Content

- Week in Review

- Winners & Losers

- Macro, Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi & Innovation

- What to Watch

- FAQs

- What are the significant events in the crypto market for the week ending 3rd May 2021?

- How did Bitcoin and Ethereum perform during the week?

- What are the notable developments in the DeFi and innovation space?

- What are the key technical aspects and order flow for Bitcoin and Ethereum?

- What are the future considerations and things to watch in the crypto market?

- Disclaimer

3 May, 21

Weekly Crypto Market Wrap, 3rd May 2021

- Week in Review

- Winners & Losers

- Macro, Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi & Innovation

- What to Watch

- FAQs

- What are the significant events in the crypto market for the week ending 3rd May 2021?

- How did Bitcoin and Ethereum perform during the week?

- What are the notable developments in the DeFi and innovation space?

- What are the key technical aspects and order flow for Bitcoin and Ethereum?

- What are the future considerations and things to watch in the crypto market?

- Disclaimer

Zerocap provides digital asset investment and custodial services to forward-thinking investors and institutions globally. Our investment team and Wealth Platform offer frictionless access to digital assets with industry-leading security. To learn more, contact the team at hello@zerocap.com or visit our website www.zerocap.com

Week in Review

- Equities has had its strongest month since November, taking the week to cool off with sideways movements.

- Germany passes a new legislation, allowing institutional fund managers to invest up to 20% of their portfolio into crypto-assets, to be effective from 1 July.

- European Investment Bank (EIB) issues 2-year, €100 million Euro bonds on ethereum.

- Rumours of a cryptocurrency ETF emerging on the Australian Securities Exchange are circulating.

- JPMorgan to prepare a managed bitcoin fund for clients, according to sources.

- Andressen Horowitz plans to raise up to $1 billion USD for their cryptocurrency fund.

- Tesla sells 10% of their bitcoin holdings, citing that he wanted to demonstrate liquidity as a reason.

- Nexon acquires $100M of bitcoin.

- Paxos, a stablecoin issuer and custody solution, raises $300 million at a $2.4 billion valuation.

Winners & Losers

- Bitcoin spent the week recovering from its drop below US$50,000, riding the wave of consistent news surrounding institutional adoption. Strong fundamentals coming out of Europe had a positive impact on the cryptocurrency market and are beginning to suggest that the region’s progressive regulation may paint the US as a laggard in the development of the space.

- Bitcoin’s market dominance continues to fall, sitting at its lowest since July 2018. This combined with the market’s recovery from last week’s lows was due to a number of rallies across the asset class, most noticeably in ethereum which continued to make new highs across the week. Money flows appear to be leaning towards large and mid-cap coins, the majority of which have enjoyed a consistent flow of positive news as products launches and adoption continues. Overall, BTC recorded a 15.27% gain and ETH a 27.05% gain.

- Gold sustained a decline over the course of the week as positive consumer confidence increased on the back of vaccine and jobs news. This coincided with a jump in US10Y yields, weakening gold’s appeal. The week opened at US$1,784 and closed -0.05% down.

- The US10Y had a strong week recording a 4.59% gain. The release of strong Q1 2021 economic data supported the increase. Despite clear signs of economic recovery, Jerome Powell stated that he has no intention of changing the Fed’s stance any time soon.

- Equity markets had a relatively flat week, likely a breather from the drastic upside that has been experienced over the last month. As such, the VIX ranged with some limited upside, finishing up 3.73% WoW.

- Market sentiment continues to lead price sensitivity. As mentioned above, this week saw positive economic data that is highly suggestive that an economic recovery is underway. Despite this, the Federal Reserve has no intention of altering its current plan, meaning asset inflation is still a key focus for many.

