1 Dec, 20

Decentralised Finance – An Overview

Originally published on Capitalist Exploits on November 27, 2020.

Imagine a world where you can loan money, access credit markets, trade both financial and non-financial assets, margin trade or even invest in a managed fund, all without financial institutions acting as intermediaries. Instantly and globally. How? Through Decentralised Finance.

Decentralised Finance (DeFi) is an ecosystem of financial services, facilitated through the use of smart contracts deployed on Ethereum. These smart contracts remove the need for an intermediary, creating a cheaper, faster, more secure and efficient way of providing financial services. DeFi extracts value from the traditional finance sector, where intermediaries are paid large fees to facilitate financial transactions. Being primarily built on the Ethereum network, ETH is required to use DeFi services, hence the adoption of DeFi will increase demand for ETH.

In this article, we will give an overview of DeFi, explain what Decentralised applications are, how they relate to Decentralised Finance and its impact on the value of Ethereum.

Decentralised Applications (Dapps)

To understand DeFi, we first have to understand Dapps – Decentralised Applications.

A Dapp involves:

- A front-end interface – a website or mobile app interface.

- A smart contract – A digital program that can autonomously facilitate transactions and contracts via the rules it was programmed with.

- The Ethereum Blockchain.

The smart contract is the heart and soul of the Dapp; Anyone can create a front-end interface for a Dapp, but the core functions of the Dapp are baked into the smart contract. These smart contracts are deployed on Ethereum to ensure they are tamper-proof and cannot be hacked. The Ethereum network is used to execute the smart contract’s code on the blockchain, resulting in verifiable, tamper-proof transactions. As this process uses Ethereum’s computing power, a “gas” fee is charged to the user every time a smart contract is used. (Gas fees are denominated in ETH, think of it like gas to power a network instead of a car.) It is important to note that when using a smart contract, you are trusting its code to be non-malicious or bug-free. However, since these smart contracts are deployed on the Ethereum blockchain, you are able to perform audits on the code to ensure it works as intended.

Here is an example of how a smart contract can be programmed to work: Person A wants to borrow $100 at 10% interest from Person B, due for payment in one month. A sends $150 worth of Gold certificates as collateral to a smart contract. B sends $100 to the smart contract, and the smart contract transfers the $100 to A.

If A deposits $110 back to the smart contract in one month, B gets $110 back and A gets the Gold certificates back. If A does not deposit $110 back to the smart contract by the deadline, B receives the Gold certificates and A loses his collateral.

So what is Decentralised Finance?

Decentralised Finance is an entire ecosystem of Dapps that provide financial services. Current services include but are not limited to: Savings accounts, borrowing and lending money, exchanges, marketplaces, insurance and investment funds.

Traditionally, in order to trade assets with another party, you would have to go to an exchange. So let’s say you want to trade $820 USD for 1 Ethereum. You would have to deposit your money to an exchange, let the third party facilitate this trade, and then withdraw your Ethereum from them. This has a few issues:

- You are trusting the exchange with your funds.

- The exchange can charge you a number of fees, transaction costs, withdrawal fees and bid/ask spreads.

- If the exchange closes, you cannot complete deposits, withdrawals or trade your assets.

With a DeFi exchange, you are able to utilise a smart contract to mitigate third-party risk, reduce exchange fees and trade any time you want. The only requirement is that you have the ETH to pay for the execution of the smart contract. Since smart contracts are programmable and deployable on the blockchain by anyone, an ever expanding number of DeFi applications are created on Ethereum and are being used today. From lending platforms, investment funds or even platforms that facilitate the creation of derivatives, tracking real world assets like Brent Oil or the Nikkei Index.

Here are the main reasons why you would consider using DeFi over traditional financial services:

- Transparent – Smart contract code is public and auditable.

- Blockchain-based – All transactions are recorded on a public database.

- Cost-efficient – No need for intermediaries.

