Content

- Week in Review

- Winners & Losers

- Macro Environment

- Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi

- Innovation

- Altcoins

- NFTs & Metaverse

- What to Watch

- Insights

- Disclaimer

- FAQs

- What significant changes occurred in the crypto market during the week of 31st October 2022?

- What were the significant macroeconomic events affecting the crypto market during this week?

- What were the technical and order flow trends for Bitcoin and Ethereum during this week?

- What were the significant developments in the DeFi and Innovation sectors during this week?

- What were the notable events in the Altcoins, NFTs & Metaverse sectors during this week?

31 Oct, 22

Weekly Crypto Market Wrap, 31st October 2022

- Week in Review

- Winners & Losers

- Macro Environment

- Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi

- Innovation

- Altcoins

- NFTs & Metaverse

- What to Watch

- Insights

- Disclaimer

- FAQs

- What significant changes occurred in the crypto market during the week of 31st October 2022?

- What were the significant macroeconomic events affecting the crypto market during this week?

- What were the technical and order flow trends for Bitcoin and Ethereum during this week?

- What were the significant developments in the DeFi and Innovation sectors during this week?

- What were the notable events in the Altcoins, NFTs & Metaverse sectors during this week?

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

Week in Review

- UK government votes to recognise cryptocurrencies as regulated financial instruments.

- UK’s new PM Rishi Sunak holds very pro-crypto stances – seeks to make Britain a “global hub for crypto asset technology.”

- Following Merge update, Ethereum successfully reduces energy consumption by 99.9%.

- Elon Musk officially buys Twitter – Binance to allegedly provide platform with blockchain tech after company confirms $500 million investment towards the takeover.

- About 58% of institutions invested in crypto during first half of 2022; Fidelity research.

- Following similar FTX partnership earlier this month, Visa partners with Blockchain.com to offer crypto debit cards.

- Meta’s heavy metaverse losses continue as company now worth less than Home Depot.

- Nearly half of US millennials and Gen Zs want crypto investment options for their retirement funds; Charles Schwab survey.

- Core Scientific, largest publicly-traded BTC miner, files with SEC that it’ll run out of money by year’s end – stock plummets 73% in a day as company explores bankruptcy.

- Market sentiment turns positive as US GDP for Q3 shows better-than-expected results – meanwhile, US Core PCE inflation hits 0.3% for September, 6.2% increase over 9/2021.

- European Central Bank raises rates by 75 bps to 1.5%, highest since early 2009.

Winners & Losers

Macro Environment

- Markets entered the week with renewed confidence, on the heels of a larger-than-expected fall in the United States (US) Manufacturing PMI – down from 52 to 49.9 for the month of September. This downward revision in US Manufacturing PMI marked the sector’s first contraction since June 2020, missing analysts’ expectations of a slight expansionary print of 51. The move was attributed to persistently high levels of inflation, material shortages, rising input costs, and weakening export demand due to a stronger dollar. Market participants, having largely doubted the effectiveness of contractionary policy in controlling for supply-side inflation were pleasantly surprised – the SPX and NASDAQ were up as much as 0.77% and 0.96% on the day, despite Tesla putting the brakes on growth with a share price fall in excess of -7.4% on the day, suffered drawdowns related to its reduced pricing of electric vehicle batteries in China. Investors are now flirting with the possibility of a lesser hike heading into the next Federal Open Market Committee.

- China saw mixed market sentiment beating Year on Year (YoY) Gross Domestic Product estimates for Q3, advancing 3.9% – well ahead of market expectations of 3.4%. China’s industrial production released the same day, similarly surprised to the upside at 6.3% YoY in September – Smashing estimates of 4.5%. Manufacturing and mining were amongst the core contributors to the result – Each posting gains of 6.4% and 7.2% vs August increases of 3.1% and 5.3% respectively. The Chinese Yuan was hesitant to react to the initial GDP release, newsflow from Guangzhou and Wuhan weighing down upwards momentum with a new wave of COVID restrictions established in a bid to stem heightened COVID cases. Despite this, the Yuan locked gains of +0.08% WoW closing at ¥7.27362 (USD/CNH), hitchhiking off of weakened US Treasury Yields – US 10 Year Yields closing the week lower at 4.016.

