19 Dec, 23

The Ledger Hack: What Happened?

The December 2023 Ledger hack is a significant event in the cryptocurrency world, highlighting the vulnerabilities in digital asset security. This article delves into the incident, examining its origins, impact, response, and broader implications for the crypto industry.

In December 2023, Ledger, a renowned crypto hardware wallet manufacturer, experienced a significant security breach. This hack not only raised concerns over the safety of digital assets but also sparked debates about the security practices of companies within the crypto space.

The Origin of the Hack

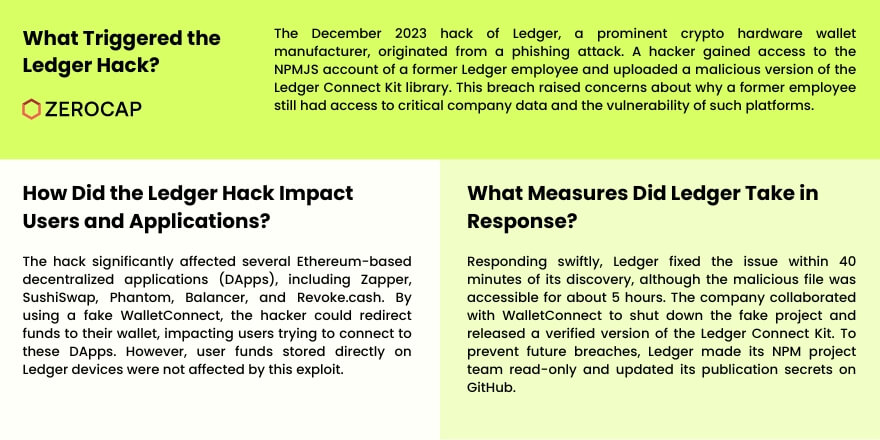

The breach originated when a hacker accessed the NPMJS account of a former Ledger employee through a phishing attack. NPMJS is a platform for hosting code packages for developers. The crypto community raised concerns over why a former employee retained access to such critical company data. After gaining access, the hacker uploaded a malicious version of the Ledger Connect Kit library, a tool allowing hardware wallets to connect to web browsers and other platforms.

Impact on Decentralized Applications

The hack impacted multiple Ethereum-based decentralized applications (DApps), including Zapper, SushiSwap, Phantom, Balancer, and Revoke.cash. The malicious code employed a fake WalletConnect to redirect funds to the hacker’s wallet, affecting any user attempting to connect to these DApps. Notably, the exploit did not impact user funds stored directly on Ledger devices.

Ledger’s Response and Remedial Actions

Ledger responded by fixing the issue within 40 minutes of discovery, confirming that the malicious file was available for about 5 hours. The company worked with WalletConnect to shut down the fake project and released a verified version of the Ledger Connect Kit. To enhance future security, Ledger made the connect-kit development team for the NPM project read-only and updated secrets for publication on Ledger’s GitHub repository.

Community Reaction and Criticism

The crypto community’s reaction was mixed, with some advising the use of other wallet platforms and others calling for Ledger to open-source its code for greater transparency. The incident brought to light Ledger’s past security issues, with some community members expressing scepticism about the company’s commitment to operational security.

Broader Implications for Crypto Security

The Ledger hack underscores the ongoing challenges in securing digital assets, especially in the decentralized finance (DeFi) sector. It highlights the importance of robust security measures, regular audits, and the need for heightened user awareness in the crypto ecosystem.

Conclusion

The December 2023 Ledger hack serves as a stark reminder of the vulnerabilities in the crypto space. While Ledger took swift action to mitigate the breach’s impact, the incident raises critical questions about security practices and user trust in digital asset management companies.

FAQs

1. What exactly was compromised in the Ledger hack? The hack involved a phishing attack to access a former employee’s NPMJS account, leading to the uploading of a malicious version of the Ledger Connect Kit library.

2. Which applications were affected by the Ledger hack? Several Ethereum-based DApps were affected, including Zapper, SushiSwap, Phantom, Balancer, and Revoke.cash.

3. Were funds stored on Ledger devices affected by the hack? No, the hack did not impact user funds stored directly on Ledger devices.

4. How did Ledger respond to the hack? Ledger fixed the issue within 40 minutes, released a verified version of the Ledger Connect Kit, and enhanced security protocols for future protection.

5. What does the Ledger hack indicate about crypto security? The hack highlights the ongoing security challenges in the crypto space, emphasizing the need for robust security measures and user vigilance.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post