28 Oct, 24

Weekly Crypto Market Wrap: 28th October 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

This is not financial advice. As always, do your own research.

Week in Review

- The total holdings of retail investors have increased by 18K BTC since its previous local bottom on July 3, bringing the total to 1.753 million Bitcoin.

- BTC ETF net inflows for the week amounted to $997.7 million, marking the 3rd consecutive week of positive flows, signalling robust institutional demand.

- The way BTC options trading on Deribit are currently priced suggests a 9.58% chance of prices rising above $100,000 by Dec. 27.

- Microsoft urges shareholders to vote against a proposal to assess Bitcoin as a diversification investment.

- A criminal investigation is looking into whether Tether is being used by third parties for illicit activities such as terrorism and hacking

- Denmark’s tax authority has recommended a “mark-to-market” taxation on crypto assets as part of its upcoming legislative proposal.

- Cryptocurrency exchange Coinbase has launched a new tool called “Based Agent,” claiming it allows crypto users to set up their own artificial intelligence agent with a crypto wallet in under three minutes.

Technicals & Macro

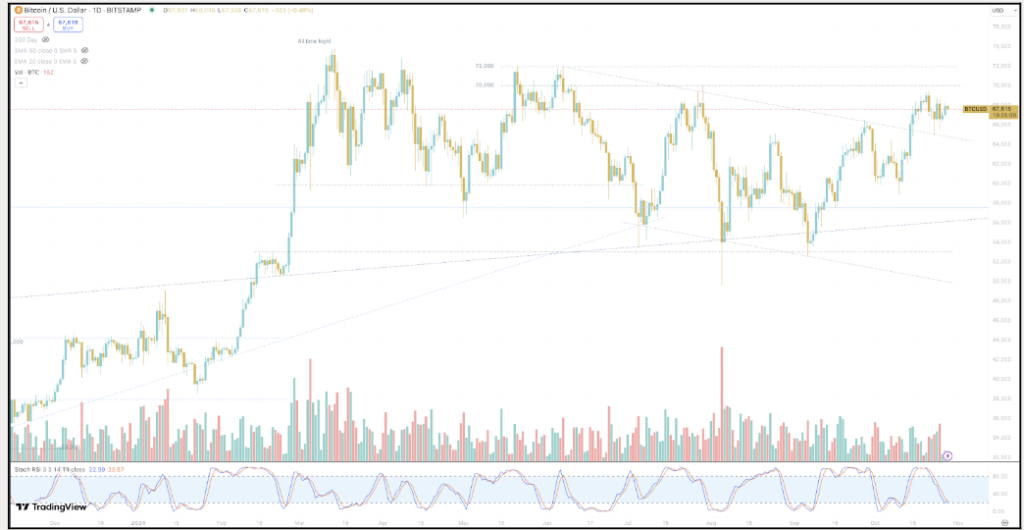

BTCUSD

Key levels

53,000 / 55,000 / 66,000 / 72,000 / 73,794 (ATH!)

With geopolitical pressure heating up, markets and the world had a wild girly wild week. Israel struck Iran as a show of force, but importantly, struck in a way that has left some room for negotiation. Israel targeted military sites across various regions, in retaliation for Iranian attacks, which included a barrage of ~200 ballistic missiles fired towards Israel on Oct 1. The VIX volatility index (fear gauge) is back above 20, but still fairly contained given the geopolitical upheaval in the middle-east.

BTCUSD began dumping on Wednesday as bond yields rose on interest rate expectations, and rumours began circulating that Israel was getting ready to fire, but rebounded quickly forming pinbars off the descending trendline from June. The USDT Tether probe by the DOJ also did not help, but what is most telling about BTCUSD’s structure right now is the velocity at which it is being bid on down moves. There are clearly real money buyers waiting in the sidelines, and we are still watching the 70K and 72K zone channel as being a precursor for momentum buyers to take us above all-time highs.

