Content

- What is Bitcoin?

- Bitcoin is the face of the industry

- Network effects & Innovation

- True Decentralization

- Interoperability

- Bitcoin as Legal Tender

- Conclusion

- FAQs

- What Makes Bitcoin the Most Valuable Project in the Crypto Asset Class?

- How Does Bitcoin's Network Effect Contribute to Its Value?

- What Are the Innovations and Upgrades in Bitcoin's Technology?

- How Does Bitcoin's Interoperability Enhance Its Utility?

- Why Is Bitcoin Considered Legal Tender in El Salvador, and What Are the Implications?

- About Zerocap

2 Feb, 22

Bitcoin is still the King, and here’s why

- What is Bitcoin?

- Bitcoin is the face of the industry

- Network effects & Innovation

- True Decentralization

- Interoperability

- Bitcoin as Legal Tender

- Conclusion

- FAQs

- What Makes Bitcoin the Most Valuable Project in the Crypto Asset Class?

- How Does Bitcoin's Network Effect Contribute to Its Value?

- What Are the Innovations and Upgrades in Bitcoin's Technology?

- How Does Bitcoin's Interoperability Enhance Its Utility?

- Why Is Bitcoin Considered Legal Tender in El Salvador, and What Are the Implications?

- About Zerocap

Thirteen years have passed since the first blockchain transaction, and yet Bitcoin continues to hold its title as the most valuable project of the crypto asset class. Why is that? In this article, Zerocap Research Analyst Parth Singhal explains the reasons why Bitcoin is still the King, even as the digital assets market grows into new proportions and functionalities for global finance.

What is Bitcoin?

Launched in 2009 as a response to the Global Financial Crisis (GFC), Bitcoin (BTC) was the first successful implementation of a digital asset that utilized blockchain technology to create a decentralized, electronic peer-to-peer cash system. It took about 2 years for another cryptocurrency to be released, at which time more than 8 million Bitcoins had been mined, endowing BTC with a major first-mover advantage.

Since then, Bitcoin and other cryptocurrencies have seen a dramatic influx of worldwide interest and mainstream media coverage, leading to the evolution of a multi-trillion dollar industry, and a growing impact on legacy markets and traditional financial institutions.

Bitcoin is the face of the industry

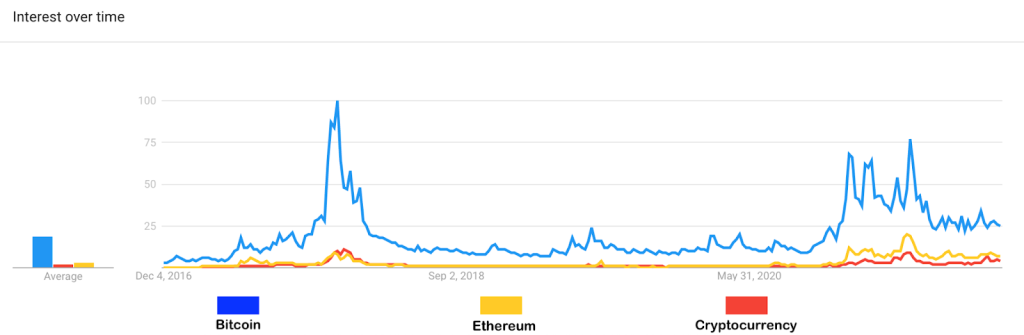

BTC is the model digital asset that everyone tends to associate with cryptocurrencies. A Google Trends search comparing worldwide interest over the last 5 years in search terms “Bitcoin”, “Ethereum” & “Cryptocurrency” illustrates the substantial supremacy in the popularity of Bitcoin, compared to other digital assets, and the industry as a whole.

This is further accentuated by Bitcoin’s dominance as a function of the cryptocurrency market’s overall market capitalisation as Bitcoin accounts for over 40% (almost $1 trillion) of the entire space. To put this into perspective, ETH, the second-largest cryptocurrency, only accounts for about 20%.

The following chart provides a great illustration of Bitcoin’s dominance in the industry. Despite consistently losing market share over the last decade, BTC remains as the market leader and has continued to dictate volatility amongst Altcoins.

Network effects & Innovation

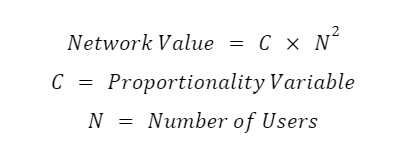

As the crypto market matures, we are increasing our ability to apply traditional valuation metrics to help inform our decisions. Metcalfe’s Law states that the utility of a network is proportional to the squared number of its users (i.e – networks with more users are more valuable).

Metcalfe’s Law:

Metcalfe’s Law is commonly used as a valuation metric for communication networks – such as social media platforms. For example, when there were only a handful of users on Instagram, it wasn’t inherently valuable. However, with billions of users on the platform, it has become extremely useful and valuable.

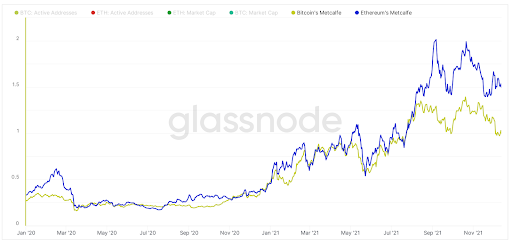

In the case of BTC, early adopters were required to have Bitcoin wallets that were difficult to access and required an arduous transaction process. Today the network is much more user friendly – while you may not be able to buy Bitcoin through ATMs or brokerage accounts, the rise of centralized exchanges and the adoption of crypto by payment services such as Cash App and Venmo have allowed for increased adoption by mainstream users, leading to an exponential increase in total Bitcoin addresses with over 900 million now in existence. In direct contrast, ETH only has about 140 million users despite being the second-largest cryptocurrency, demonstrating the disparity between the two assets.

