17 Nov, 23

The Frameworks of Crypto Lending

In the evolving landscape of digital finance, crypto lending has emerged as a significant trend, reshaping how investors and consumers interact with cryptocurrencies. This mechanism offers an innovative approach for cryptocurrency holders to unlock the value of their assets without selling them. In this article, we’ll delve into the core frameworks of crypto lending, exploring its mechanics, benefits, risks, and the future outlook of this fascinating financial tool.

Understanding Crypto Lending

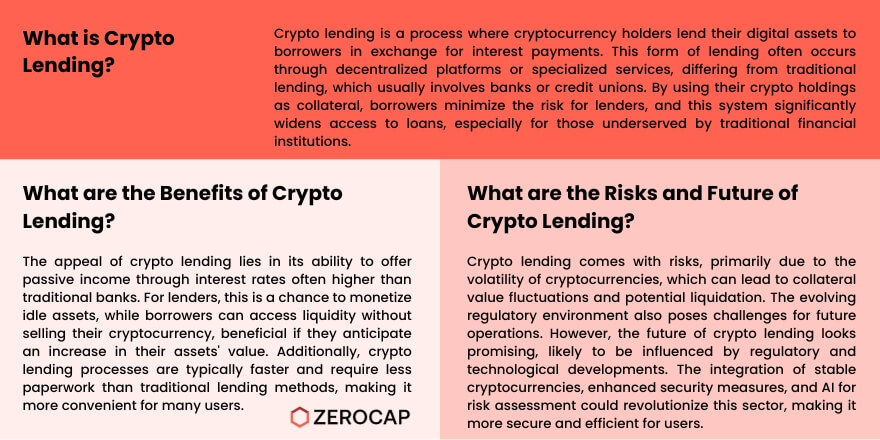

Crypto lending refers to the process where cryptocurrency holders lend their assets to borrowers in exchange for interest payments. Unlike traditional lending, which relies on banks or credit unions, crypto lending typically happens through decentralized platforms or specialized lending services. Borrowers often use their crypto holdings as collateral to secure loans, which minimizes the risk for lenders. This system has democratized access to loans, especially for those who might be underserved by traditional financial institutions.

The Benefits of Crypto Lending

One of the most compelling advantages of crypto lending is the ability to earn passive income through interest rates often higher than those offered by traditional banks. For lenders, it’s an opportunity to monetize idle assets. Borrowers, on the other hand, can access liquidity without having to sell their cryptocurrency, which could be advantageous if they expect their assets to appreciate in value. Furthermore, the process is typically quicker and requires less paperwork than traditional lending, making it a convenient option for many.

Risks and Challenges

Despite its benefits, crypto lending is not without risks. The volatility of cryptocurrencies means the value of collateral can fluctuate wildly, which could lead to liquidation if the value falls below a certain threshold. Moreover, the regulatory environment surrounding crypto lending is still evolving, which could pose future challenges or changes in how these services operate. Additionally, the security of lending platforms is paramount, as they are attractive targets for hackers.

The Future of Crypto Lending

Looking ahead, the future of crypto lending appears promising but is likely to be shaped by regulatory developments and technological advancements. The integration of more stable cryptocurrencies and the adoption of robust security measures could address some of the current challenges. Additionally, the incorporation of AI and machine learning for risk assessment could further revolutionize this domain, making it more secure and efficient for users.

Conclusion

Crypto lending is a dynamic and innovative segment of the cryptocurrency market that offers unique opportunities and challenges. It presents an alternative investment strategy for crypto holders and a new avenue for borrowers to access funds. As the market matures and regulatory frameworks become more defined, crypto lending could play an increasingly significant role in the broader financial ecosystem.

FAQs

Q1: What is crypto lending? A1: Crypto lending is the practice of lending cryptocurrency assets to borrowers in exchange for interest payments, often conducted through decentralized platforms or specialized services.

Q2: What are the benefits of crypto lending? A2: The benefits include the potential for high interest earnings, liquidity access for borrowers without selling assets, faster and more convenient loan processes, and financial inclusivity.

Q3: What risks are associated with crypto lending? A3: Key risks include the volatility of cryptocurrency values, potential regulatory changes, and security risks associated with lending platforms.

Q4: How does crypto lending differ from traditional lending? A4: Crypto lending typically requires less paperwork, offers faster processing, and uses cryptocurrency as collateral instead of traditional assets. It also operates largely outside of traditional banking systems.

Q5: What is the future outlook for crypto lending? A5: The future of crypto lending looks promising but will be influenced by regulatory developments, technological advancements, and the stabilization of the cryptocurrency market.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post