- Despite some positive sentiment creeping into overseas markets, the European Central Bank (ECB) matched market expectations of a 75 basis points hike. The latest hike brings European borrowing costs to the highest they have been since 2009 – investors now expect the deposit rate to rise as high as 3% next year. ECB president Christine Lagard asserted the hike was “Critically Important,” despite analysts’ fears that the hike will do little to curb surging European household energy prices – largely fueled by Vladimir Putin’s ongoing gas export limitations via Nord Stream 1. The ECB’s ongoing efforts to curb inflation have had mixed success across the various European nations, with Estonia’s September inflation print sitting at an elevated 23.7% YoY, vastly higher than France’s 6.2%.

- Disappointing Big Tech earnings saw markets retrace gains made earlier in the week, with the four main tech companies: Amazon, Alphabet, Meta and Microsoft losing a combined $350 billion in market capitalisation over the week. Meta further realised its worst week since its IPO, down in excess of 24%. Surprising US GDP results for Q3 seemed to remedy turbulent markets, however, above expectations at +2.6% growth QoQ. The US economy notably vaulted out of its period of technical contraction.

Technicals & Order Flow

Bitcoin

- Bitcoin (BTC)’s weekly open was synonymous with traditional markets, largely driven by positive macroeconomic indicators. Tuesday saw gains of +6.2% on the week open, forming a tight daily channel between the 20,000 and 20,300 support and resistance levels.

- A sharp contrast to the previous week, BTC’s price action broke free of its tight range, as it rose to touch the 21,000 mark. In the span of just over 1 day, the price of BTC rose again, up 9.31% since the week opened and is now consolidating between 20,600 and 20,800.

- In contrast to poor BigTech earnings results for Q3, and gloomy market commentary for Q4, BTC dislocated from traditional risk markets – cementing weekly gains in excess of 6.6%. Driven by the fundamental differences in BTC and BigTech, where BTC is devoid of quarterly reporting saw BTC’s gains juxtaposing Amazon and Meta weekly contractions of -14.26% and -22.98% respectively.

- Since the beginning of this year, the total BTC held on exchanges has been dropping. This week saw a slight increase following lows not seen since January 2018. Notably, Coinbase endured a significant withdrawal of 41.6k BTC over the last week, holistically contributing to these lows. This could point to the fact that more investors are moving their BTC off-chain using more secure solutions, like Zerocap, non-custodial wallets or cold wallets on the back of credit risk following the Celsius/3AC fallout. However, converse to this – the value of stablecoins on exchanges has soared, indicating that the play could be more based on volatility management of underlying collateral.

- This data point does notably indicate that more entities are looking to hold their BTC. The withdrawal of these coins is not directed to other exchanges, hence are not being traded. Currently, the exchange balances represent only 12.3% of the total BTC supply. With this percentage falling nearly 5% since March 2020, it appears that bulls are taking a long-term view with regard to the price of BTC.

- The balance of BTC held in miner wallets has continued to fall over the past week. This is not to say that miners are receiving fewer rewards in BTC, but due to the cost of mining BTC eclipsing the rewards in fiat, mining operators are selling their issued coins to remain afloat. Over the last month, the total transfers from miners to exchanges have nearly doubled. Further, the pain being faced by miners has spread to even the largest mining companies; Core Scientific announced that unless it is able to raise capital, it will need to explore bankruptcy. The publicly traded company cited rising computational prices, increasing electricity costs and the decreasing price of BTC as the reasons for its financial woes.