- Fast – Instantaneous transfer of assets around the world.

- Globalised – Anyone with an internet connection can access these services.

Let’s have a closer look at a DeFi app, Compound.Finance

Compound.Finance is an open-source lending and borrowing platform managed by smart contracts on Ethereum. You can verify their open-source code on their GitHub.

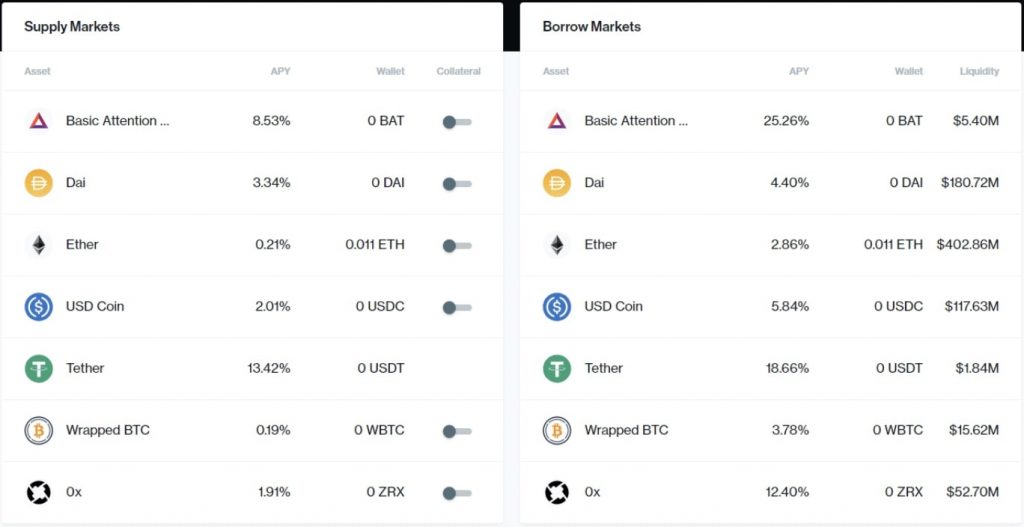

Below, we can see their borrowing and lending rates. These rates are dynamic, depending on the amount of money being supplied and borrowed.

So how do we lend money?

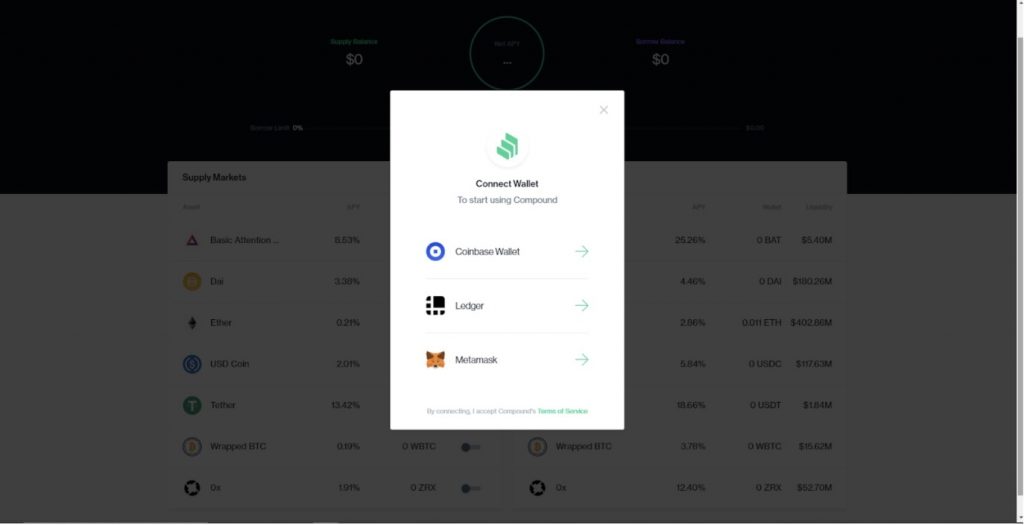

First, we have to connect our Ethereum wallet. In this case, we will be using Metamask.

