Content

- OTC Crypto Trading Explained: Why It's the Choice for Large Transactions

- The Rise of OTC Crypto Trading

- Why OTC is the Choice for Big Players

- How OTC Crypto Trading Works

- Potential Risks and How to Mitigate Them

- The Future of OTC Crypto Trading

- FAQs

- Why is OTC crypto trading preferred for large transactions?

- How is the price determined in OTC trading?

- Is OTC trading safe?

- Do all cryptocurrencies support OTC trading?

- How does OTC trading differ from exchange trading?

- Can individual investors participate in crypto OTC trading?

- Conclusion

- About Zerocap

- DISCLAIMER

5 Sep, 23

OTC Crypto Trading Explained: Why It’s the Choice for Large Transactions

- OTC Crypto Trading Explained: Why It's the Choice for Large Transactions

- The Rise of OTC Crypto Trading

- Why OTC is the Choice for Big Players

- How OTC Crypto Trading Works

- Potential Risks and How to Mitigate Them

- The Future of OTC Crypto Trading

- FAQs

- Why is OTC crypto trading preferred for large transactions?

- How is the price determined in OTC trading?

- Is OTC trading safe?

- Do all cryptocurrencies support OTC trading?

- How does OTC trading differ from exchange trading?

- Can individual investors participate in crypto OTC trading?

- Conclusion

- About Zerocap

- DISCLAIMER

Over-the-counter (OTC) crypto trading has emerged as a game-changer in the world of cryptocurrency. But what is it, and why is it becoming the go-to choice for large transactions? In this comprehensive guide, we’ll break down the ins and outs of OTC crypto trading and shed light on its increasing significance in the crypto sphere.

OTC Crypto Trading Explained: Why It’s the Choice for Large Transactions

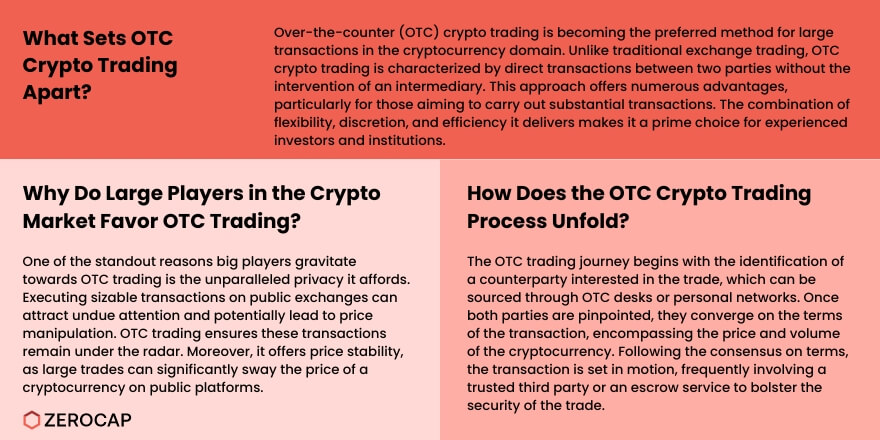

OTC crypto trading, unlike traditional exchange trading, involves direct transactions between two parties without the need for an intermediary. This method offers a plethora of benefits, especially for those looking to conduct large transactions. The flexibility, privacy, and efficiency it provides make it a top choice for seasoned investors and institutions.

The Rise of OTC Crypto Trading

- Historical Context: Before the advent of cryptocurrency exchanges, OTC trading was the norm. As crypto gained traction, the need for a more structured trading platform led to the rise of exchanges. However, with the increasing volume of large transactions, OTC trading has made a significant comeback.

- Benefits Over Traditional ExchangesOTC trading offers several advantages over traditional exchanges. These include better price stability, faster transactions, and enhanced privacy. For large investors, these benefits can translate to significant cost savings and efficiency.

Why OTC is the Choice for Big Players

- Privacy and AnonymityOne of the primary reasons big players opt for OTC trading is the privacy it offers. Large transactions on public exchanges can lead to unwanted attention and price manipulation. OTC trading ensures that these transactions remain confidential.

- Price StabilityLarge transactions can significantly impact the price of a cryptocurrency on public exchanges. OTC trading allows for price agreements that don’t cause drastic market fluctuations.

- Flexibility and CustomizationOTC desks often provide personalized services tailored to the needs of their clients. This includes flexible trading hours and customized transaction terms.

How OTC Crypto Trading Works

- Finding a CounterpartyThe first step in OTC trading is finding a counterparty interested in the trade. This can be done through OTC desks or personal networks.

- Agreeing on TermsOnce both parties are identified, they agree on the terms of the transaction, including the price and quantity of the cryptocurrency.

- Transaction ExecutionAfter agreeing on the terms, the transaction is executed. This often involves a trusted third party or an escrow service to ensure the security of the trade.

Potential Risks and How to Mitigate Them

- Counterparty RiskThe primary risk in OTC trading is the potential for one party to default on their obligations. To mitigate this, it’s essential to conduct thorough due diligence and use trusted intermediaries.

- Price Discrepancies: Without a centralized exchange, there might be discrepancies in the agreed-upon price. It’s crucial to stay informed about market prices and negotiate accordingly.

The Future of OTC Crypto Trading

As the cryptocurrency market matures, the demand for OTC trading is expected to grow. With institutional investors entering the scene and the increasing need for privacy and flexibility, OTC trading is poised to play a pivotal role in the future of cryptocurrency transactions.

FAQs

Why is OTC crypto trading preferred for large transactions?

OTC crypto trading offers privacy, price stability, and flexibility, making it ideal for large transactions that might otherwise impact market prices.

How is the price determined in OTC trading?

The price in OTC trading is negotiated between the two parties based on current market prices and the specifics of the transaction.

Is OTC trading safe?

While OTC trading offers many benefits, it’s essential to be aware of the risks, such as counterparty default. Conducting thorough due diligence and using trusted intermediaries can mitigate these risks.

Do all cryptocurrencies support OTC trading?

While OTC trading is common for major cryptocurrencies like Bitcoin and Ethereum, it might not be available for all cryptocurrencies, especially those with low market capitalization.

How does OTC trading differ from exchange trading?

OTC trading involves direct transactions between two parties without an intermediary, while exchange trading involves buying and selling on a public platform.

Can individual investors participate in crypto OTC trading?

Yes, individual investors can participate in OTC trading, but it’s more common among institutional investors and those looking to conduct large transactions.

Conclusion

OTC crypto trading offers a unique blend of benefits that cater to the needs of large investors and institutions. Its emphasis on privacy, price stability, and flexibility makes it a preferred choice for significant transactions. As the crypto market continues to evolve, OTC trading’s role is set to become even more prominent, shaping the future of cryptocurrency transactions.

About Zerocap

Zerocap provides digital asset liquidity and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

DISCLAIMER

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799. Material covering regulated financial products is issued to you on the basis that you qualify as a “Wholesale Investor” for the purposes of Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account the financial objectives or situation of an investor; nor a recommendation to deal. Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Zerocap selects Pier Two to offer institutional staking yields

Institutional clients gain secure, non-custodial access to native crypto yields with top-tier infrastructure Leading digital asset firm Zerocap has selected global institutional staking provider Pier

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post