The US election could be the powder keg that lights the next move. At this stage it is neck and neck, and both represent very different worlds. One of more striking numbers is that of forecasted debt in the US – under a Harris administration, It’s expected to grow debt by $3.5T, whilst under Trump, $7.5T. This substantially shifts the bond yield dynamic – and under a Trump presidency, pours some gas on the long energy, banks, bitcoin trade.

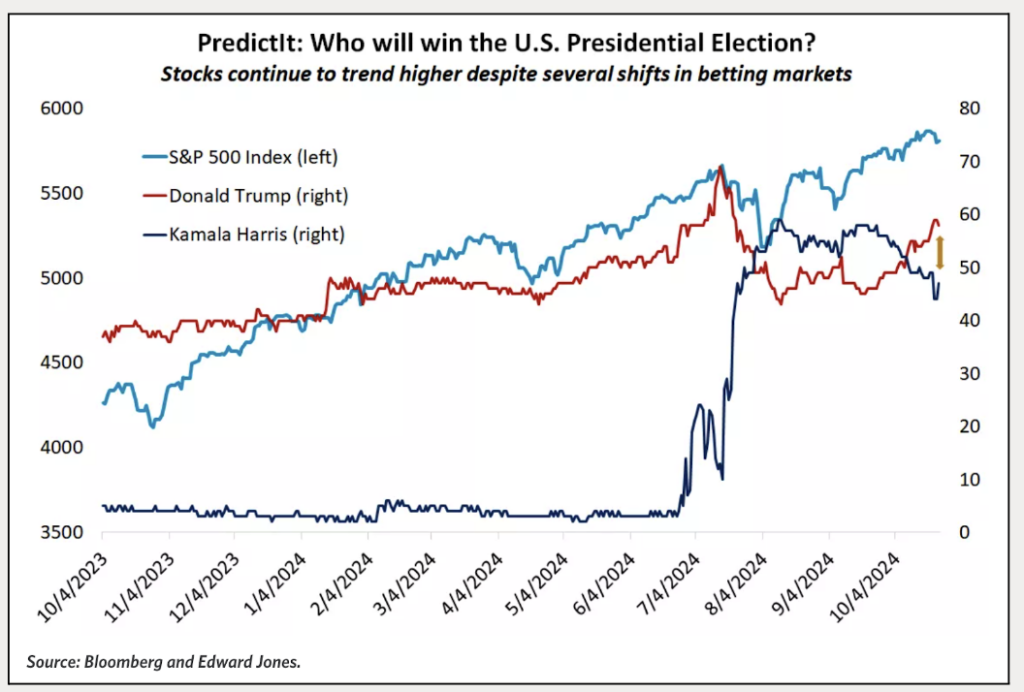

Stocks driving higher despite shifting betting odds on US election, however a Trump win looks to be the driving factor