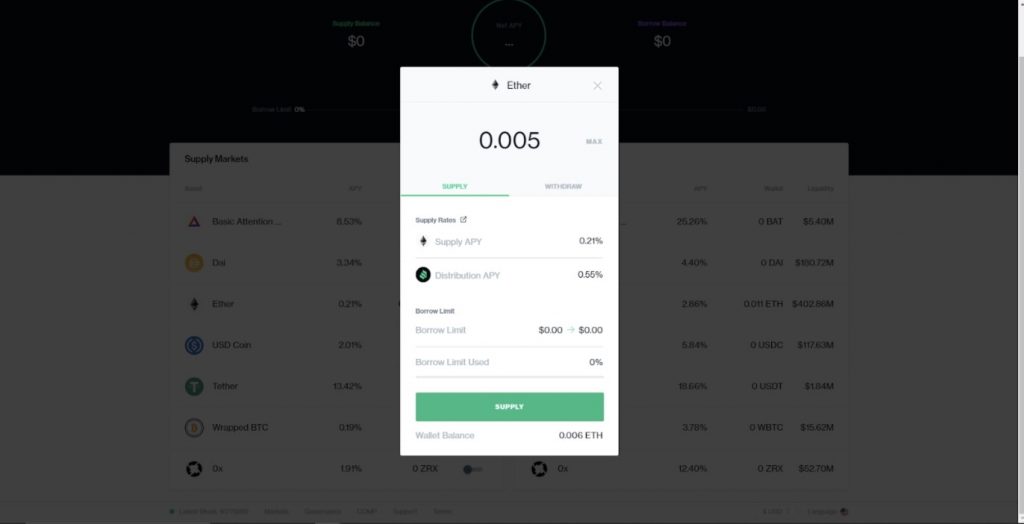

Then we have to choose an asset to lend out. In this case, we will try with 0.005 ETH. Click on “Ether” and a pop-up showing the APY will follow.

Enter in 0.005 ETH, and click Supply. A pop-up from Metamask will ask you to confirm the transaction.

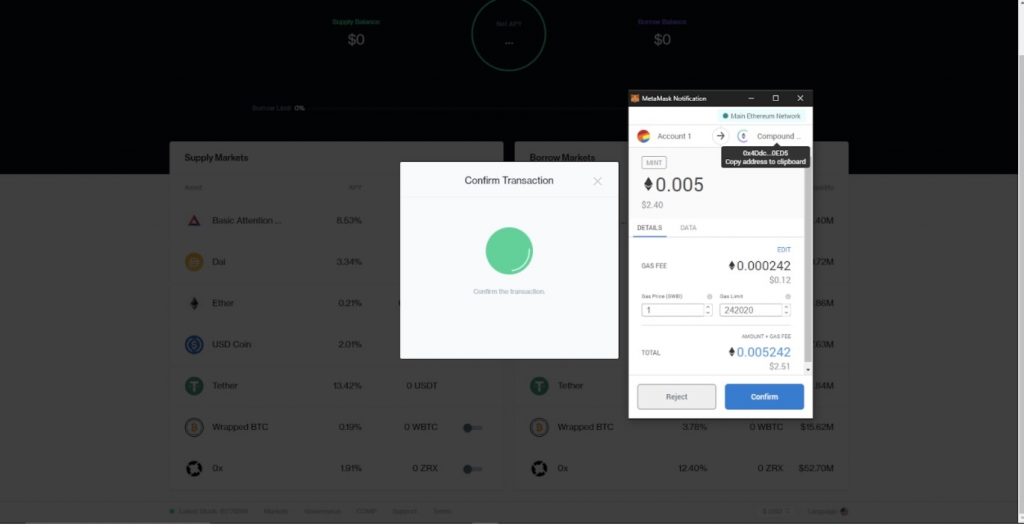

Note that you can hover over “Compound…” to see the smart contract you are interacting with. You can enter this address on Etherscan and verify the smart contract here. Specify the gas fee and confirm the transaction.

