15 Apr, 21

What is Bitcoin Mining? An overview and impacts

Brief intro to Bitcoin

Bitcoin is widely regarded as the world’s leading cryptocurrency, a type of digital asset that utilises blockchain technology to create a decentralised, transparent and secure monetary network. Released in 2008 as a targeted response to the Global Financial Crisis, Bitcoin’s early-day proponents hoped to develop an asset that could provide a secure and reliable currency, removed from a ‘broken’ centralised system.

Fast forward to today and the digital asset is on its way to becoming the world’s leading store of value, chipping away at legacy markets like gold that have captured a monopoly on this market for centuries. Bitcoin and the broader crypto market has seen a drastic surge in mainstream media coverage and everyday discussions, paving the way for an influx of crypto-based projects, strong adoption fundamentals and a growing interest in the impact this will have on traditional structures of the economy.

What is Bitcoin mining?

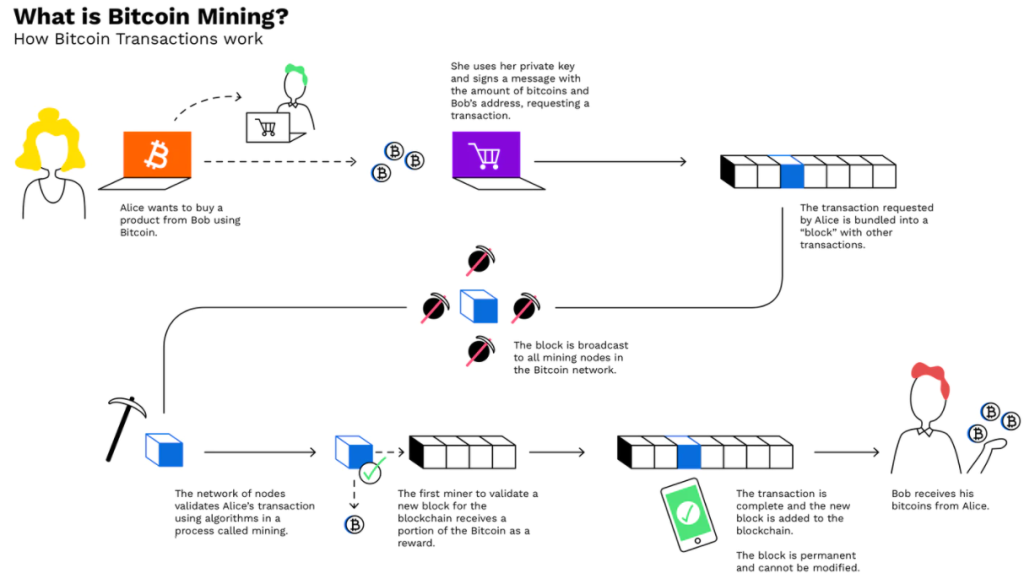

Bitcoin mining is a fundamental component of the asset’s ecosystem. Its primary purpose is to verify the quality of information on its blockchain, a digital record of information exchanged on the network that is immutable. It ensures that the decentralised monetary network is free of any fraudulent or nefarious behaviour. Miners compete to process a block of transactions (currently ~2,000 transactions per block) and complete a complex computational problem dubbed a ‘proof of work’ (PoW). Once the PoW is finished, the block is added to the blockchain and the winner (or the first to solve the proof of work puzzle) is rewarded.

The PoW reward is the system’s way of introducing new bitcoin to the circulating supply. As this mining reward is halved every 210,000 blocks (roughly every 4 years), the asset will become increasingly deflationary over the coming decades. Since May 2020, the block reward has sat at 6.25 BTC. This will continue to halve every 210,000 blocks until 21 million bitcoin have been mined, the total coded supply.

How can Bitcoin miners impact the ecosystem?

In addition to their role as validators, processors and minters, bitcoin miners also control supply flow to markets, adding to their list of significant powers over the ecosystem. In theory, this could be used to slow down transaction processing much like the proposed attack by Ethereum miners to protest the implementation of EIP-1559, a network upgrade that would reduce mining rewards. While this is possible, it remains unlikely as there will always be miners willing to contribute to the network with competitive hash rates and thus will fill the spots of miners that are not willing to maintain the effectiveness of the network.

In order to remain competitive as a miner, processing power and hash rate contribution are key to ensuring a share of block rewards. Over time, this has increased the cost of mining significantly as the computers required to remain competitive are expensive. As the cost of mining increases against the value of bitcoin (and USD equivalent revenue decreases), miners are more inclined to hold their rewards as opposed to selling them. In doing so, the supply of bitcoin is reduced, leading to increased scarcity which is met with the same level of demand. While the impact of this holding is minimal compared to daily trade volume, it does impact general market sentiment amongst some of bitcoin’s most bullish market participants.

What are the downsides of Bitcoin mining?

