Content

- Week in Review

- Winners & Losers

- Market Highlights

- Bitcoin’s Outperformance

- Arbitrum announces $ARB

- What to Watch

- Insights

- Research Lab

- DISCLAIMER

- FAQs

- What significant events occurred in the crypto market during the week of 20th March 2023?

- What was Bitcoin's performance during the week of 20th March 2023?

- What is the significance of Arbitrum's announcement of $ARB?

- What were the market highlights for the week of 20th March 2023?

- What are the upcoming events to watch in the crypto market?

21 Mar, 23

Weekly Crypto Market Wrap, 20th March 2023

- Week in Review

- Winners & Losers

- Market Highlights

- Bitcoin’s Outperformance

- Arbitrum announces $ARB

- What to Watch

- Insights

- Research Lab

- DISCLAIMER

- FAQs

- What significant events occurred in the crypto market during the week of 20th March 2023?

- What was Bitcoin's performance during the week of 20th March 2023?

- What is the significance of Arbitrum's announcement of $ARB?

- What were the market highlights for the week of 20th March 2023?

- What are the upcoming events to watch in the crypto market?

Zerocap provides digital asset investment and digital asset custodial services to forward-thinking investors and institutions globally. For frictionless access to digital assets with industry-leading security, contact our team at hello@zerocap.com or visit our website www.zerocap.com

Week in Review

- Zerocap partners with Marex Solutions to launch credit rated crypto structured products – Marex Solutions is a division of Marex, specialising in the manufacture and distribution of customised OTC derivatives and structured products.

- UBS announces Credit Suisse acquisition in historic banking rescue deal – Credit Suisse previously borrowed $54 billion from Swiss central bank after shares plummeted 30%.

- Ethereum’s Shanghai upgrade date is officially set for 12th April.

- CME Group goes live with event contracts for Bitcoin futures.

- Silicon Valley Bank’s Financial Group files for Chapter 11 bankruptcy to preserve value – SVB’s UK arm acquired by HSBC for one British pound.

- BlackRock CEO Larry Fink praises digital asset tokenisation, claims US lacks innovation.

- Meta pulls the plug on all NFT projects for Instagram and Facebook.

- FTX filings show Sam Bankman-Fried’s inner circle received $3.2 billion from Alameda – FTX influencers face a $1 billion lawsuit over alleged crypto fraud promotion.

- Recent paper published by Columbia, Stanford economists following an SVB closure analysis claims 186 US banks are facing imminent risk of collapse.

- US banks inject $30 billion to rescue First Republic Bank.

- European Central Bank increases interest rates again, claims local banks are “resilient.”

- FED’s emergency lending reached $300 billion last week – US inflation slows down to 6% as banking crisis looms.

Winners & Losers

Market Highlights

Bitcoin’s Outperformance

- As the global financial sector strained over the week, BTC posted an astounding 27.17%, eclipsing every major asset WoW. With the Fed stuck between a rock (systemic collapse) and a hard place (hyperinflation), they made the decision to unwind a significant portion of their QT by increasing the size of their balance sheet to ~$300 billion. With the failure of much larger institutions like Credit Suisse and turbulent headlines for others (BNP Paribas), the potential for additional global inflationary pressures has increased, further deteriorating market sentiment. Through all the turmoil, BTC has stood out from the crowd, breaking correlation to equities in a meaningful way and tracking as a flight to safety assets much like gold.

- Perhaps the most telling depiction of the crypto derivatives market over the past week is the spike in open interest for BTC options and the relatively unchanged amount of open interest for ETH ($USD notional). Notional OI for BTC climbed to a multi-year high of over $10b while ETH OI was comparatively unchanged, sitting at around $6b. Given the Shanghai/Capella fork scheduled for next month, this dynamic reaffirms the notion of BTC being used as a hedge against the aforementioned banking crisis.

- The buying pressure in BTC has seen a consistently aggressive spot bid across Binance and Coinbase as the market accumulates. In recent times, market rallies across the sector have seen balanced demand across derivatives and spot. The skew towards spot hints that buyer intention is more aligned with capital preservation and accumulation versus trend speculation.