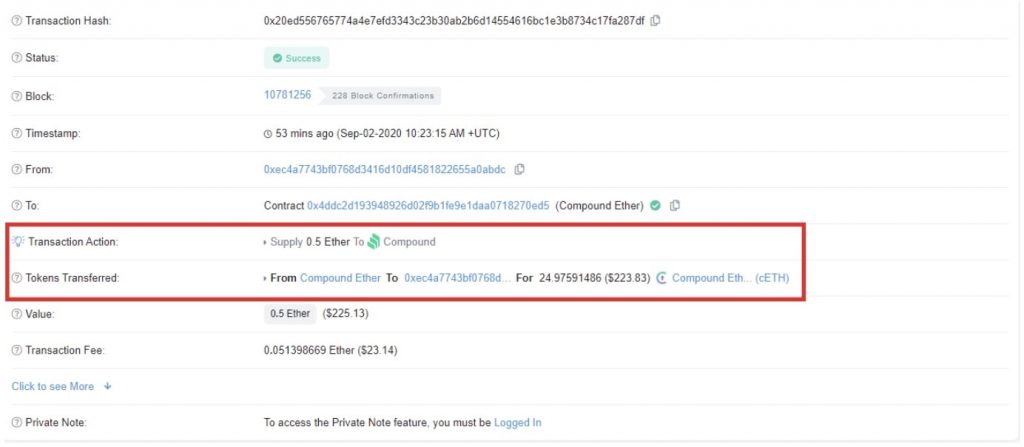

After the transaction completes, you will receive Compound Tokens. In this case, it will be cETH (Compound Ether). Your cETH will appreciate in value over time, at the rate of interest, relative to ETH. This cETH is redeemable for ETH at any time through the Dapp. Here’s an example transaction.

The ETH supplied will now be sent into a lending pool, where borrowers can access it by providing collateral to the platform. Since you have supplied money into the platform, you can also use it as collateral to borrow money. If the value of your collateral drops below the specified percentage in the smart contract (e.g. below 150%), you get liquidated and lose some or all of the collateral to the platform’s liquidators. This ensures the protocol controls its default risk.

So here is one example of a decentralised, globally accessible platform that anyone can use to earn interest on their assets. Since there is no need for an intermediary, the reduced cost is transferred onto higher rates for lending and lower rates for borrowing.

Implications

Without the need for an intermediary in financial services, the costs and difficulty of accessing a banking system is significantly reduced, and the value extracted is shared among the users. Since anyone with an internet connection and a device can access DeFi services, this is a globalised ecosystem that seamlessly connects the entire world. Americans could loan assets to Australians instantly, while people from third world countries with no access to traditional banking systems can have access to an entire suite of financial services.

The Potential

Ethereum and Decentralised Finance are still in their infancy. With Gold, Brent Oil and even the Nikkei Index being represented on Ethereum, a future where individual stocks, commodities and real estate are tokenized does not seem far away. This will pave the way to true peer-to-peer transactions in the financial sector and securities will be traded globally on Dapps instead of centralised stock exchanges. Removing the intermediary means no more egregious fees from banks, marketplaces, brokerages, real estate agencies, etc.

Of course, there are certain functions of traditional financial services that DeFi cannot replicate without a centralised entity. For example, you could get a loan from a bank by using your house, vehicle or financial assets as collateral. You would not be able to put your house as collateral on Dapps like Compound.Finance yet. However, it is a possibility that a centralised entity can tokenize real estate onto the Ethereum blockchain, representing ownership of the property, and use that token as collateral on a lending Dapp.

