Crypto asset insurance for private client investors, institutions and family offices

Safeguard your crypto assets with comprehensive insurance.

Check our Crypto Asset Custody and Insurance Services here

Who is the underwriter?

The crypto insurance coverage is arranged, backed and underwritten by Lloyd’s of London.

What is covered?

The crypto insurance is a proprietary solution underwritten by Lloyd’s of London and covers theft, loss, damage, destruction and many other situations.

How much is covered?

We have several insurance cover options all the way to full comprehensive crypto insurance of your digital assets.

Who is the policy owner?

Unlike other digital asset custody services your insurance policy cover is not shared or split with other clients.

Discuss Digital Asset Insurance – Request a callback from the Zerocap team

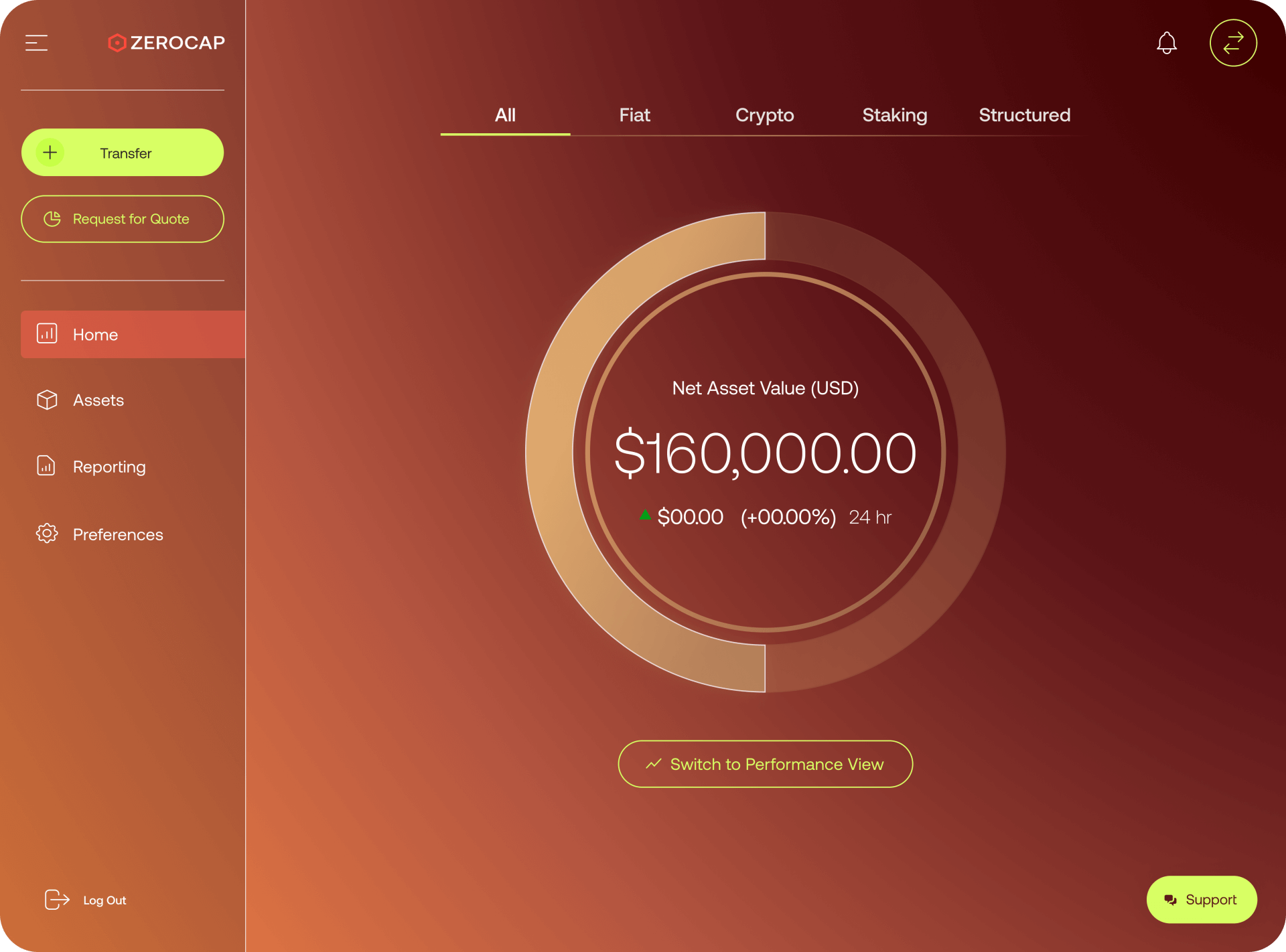

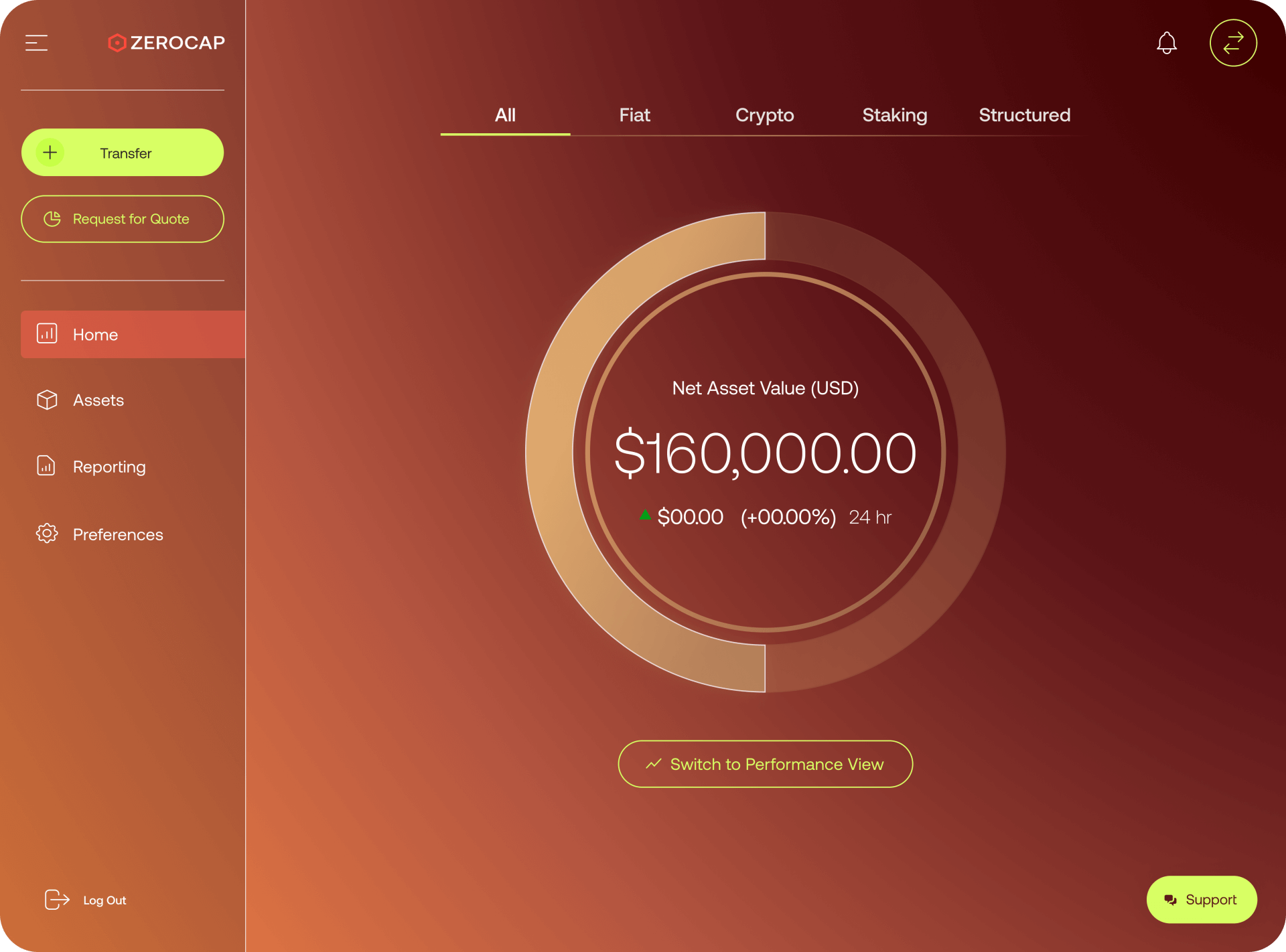

Get in TouchMarket leading Trading Portal to manage your digital assets

-

Secure your assets

Safely store and access your assets, utilising our best-in-class MPC technology with market-leading crypto insurance

