Content

- Week in Review

- Winners & Losers

- Macro, Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi & Innovation

- What to Watch

- Insights

- FAQs

- Q: What significant announcements were made by Elon Musk and Biden regarding Bitcoin and recovery plans?

- Q: How did the Bitcoin and Ethereum markets perform during the week?

- Q: What are some of the latest developments in DeFi and Innovation?

- Q: What are the key things to watch in the coming weeks regarding Biden's recovery plan and Bitcoin?

- Q: How are economies transitioning to cashless systems, and what role do cryptocurrencies play?

29 Mar, 21

Weekly Crypto Market Wrap #12, 2021

- Week in Review

- Winners & Losers

- Macro, Technicals & Order Flow

- Bitcoin

- Ethereum

- DeFi & Innovation

- What to Watch

- Insights

- FAQs

- Q: What significant announcements were made by Elon Musk and Biden regarding Bitcoin and recovery plans?

- Q: How did the Bitcoin and Ethereum markets perform during the week?

- Q: What are some of the latest developments in DeFi and Innovation?

- Q: What are the key things to watch in the coming weeks regarding Biden's recovery plan and Bitcoin?

- Q: How are economies transitioning to cashless systems, and what role do cryptocurrencies play?

Week in Review

- Elon Musk announces that Teslas can be bought with bitcoin, and “bitcoin paid to Tesla will be retained as bitcoin, not converted to fiat currency.”

- Biden plans to spend a reported $3 trillion on recovery plans, with detailed proposals to be discussed in the coming weeks.

- Fidelity Investments and SkyBridge Capital file for bitcoin ETFs.

- Crypto hedge funds grew by 35% last February alone following 200% growth in 2020.

- Blockchain.com raises $300 million in funding round, valued at $5.2 billion.

- Bloomberg’s commodity strategist forecasts six-figure BTC by the end of 2021.

- Focused on promoting digital anonymity and wallet types, Digital Yuan enters Phase 2 trials.

- Fed Chair Jerome Powell finds congressional support needed for digital dollar adoption.

- Blockchain-based Covid-19 vaccine passport is now live for use in the state of New York.

