Content

- What are Governance Tokens?

- The Effects of Political Commodification

- Example #1: Uniswap BNB Bridge: a16z vs Jump Crypto

- Example #2: The Curve Wars

- The Duality of Financial and Strategic Incentives

- The Effects of Regulatory Uncertainty on Governance Tokens

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What are Governance Tokens in the context of blockchain technology?

- How does the concept of Political Commodification impact Governance Tokens?

- What are some examples of how Governance Tokens have been used in practice?

- What are the effects of regulatory uncertainty on Governance Tokens?

- What is the potential future of Governance Tokens?

19 May, 23

Governance Tokens, Bribery, and the Effects of Political Commodification

- What are Governance Tokens?

- The Effects of Political Commodification

- Example #1: Uniswap BNB Bridge: a16z vs Jump Crypto

- Example #2: The Curve Wars

- The Duality of Financial and Strategic Incentives

- The Effects of Regulatory Uncertainty on Governance Tokens

- Conclusion

- About Zerocap

- DISCLAIMER

- FAQs

- What are Governance Tokens in the context of blockchain technology?

- How does the concept of Political Commodification impact Governance Tokens?

- What are some examples of how Governance Tokens have been used in practice?

- What are the effects of regulatory uncertainty on Governance Tokens?

- What is the potential future of Governance Tokens?

Blockchain protocols differentiate themselves from traditional web applications largely due to their ideals rooted in decentralisation and trustlessness. While traditional tech startups are managed by a small team of developers, introducing inherent centralisation and trust assumptions with regards to the maintenance of the infrastructure itself; governance tokens present themselves as an opportunity to decentralise decision-making within blockchain protocols and have gained significant prominence as a means for protocols to implement community-based decision-making. While the concept behind governance tokens aims to create a fairer and more equitable environment, the reality is that political commodification often favours those with more capital to stake. Parties with vested or competing interests such as venture capital firms or other blockchain projects have the most to gain through holding governance tokens by accessing the ability to sway governance proposals in their favour. For better or worse, bribery acts as a functional form of utility for these tokens, underpinning their fundamental value.

What are Governance Tokens?

Governance tokens are a type of digital asset that has a key role in commodifying the political power of decentralised protocols. The aim of governance tokens is to promote fair community-based decision-making through consensus and collective intelligence. This outcome is achieved through forum discussions, proposals and eventually token weighted voting. By implementing governance tokens, token project founders aim to decentralise the protocol, democratising decision-making by including the broader community and reducing the potential liability for the founding team. In theory, this should lead to a fairer and more equitable environment that engages and invests the community in the protocol’s success.

Governance tokens utility is to act as a medium of influence that fuels protocol changes and improvements, allowing members to buy their way into power within the protocol or obtain power within the protocol through community participation. These assets are generally issued through airdrops, token sales, and/or on the free market. The fair distribution between different stakeholders lies at the core of a fair and sustainable governance system and should ultimately encourage the use of the token as its intended utility as opposed to as a tool for speculation.

The Effects of Political Commodification

According to Chainalysis, DAO ownership is concentrated, indicating that the average token holder may not gain much actual utility from holding governance tokens, despite the ideological perspectives of the token project founders. This is because the very nature of political commodification favours those with more capital to stake, leaving those with less available capital, a limited ability to have a real impact on the future of the protocol. Criticisms have been made regarding governance tokens’ ability to create net positive value for the protocol communities they govern. Co-founder of Ethereum, Vitalik Buterin, has expressed concerns that governance tokens’ underlying concept is foundationally misaligned with decentralisation. Buterin argues that the cost of getting a chance to influence votes is too high for regular individuals, rendering it a good trade only for multimillionaires, hedge funds, and attackers. A Chainalysis report found that on average, only 1 in 10,000 governance token holders had enough tokens to create a proposal. Moreover, the report highlights that the number of token holders with enough tokens to pass a proposal was even more scarce, with only 1 in 30,000 holders meeting the threshold.

While Buterin’s quote highlights the high barrier to entry for regular market participants, his point validates a core form of value that is captured through governance. This form of value is captured through bribery from ultra-high net worth individuals with vested or competing interests. Similar to lobbying in traditional politics, governance tokens act almost like indices that measure the demand for bribery over decisions made regarding the future of decentralised protocols. The perpetual bidding for power over governance underpins the true value of governance tokens. In essence, the value of governance tokens stems from their ability to govern. Nevertheless, if a small group of individuals monopolise these tokens, they may not lose their monetary worth, but they will lose their value in the eyes of the community. The following examples provide historic cases of governance tokens have accrued or sustained value through bribery as a form of utility:

