Content

- FAQs

- What is the Zerocap's Smart Beta Bitcoin strategy and why did it win the Finder’s “Best Digital Currency Innovation” award?

- How does the Smart Beta Bitcoin strategy manage the volatility of Bitcoin?

- What was the performance of Zerocap’s Smart Beta Bitcoin Fund in Q3 2022?

- What services does Zerocap provide?

- What technology does Zerocap use for digital custody and storage?

28 Oct, 22

Smart Beta Bitcoin Fund For Wholesale Investors Wins Award

- FAQs

- What is the Zerocap's Smart Beta Bitcoin strategy and why did it win the Finder’s “Best Digital Currency Innovation” award?

- How does the Smart Beta Bitcoin strategy manage the volatility of Bitcoin?

- What was the performance of Zerocap’s Smart Beta Bitcoin Fund in Q3 2022?

- What services does Zerocap provide?

- What technology does Zerocap use for digital custody and storage?

Zerocap’s strong performance and innovative use of financial instruments has been recognised as Zerocap’s Smart Beta Bitcoin strategy for wholesale investors was awarded Finder’s “Best Digital Currency Innovation” award. The Finder Innovation Awards celebrate the excellence, creativity and impact of initiatives introduced in the past 12 months.

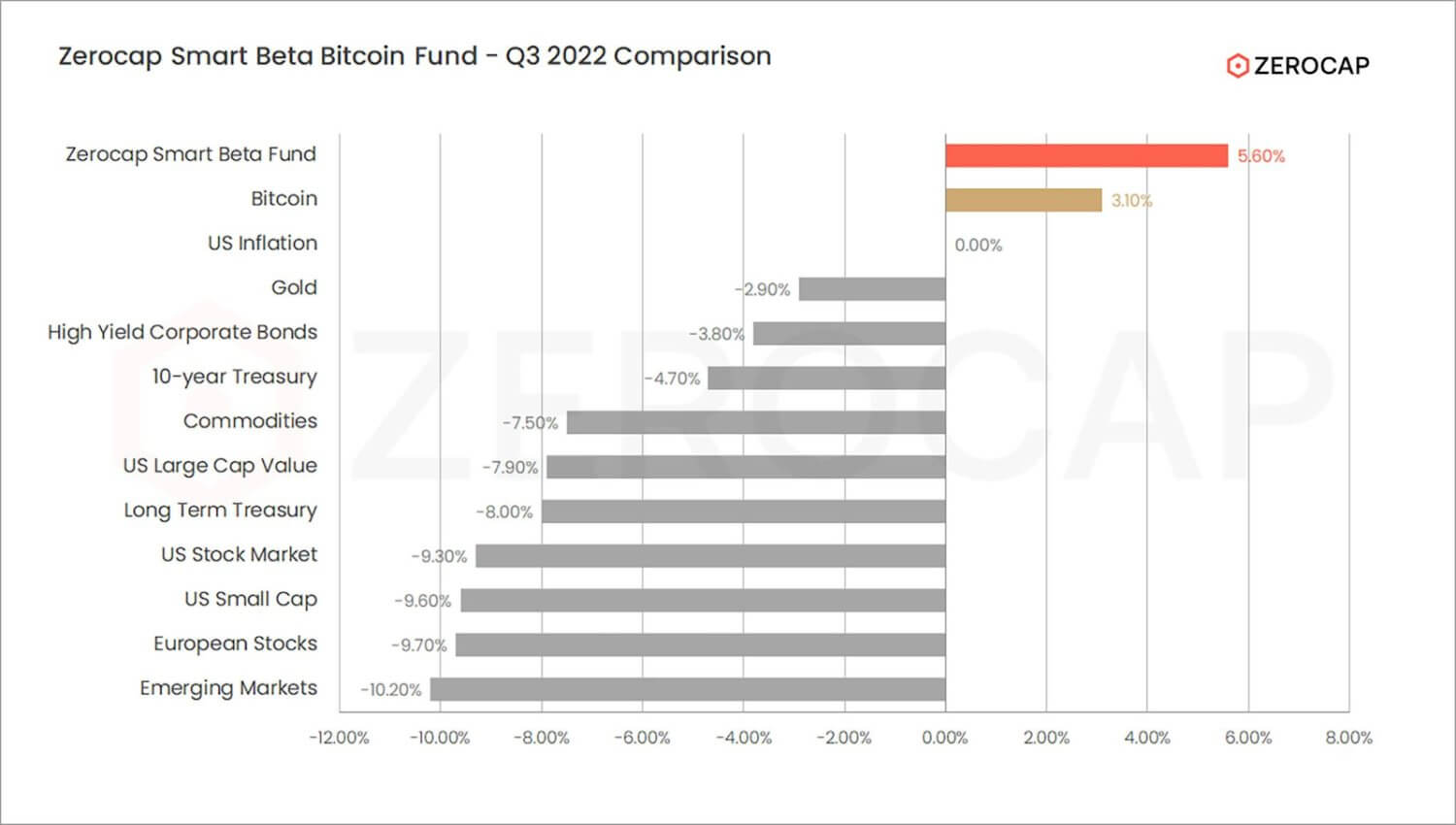

Zerocap’s Smart Beta Bitcoin Fund returned 5.6% in Q3 2022, an outstanding return in challenging markets that bested virtually all other asset classes in the quarter including Bitcoin itself, US equities, European equities, gold, commodities, and corporate bonds.

