Content

- Week in Review

- Winners & Losers

- Market Highlights

- What to Watch

- Research Lab

- FAQs

- What are the proposed crypto regulations by the US Treasury and IRS?

- How is the London Stock Exchange integrating blockchain technology?

- What recent developments have occurred with Coinbase's BASE blockchain and its services?

- How is Visa enhancing its stablecoin settlement capabilities?

- What significant event occurred with Ethereum co-founder Vitalik Buterin's social media?

- DISCLAIMER

11 Sep, 23

Weekly Crypto Market Wrap, 11th September 2023

- Week in Review

- Winners & Losers

- Market Highlights

- What to Watch

- Research Lab

- FAQs

- What are the proposed crypto regulations by the US Treasury and IRS?

- How is the London Stock Exchange integrating blockchain technology?

- What recent developments have occurred with Coinbase's BASE blockchain and its services?

- How is Visa enhancing its stablecoin settlement capabilities?

- What significant event occurred with Ethereum co-founder Vitalik Buterin's social media?

- DISCLAIMER

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

Week in Review

- US Treasury and IRS propose crypto regulations for brokers, referred to as “digital asset middlemen”.

- IMF and FSB release joint crypto policy recommendations per G20 request.

- London Stock Exchange to create a traditional assets trading platform on blockchain.

- Visa expands stablecoin settlement capabilities with Circle’s USDC stablecoin and utilising Solana blockchain.

- Coinbase’s BASE blockchain faces its first outage since launch on 9th August – launches lending platform for US institutions.

- Coinbase signals EU, Canada, Brazil, Singapore and Australia as next countries where it seeks to focus operations.

- Australia Senate Committee rejects crypto bill from opposition senator Andrew Bragg – Bragg states it exposes Australians to unregulated markets.

- Roughly a quarter of US and Europe-based asset management firms assign senior execs to digital assets; Amberdata report.

- Turkish crypto exchange Thodex’s CEO gets 11,196 year prison sentence for running a $2 billion scam.

- Ethereum co-founder Vitalik Buterin’s X account hacked, followers scammed.

- Apple secures rights to publish book on Sam Bankman-Fried, out in October.

- US jobless claims hit lowest level since February.

- Bank of Canada maintains policy rate, continues quantitative tightening.

- Australian economy grows modestly in Q2, eases recession fears.