-

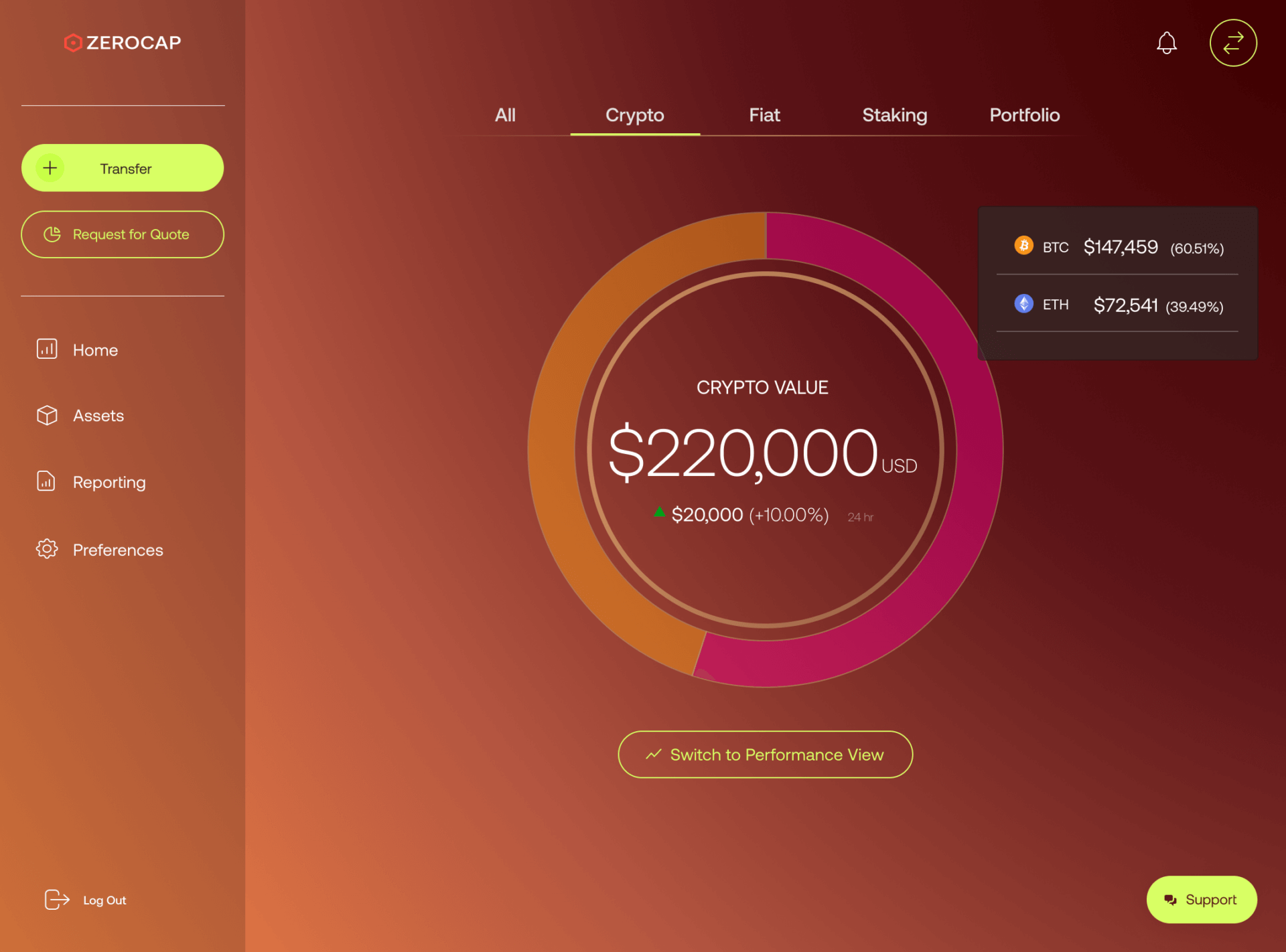

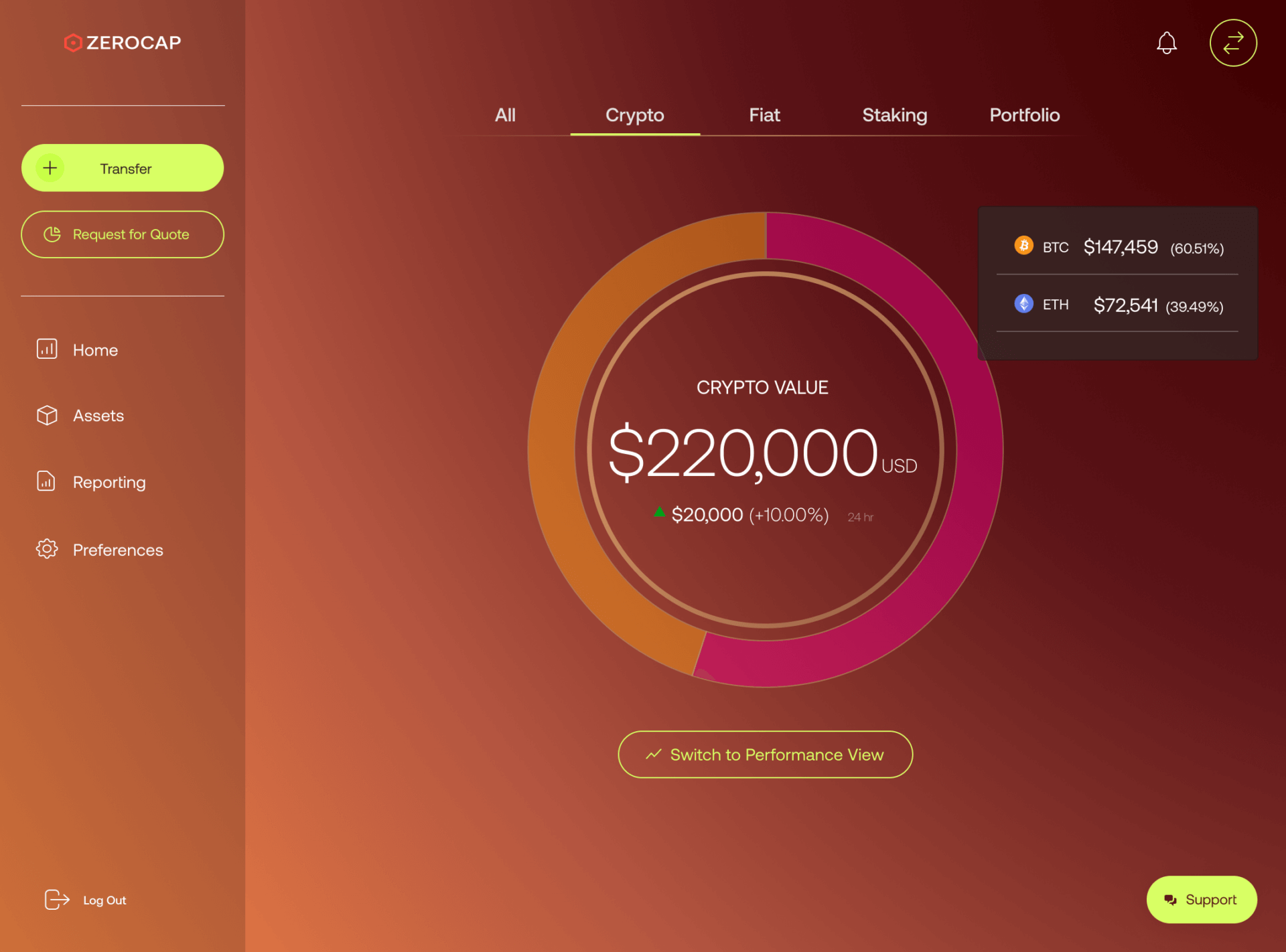

Manage your portfolio

Build a balanced portfolio of digital assets. Invest directly from the platform.

