Content

- Exchange Trading

- OTC Crypto Trading

- Benefits for Investors

- FAQs

- What is the primary difference between Exchange and OTC crypto trading?

- Which trading method offers more privacy?

- Is one method riskier than the other?

- Which method is more suitable for large volume trades?

- Do all cryptocurrencies support both trading methods?

- Conclusion

- About Zerocap

- DISCLAIMER

5 Sep, 23

Exchange vs. OTC Crypto Trading: Key Differences and Benefits for Investors

- Exchange Trading

- OTC Crypto Trading

- Benefits for Investors

- FAQs

- What is the primary difference between Exchange and OTC crypto trading?

- Which trading method offers more privacy?

- Is one method riskier than the other?

- Which method is more suitable for large volume trades?

- Do all cryptocurrencies support both trading methods?

- Conclusion

- About Zerocap

- DISCLAIMER

Cryptocurrency trading has seen a surge in popularity over the past few years, with investors exploring various avenues to maximize their returns. Two primary methods dominate the trading landscape: Exchange Trading and Over-the-Counter (OTC) Trading. Both have their unique features, advantages, and drawbacks. Let’s delve into the key differences between these two trading methods and understand their benefits for investors.

Exchange Trading

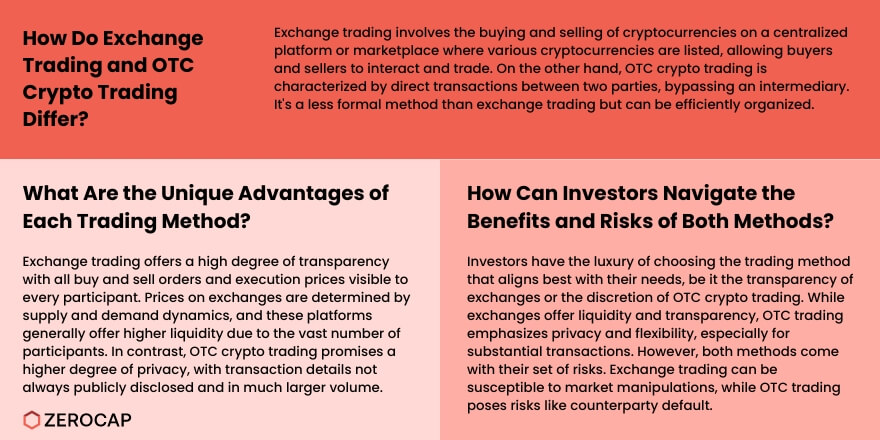

Definition: Exchange trading refers to the buying and selling of cryptocurrencies on a centralized platform or marketplace. These platforms list various cryptocurrencies, allowing buyers and sellers to interact and trade.

Transparency: Exchanges offer a high level of transparency. All buy and sell orders, as well as execution prices, are visible to every participant on the platform.

Price Determination: Prices on exchanges are determined by supply and demand dynamics. When two parties agree on a price, the transaction is executed, and the agreed-upon price is communicated throughout the market.

Electronic Evolution: Traditional trading floors are becoming obsolete as electronic trading gains prominence. Platforms like the London Stock Exchange and NASDAQ have transitioned to fully electronic systems.

Liquidity: Exchanges generally offer higher liquidity due to the vast number of participants and the volume of trades.

OTC Crypto Trading

Definition: OTC crypto trading involves direct transactions between two parties without the intervention of an intermediary. It’s less formal than exchange trading but can be well-organized.

Privacy: OTC crypto trading offers a higher degree of privacy. The prices at which transactions occur are not always publicly disclosed, ensuring confidentiality for both parties.

Price Determination: In OTC crypto trading, prices are negotiated directly between the buyer and the seller. This can lead to better price agreements, especially for large-volume trades.

Flexibility: OTC crypto trading offers more flexibility in terms of trading hours and transaction terms. It’s especially beneficial for large investors or institutions that require customized trading solutions.

Risks: OTC crypto trading can pose certain risks, such as counterparty default. However, thorough due diligence and the use of trusted intermediaries can mitigate these risks.

Benefits for Investors

- Choice: Investors can choose the trading method that best suits their needs, be it the transparency of exchanges or the privacy of OTC crypto trading.

- Flexibility: Both methods offer different levels of flexibility, allowing investors to tailor their trading strategies accordingly.

- Price Stability: OTC crypto trading can provide more stable prices for large transactions, preventing drastic market fluctuations.

- Diverse Opportunities: With both trading methods at their disposal, investors can diversify their portfolios and hedge against risks.

FAQs

What is the primary difference between Exchange and OTC crypto trading?

Exchange trading occurs on a centralized platform with visible buy and sell orders, while OTC crypto trading involves direct negotiations between two parties without an intermediary.

Which trading method offers more privacy?

OTC crypto trading offers more privacy as the transaction details, especially prices, are not always publicly disclosed.

Is one method riskier than the other?

Both methods have their risks. While exchange trading can be affected by market manipulations, OTC trading poses risks like counterparty default. However, with due diligence and proper precautions, these risks can be mitigated.

Which method is more suitable for large volume trades?

OTC crypto trading is generally preferred for large volume trades as it offers better price stability and prevents drastic market fluctuations.

Do all cryptocurrencies support both trading methods?

While major cryptocurrencies like Bitcoin and Ethereum are available for both trading methods, some lesser-known or newer cryptocurrencies might not be available on all platforms.

Conclusion

Both exchange and OTC crypto trading offer unique advantages to investors. While exchanges provide transparency and liquidity, OTC trading offers privacy and flexibility, especially for large transactions. Investors should evaluate their needs and understand the nuances of each method to make informed trading decisions. As the crypto landscape continues to evolve, staying informed and adaptable is key to successful trading.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post