- For many, awaiting confirmation of the 25,000 break was a necessary trigger to begin more aggressive asset accumulation.

- With the price coming into key resistance ahead of one of the most critical FOMC meetings in the last twelve months, it’s likely the asset sees heightened volatility. Markets will hang onto every word that comes out of the press conference. With the market pricing a 25 bps rate hike as the most likely outcome, any deviation in expectations is likely to spook.

- While BTC has clearly broken out of a multi-month range, even if we see a 13% drawdown, we would still be in a technical bullish market structure. Given the statistically significant performance of late, buyers in this region should be cautious in timing their bidding – 28,500 is the key resistance level above, and any reversion into the range would be reasonable above 25,000. If we see a convincing break of 28,000 – a retest of 28,000 support would be a valid entry point. As for sellers, now at 28,100 would be a rational spot to de-risk, with additional key distribution zones ahead between 28k – 32k. Stops above 28,000 could see a nice rally into the range, allowing exits before 29,000.

Arbitrum announces $ARB

- Arbitrum, the largest Ethereum rollup by TVL, has announced the airdrop of its own token ‘ARB’. Planned for March 23rd, Arbitrum’s ARB will be airdropped to community members that meet specific criteria, marking Arbitrum’s transition into a DAO. $ARB is initially intended to serve as a governance token.

- Following 2022’s broader market contraction, various Layer 1’s such as Solana and Fantom lost relevance in terms of TVL while Layer 2’s built on Ethereum ascended to prominence. More specifically, Arbitrum’s presence has fostered alongside the rise of protocols built on Arbitrum, such as GMX, which have grown in popularity. Now, Arbitrum’s airdrop is poised to potentially shift market dynamics amongst existing Layer 2’s.