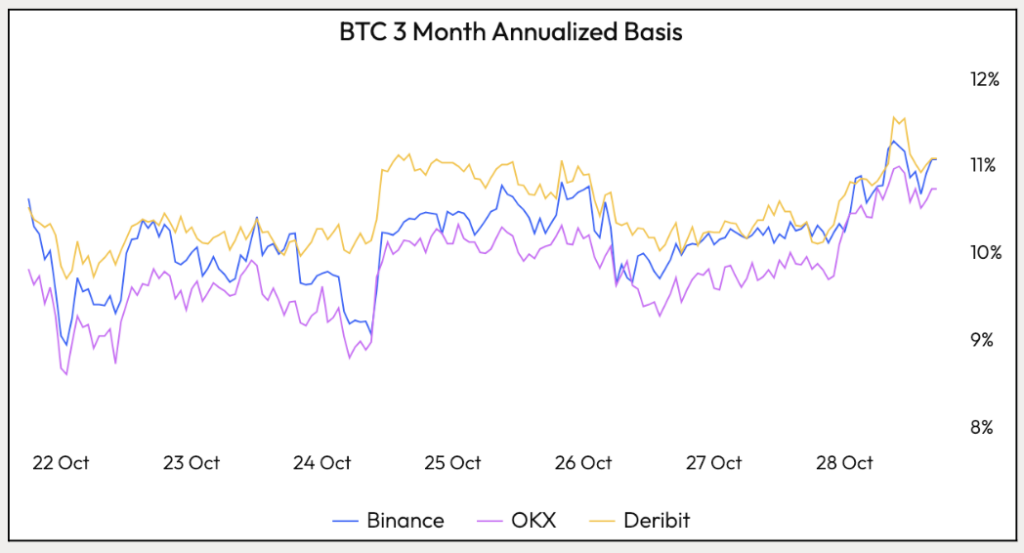

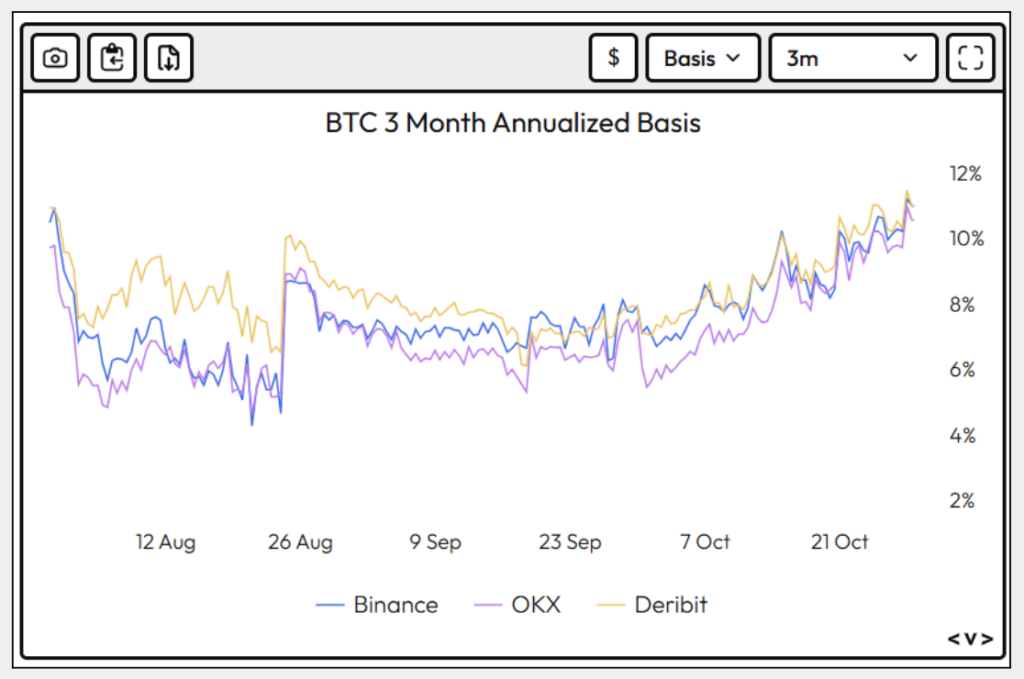

Basis looking stronger week on week

The futures basis curve continues to float higher, indicative of growing bullish sentiment and leverage.