In February 2021, Bloomberg, The Guardian, Washington Post and BBC were among a number of media institutions to cover the negative impacts of this process, most of which raised comparisons to oil. The majority of coverage highlighted the concerns of a significant contribution to CO2 emissions, with particular mention of the Bitcoin network consuming as much power as countries like Argentina and New Zealand. For many, this has exposed a negative side of the current monetary revolution unfolding. However, while the carbon emission statistics are true, key components of the narrative have been omitted.

A recent study by the University of Cambridge found that 76% of crypto miners use renewables as a portion of their energy mix with 39% of the total energy consumed by PoW cryptocurrencies such as bitcoin and ethereum coming from renewable sources. Due to slim profit margins in bitcoin mining, large-scale operations prefer the cheaper alternative of renewable energy particularly in regions where excess energy is produced and cannot be repurposed elsewhere.

The most common example of renewable energy within crypto has been the significant uptake in hydroelectricity as a main source of power. Regions of China and Canada are of particular interest as changes in season (wet season in China and summer in Canada) bring excess water, leading many hydropower plants to reach maximum capacity and forego the opportunity of further energy generation. This method of capturing excess energy that would otherwise be discarded is used across other energy sectors also, most notably in oil drilling where it is rarely profitable to capture gas flare for the purpose of sale. As this gas is typically released into the atmosphere or burned, oil companies and a number of startups are utilising this byproduct to fuel their mining rigs.

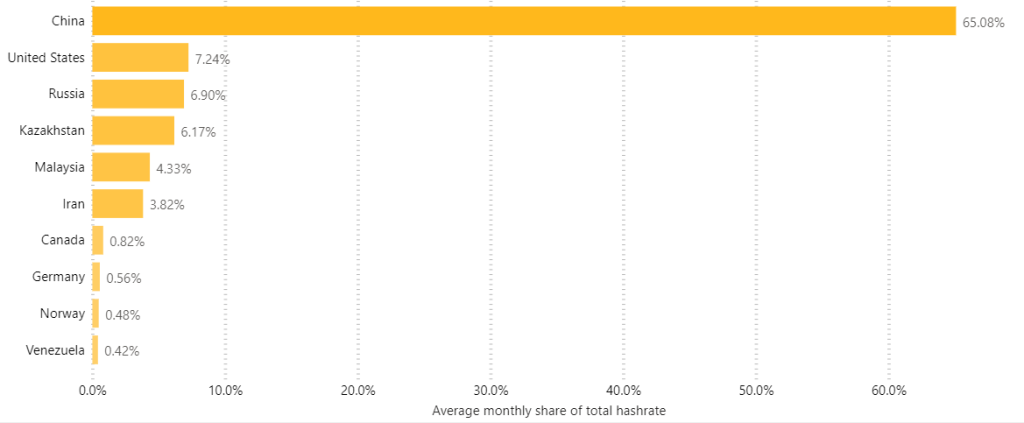

However, as the crypto market continues to grow, more solutions will need to be implemented to tackle this problem. Inner Mongolia, for instance, has banned bitcoin mining due to its contribution to the region’s energy consumption. China’s distaste for bitcoin mining is also no secret. As the nation is responsible for ~65% of the Bitcoin network’s hashrate, any distinctly negative political position could mark a new era for bitcoin mining, as they will be forced to come up with creative ways to capture cheap energy alternatives.

What will happen when all Bitcoin is mined?

Of the 21 million bitcoin that will ever exist, ~18.5 million bitcoin have been mined, although due to the reward halving every 210,000 blocks, it is likely the last bitcoin will not be mined until the year 2140. When this does eventually occur, miners will no longer receive newly minted bitcoin as a reward for verifying transactions, although they will still earn transaction fees which should keep them profitable assuming the Bitcoin network is still widely used at this point in time and mining operations become cheaper to run.

However, the past ten years of Bitcoin’s development show that it is unlikely the Bitcoin network will remain unchanged between now and 2140. The emergence of new technology will prompt the Bitcoin community to upgrade the network along the way to ensure its integrity is protected. Quantum computing is cited as a particular concern among cryptocurrency communities as it has the potential to compromise the security of PoW networks.

What does Bitcoin’s future look like?

An array of factors have the ability to change significant aspects of the Bitcoin network protocol, making it impossible to predetermine how the cryptocurrency will look in ~120 years. While the future remains unclear, bitcoin and its PoW model are uniquely positioned to tackle any issues that arise. As mainstream and institutional adoption is realised, Bitcoin’s unique challenges will continue to be met with solutions from those passionate about what cryptocurrency represents.

About Us

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Our investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security. To learn more, contact the team at [email protected] or visit our website www.zerocap.com

Like this article? Share

Latest Insights

Interview with Ausbiz: How Trump’s Potential Presidency Could Shape the Crypto Market

Read more in a recent interview with Jon de Wet, CIO of Zerocap, on Ausbiz TV. 23 July 2024: The crypto market has always been

Weekly Crypto Market Wrap, 22nd July 2024

Download the PDF Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact

What are Crypto OTC Desks and Why Should I Use One?

Cryptocurrencies have gained massive popularity over the past decade, attracting individual and institutional investors, leading to the emergence of various trading platforms and services, including

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post