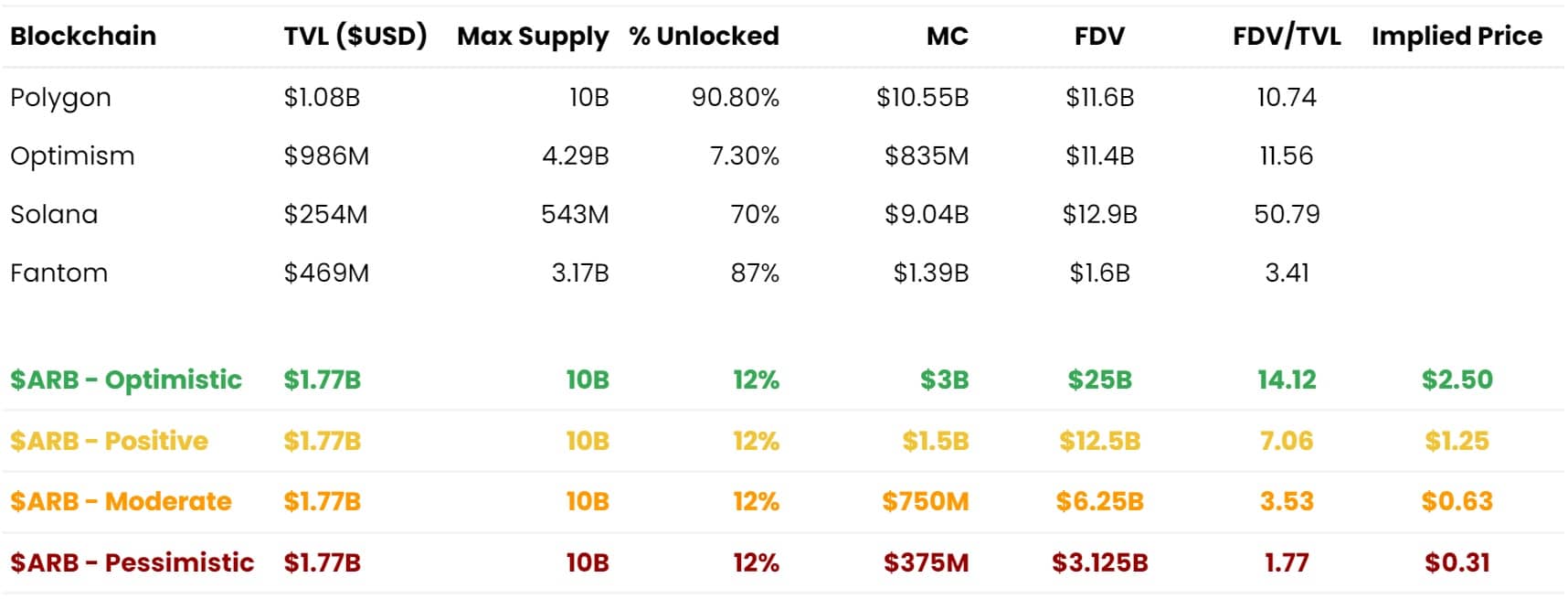

- $ARB’s total circulation will be 10B. 56% will be controlled by the Arbitrum community and while the remaining 44% will be directed to investors and employees of Offchain Labs. Moreover, we’ve depicted pessimistic to optimistic scenarios for Arbitrum’s potential token value based on comparative analysis to existing Layer 2’s built on Ethereum as well as competing Layer 1’s. Given community members, who are entitled to the airdrop, can capture anywhere between 500 – 10,200 tokens, this drop encapsulates a significant influx of capital to the space and is an event any trader should keep a keen eye on.

What to Watch

- US Consumer Sentiment report and Australian CPI, on Tuesday.

- Germany’s preliminary CPI and US’ unemployment claims, on Thursday.

- Canada’s GDP and US’ Core PCE Price Index, on Friday.

Insights

Zerocap is building a bridge between digital assets and TradFi by providing solutions with strong governance, digital asset custody, security, administration and counterparty risk management. The Zerocap/Marex partnership bolsters our vision by providing a range of structured investment tools to generate defined investment payoff structures – with the extra assurance of S&P Global investment grade credit ratings.

Research Lab

The Solana Virtual Machine (SVM) is bringing liveness and game-changing complex executions to the Solana Labs network.

Learn about the lightning-fast runtime environment that’s transforming smart contracts and dApps on the Solana blockchain in the latest Zerocap Research Lab article, written by Innovation Analyst Beau Chaseling.

Explore the intricacies of Sei Network as Zerocap’s Innovation Lead, Nathan Lenga, unravels the innovative strategies proposed that harmonize decentralization, security, and scalability in the crypto and blockchain sphere.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | TreasuryYields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice,take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

FAQs

What significant events occurred in the crypto market during the week of 20th March 2023?

The week saw several significant events in the crypto market. Zerocap partnered with Marex Solutions to launch credit-rated crypto structured products. Ethereum’s Shanghai upgrade date was officially set for 12th April. CME Group went live with event contracts for Bitcoin futures. Arbitrum announced the airdrop of its own token ‘ARB’.

What was Bitcoin’s performance during the week of 20th March 2023?

Bitcoin posted an astounding 27.17% increase during the week, breaking correlation to equities and tracking as a flight to safety assets much like gold. The buying pressure in Bitcoin has seen a consistently aggressive spot bid across Binance and Coinbase as the market accumulates.

What is the significance of Arbitrum’s announcement of $ARB?

Arbitrum, the largest Ethereum rollup by Total Value Locked (TVL), announced the airdrop of its own token ‘ARB’, marking Arbitrum’s transition into a Decentralized Autonomous Organization (DAO). The airdrop is poised to potentially shift market dynamics amongst existing Layer 2’s.

What were the market highlights for the week of 20th March 2023?

The market highlights for the week included Bitcoin’s outperformance, the announcement of Arbitrum’s $ARB, and the anticipation of the Federal Open Market Committee (FOMC) meeting. Bitcoin broke out of a multi-month range, and Arbitrum’s airdrop is expected to shift market dynamics amongst existing Layer 2’s.

What are the upcoming events to watch in the crypto market?

Some of the events to watch include the US Consumer Sentiment report and Australian Consumer Price Index (CPI) on Tuesday, Germany’s preliminary CPI and US’ unemployment claims on Thursday, and Canada’s GDP and US’ Core PCE Price Index on Friday.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 21st July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 14th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post