15 Nov, 23

The Importance of Volatility Management for a Portfolio

In the world of finance, volatility represents the degree of variation in the price of an asset over time. For investors and portfolio managers, understanding and managing this volatility is crucial. Volatility management is not about eliminating risk but rather about understanding and controlling it to achieve the desired balance between risk and return in a financial portfolio. This article delves into the importance of volatility management and its impact on investment strategies.

Defining Volatility in Financial Terms

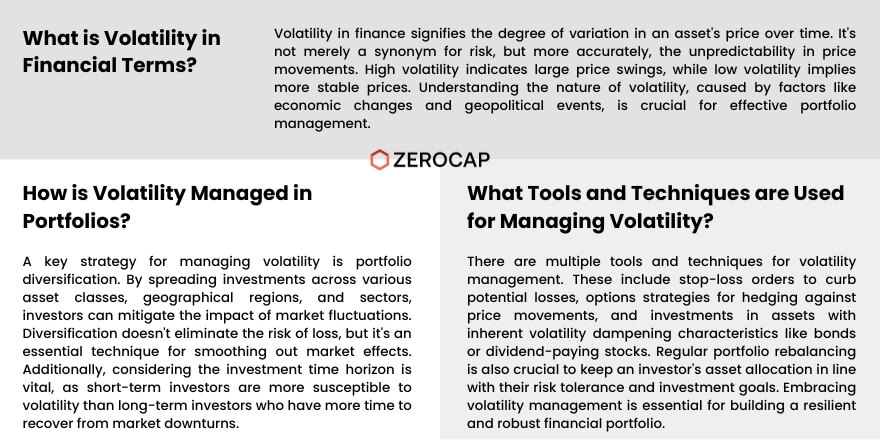

Volatility is often perceived as a synonym for risk, but it is more accurately described as the unpredictability in the price movements of an asset. High volatility indicates large price swings, while low volatility implies more stable prices. This variability can be caused by several factors, including economic changes, geopolitical events, and market sentiment. Understanding the nature of volatility is the first step in managing it effectively within a portfolio.

The Role of Volatility in Portfolio Diversification

One of the fundamental strategies in volatility management is portfolio diversification. By spreading investments across various asset classes, geographical regions, and sectors, investors can reduce the impact of volatility on their overall portfolio. Diversification does not guarantee against loss, but it is a critical technique for managing risk and smoothing out the effects of market fluctuations.

Volatility Management and Investment Time Horizon

The investment time horizon plays a significant role in how volatility affects a portfolio. Short-term investors may be more concerned with volatility, as they have less time to recover from market downturns. In contrast, long-term investors can often ride out periods of high volatility, as they have more time to wait for the market to recover. Understanding one’s investment time horizon is vital for effective volatility management.

Tools and Techniques for Volatility Management

There are several tools and techniques that investors can use for volatility management. These include using stop-loss orders to limit potential losses, employing options strategies to hedge against price movements, and investing in assets with inherent volatility dampening characteristics, like bonds or dividend-paying stocks. Additionally, regular portfolio rebalancing ensures that an investor’s asset allocation remains aligned with their risk tolerance and investment goals.

Conclusion: Embracing Volatility Management for Portfolio Success

Volatility management is an essential aspect of building and maintaining a successful financial portfolio. By understanding and implementing strategies to manage volatility, investors can better position themselves to achieve their investment objectives while mitigating undue risk. Embracing volatility as a part of the investment process can lead to more informed decision-making and ultimately, a more resilient and robust portfolio.

FAQs

- What is volatility management in finance?

- Volatility management in finance refers to the process of understanding, measuring, and controlling the variability in the price of assets in a portfolio to achieve an optimal balance between risk and return.

- Why is volatility important in investment decision-making?

- Volatility is important in investment decision-making because it impacts the risk level of a portfolio. Understanding volatility helps investors make informed choices about asset allocation and risk volatility management.

- How does diversification help in managing volatility?

- Diversification helps in managing volatility by spreading investments across different asset classes, sectors, and geographical regions, reducing the impact of market fluctuations on the overall portfolio.

- Can volatility be completely eliminated in a portfolio?

- No, volatility cannot be completely eliminated as it is an inherent part of financial markets. However, it can be managed and mitigated through various strategies such as diversification, hedging, and appropriate asset allocation.

- Is high volatility always bad for investors?

- High volatility is not always bad for investors; it can present opportunities for buying assets at lower prices. However, it does increase the risk and requires careful management, particularly for short-term investors.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap selects Pier Two to offer institutional staking yields

Institutional clients gain secure, non-custodial access to native crypto yields with top-tier infrastructure Leading digital asset firm Zerocap has selected global institutional staking provider Pier

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post