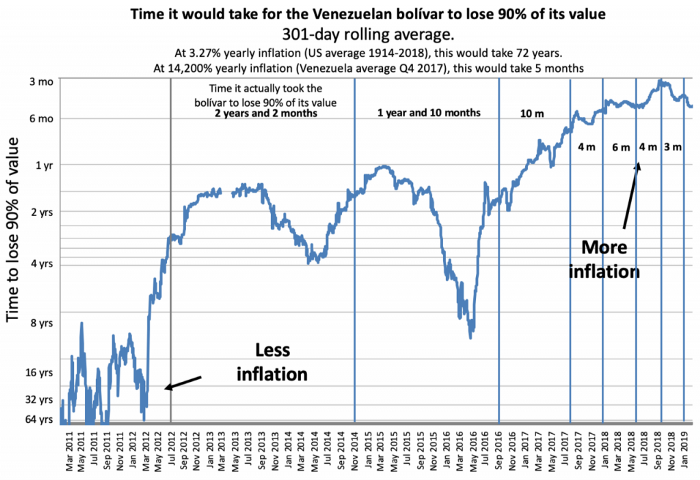

By taking purchasing power away from individuals at will (through hyperinflating the currency) and driving away all foreign investment (so no jobs are available anymore to people who would otherwise be able to earn in USD — the main way to hedge against hyperinflation in Venezuela) and introducing capital controls into the market (so that even if you somehow manage to find a way to earn in USD, you can’t get the money transferred in your bank account), the government has destroyed what little was left of the middle class in the country.

By doing this, the government has found a way to keep its people hopeless in the face of poverty and too busy thinking about how to survive to even consider uprising.

What are the alternatives in Venezuela to their hyperinflated currency?

In a hyperinflationary environment you spend your currency as soon as you can and buy any non-perishable items you can find around you.

It’s not a matter of choice. You buy whatever you can because you know your money will be worth at least 30% less tomorrow. It really is a race against time as soon as you receive your paycheck.

You also need to consider that carrying any other currency that is not the Bolivar is illegal in Venezuela. Not to mention it is hard for most people to access any foreign currency inside the country, so people have to get creative.

Anything from flour to scotch and cigarettes can be used as a hedge against inflation.

And of course, for those who have access to it, Euros and US Dollars used to be the most common ones. Nowadays people turn to bitcoin and gold as well.

I have a cousin who lived in Caicara del Orinoco (close to the border with Brazil) near the gold mines. He lived on a farm so he would hoard rice in sacks. He would then drive down to the gold mines and trade his rice and whatever else he could for gold dust.

He would then take that gold dust home and melt it into ‘pepitas de oro’ or tiny gold nuggets and then sell them in the black market for USD or BTC. He then would sell the USD or BTC for Bolivares and live off that with his family.

Given what’s happened/happening in Venezuela, do you think there are similar risks to the rest of the world given the QE and stimulus packages that are being designed to tackle the Coronavirus crisis?

That’s one thing that’s been in my mind for some time now.

Turning on the printing press means you get handed more paper currency but end up with less money.

To get to the point Venezuela is at right now, it took about 20 years of money printing, so I don’t think we’ll end up there just yet.

However, currencies will be devalued, as they do when they are printed in excess. This was the exact response Chavez’s government had in order to ‘end poverty’. To print more money so that they could give handouts to the least educated segments of the population and gain their votes.

Nobody says ‘no’ to a ‘free lunch’ especially if they’re starving, and politicians love to ‘feed’ those who are in need.

Perception versus reality — how do you think the rest of the world views Venezuela versus what it is really like?

I think a lot of people are waking up to the truth. Specially since the US Government issued an indictment order against Maduro’s regime for drug trafficking and terrorism.

People used to look at Chavez (Maduro’s predecessor) and think he was some sort of hero, a man of the people. The man who came to save South America from the hands of the USA by way of communism.

Don’t get me wrong, I am not a fan of the USA. But I am not a fan of my family starving to death either.

For some reason many people in first world countries think Communism/Socialism is the answer to all their problems. Take from the rich and give to the poor, they say.

I find that these tend to be mostly younger, caucasian, middle class people who do not yet know if they’re a male or a female and happen to have a sense of entitlement about what the world ‘should be like’.

We’re big believers in Bitcoin and decentralisation, and being a long-term bitcoin holder, trader, educator and believer yourself, why does crypto matter, if it even does at all?

I think cryptos are here to stay. Whether it’s bitcoin or another cryptocurrency, I see us all using crypto in the near future.

Bitcoin was designed with a very clear end in mind: to solve problems fiat currencies can’t.

Bitcoin is a liquid asset, not a debt based one.

If you hold the private keys to your bitcoin, you own a bitcoin, not a promissory note of a bitcoin.

In my opinion there are two main reasons why crypto matters more than ever:

1) We live in an increasingly digital world, hence we need a digital currency.

I think the economy grows and moves at the speed in which settlements can be made. Or at least at a business level.

It’s not the same for me as a business owner to make a sale today and receive a settlement in two weeks rather than to receive the settlement instantly.