Benefits to the Ethereum Network

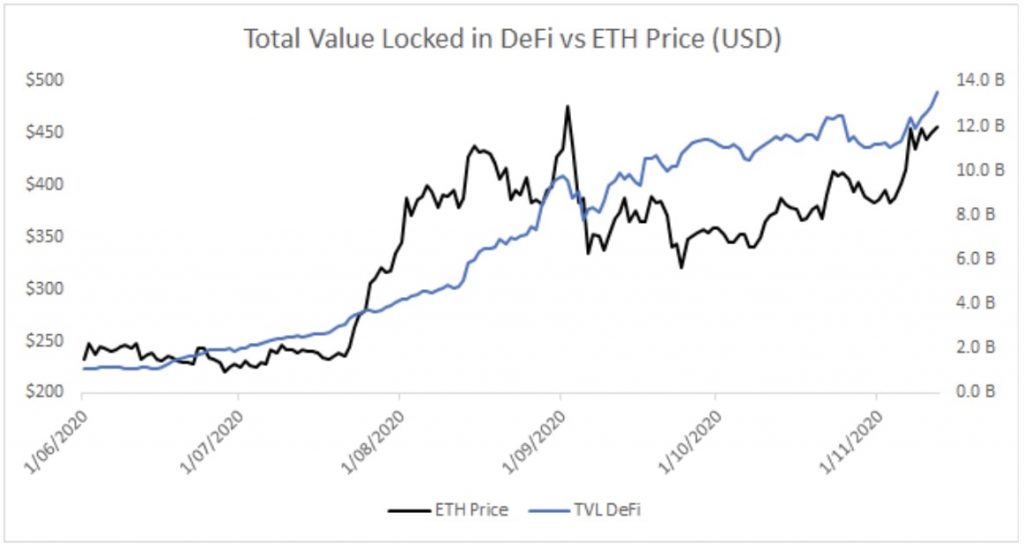

We believe that DeFi will be a leading global financial system in the future. Currently, Ethereum is the underlying protocol for all relevant DeFi apps, with around 13.62 billion USD locked in the ecosystem as of 12th November 2020. Since ETH is required as a fee any time someone interacts with a smart contract, an increase in usage of DeFi apps means an increased demand for ETH. Let’s see how ETH has performed since the surge of capital into DeFi in June.

The DeFi ecosystem has taken off recently as we see innovations that have the potential to disrupt traditional financial services. AAVE, a DeFi loaning platform, recently introduced credit delegation, which allows borrowers to access loans without collateral. This works by having one party providing the collateral, and delegating their credit line to another trusted party. Both parties then sign a legally-binding agreement with OpenLaw, a digital contracting platform which has smart contract functionality built into their contracts. Another platform, Yearn.Finance, introduced yield optimization for lenders via automated capital delegation between platforms that provide the greatest yields and incentives.

The constant increase in functionality and growth of DeFi platforms have caused a mania in the space, with an eerie similarity between the 2017 crypto craze. The AAVE token has appreciated by approximately 3,900% in the past year, to a 630 million market cap, while the Yearn.Finance token has shot up by about 2,000% since its inception in July, reaching a 495 million market cap. However, the difference between the boom in 2017 cryptocurrencies and the current DeFi bull market is that current DeFi platforms are seeing actual use. AAVE has attracted 1.3 billion USD worth of assets locked into the protocol, while Yearn.Finance has 1.1 billion.

So how do we know if we should jump into a DeFi project or to stay away from the potential bubble? We can’t say for sure. However, what we do know, is that 99% of these projects are based on Ethereum. Any one of these project’s success will generate significant value for Ethereum, as we have seen a relationship between DeFi app usage and an increased requirement of ETH. Therefore, if you are looking for a piece of the DeFi pie without the risk of project failure or choosing the wrong project, then it would be worth looking at, and taking a position in ETH.

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Our investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security. To learn more, contact the team at hello@zerocap.com or visit our website www.zerocap.com

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post