Macro, Technicals & Order Flow

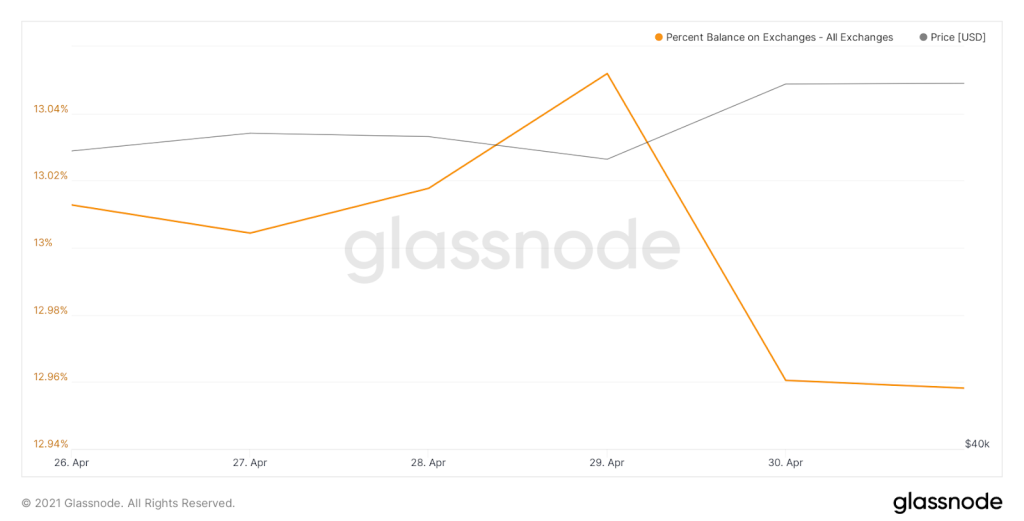

Bitcoin

- The daily close above 53,000 held at the beginning of the week, then found support on the ascending trendline from December 2020. This false break, coinciding with ethereum’s run, is poised to continue this week. A hold above 58,000 is the key level to watch.

- Tesla revealed that it had sold 10% of its BTC holdings in their Q1 report. Investors may view this as bearish. However, Tesla has proven that bitcoin is a highly liquid asset that can be liquidated any time of the week, 24/7, without large price impacts or slippage. This event should give a friendly nudge to corporations still on the fence about hedging their Treasury holdings through bitcoin.

- Nexon is another addition to the list of corporations holding BTC, and we expect this to be a recurring theme as US10Y yields continue to pop, and the inflation narrative continues to gain momentum.

- Open interest and funding rates edge up slightly together with the price of bitcoin, but is no cause for concern yet – levels remain compressed compared to historical liquidation periods.

- Despite bitcoin’s dominance continuing to fall against ethereum and related protocols, we still expect topside in the near-term. The ETF narratives are heating up, and access points for traditional investors continue to open up. The speculative hype that we are increasingly seeing in the market may take some of the shine away from the ‘digital gold’, but in 20-years, think hard about which digital assets will still be around.

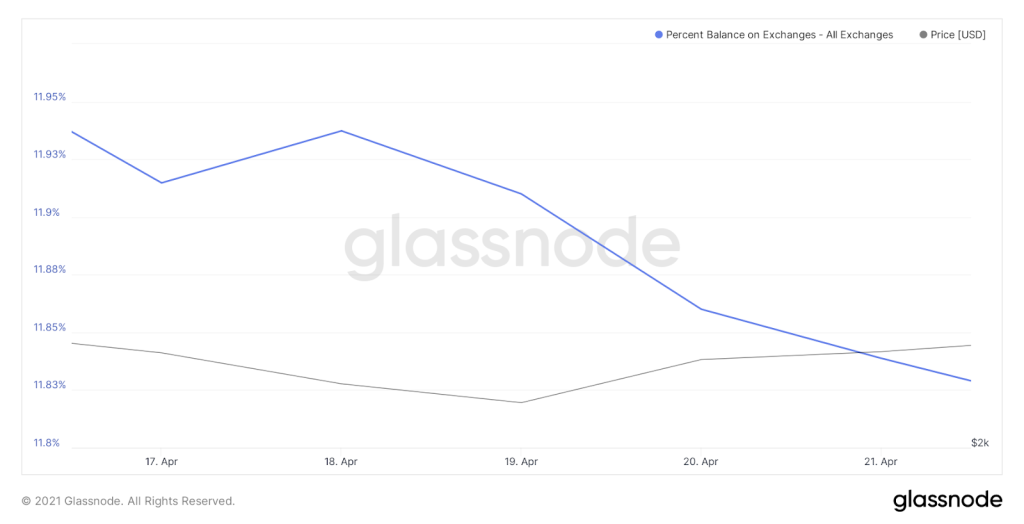

Ethereum

- We forecast a break of all-time-highs last week, and through the tops she went. This time with limited leverage, indicating that the current price increase may be more sustainable than usual.

- Ethereum continues to thrive off institutional interest as institutional grade bonds are issued on the network, while the three ethereum ETFs which started trading on April 20 on the Toronto Stock Exchange have amassed a total of CAD$260M.

- MetaMask, an ethereum-based wallet used for transactions and DeFi, surpasses 5 million monthly active users.,

- Some proponents of the ecosystem are claiming that ethereum will go through the equivalent of three halvings when it upgrades to proof-of-stake and incorporates EIP1559, which would theoretically cause an illiquidity crisis and supply shock. We agree that illiquidity and a limited supply crunch is probable, but that excessive volatility will lead to responses from developers and the broader ecosystem to dampen this. It’s time for the wild west to mature, and this can only happen with more measured volatility.