Winners & Losers

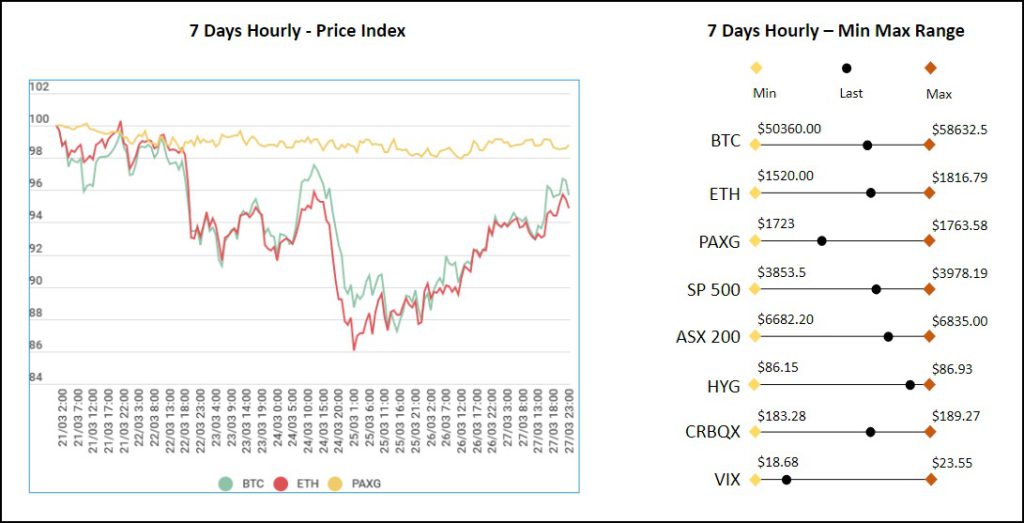

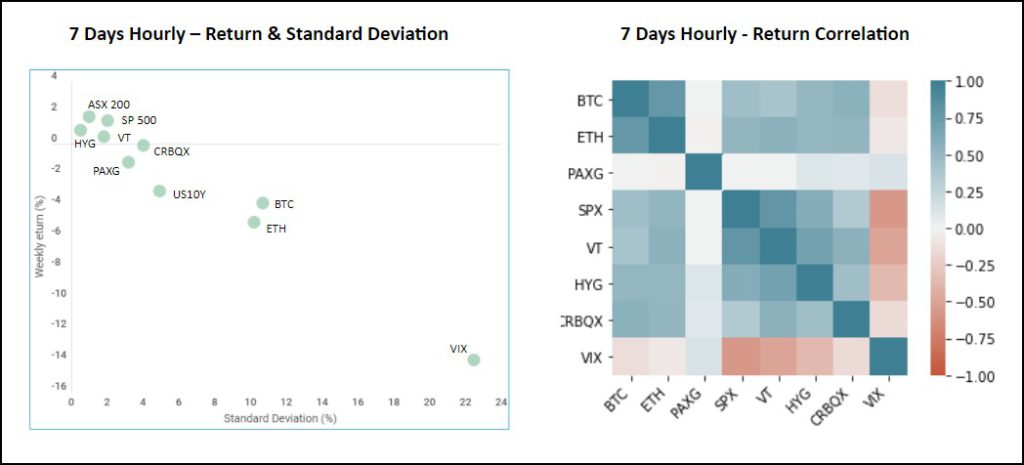

- The week opened with BTC just over US$58,000 however, this was short lived as the asset failed to sustain this level. The days following saw a swift selloff to US$50,360 (the week’s low) before seeing a recovery over the US$55,000 mark, closing at ~US$55,800.

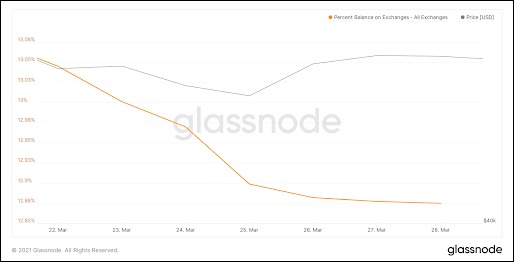

- This comes at a time when on-exchange BTC is at a two-year low (~2.4 million BTC), keeping underlying sentiment positive. Ethereum followed suit, opening the week at ~US$1,805 before dropping alongside BTC. It closed the week at ~US$1,714. Overall, BTC recorded a -3.85% week slightly outperforming ether which ended at -5.06%.

- Gold prices were largely flat over the course of the week as the greenback rallied (limiting topside) and treasury yields dropped (limiting downside), closing at ~US$1,731 for a -1.2% loss. With many traders and investors sidelined, upcoming macroeconomic news will fuel decision making in the coming weeks.

- The US 10-yr Treasury yield rate eased up this week, leading to its largest weekly decline since December. Although, it did close up from its low at ~1.59% to finish the week at ~1.67%. Fear of inflation remains the key focus for bond traders as Biden’s fiscal stimulus hangs overhead. In an interview on Thursday, Jerome Powell announced the Fed will slowly curb its US$120 billion per month bond purchases once it is convinced that the US economic recovery is in full swing.

- The VIX held within its range on the back of a relatively slow week for the S&P 500. It closed toward the range lows at -13.92% down at 18.86.

- The S&P500 rebounded toward the end of the week, seeing strong inflows into utilities and other value sectors.

- Movement across all markets indicate that many are still cautious of the impacts that incoming inflation may have across the board. Our view is that suppressed interest rates and continued stimulus will bring spikes in growth stocks and VC backed cryptocurrencies. However, medium to longer-term indicators are currently favouring value stocks and stores of wealth such as bitcoin.

Macro, Technicals & Order Flow

Bitcoin

- We bet the pennant would break topside last week – we owe the rest of the team a beer for being on the wrong side of that bet. We saw a clean downside break, before bouncing at the 50,000 level. The technicals are playing out well for BTC at the moment – a number of our investors were entered into pending orders on the move down to key levels.

- Despite the downside break, bitcoin remains bid into the new week, even as the U.S Dollar surges and 10Y treasury yields remain elevated.

- Inflation and currency devaluation are key market themes right now. Soros Fund Management continues to invest in crypto infrastructure providers, with the CIO stating that Bitcoin is no longer a “fringe asset” due to increasing fears of fiat debasement in the U.S. This continues to play into the institutional growth narrative, and we continue to forecast BTC buying on dips.