- The last week has seen an increase in the Bitcoin network’s mempool transaction count. This means that at any given time during the past week, there were more addresses waiting for miners to pick up their transaction and execute it. From a bullish perspective, this underlines that addresses are finding more reasons to use the Bitcoin blockchain to send BTC in a peer-to-peer fashion. Contrastingly, from a bearish perspective, as mining becomes a less profitable activity, the interval between blocks appended to the Bitcoin blockchain increases. Over the last month, the block interval increased by just under 20%. With slower blocks, the efficiency of the network is reduced, forcing more addresses to wait longer periods until their transactions have been finalised, ergo increasing the cumulative transactions in the mempool.

- Following the significant run-up, BTC’s price action remained relatively stable. As we look to next week, more catalysts are on the horizon with crypto-friendly Elon Musk having purchased Twitter and the continued release of economic data, such as November’s FOMC meeting.

Ethereum

- Following a strong weekend push towards the top of an increasingly constricting range, ETH began the week with what looked like another rejection from the range high. Although by Tuesday, we saw a high volume breakout to the topside accounting for more than a billion dollars in liquidations sector-wide. The strong momentum continued over the course of the week, breaking out of a two and half month downtrend channel and successfully retesting it as support (1,480). By Sunday close momentum had cooled although, it is important to note the excessive weekend volume that occurred as the move brought many participants off the sidelines. WoW ETH returned 16.61% to close at 1,590.

ETHBTC Daily Chart

- ETH/BTC staged a similarly impressive rally this week as the price moved away from the multi-week support base at 0.068. The bulk of the move occurred on Tuesday and Wednesday when a relative spike in open interest occurred. While liquidations and traditional market influences fueled the velocity of the marketwide increase, ETH saw a strong bid. This is likely a result of the medium-term impacts of the merge that have previously been discussed. While the sell-off post-merge led to a strong narrative rotation away from Ether, the impacts the event had on the network and its token cannot be overlooked. ETH/BTC closed the week just above the previous resistance at 0.077 to return 10.62% WoW.