-

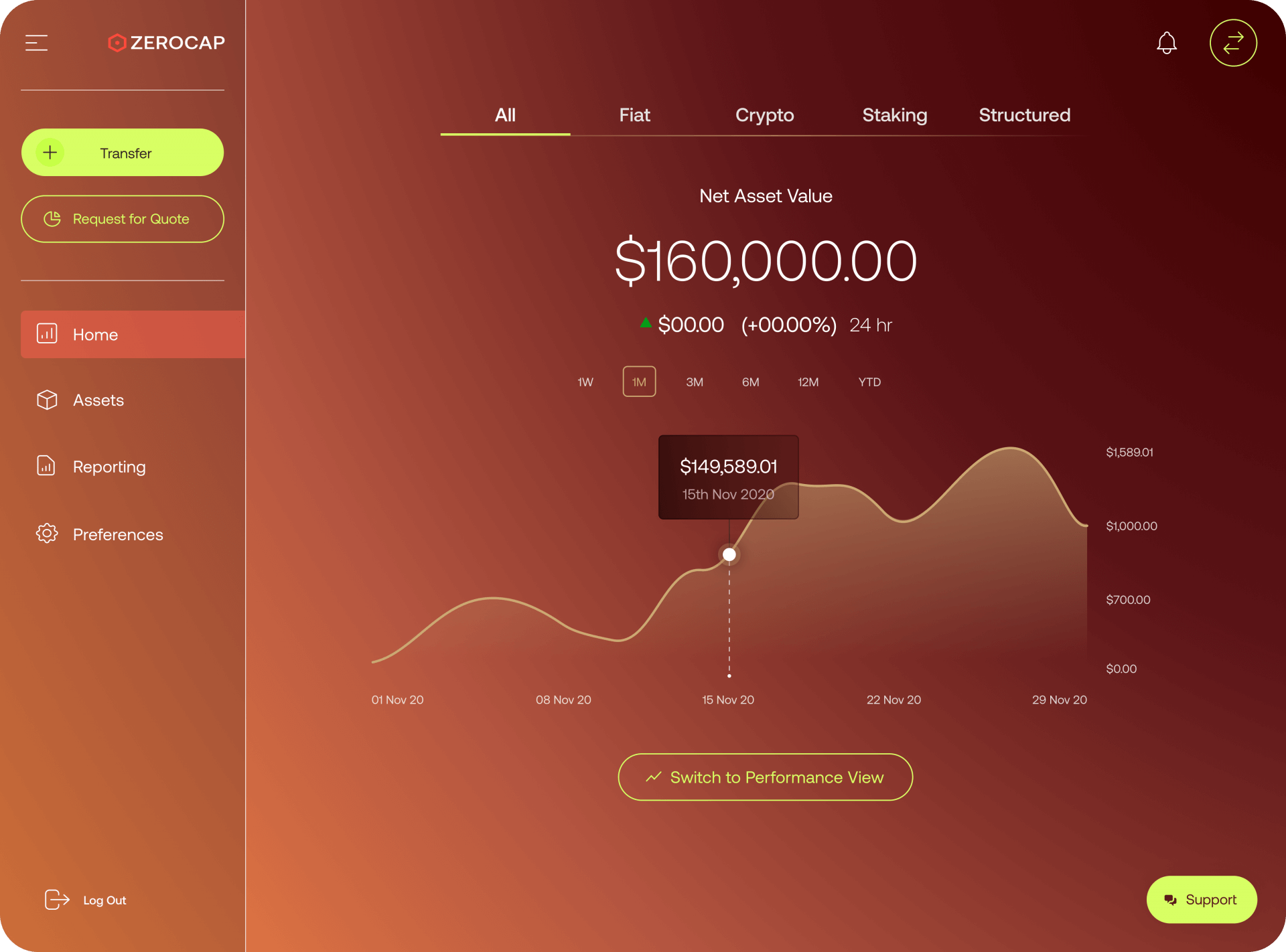

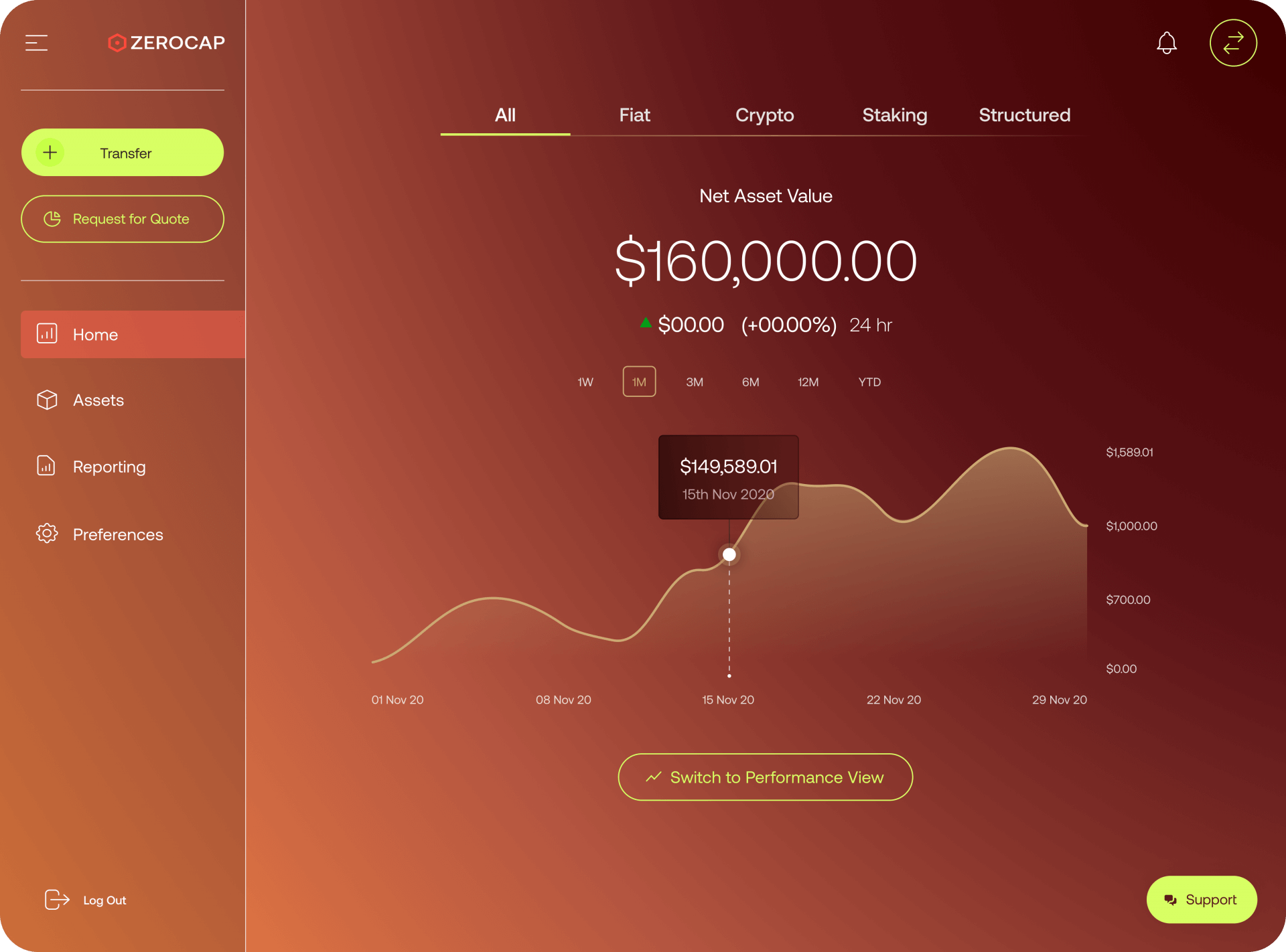

Track your returns

View your NAV over time, with reporting on underlying digital asset performance and interest earned via our yield products.