Winners & Losers

Data source: TradingView

Market Highlights

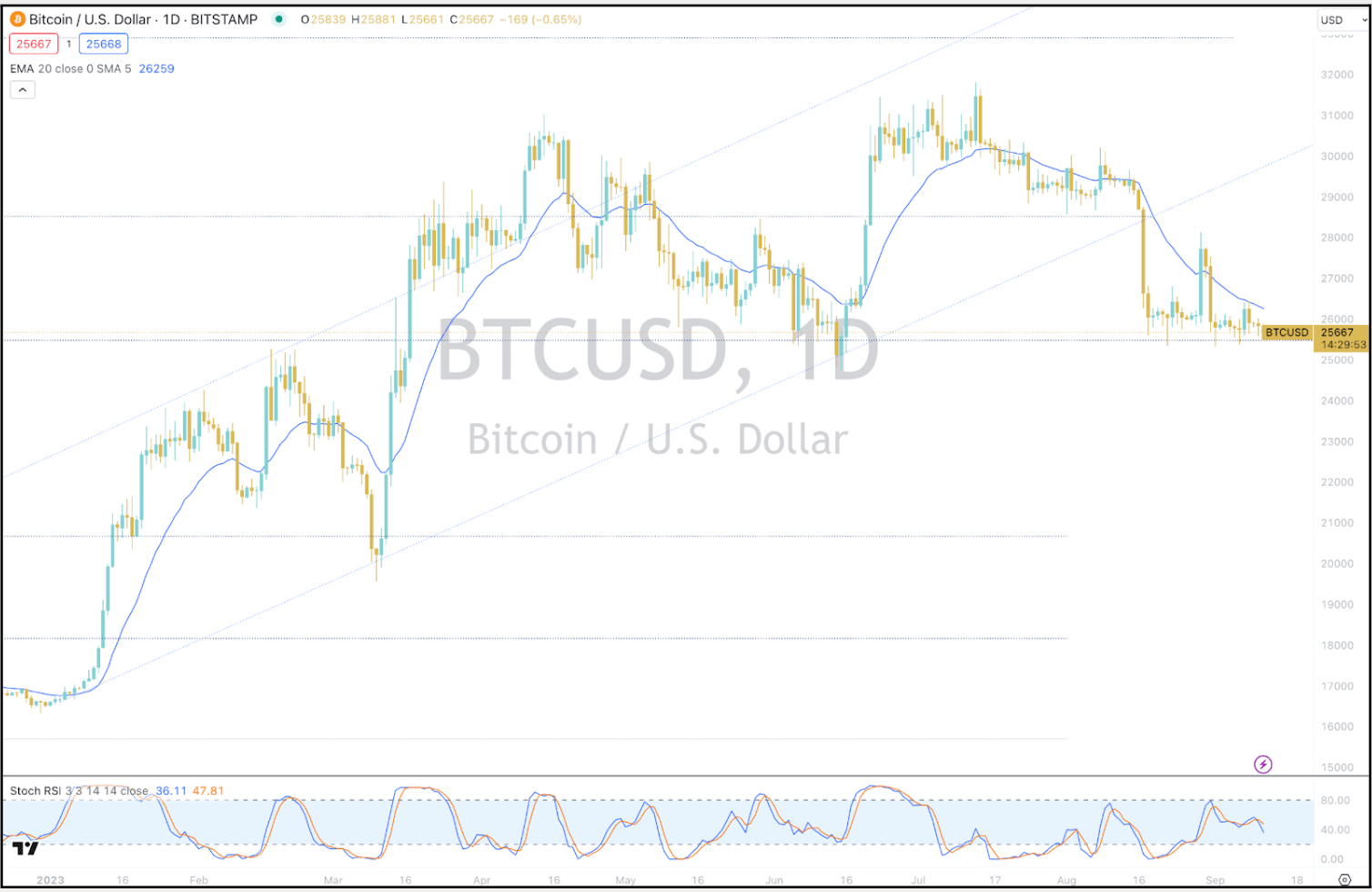

- BTC and ETH hold support levels, with recent weeks seeing flat to negative pricing as traders grapple with indecision. This uncertainty stems from the ongoing delay in a spot Bitcoin ETF and the impending Federal Reserve interest rate decision. Last week, the US ISM’s August PMI report pleasantly surprised, with the services PMI exceeding expectations, rising to 54.5 from the previous month’s 52.7. However, subsequent developments, such as slowing job growth in the US and a sluggish Chinese economy, are showing a 93% chance of a hold at the September meeting.

- On September 7, the bulls encountered resistance at the 20-day EMA, a level likely to hold in the short term. Notably, the bears made no substantial attempt to breach the 24,800 support level, underscoring the ongoing absence of significant selling interest below 25,000. A break above the 20-day EMA could signal strength, but a robust movement below the 24,800 support might initiate a downtrend towards the 24,000 support. This week, the release of CPI and PPI data from the U.S. will offer further insight into the Fed’s impending actions. Looking ahead to next week, the FOMC rate decision will be a pivotal event, despite market pricing with little change in expectations.

Data Source: TradingView

- In August, the total trading volume for both cryptocurrency spot and derivatives on centralised exchanges decreased to $2.09 trillion, representing the lowest monthly combined trading volume for the year. This decline, coupled with the ongoing delays in the spot BTC ETF, could potentially bring opportunities for a volatility puke at some point. If a BTC ETF is approved, it could stimulate increased institutional and retail participation, leading to sustained long-term volume growth, thereby enhancing the overall health of crypto markets.

Data Source: The Block

- During the latter part of the week, we observed intriguing activity on the $PERP protocol’s perpetual contracts on exchanges. On Binance, open interest shot up from $4m to $165m, moving in tandem with its price, which rose 200% in just 48 hours. A significant buildup of short interest pushed the contract to trade at a notable 2.48% lower from the spot price on Binance, translating to an annualised rate of 2700% just to hold the short position. As the short squeeze picked up steam, 24-hour trading volume for this pair climbed to third place, trailing only behind the ETH and BTC perpetual contracts on Binance. The price of $PERP has now halved since Friday, and we’re yet to see anything meaningful that may explain the trading behaviour.

Data Source: WorldCoinIndex

- Ethereum’s founder, Vitalik Buterin, suffered a Twitter hack that misled his vast following of 4.9 million users with a fraudulent link, falsely advertising the launch of commemorative non-fungible tokens (NFTs) by Consensys. Those who clicked on the link were prompted to connect their wallets to mint the supposed NFT, but this instead allowed the hacker to access and steal their funds. Though the post was removed, the hacker managed to siphon off $691,000 of stolen funds. The incident reignited concerns about social media security, especially considering two-factor authentication is only available to paid Twitter Blue users.

What to Watch

- UK unemployment claims (Claimant Count Change), on Tuesday.

- UK m/m GDP and US CPI, on Wednesday.

- EU monetary policy statement, ECB press conference and US Retail Sales, on Thursday.

- US Empire State manufacturing index and preliminary consumer sentiment, on Friday.

Research Lab

Crypto custody is at the forefront of blockchain discussions. From the intricacies of blockchain wallets to the innovation of Secure Multi-Party Computation, the landscape is vast and evolving. Dive into the Research Lab’s detailed examination of the subject, shedding light on key management, hot vs. cold wallets, and the future of digital asset safekeeping.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

FAQs

What are the proposed crypto regulations by the US Treasury and IRS?

The US Treasury and IRS have put forth regulations targeting “digital asset middlemen,” aiming to bring more clarity and oversight to the intermediaries in the crypto space.

How is the London Stock Exchange integrating blockchain technology?

The London Stock Exchange is developing a traditional assets trading platform using blockchain technology, signifying the growing acceptance and integration of blockchain in traditional finance.

What recent developments have occurred with Coinbase’s BASE blockchain and its services?

Coinbase’s BASE blockchain faced its first outage since its launch on 9th August. Additionally, Coinbase has launched a lending platform specifically for US institutions and is expanding its focus to several countries, including the EU, Canada, Brazil, Singapore, and Australia.

How is Visa enhancing its stablecoin settlement capabilities?

Visa is broadening its stablecoin settlement capabilities by integrating Circle’s USDC stablecoin and utilizing the Solana blockchain, showcasing its commitment to embracing digital assets.

What significant event occurred with Ethereum co-founder Vitalik Buterin’s social media?

Vitalik Buterin’s Twitter account was compromised, misleading his 4.9 million followers with a fraudulent link advertising the launch of commemorative non-fungible tokens (NFTs) by Consensys. The hack resulted in the theft of $691,000 from unsuspecting users.

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap selects Pier Two to offer institutional staking yields

Institutional clients gain secure, non-custodial access to native crypto yields with top-tier infrastructure Leading digital asset firm Zerocap has selected global institutional staking provider Pier

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post