11 Nov, 24

Weekly Crypto Market Wrap: 11th November 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

This is not financial advice. As always, do your own research.

Week in Review

- Trump wins the US election

- BlackRock’s bitcoin ETF has surpassed its gold ETF in net assets just months after debut

- Leading stablecoin firm Tether is looking to become a top player in the trading of commodities (oil), placing a $45 million trade

- From November 4 to November 8, Bitcoin spot ETFs had a net inflow of US$1.63 billion last week, BlackRock ETF IBIT had a weekly net inflow of US$1.25 billion

- Analysts at Animoca Brands Research claim that Polymarket users will likely stick with the platform after its biggest draw — the U.S. presidential election — has concluded.

- Dune acquires a16z-backed smlXL to expand real-time blockchain data offering

Technicals & Macro

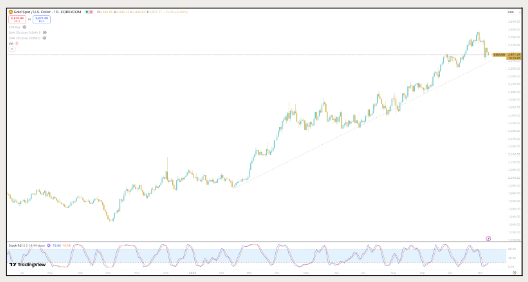

BTCUSD

Source: TradingView

Key levels

66,000 / 72,000 / 73,000, 77,000

What a week! Did everyone have an all-time high party somewhere in the world?

As the election played out and it became clear that Trump was a shoo-in, the move began, and didn’t really take a breather until we smashed through all-time highs and beyond. I’m surprised we didn’t see more buying prior to election day given the velocity at which the election odds were shifting. The prior week, the aggregated betting odds moved from Trump holding a slight lead, to Trump taking a convincing win in the race. The proprietary polls models (FiveThirtyEight, The Hill, Economist/Columbia) were less definitive – but were still supporting a Trump win.

In many ways this was an election about the unheard/silent voters – and betting apps are an anonymous way to bid from the silent majority. Betting odds ended up being the right indicator on this occasion – but what really struck me was the black and latino vote that made up a substantial piece of Trump’s win. The economy was the overarching theme, and it has definitely sparked renewed attention on the effect of inflation and the growing wealth divide in the US (and globally). People are looking for change, and Trump brings the hope of change.

Where does that leave us in markets? Long energy, banks, bitcoin hit the accelerator. Actually wall street broadly hit the accelerator, but the Trump trade outperformed. Cryptocurrency is in a unique position in this mix – Gary Gensler is getting ‘fired’, Ross William Ulbricht of Silk Road fame is being released, and we have Senator Cynthia Lummins Cummins screaming from the bleachers that the Strategic Bitcoin Reserve is going to be built.

The bill proposes that the US treasury acquire one million Bitcoin over five-years, which is around 5% of the fully diluted supply. The theory goes that the reserve will hedge against debasement of the US dollar and, over time, help the nation climb its way out of US$35 trillion in US debt. It’s a brazen approach, and one that may just work. Other sovereign nations are adopting BTC; the roadmap is there. Hell, they could just buy the ETF. Watch this space, because stranger things have happened. If this goes through – or has any inkling of going through, I think the market front-runs like it’s never front-run before. But let’s walk before we run, Trump takes office on Jan 20th. The moves from here will be closely tied to his expected policy rollout, and any wild surprises we get along the way.

Broader market downside risks are centred around any policy hiccups in Trump’s unscripted speeches and further escalation in the Israel / Iran conflict. The VIX is still historically less elevated given the conflict risk, and the crisis does have the potential to escalate, and fast.

Gold taking a breather on USD strength

With BTC’s breakout, we are beginning to close the relative value market cap trade with gold. BTC at US $1.6T, with Gold at US $17T. Still a long way to go here, and notably the Blackrock BTC ETF now has more AUM than its gold ETF.

ETHBTC getting a little love

ETHBTC has found a nice base on the back of the risk moves. How far can we go higher? I’m not sure we go that much higher given the convexity around BTC and Trump taking office.

Be careful out there, and enjoy the fireworks.

Jon de Wet, CIO

Spot Desk

The Australian Dollar (AUD) has been under pressure, declining against the US Dollar (USD) due to the renewed strength of the USD following the election and latest FOMC meeting. Despite an improved risk sentiment, the US Dollar’s dominance continues to weigh on the AUD, although the hawkish stance of the Reserve Bank of Australia (RBA) and expectations for further Chinese stimulus could offer support to the Aussie.

On the trading desk, there was a noticeable skew towards off-ramping as the AUD continued its decline. Meanwhile, major cryptocurrencies such as Bitcoin, Ether, and Solana remained in high demand, reflecting continued confidence in the broader crypto market, especially following Trump’s victory.

