Content

26 Oct, 23

The Importance of Global Banking Rails

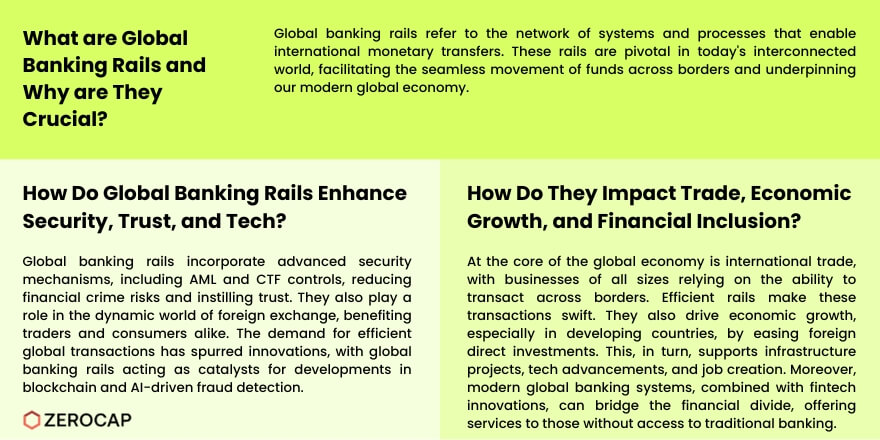

In today’s interconnected world, the significance of global banking rails – or the network of systems and processes that facilitate international monetary transfers – cannot be understated. These rails allow for the seamless movement of funds across borders, making our modern global economy possible. This article delves into the importance of global banking rails, highlighting the multiple facets of its impact.

- Facilitation of Global Trade: At the heart of the world economy lies international trade. Businesses, from small entrepreneurs to multinational corporations, rely on the ability to send and receive payments across borders. Without the support of efficient global banking rails, these transactions would be cumbersome, slow, and fraught with risk.

- Economic Growth and Development: By enabling cross-border trade and investments, global banking rails contribute to economic growth. Developing countries, in particular, benefit from the influx of foreign direct investments which are made easier through these rails, thereby facilitating infrastructure projects, technological advancements, and job creation.

- Support for Migrants and Their Families: Remittances, which are funds sent by migrants to their home countries, play a crucial role in the economies of many nations. Reliable global banking rails ensure that these funds reach their intended recipients promptly and securely, providing vital support to families and communities.

- Risk Management and Security: Efficient banking rails incorporate sophisticated security mechanisms, such as anti-money laundering (AML) and counter-terrorist financing (CTF) controls. These systems reduce the risk of financial crimes, providing trust and assurance to users.

- Currency Exchange and Arbitrage: The dynamic world of foreign exchange is underpinned by global banking rails. Traders, businesses, and everyday consumers benefit from the fluidity of currency exchange, which is made possible through the efficiency and speed of these networks.

- Fostering Financial Inclusion: Modern global banking systems can help bridge the gap for those who lack access to traditional banking services. Digital platforms and fintech innovations, often reliant on robust banking rails, provide financial services to previously underserved populations.

- Enhancing Competitive Dynamics: The presence of a streamlined international banking infrastructure levels the playing field, allowing even smaller banks and financial institutions to compete in the global market. This ensures that consumers and businesses have a broader range of choices and encourages innovation in the sector.

- Supporting Geopolitical Stability: By fostering economic interdependence between nations, global banking rails can contribute to geopolitical stability. When nations are economically linked, they have a vested interest in each other’s well-being and are more inclined towards cooperation rather than conflict.

- Driving Technological Advancements: The demand for faster, more secure, and more efficient global transactions has spurred innovations in the financial technology sector. From blockchain to AI-driven fraud detection, global banking rails have been the catalyst for many cutting-edge technological solutions.

In conclusion, global banking rails are the unsung heroes of our modern economy. Their importance stretches beyond mere financial transactions; they are integral to global trade, economic growth, and the broader socio-economic fabric of our interconnected world. As the pace of globalisation accelerates, it is crucial to continue investing in and refining these systems to ensure they meet the evolving demands of our global society.

FAQs

- What are global banking rails?

- Global banking rails refer to the network of systems and processes that facilitate international monetary transfers, enabling the seamless movement of funds across borders and underpinning our modern global economy.

- How do global banking rails support global trade?

- Global banking rails play a pivotal role in facilitating international trade by allowing businesses, ranging from small entrepreneurs to multinational corporations, to send and receive payments across borders efficiently and securely.

- Why are global banking rails crucial for economic growth and development?

- By enabling cross-border trade and investments, global banking rails contribute to economic growth. They are especially beneficial for developing countries, which can attract foreign direct investments more easily, facilitating infrastructure projects, technological advancements, and job creation.

- How do global banking rails enhance financial security?

- Efficient global banking rails incorporate advanced security mechanisms, such as anti-money laundering (AML) and counter-terrorist financing (CTF) controls. These systems help reduce the risk of financial crimes, providing trust and assurance to users.

- In what ways do global banking rails foster financial inclusion?

- Modern global banking systems, supported by robust banking rails, can bridge the gap for individuals who lack access to traditional banking services. Digital platforms and fintech innovations often rely on these rails to provide financial services to previously underserved populations.

- How do global banking rails impact currency exchange and arbitrage?

- The dynamic world of foreign exchange is underpinned by global banking rails. Their efficiency and speed ensure fluidity in currency exchange, benefiting traders, businesses, and everyday consumers.

- Why are global banking rails vital for geopolitical stability?

- By fostering economic interdependence between nations, global banking rails can contribute to geopolitical stability. Economically linked nations have a vested interest in each other’s well-being, leading to increased cooperation and reduced conflict.

- How do global banking rails drive technological advancements in the financial sector?

- The demand for faster, more secure global transactions has led to innovations in financial technology. Global banking rails have acted as catalysts for cutting-edge technological solutions, including blockchain and AI-driven fraud detection.

- How do global banking rails support migrants and their families?

- Remittances, funds sent by migrants to their home countries, play a vital role in many economies. Reliable global banking rails ensure that these funds reach their intended recipients promptly and securely.

- How do global banking rails level the competitive dynamics in the financial sector?

- The presence of a streamlined international banking infrastructure allows even smaller banks and financial institutions to compete on a global scale. This ensures that consumers and businesses have a broader range of choices and fosters innovation in the sector.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post