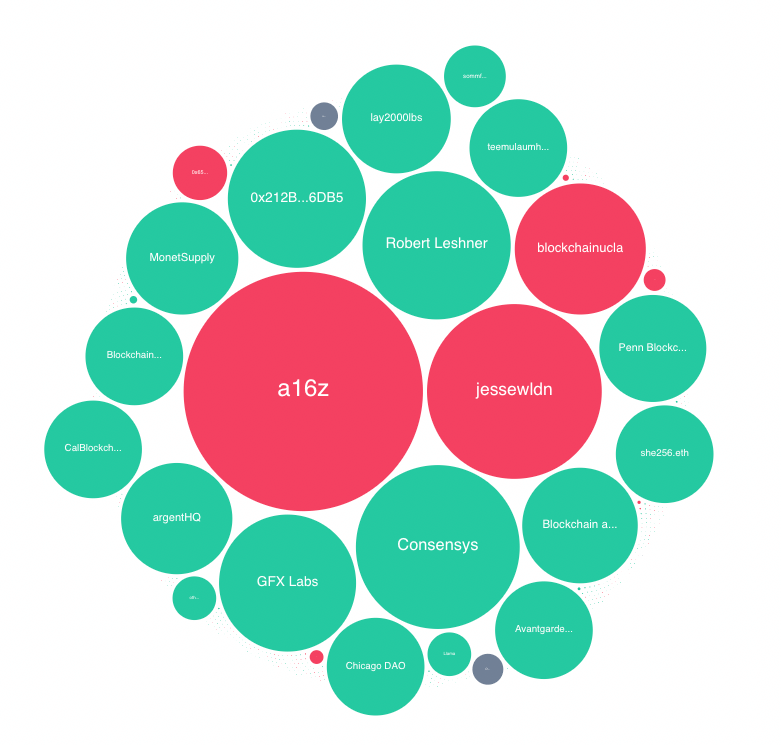

Example #1: Uniswap BNB Bridge: a16z vs Jump Crypto

On April 1st the Uniswap Foundations Business Source License for Uniswap V3 expired, allowing anyone to freely fork Uniswap V3 code with no legal consequences. In December 2022, the CEO and founder of 0xPlasma Labs set a proposal on the Uniswap governance forum that highlighted the need for Uniswap v3 to launch on the BNB Smart Chain (BNB). In order to launch on BNB Smart Chain, Uniswap needed a default inter-chain bridge that would allow users to deposit and withdraw assets from legacy chains to the BNB Smart Chain; this is where the governance battle began. The decision was to pick one of the four token bridges, Wormhole, LayerZero, Debridge and Celer to be the default bridge. The real battle was between Jump Crypto, and Andreessen Horowitz (a16z), both of whom were early investors in Uniswap and subsequently hold significant amounts of the UNI governance token. Jump Crypto is also a major investor in LayerZero, while a16z has vested interests in Wormhole, indicating their potential bias in their decision-making process for the token bridge proposal.

In the first community sentiment vote, a non-binding proposal was presented to the Uniswap community, and an overwhelming majority of voters, 80.28%, supported the use of Wormhole as a bridge, while 19.72% voted against it. However, a16z partner Eddie Lazzarin acknowledged that his a16z could not pledge its 15 million UNI tokens to the proposal due to technical issues with their custodial arrangement. In the official ballot, a16z was able to gain custody of their 15 million tokens and voted against the proposition to integrate Uniswap v3 over to the BNB Smart Chain. Regardless, the sizable vote did not sway consensus, with the vote leaning towards ‘For’; making Wormhole the chosen token bridge for BNB Smart Chain.

Source: Tally.xyz

It is demonstrated in these examples that there is a myriad of strategic benefits that come from owning UNI governance tokens. With that said, it is worth noting that even though the BNB-Chain bridge proposal was the second most active proposal in Uniswap governance history, the UNI tokens used to vote only counted for only 8.4% of the total circulating supply. Indicating that over 90% of the tokens held by the community are owned for speculative purposes rather than for their intended purpose as a governance utility.

Example #2: The Curve Wars

Curve Finance is a decentralised exchange (DEX) that specialises in providing low-slippage trading of stablecoins, mitigating the possibility of impermanent loss (provided that the stablecoins don’t de-peg), making it attractive for traders and liquidity providers. Curve Finance has its own native governance token, CRV. Users can lock their CRV in order to participate in governance as well as receive rewards and incentives. Upon staking CRV, token holders receive Vote Escrowed CRV tokens (veCRV), the more CRV staked, the more veCRV is received. 50% of all trading fees on the protocol are distributed to veCRV token holders; additionally, rewards for liquidity providers are amplified up to 2.5x depending on the amount of veCRV held. The purpose of these protocol functions is to align incentives between liquidity providers and governance participants.

The name ‘The Curve Wars’ refers to the idea that various parties with vested interests are competing against each other to bid on CRV and veCRV in order to gain power over the protocol for the benefit of control over the protocol’s liquidity. The outcome of these bidding wars between various parties feeds a consistent narrative of the underlying demand of CRV tokens. From a strategic perspective, the ability to sway a vote on CRV provides the opportunity to get a token project listed on the DEX as well as boost rewards for users staking in specific liquidity pools.