For example, let’s say that you’re building a restaurant and you’re waiting to receive a settlement from a loan coming from a private lender overseas.

The money has already been sent by the lender, however you don’t receive that money until after a month later due to the fact that the bank you’re using had to ‘run a compliance check’ simply because the money comes from a private lender who is overseas.

That would put an unnecessary strain on your business’ cash flow. Not to mention the psychological stress related to not knowing when the bank will release the funds.

We can currently negotiate all kinds of contracts between all time zones in real time using phone calls, texting, etc. However payment settlements can take weeks and in some cases even months depending on the size amount to be settled.

A parallel example is what text messaging and real-time video conferencing has done for communication in the last decade.

Most of us can’t even imagine anymore what it would be like to send someone a letter by mail and not have the ability to receive an instantaneous response.

How fast can businesses grow nowadays by the mere fact that they are able to send information in real time to anyone, almost anywhere around the globe. It is much more efficient to use instant messaging than to send a letter.

I believe crypto is doing for ‘sending money’ what instant messaging did for ‘sending information’ in the last decade.

Value can now be transferred online, in real time.

2) Bitcoin was made with the aim to help individuals preserve their wealth in the long run by fighting inflation and confiscation.

It might sound weird to some people when I put ‘wealth preservation’ and ‘bitcoin’ in the same sentence, as BTC is a very volatile asset. But we need to remember where that volatility comes from: speculation.

Let’s look at some fundamentals before we jump to conclusions.

Money, by definition, is a unit of account that has the following attributes:

- Durability

- Portability

- Divisibility

- Limited in supply / scarce

- Fungibility (interchangeable)

- Store of value — this applies for money but not necessarily for fiat currencies (which is an expression/representation of money — aka dolla dolla bills y’all)

In my view, BTC ticks all the boxes when it comes to all of the above. And if we were to compare it to an asset likem gold, for example, it even fares better in some categories:

- Durability: I’d say both are just as durable. I mean, as long as the internet doesn’t shut down, your BTC will always exist in the blockchain.

- Portability: when was the last time you saw someone send $1 million across the globe in less than 10 min using physical gold? And how much would it cost to send that amount of money in gold too?

- Divisibility: let’s say you have a 1kg gold bar and you want to give somebody $10 worth of that gold. What would that process be like?

- Limited in supply: we don’t actually know with 100% certainty how much gold is still to be mined.

- Fungibility (interchangeable): I think gold and BTC have a similar problem here. You can’t really buy or sell a gold bar if that gold bar hasn’t been mined legally, unless you go to the black market. Same as the current issue we have we BTC and tainted coins that have been stolen.

- A store of value: Gold is the safe-haven asset par excellence. It’s been around for more than any of us have even been alive for, so there really is no competition here.

Now let’s compare BTC to the USD using the same criteria.

- Durability: USD as a currency will last as long as there is a central bank printing it. I don’t think the US is going to disappear any time soon. So I think BTC and USD are on par in this case.

- Portability: here is where it gets interesting. USD as a currency is quite portable, yes. However, we’re not talking about banknotes in your pocket. We’re talking about how easy it is to move it across borders. In that case, if you’ve ever tried to move more than $100k in a single bank transfer, you’re sure to have to ask permission from your bank (and in some cases your local government), not to mention how long that transfer can take to arrive at its destination. With BTC all you need to do is send the money to the correct address and the money is sure to arrive within minutes (maybe hours if the network is congested).

- Divisibility: they’re both just as divisible as each other.

- Limited in supply/scarce: I literally just giggled as I arrived at this point, haha. No need to explain anything here.

- Fungibility (interchangeable): I think USD currently wins this one.