- Furthermore as mentioned above, the amount of Bitcoin held on exchanges continues to decrease, suggesting an increase in longer-term Bitcoin holdings.

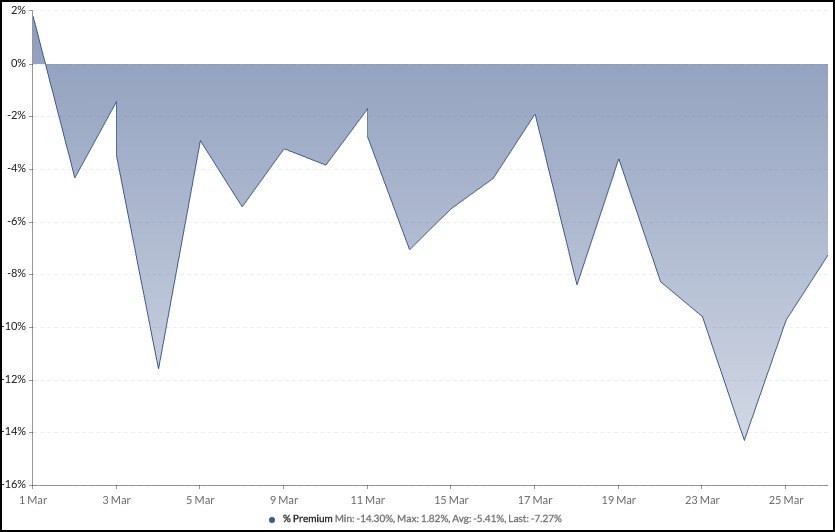

- Grayscale’s Bitcoin Trust continues to sit at a heavy discount, ranging from 3% to 14% in the past month. Growing access to newer Bitcoin funds that have a lower expense ratio may be having an indirect impact, in combination with an increasingly crowded hedge fund trade.

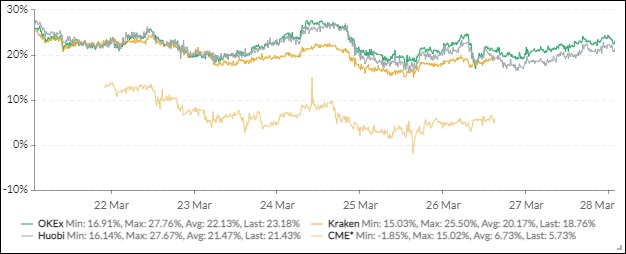

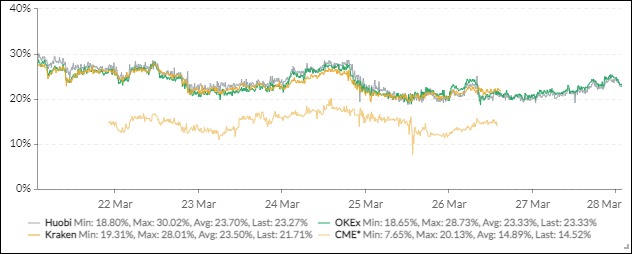

- The futures basis continues to range at the 20% level.

Ethereum

- With the heated debate around how to scale ETH’s fee structures and processing times, the news that Ethereum’s scaling solution, Optimism has delayed its launch until at least July will potentially keep a lid on any short-term breaks of recent highs. Although eyes are still on ImmutableX to bring scaling to NFTs this month.

- Furthermore, there have been rumours that we may see Ethereum implement Proof-of-Stake much earlier than expected (this year instead of next year),

- Given two-sided flows – ETH (like BTC) is trading technically very well within prior ranges. Key downside support sites between the 1,400 and 1,500 levels, with topside resistance up at 2,000.