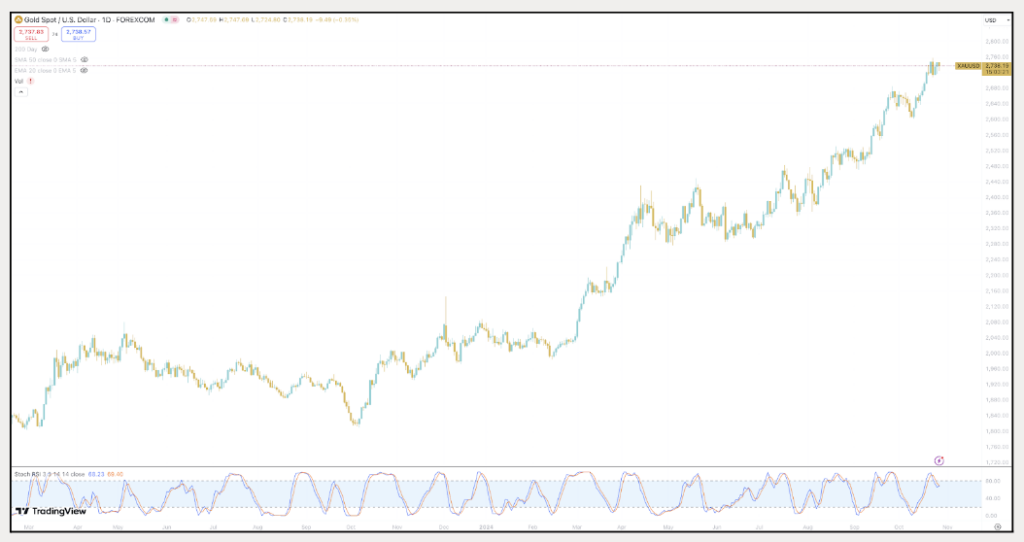

Gold still unstoppable

Source: TradingView

Gold holding a tight range looking for the next move. There’a a triple whammy here – rising geopolitical risk, repricing of bond yields and a general push to scarcity. We think Gold goes higher, and with it, the relative value trade with BTC – sitting at about a 13x gap right now.

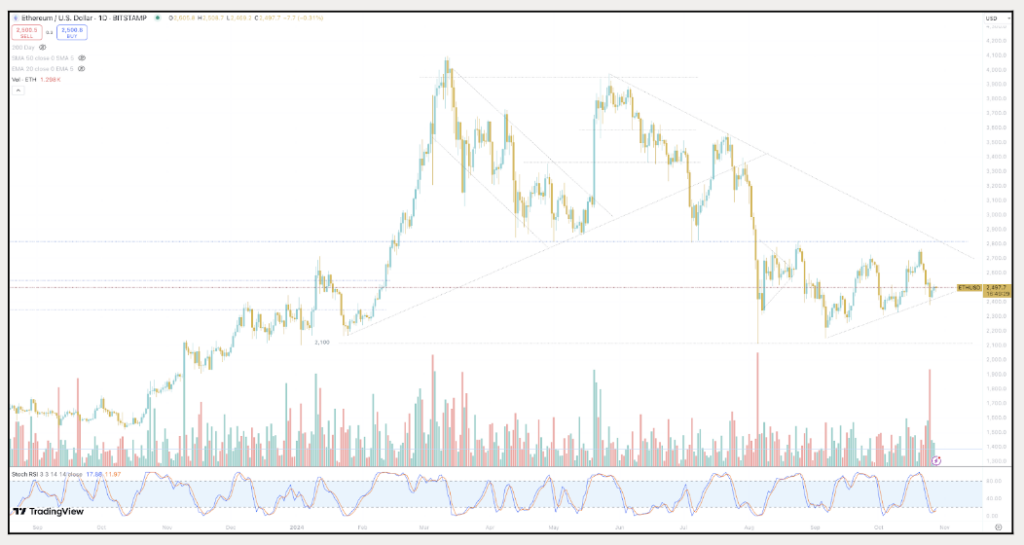

ETHUSD

Source: TradingView

Key levels

2,100 / 2,800 / 3,600 / 4,000

ETH had found its base, but has broken down against BTC, validating the ETHBTC proxy short