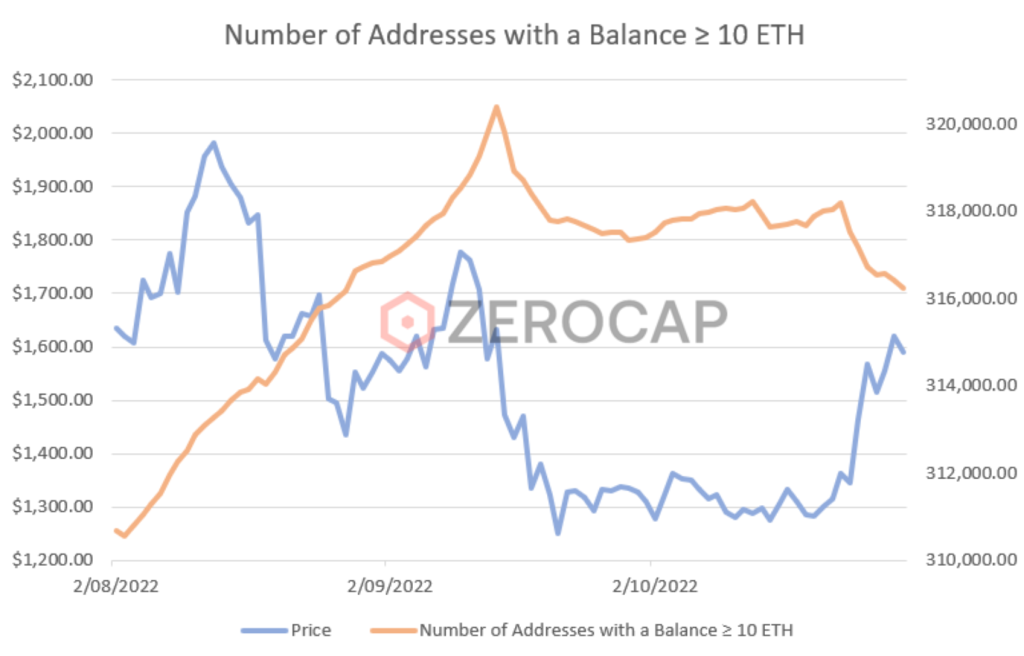

- Interestingly we saw a sharp drop in addresses with 10 ETH or more over the course of the week. With the rate of change being even more aggressive amongst the network’s largest holders, this sparks caution for those chasing the rally. Typically larger wallet (deemed ‘smart money’) behaviour can assist in deriving the health of a move. Smart money distribution into this price appreciation indicates that the buyers in the current market are smaller fish or that the majority of buy flow is occurring in derivatives markets, both of which are not conducive to healthy sustained rallies.

DeFi

- FTX founder, Sam Bankman-Fried (SBF) has hinted that the exchange is working on its own, centralised stablecoin. Notably, FTX is one of the only tier 1 exchanges that do not have its own stablecoin. Unlike Binance, which has its BUSD, FTX does not generate revenue based on the usability and volume transacted with a platform-native stablecoin. It is likely that the launch of an FTX stablecoin would truly light the flames of what the community has named the “Second Great Stablecoin War”.

- Last week, we reported that MakerDAO is looking at restructuring into MetaDAOs; DAOs that operate independently of the primary DAO. The proposal to split up 3 of Maker’s subDAOs into these separate entities passed. However, despite the passing of the MetaDAO Maker Improvement Proposal (MIP), the DeFi landscape is split over whether the reorganisation should occur. Those rejecting change are arguing that the MIP only passed because of the influence that Rune Christensen (the founder of MakerDAO) had when pushing for the change.

Innovation

- Google has escalated its presence in the web3 space by introducing cloud-based Ethereum node services. With more technology giants paying attention to the crypto industry, Google is seeking to capture some share of the Ethereum validator market through this fully-managed node service. Notably, this announcement has followed Google Cloud’s partnership with Coinbase to facilitate payments in crypto for its services, and the establishment of Google Cloud’s Digital Assets Team. Although this service will initially solely support Ethereum, it is likely that if the product is successful, Google will expand to support other blockchains.

- To support research and development around layer 2 applications, the Ethereum Foundation has launched a new US$ 750k grants program. As stated by the company, the underlying intention for this new grants round is to scale Ethereum through rollups and preserve decentralisation as well as public goods. In this context, all open-source applications on Ethereum or layer 2s are public goods. The foundation is accepting simple ideas, proof of concepts, existing projects and more. If the round is successful in funding ambitious projects, Ethereum will edge closer to satisfying its rollup-centric roadmap.

Altcoins

- USN, a NEAR-native, algorithmic stablecoin launched by Decentral Bank, faced a depeg from the price of US$ 1 last week due to a collateral gap of US$ 40 million. As a result of the importance of USN to NEAR’s DeFi space, the total value locked in the blockchain’s platforms fell by just under US$ 120 million, equating to over 48%. In response, the NEAR Foundation urged Decentral Bank to wind down the USN stablecoin. Notwithstanding, the foundation set aside US$ 40 million to find a “USN Protection Programme” to ensure addresses that held the token could withdraw it for tokens worth US$ 1.

NFTs & Metaverse

- With the release of Meta’s Q3 2022 earnings, it became known that Meta’s Reality Labs burned through US$ 3.67 billion in the quarter. Following this, Reality Labs has now lost US$ 9.44 billion in 2022. Nonetheless, Meta still elucidated that its spending on the metaverse-focused division will only grow into 2023. As such, Meta executives, including Mark Zuckerberg, do not appear disconcerted and instead remain adamant about building the metaverse space.

- Reddit’s digital collectibles launched this week, taking Polygon’s NFT trading volume to all-time highs. With just under 3 million avatars minted, Reddit’s NFTs have been involved in over 32.2k trades, amounting to nearly US$ 10 million in under a week. Simultaneously, Reddit has onboarded 2.8 million users into the crypto space through Polygon wallets. Despite this, apart from the initial minting, the majority of these wallets have not interacted with any protocols on the blockchain.