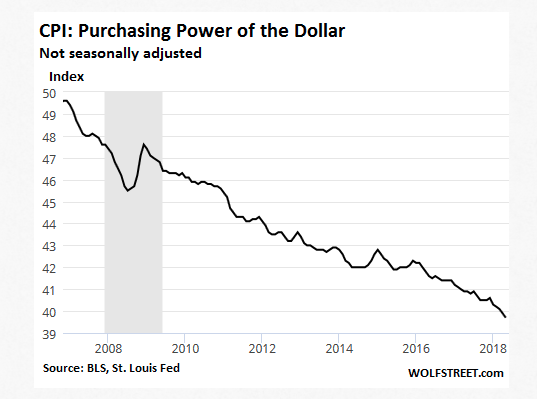

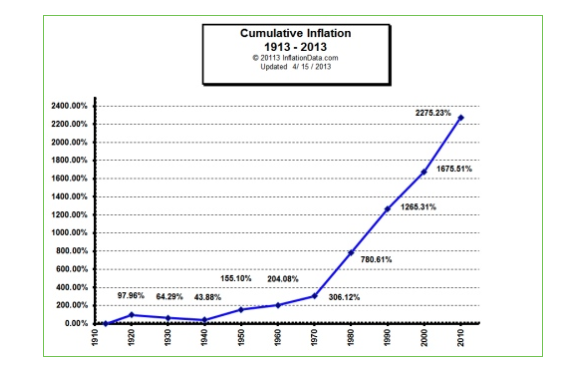

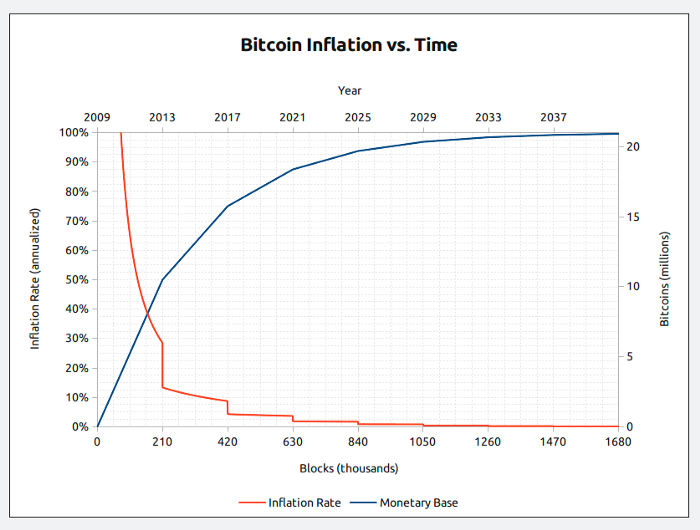

- Store of value: BTC’s inflation is set to reduce over time. Which is not the case with the USD. We can see in the chart below, how the almighty dollar losses purchasing power every year. And how BTC keeps gaining value against the USD.

Source — inflation data

The above charts basically say that your USD is losing its real value and purchasing power every year.

So considering the fundamental attributes of money, I believe yes, bitcoin can be a store of value. Especially when your government thinks that printing money will save the economy.

[Zerocap] So essentially what Carlos is saying is aptly described by — a $5 beer becomes a $10 beer after a few years, and then that $10 beer would become a $20 beer just a few years after that. Ouch.

In this chart, which tells us that if beer was priced in bitcoin, the 0.005 BTC beer may become a 0.007 BTC beer after a few years, but then become a 0.008 BTC beer a few years after that. You see, the rate of inflation is decreasing. A log chart would show a flattening of the curve. Hmmmm beeeeeeer.

Source — Forbes

Tune in next week for Part 2 of Crypto in Venezuela – Interview with a savvy user

…where we will expand on how Carlos and other Venezuelans not only diversify and hedge against inflation, but also the creative ways in how they do it; some other stories from Carlos’ life in Venezuela; the plundering of Venezuela’s resources and riches; and finally, which is absolutely crazy, how the President, Nicolas Maduro made the DEA’s hitlist, and made otherworldly wealth frontrunning the cocaine cartel Cártel de Los Soles, or “Cartel of the Suns”.

— — —

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Our investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security. To learn more, contact the team at [email protected] or visit our website www.zerocap.com

Originally published at https://capitalistexploits.at on April 10, 2020.

FAQs

1. Q: What are the key insights into Carlos’ upbringing in Venezuela, and how does he compare living in Venezuela to Australia? A: Carlos, a crypto-savvy user from Venezuela, shares his experiences of growing up in a country plagued by fear, violence, and economic instability. He recalls instances of shootings, kidnappings, and hyperinflation. Comparing Venezuela to Australia, he highlights the safety and stability in Australia but also draws parallels between the political behaviors in both countries.

2. Q: How has the Venezuelan economy changed over time, and what are the creative ways people hedge against hyperinflation? A: The Venezuelan economy has suffered from bad practices like money printing and capital controls, leading to hyperinflation. People have turned to creative ways to hedge against inflation, such as trading rice for gold dust or using Euros, US Dollars, Bitcoin, and gold. The government’s control over currency has led to a destruction of the middle class and a struggle for survival.

3. Q: What role does Bitcoin and other cryptocurrencies play in Venezuela’s economy? A: In Venezuela, cryptocurrencies like Bitcoin have become vital tools for wealth preservation and value transfer. Carlos explains that Bitcoin’s attributes, such as durability, portability, divisibility, scarcity, and fungibility, make it a viable alternative to the hyperinflated Bolivar. People have turned to Bitcoin to hedge against inflation and to transfer value quickly and efficiently.

4. Q: How does Carlos view the global risks related to Quantitative Easing (QE) and stimulus packages in response to crises like COVID-19? A: Carlos sees similarities between Venezuela’s money printing practices and the global trend of QE and stimulus packages. While he doesn’t believe the world will reach Venezuela’s extreme hyperinflation level soon, he warns that currencies will be devalued, and the consequences of excessive money printing can lead to economic challenges.

5. Q: How does Carlos perceive the importance of Bitcoin and decentralization in the current economic landscape? A: Carlos emphasizes the importance of Bitcoin and decentralization in the modern digital world. He believes that cryptocurrencies are here to stay and that Bitcoin was designed to solve problems that fiat currencies can’t. He compares Bitcoin favorably to gold and USD in terms of durability, portability, divisibility, and scarcity. Carlos sees Bitcoin as a tool for wealth preservation and a means to transfer value in real-time, akin to what instant messaging did for communication.

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post