The chart above illustrates the respective network values for BTC and ETH in terms of Metcalfe’s law, taking into account market capitalization as the proportionality variable. As shown, both networks have a high level of correlation, however Bitcoin’s network is undervalued in relative comparison to ETH, despite having more total and active users. This implies that Bitcoin’s network is still far superior to Ethereum in terms of Metcalfe’s Law value.

True Decentralization

Among the top 10 Cryptocurrencies, Bitcoin is the only one that is truly decentralised. Bitcoin was launched under the pseudonym of “Satoshi Nakamoto”, although nobody truly knows who this individual or group is, thus enabling a trustless and permissionless blockchain. However, this lack of leadership is a common criticism, as competitors criticize Bitcoin’s Proof-of-Work technology as ageing and obsolete. The lagging advancement in Bitcoin can be attributed to the requirement of community consensus before innovation, however this is necessary for a truly democratic system.

The implementation of the Lightning network and the recent Taproot upgrade aim to increase BTC’s scalability and privacy, while potentially enabling the scaling of smart contracts on the Bitcoin blockchain. Given that smart-contract function, upgrades are imperative to other protocols, it is likely that similar upgrades and complementary technology (layer 2s) will be implemented to, and alongside, the Bitcoin blockchain, further enhancing its entire ecosystem, albeit rather slowly.

Interoperability

Centralized payment companies such as Visa and Mastercard are able to process over 5000 transactions per second on aggregate, whereas BTC currently processes about 7 transactions per second. Similar to BTC, most blockchains develop in isolation, unable to communicate with other chains that operate under a different consensus. The need to interact with other blockchains becomes critical to ensure efficiency and scalability in the long term. This is where bridges come into play.

Bridges allow for an exchange of valuable data and information between the many blockchains and layers. Interoperability platforms such as Polkadot and Cosmos (layer 0 blockchains) facilitate bridging by providing hubs that all chains can connect to, creating an infrastructure that prevents the scaling issue of bridging networks. Through this, BTC is able to bridge to other major blockchains such as Polkadot or Solana, taking advantage of their faster transaction speeds and lower fees. As other major blockchains continue to bridge to an interoperable protocol, the use of BTC as collateral for payment systems will be enhanced, consequently improving its utility for everyday transactions.

Bitcoin as Legal Tender

El Salvador abandoned its own national currency for the US Dollar in 2001, recently adding Bitcoin as legal tender. As per national laws, debt settlement and commercial services must accept legal tender transactions, indicating that firms must comply with BTC and USD as payment options.

The adoption of BTC as a legal currency undoubtedly distinguishes it from its peers, facilitating the original goal of Bitcoin – to act as an alternative to fiat. Due to Bitcoin’s decentralized nature, the elimination of financial intermediaries reduces red tape, aiding in cross-border transactions without having to worry about exchange rates. Furthermore, its anti-inflationary nature, achieved by an eventually limited supply of 21 million coins, contributes towards its status as a store-of-value.

Conclusion

BTC and its influence on the market are of paramount importance. Being the only cryptocurrency to be classified as legal tender has been met with resistance. But as institutional investors continue to join the space with billions, Bitcoin’s challenges will continue to be resolved by passionate developers and community members, preserving it as the true ‘King’ of Cryptocurrencies.

FAQs

What Makes Bitcoin the Most Valuable Project in the Crypto Asset Class?

Thirteen years after its inception, Bitcoin continues to be the most valuable project in the crypto asset class. Its first-mover advantage, dominance in market capitalization, true decentralization, network effects, interoperability, and status as legal tender in El Salvador contribute to its supremacy. Despite the emergence of other digital assets, Bitcoin’s influence and value remain unparalleled.

How Does Bitcoin’s Network Effect Contribute to Its Value?

Metcalfe’s Law states that the utility of a network is proportional to the squared number of its users. Bitcoin’s network has become more user-friendly over time, with over 900 million addresses now in existence. This exponential increase in users has led to a corresponding increase in value, making Bitcoin’s network far superior to other cryptocurrencies like Ethereum in terms of Metcalfe’s Law value.

What Are the Innovations and Upgrades in Bitcoin’s Technology?

Bitcoin’s technology continues to evolve, with the implementation of the Lightning network and the recent Taproot upgrade. These innovations aim to increase Bitcoin’s scalability and privacy and potentially enable the scaling of smart contracts on the Bitcoin blockchain. Despite being criticized for its aging Proof-of-Work technology, Bitcoin’s community-driven innovation ensures a truly democratic system.

How Does Bitcoin’s Interoperability Enhance Its Utility?

Interoperability platforms like Polkadot and Cosmos facilitate bridging between different blockchains, allowing Bitcoin to take advantage of faster transaction speeds and lower fees on other chains. This bridging enhances Bitcoin’s utility for everyday transactions and ensures efficiency and scalability in the long term.

Why Is Bitcoin Considered Legal Tender in El Salvador, and What Are the Implications?

El Salvador has adopted Bitcoin as legal tender alongside the US Dollar. This move distinguishes Bitcoin from its peers and facilitates its original goal of acting as an alternative to fiat. Bitcoin’s decentralized nature eliminates financial intermediaries, aids in cross-border transactions, and contributes to its status as a store-of-value. Its anti-inflationary nature and limited supply further enhance its appeal.

About Zerocap

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Our investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security. To learn more, contact the team at hello@zerocap.com or visit our website www.zerocap.com

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 4th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post