“First you get the money, then you get the CRV, then you get the power, then you get more money.” – anon

The Duality of Financial and Strategic Incentives

Although governance alone may seem to be a highly productive utility for an asset, publicly traded equities provide a similar comparison as they also generally include governance as a form of utility. The main difference is that company equity pays dividends to shareholders, or at least intends to do so when the company becomes sufficiently mature and profitable. This dual benefit of governance and direct financial incentives enables the market to determine the optimal outcome for both the company and investors. Shareholders can purchase company shares based on its historical revenue and calculate the potential future dividend based on market data, without having to rely on bribery to realise the value of their investment. Furthermore, entities seeking significant control over a company can do so by purchasing a large or majority stake at a fair market value, providing liquidity to smaller investors.

The use of alternative incentives offers the public a compelling reason to purchase and hold the asset, as opposed to pure governance tokens, which may only hold value for a select few individuals, while retail investors speculate on the asset’s price in the hopes of selling it to someone else for a higher price. Direct financial benefits help align incentives among protocol users, speculators, and governance participants, while also making it easier for the market to reach a consensus on the asset’s fair valuation by evaluating revenue multiples.

The Effects of Regulatory Uncertainty on Governance Tokens

Surprisingly, the act of issuing dividends to token holders opens token project founders up to the possibility of regulatory scrutiny. Most token founders are forced to find loopholes While some projects such as Curve Finance and GMX offer dividends to token holders, this comes at the price of significant regulatory risk to the founders. In order to combat this regulatory risk, the founders of GMX have chosen to stay anonymous. While this is somewhat of a fix, it is more of a short-term band-aid solution that enables token holders to realise non-speculative value from their investments at the detriment of the project’s founders. The real fix to this issue lies in the hands of regulatory bodies, such as the Securities and Exchange Commission (SEC), which hold the power over how these assets are treated from a regulatory point of view. In the recent SEC hearing, committee members showed their frustration with the lack of regulatory clarity provided by Chair Gary Gensler in his efforts to regulate the asset class. It is widely assumed that clear regulatory guidelines would enable token project founders to architect token incentives in a compliant manner, providing a more structured and mature environment for decentralised digital assets to exist.

Conclusion

Bribery is deeply ingrained in the utility of governance tokens. However, as shown in the examples of this report, the use of alternative incentives in conjunction with governance can help align incentives between protocol users and governance participants. Traditional assets such as public equities are encouraged to utilise this duality to allow for a more equitable environment as opposed to governance as a stand-alone utility. However, due to regulatory uncertainty in the crypto market, token founders are wary of offering dividend-like financial incentives for token holders for fear of being labelled as a security. As regulators work to protect investors from malicious activity, their efforts are often deemed counterproductive as the ambiguous status of crypto regulation in most cases forces token projects to limit the utility of their native asset. As the regulatory status of digital assets eventually matures, it is anticipated that token mechanics for governance tokens will adapt accordingly.

About Zerocap

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

All material in this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any digital asset. Investments in digital assets can be risky and you may lose your investment. Past performance is no indication of future performance.

FAQs

What are Governance Tokens in the context of blockchain technology?

Governance tokens are a type of digital asset that commodify the political power of decentralised protocols. They aim to promote fair community-based decision-making through consensus and collective intelligence. This is achieved through forum discussions, proposals, and eventually token-weighted voting. By implementing governance tokens, token project founders aim to decentralise the protocol, democratising decision-making by including the broader community and reducing the potential liability for the founding team.

How does the concept of Political Commodification impact Governance Tokens?

The nature of political commodification favours those with more capital to stake, leaving those with less available capital a limited ability to have a real impact on the future of the protocol. This can lead to a situation where governance tokens’ underlying concept is foundationally misaligned with decentralisation. The cost of getting a chance to influence votes can be too high for regular individuals, rendering it a good trade only for multimillionaires, hedge funds, and attackers.

What are some examples of how Governance Tokens have been used in practice?

Examples of governance tokens in action include the Uniswap BNB Bridge and The Curve Wars. In the Uniswap BNB Bridge case, major investors in Uniswap, Jump Crypto and Andreessen Horowitz (a16z), held significant amounts of the UNI governance token and used their influence to sway governance proposals in their favour. The Curve Wars refers to the bidding wars between various parties to gain power over the Curve Finance protocol for the benefit of control over the protocol’s liquidity.

What are the effects of regulatory uncertainty on Governance Tokens?

Regulatory uncertainty in the crypto market can make token founders wary of offering dividend-like financial incentives for token holders for fear of being labelled as a security. As regulators work to protect investors from malicious activity, their efforts are often deemed counterproductive as the ambiguous status of crypto regulation in most cases forces token projects to limit the utility of their native asset.

What is the potential future of Governance Tokens?

As the regulatory status of digital assets eventually matures, it is anticipated that token mechanics for governance tokens will adapt accordingly. Clear regulatory guidelines would enable token project founders to architect token incentives in a compliant manner, providing a more structured and mature environment for decentralised digital assets to exist.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post