The market is currently in a risk-on, with increased interest in altcoins. Notably, there has been significant selling of BNB, MPL, and SUI as traders took profits from recent gains. In contrast, POL saw increased buying activity. As Bitcoin’s dominance eased, speculative buying in altcoins picked up.

Additionally, the desk continues to offer strong support for memecoin custody and OTC trading. We are well-positioned to provide competitive rates across major currencies, altcoins, memecoins, and stablecoin pairs against key fiat currencies, with T+0 settlement available for added convenience. For any specific inquiries, please feel free to reach out.

Arpit Beri, Trading Operations Manager

Derivatives Desk

WHOLESALE INVESTORS ONLY

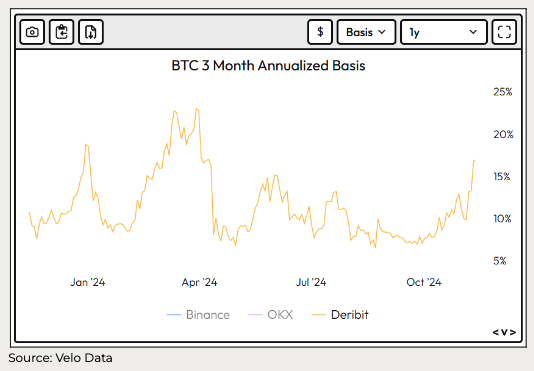

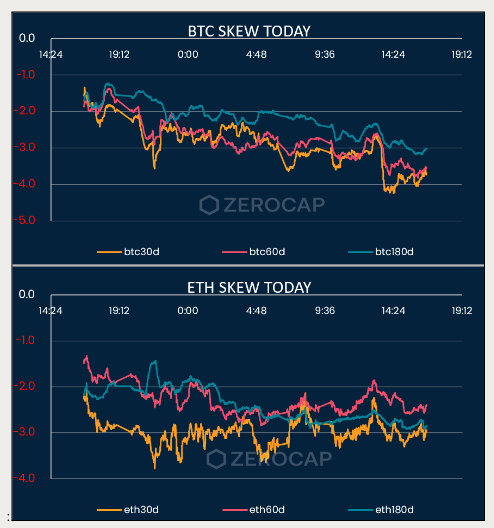

Basis rates on BTC and ETH are flying higher:

- BTC’s 90-day annualised basis rate is up 600 bps (16.8%).

- ETH’s is also up 470 bps (14.8%).

Skew on BTC and ETH is heavily biased towards calls at the moment

With basis rates elevated and skew towards the upside – covered calls are paying very attractive premiums at the moment. For investors with any large holdings in BTC/ETH or altcoins, they could look at trading covered calls expiring at the end of the year with strike prices 10%/20% above current spot price.

Hit the derivs team up for current yield rates and pricing!

Berkeley Cox, Derivatives Analyst

What to Watch

- BOJ SOO (MON): The BoJ will release the Summary of Opinions from its October 30th-31st meeting where it provided no major surprises as it kept the short-term policy rate at 0.25%, as expected, which money markets were pricing a 99% likelihood of ahead of the announcement

- UK JOBS (TUE): Expectations are for the unemployment rate in the 3M period to September to rise to 4.1% from 4.0%, whilst headline average earnings are expected to pick up to 3.9% from 3.8% on a 3M/YY basis

- US CPI (WED): The consensus looks for headline CPI to rise +0.2% M/M in October (prev. +0.2%), and the core rate is seen printing 0.3% M/M (prev. 0.3%)

- AUSTRALIAN JOBS (THU): The Australian labour force report is expected to show an addition of 25k jobs in October (vs 64.1k in September), with the unemployment rate seen ticking up to 4.2% from 4.1%, and the participation rate expected steady at 67.2%

- JAPANESE GDP (THU): GDP Q/Q for Q3 is expected to wane to +0.2% from +0.7% in Q2. Desks highlight that the Q2 “megaquake” and typhoon in August dampened economic activity

- CHINESE ACTIVITY DATA (FRI): Chinese Industrial Production is seen coming in steady at 5.4% (prev. 5.4%) whilst Retail Sales are expected at 3.8% (prev. 3.2%) and Urban Investments at 3.5% (prev. 3.4%)

- UK GDP (FRI): Expectations are for a 0.2% M/M pick-up in growth for September

- US RETAIL SALES (FRI): US retail sales data is due on Friday, whereby in September the headline came in at 0.4% M/M and Y/Y, with the retail control at 0.7%. In terms of recent commentary from retailers, Amazon management noted in its retail business it is seeing favourable trends in everyday essentials,

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post