- Twitter has launched its NFT pilot program in collaboration with a multitude of marketplaces, including Magic Eden, Dapper Labs, Rarible and Jump.trade. Twitter will be enabling users to display their listed NFTs directly within tweets. In addition to this, interested purchasers will be able to click an integrated button that allows them to buy them off the marketplace that the NFT is listed on. Through the involved marketplaces, Twitter’s pilot already supports Ethereum, Solana, Flow and more.

- In a Singapore High Court, the ruling justice has determined that NFTs can be representative of property. Based on the fact that NFTs and other digital assets do meet certain legal requirements, including being distinguishable from other assets of the same type and recognisable, the High Court justice issued the first injunction in Asia to protect an NFT. This injection, initially issued in May, related to the transfer of a BAYC NFT; the previous ruling was upheld by the judge, ensuring that a manipulative attempt by another party to obtain control over the asset was illegal. This new ruling has the potential to set a precedent for NFTs to be deemed as property in Singapore courts.

What to Watch

- Musk’s Twitter takeover – what comes next for the new crypto-friendly CEO and his Binance partnership?

- US’ Jolts Job Openings, on Tuesday – results have been consistently positive despite technical recession.

- FED’s FOMC statements – Will the Reserve hit the brakes on growing rate hikes?

- Bank of England’s Monetary Policy report and summary, on Thursday.

Insights

Zerocap’s partnership with Swinburne University of Technology – Crypto lectures for graduate students: Since March of this year, Zerocap’s team of experts have been providing students of Swinburne University of Technology’s Master of Finance courses with guest lectures in crypto finance, blockchain technology and market strategies. Learn more about this thrilling partnership in the release below.

Disclaimer

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

FAQs

What significant changes occurred in the crypto market during the week of 31st October 2022?

During this week, the UK government voted to recognize cryptocurrencies as regulated financial instruments, and the new PM Rishi Sunak expressed pro-crypto stances. Ethereum significantly reduced its energy consumption following the Merge update. Elon Musk officially bought Twitter, with Binance allegedly providing blockchain tech after a $500 million investment. Fidelity research revealed that about 58% of institutions invested in crypto during the first half of 2022. Visa partnered with Blockchain.com to offer crypto debit cards, and Meta faced heavy metaverse losses.

What were the significant macroeconomic events affecting the crypto market during this week?

The week saw a larger-than-expected fall in the United States Manufacturing PMI, marking the sector’s first contraction since June 2020. China’s YoY Gross Domestic Product for Q3 advanced 3.9%, ahead of market expectations. The European Central Bank raised rates by 75 bps to 1.5%, the highest since early 2009. Big Tech earnings were disappointing, leading to a loss of a combined $350 billion in market capitalisation over the week.

What were the technical and order flow trends for Bitcoin and Ethereum during this week?

Bitcoin’s price action broke free of its tight range, rising to touch the 21,000 mark and consolidating between 20,600 and 20,800. Ethereum also had a strong rally, breaking out of a two and half month downtrend channel and successfully retesting it as support.

What were the significant developments in the DeFi and Innovation sectors during this week?

FTX founder, Sam Bankman-Fried, hinted at the exchange working on its own centralized stablecoin. The Ethereum Foundation launched a new US$ 750k grants program to support research and development around layer 2 applications. Google escalated its presence in the web3 space by introducing cloud-based Ethereum node services.

What were the notable events in the Altcoins, NFTs & Metaverse sectors during this week?

USN, a NEAR-native, algorithmic stablecoin faced a depeg due to a collateral gap of US$ 40 million. Reddit’s digital collectibles launched, taking Polygon’s NFT trading volume to all-time highs. Twitter launched its NFT pilot program in collaboration with several marketplaces. A Singapore High Court ruling determined that NFTs can be representative of property.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post