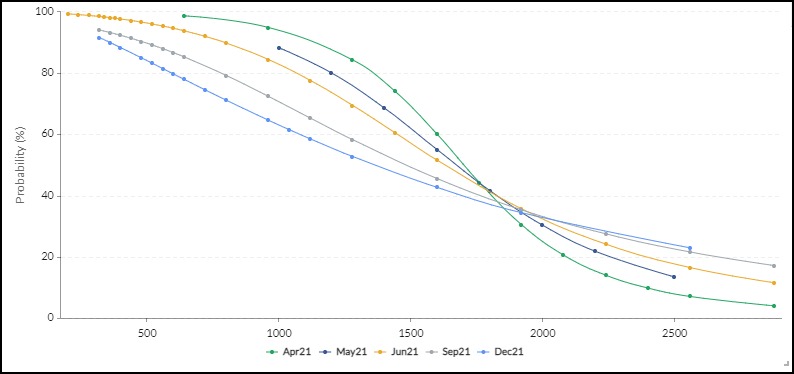

- Futures basis is trending downward, presenting a further case for ranging markets this coming week.

- The total value locked in DeFi projects decreased to $40.7 billion, an 6.3% decrease from last week.

- The amount of ETH in the ETH 2.0 staking contract currently sits at 3,604,322, an increase of 1.24% from last week. This represents 3.13% of the total supply estimated to remain locked for ~ one year.

DeFi & Innovation

- The founder of Compound Finance, a DeFi money market protocol, presented their product to Federal Reserve staff.

- Teller Finance launched its sale this week, aiming to bring credit-based lending into DeFi by leveraging credit history on the blockchain and linking wallets with traditional banks.

- Uniswap announced its V3 launch in May, claiming up to a 4000x increase in capital efficiency compared to their previous version.

- Sushiswap introduces lending and margin trading into its platform, increasing yields for liquidity providers.

- Rari capital introduces Fuse, allowing anyone to create their own money market for any ERC20 token.

- NFTs appear on Saturday Night Live, seemingly paving the way for retail Ethereum adoption.

What to Watch

- How does Biden intend to fund his new $3 trillion recovery plan? Introducing more debt into the system, increasing tax rates or a mixture of the two?

- Rumours of sovereign wealth funds investing directly into Bitcoin are circulating. Will we see confirmation from one of them? What are the implications if so?

- As Optimism fails to launch this month to scale Ethereum, will other chains absorb market and mindshare away from Ethereum? Will ImmutableX similarly announce a delay or will they successfully launch this month?

Insights

- Economies are going cashless, but is it a good idea? Have a look at the recent developments in key nations, and why cryptocurrencies are essential to face the challenges of a centralised financial system.

FAQs

Q: What significant announcements were made by Elon Musk and Biden regarding Bitcoin and recovery plans?

A: Elon Musk announced that Teslas can now be bought with Bitcoin, and the Bitcoin paid to Tesla will be retained as Bitcoin, not converted to fiat currency. Biden plans to spend a reported $3 trillion on recovery plans, with detailed proposals to be discussed in the coming weeks.

Q: How did the Bitcoin and Ethereum markets perform during the week?

A: The week opened with Bitcoin just over US$58,000 but saw a swift selloff to US$50,360 before recovering to close at ~US$55,800. Ethereum followed suit, opening at ~US$1,805 before dropping and closing at ~US$1,714. Overall, Bitcoin recorded a -3.85% week, slightly outperforming Ethereum, which ended at -5.06%.

Q: What are some of the latest developments in DeFi and Innovation?

A: The founder of Compound Finance presented their product to Federal Reserve staff. Teller Finance launched its sale to bring credit-based lending into DeFi. Uniswap announced its V3 launch in May, and Sushiswap introduced lending and margin trading. Rari capital introduced Fuse, allowing anyone to create their money market for any ERC20 token.

Q: What are the key things to watch in the coming weeks regarding Biden’s recovery plan and Bitcoin?

A: Key things to watch include how Biden intends to fund his new $3 trillion recovery plan and rumors of sovereign wealth funds investing directly into Bitcoin. Also, the implications of Optimism’s delay in scaling Ethereum and whether other chains will absorb market and mindshare away from Ethereum.

Q: How are economies transitioning to cashless systems, and what role do cryptocurrencies play?

A: The article hints at economies going cashless and emphasizes the importance of cryptocurrencies in facing the challenges of a centralized financial system. Cryptocurrencies are essential in providing decentralized alternatives and ensuring financial inclusivity.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap selects Pier Two to offer institutional staking yields

Institutional clients gain secure, non-custodial access to native crypto yields with top-tier infrastructure Leading digital asset firm Zerocap has selected global institutional staking provider Pier

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post