- Total value locked in DeFi projects rose to $68.26 billion, a 28.5% increase from last week, caused by increased stablecoin inflows and repricing of DeFi tokens.

- The amount of ETH in the ETH 2.0 staking contract currently sits at 4,109,826, an increase of 3.64% from last week. This represents 3.55% of the total supply estimated to remain locked for ~ one year.

DeFi & Innovation

- AAVE shoots past $14 billion in total locked value as they launch their liquidity mining rewards.

- Yearn Finance releases their quarterly report, highlighting a $4.8 million EBITDA.

- Scaling solutions Polygon network and Fantom gain attention from Ethereum users, as the former attracts $4.75 billion in assets locked into the blockchain.

- Maple Finance, a project that aims to bring corporate and institutional grade loans onto DeFi, finished up their initial sale this week.

- Notional Finance, a fixed-rate lending protocol, raises $10 million.

- Eminem launches his own NFT collection.

What to Watch

- Germany has given the green light for institutional investment funds (Spezialfonds) to allocate to cryptoassets, allowing the €1.2 trillion market to gain exposure to the asset class. Will other countries follow suit? When will powerhouses such as the US and Australia launch a bitcoin ETF? What will happen when there is a crypto financial product on the market that is available to every investor?

- ETH breaks all time highs while BTC consolidates. Though, if we zoom out, BTC has run 3 times above its 2017 highs and established itself as a trillion dollar asset, while ETH has barely crossed 2 times above its 2017 levels. Is the the global settlement layer still undervalued? Are market participants beginning to price in ETH’s future supply shock?

FAQs

What are the significant events in the crypto market for the week ending 3rd May 2021?

Germany passed legislation allowing institutional fund managers to invest up to 20% in crypto-assets, effective from 1 July. The European Investment Bank issued bonds on Ethereum, and rumors of a cryptocurrency ETF in Australia are circulating. Tesla sold 10% of their Bitcoin holdings, and Nexon acquired $100M of Bitcoin. Additionally, Bitcoin and Ethereum saw gains, while gold sustained a decline.

How did Bitcoin and Ethereum perform during the week?

Bitcoin spent the week recovering from its drop below US$50,000, recording a 15.27% gain. Ethereum continued to make new highs across the week, with a 27.05% gain. Bitcoin’s market dominance is at its lowest since July 2018, and Ethereum broke all-time highs.

What are the notable developments in the DeFi and innovation space?

AAVE’s total locked value surpassed $14 billion as they launched liquidity mining rewards. Polygon network and Fantom gained attention, and Maple Finance aimed to bring corporate and institutional grade loans onto DeFi. Eminem launched an NFT collection, and projects like Notional Finance raised significant funds.

What are the key technical aspects and order flow for Bitcoin and Ethereum?

Bitcoin’s daily close above 53,000 held, and a hold above 58,000 is key. Tesla’s sale of BTC holdings demonstrated liquidity, and Nexon’s addition to BTC holders is expected to be a recurring theme. Ethereum broke all-time highs with limited leverage, and its network continues to thrive off institutional interest. The amount of ETH in the ETH 2.0 staking contract increased by 3.64%.

What are the future considerations and things to watch in the crypto market?

Germany’s green light for institutional investment funds to allocate to crypto-assets may lead other countries to follow suit. The launch of a Bitcoin ETF in major markets like the US and Australia could have significant impacts. The global settlement layer may still be undervalued, and market participants may begin to price in ETH’s future supply shock.

Disclaimer

This document has been prepared by Zerocap Pty Ltd, its directors, employees and agents for information purposes only and by no means constitutes a solicitation to investment or disinvestment. The views expressed in this update reflect the analysts’ personal opinions about the cryptocurrencies. These views may change without notice and are subject to market conditions. All data used in the update are between 26 Apr. 2021 0:00 UTC to 02 May. 2021 23:59 UTC from TradingView. Contents presented may be subject to errors. The updates are for personal use only and should not be republished or redistributed. Zerocap Pty Ltd reserves the right of final interpretation for the content herein above.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | CRBQX | U.S. 10Y |

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap selects Pier Two to offer institutional staking yields

Institutional clients gain secure, non-custodial access to native crypto yields with top-tier infrastructure Leading digital asset firm Zerocap has selected global institutional staking provider Pier

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post