ETHBTC breaking down on risk shifts

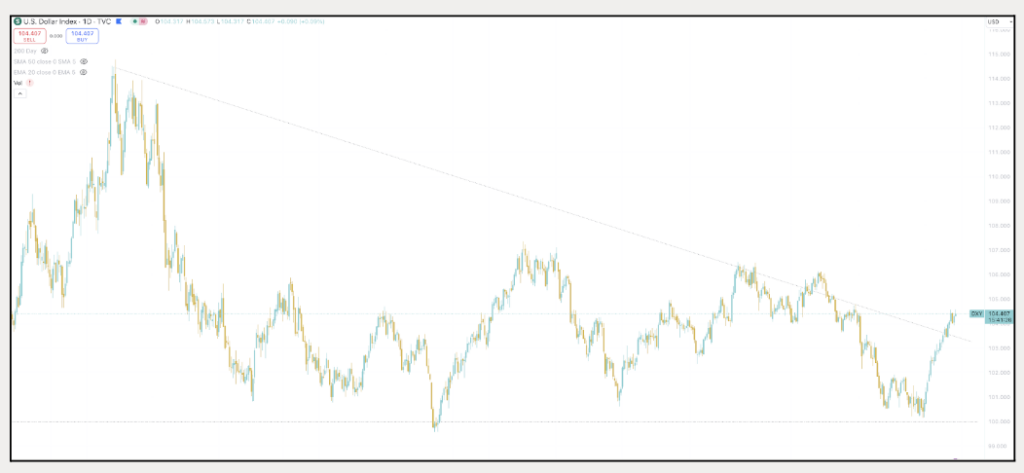

DXY rebound continuing on shifting yields and geo risk

Source: TradingView

Downside risks are still centred around wild stuff prior to the election, such as assassination attempts, or the crisis in the middle-east growing and spilling further into US political dialogue. The USD trade is a fairly safe haven on this, and we expect more strength until after the US election.

Jon de Wet, CIO

Spot Desk

The Australian dollar continued to decline for the fourth consecutive week against USD, driven by strong USD demand amongst geopolitical tensions, marking a 4.8% drop from local highs. Further, the Australian monthly CPI indicator on Wednesday is forecasted to drop from 2.7% to 2.4%. Market participants will also be on the lookout for any surprises surrounding the US non farm payrolls and unemployment rate on Friday 11:30pm AEDT.

As AUD continued to slide against USD, the desk was heavily skewed towards off-ramping, as clients saw value in bidding on AUD during the sell-off. Major cryptocurrencies—Bitcoin, Ether, and Solana persist to be bid up by clients, following last week’s trend, as market sentiment remains positive.

Altcoin activity is ramping up in anticipation of a broader crypto market rally leading up to the US election as Trump takes a commanding lead (66%) on PolyMarkets. We saw clients bidding on Layer 1s such as SUI, FTM, and STX. Additionally we saw an increased demand for smaller caps, which seems to be building each week among positive market sentiment. Notable alts clients were buying were RON, GOG, FET, IMX, CELO, AR and TAO.

The desk announced our support for a variety of memecoin assets for both custody and OTC trading, and as such we saw clients coming through for quotes on SHIB, GOAT and DOGE. Feel free to hit us up with any queries surrounding this!

The spot desk is well-positioned to offer attractive rates for major currencies, altcoins, memecoins and stablecoin pairs against major fiat currencies, with T+0 settlement available.

Oliver Davis, Trading Analyst

Derivatives Desk

WHOLESALE INVESTORS ONLY

Basis rates on BTC and ETH continue to edge higher:

- BTC’s 90-day annualised basis rate is up 30 bps to (11.1%).

- ETH’s is up 80 bps (9.7%).