-

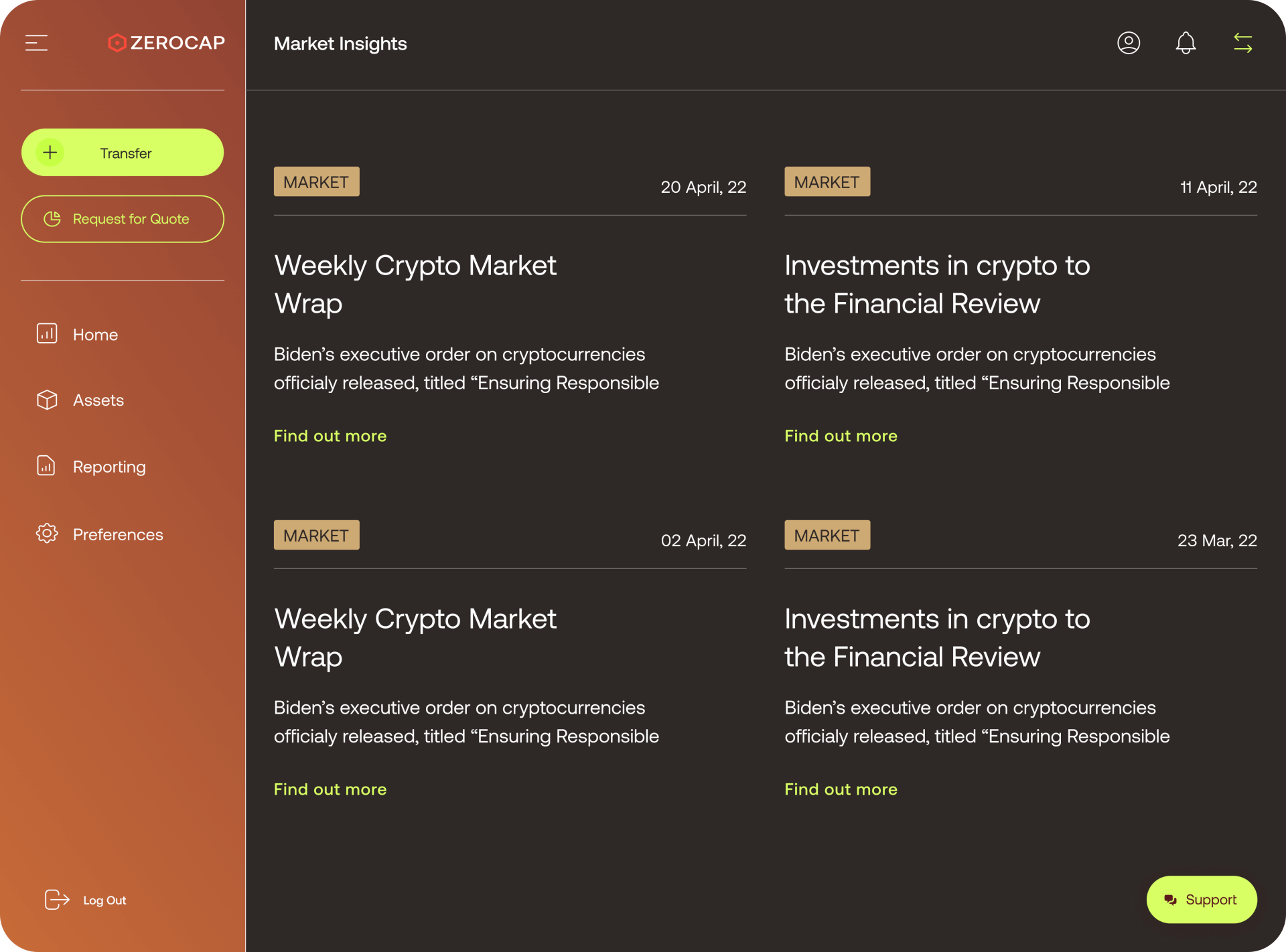

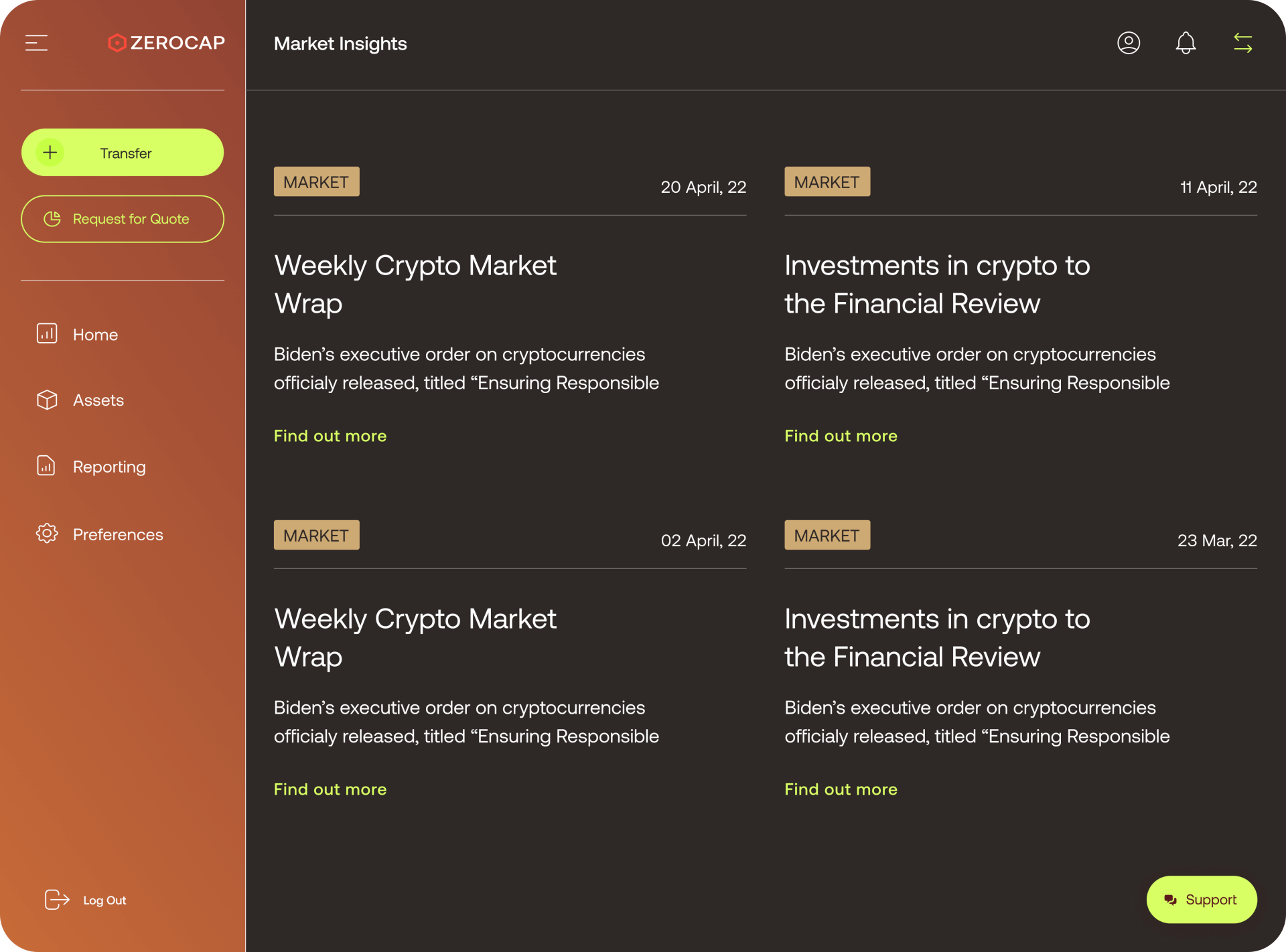

Market insights

Our expert Research Analysts understand global trends and movements, analysing the markets on a continual basis so you can better understand how to grow your wealth.

Ready to sign up?

Create an Account

Want to see how crypto insurance and other institutional services fit into your portfolio?

Contact UsReady to sign up?

Create an Account

Definition

Insurance for financial assets is important because it can provide protection against potential losses due to various risks such as theft, fraud, or natural disasters. Having insurance for financial assets can help to mitigate the financial impact of these risks and can provide peace of mind for investors.

For traditional financial assets like stocks, bonds, and real estate, insurance is typically available through specialized insurance products like securities insurance or title insurance. These types of insurance can provide protection against losses related to theft, fraud, or other types of criminal activity.

Cryptocurrencies are also considered as financial assets, and they can also benefit from insurance services. As cryptocurrencies are stored in digital wallets, they are vulnerable to hacking and cyber attacks, which can result in significant financial losses. Cryptocurrency insurance can provide protection against these types of risks and can help to mitigate the financial impact of a hack or cyber attack.

There are a few companies that provide insurance for cryptocurrency assets, they typically offer coverage for theft, hacking and loss of access to the wallets. The insurance coverage can be purchased as a standalone policy or can be included as an add-on to existing policies like cyber liability insurance.

In summary, insurance for financial assets is important for protecting against potential losses and providing peace of mind for investors. Cryptocurrencies can also benefit from insurance services as they are vulnerable to hacking and cyber attacks which can result in significant financial losses. Cryptocurrency insurance can provide protection against these types of risks.