Source: VeloData

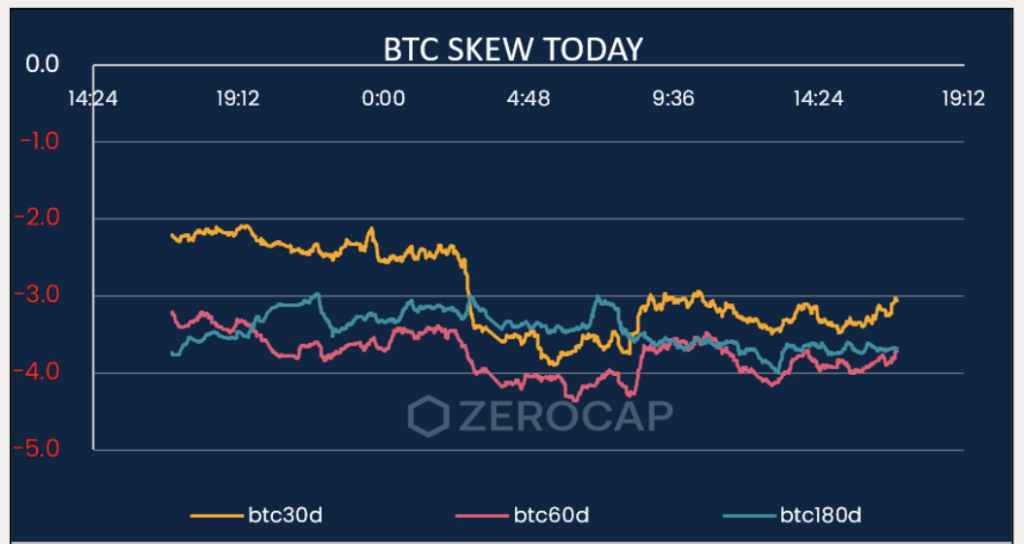

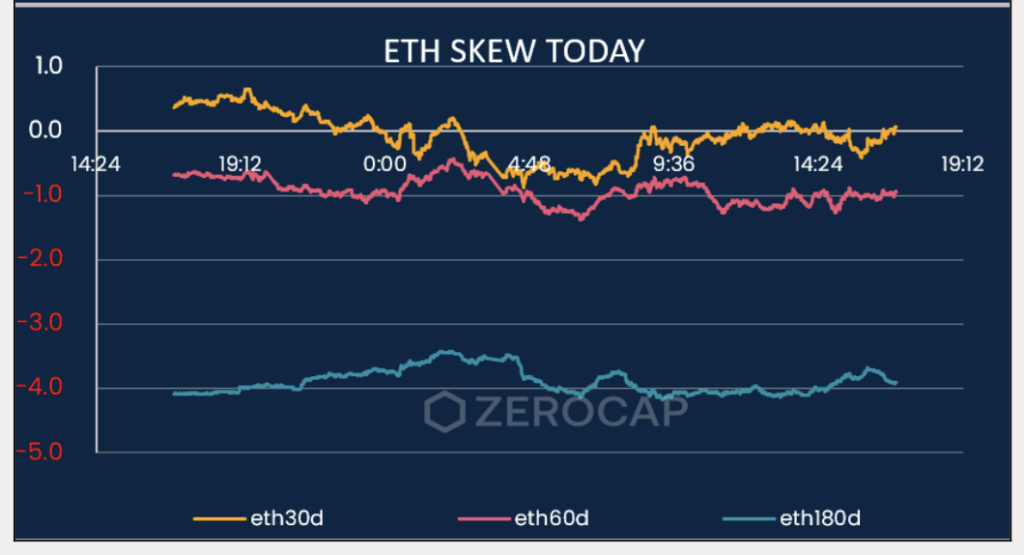

In the short term, BTC options exhibit a skew towards calls by 3-4 vol points, indicating a market preference for BTC upside volatility. Conversely, the short-term skew in ETH options remains more neutral, reflecting less emphasis on ETH’s directional volatility in the lead up to the election.

Trade ideas for the election next week:

- Trump Victory: Investors anticipating a Trump win might consider call spreads expiring later in the year – as it is widely accepted that a Trump victory could lead to further upside volatility in crypto markets.

- Harris Victory: Betting markets appear to be overpricing a Harris victory compared to the polls, with Polymarket assigning only a 34% chance of her winning. This could present a trading opportunity for those who see value in that discrepancy.

- Uncertainty About the Outcome: Those uncertain about the result might consider delta-neutral structures. For example, the basis trade is currently elevated, offering returns of around 11% p.a. on 90-day contracts.

Berkeley Cox, Derivatives Analyst

What to Watch

- This week, the United States will release:

- the preliminary value of the Q3 real GDP annualised quarterly rate;

- the preliminary value of the Q3 core PCE price index annualised quarterly rate, the September core PCE price index annual rate;

- and the most important data – the October unemployment rate and October seasonally adjusted nonfarm employment population.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post