Whilst investing in cryptocurrencies and digital assets, including Smart Beta Bitcoin Fund, involves considerable risks, Zerocap managers deploy proprietary models for the Smart Beta Bitcoin Fund that rebalance the high volatility of Bitcoin to lower levels, in line with risk profiles of equity portfolios. The objective of Smart Beta Bitcoin is to reduce and balance risk while actually improving risk adjusted returns, all while providing exposure to Bitcoin. Zerocap’s Chief Investment Officer Jonathan de Wet said,

“Our approach has paid off, demonstrating that there is a place for this product in well designed portfolios. Smart Beta allows us to maintain an amazing risk-adjusted return profile, but without the volatility”.

Zerocap’s Head of Trading Toby Chapple said,

“Based on traditional investment banking techniques developed to cure hedge fund risk profiles, Smart Beta Bitcoin uses a proprietary and rigorous methodology to redistribute risk regularly between Bitcoin and a cash equivalent digital asset to accurately control the swings in the price of Bitcoin to a predetermined level. The product allows investors to control the downside risk of their investments whilst having all the statistical benefits that the asset class offers to a portfolio approach to investing.”

About Zerocap

Zerocap’s mantra is zero friction, borderless finance. Zerocap is Australia’s leading full-service crypto platform, providing tailored investment products and secure digital custody to a global client base of wholesale investors, institutions, HNWs and family offices.

Zerocap creates bespoke solutions for investors to build and diversify their investment portfolio with digital assets, through a range of regulated and direct exposure products across the volatility spectrum to fit with their desired levels of investment and risk.

Zerocap’s people bring a deep understanding of digital asset technology, trading, and portfolio optimisation, having processed a billion dollars of digital assets for private investors, family offices and institutions. Zerocap has assembled a team of blockchain experts, institutional portfolio managers and advisers, and experienced traders; backed by strong compliance, security and reporting functions.

Zerocap provides market leading institutional grade digital custody and storage facilities backed by insurance policies for all its investors, utilising best-in-class technology such as MPC cryptography and hardware isolation.

This material is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any digital asset. Investments in digital assets can be risky and you may lose your investment. Past performance is no indication of future performance.This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799.

FAQs

What is the Zerocap’s Smart Beta Bitcoin strategy and why did it win the Finder’s “Best Digital Currency Innovation” award?

Zerocap’s Smart Beta Bitcoin strategy is an innovative financial instrument that rebalances the high volatility of Bitcoin to lower levels, in line with risk profiles of equity portfolios. It aims to reduce and balance risk while improving risk-adjusted returns, all while providing exposure to Bitcoin. The strategy won the Finder’s “Best Digital Currency Innovation” award due to its strong performance and innovative use of financial instruments.

How does the Smart Beta Bitcoin strategy manage the volatility of Bitcoin?

The Smart Beta Bitcoin strategy uses a proprietary and rigorous methodology to redistribute risk regularly between Bitcoin and a cash equivalent digital asset. This approach helps to control the swings in the price of Bitcoin to a predetermined level, allowing investors to manage the downside risk of their investments while benefiting from the statistical advantages that the asset class offers to a portfolio approach to investing.

What was the performance of Zerocap’s Smart Beta Bitcoin Fund in Q3 2022?

Zerocap’s Smart Beta Bitcoin Fund returned 5.6% in Q3 2022, an outstanding return in challenging markets that outperformed virtually all other asset classes in the quarter, including Bitcoin itself, US equities, European equities, gold, commodities, and corporate bonds.

What services does Zerocap provide?

Zerocap is Australia’s leading full-service crypto platform, providing tailored investment products and secure digital custody to a global client base of wholesale investors, institutions, high net worth individuals, and family offices. It creates bespoke solutions for investors to build and diversify their investment portfolio with digital assets, through a range of regulated and direct exposure products across the volatility spectrum to fit with their desired levels of investment and risk.

What technology does Zerocap use for digital custody and storage?

Zerocap provides market-leading institutional-grade digital custody and storage facilities backed by insurance policies for all its investors. It utilises best-in-class technology such as Multi-Party Computation (MPC) cryptography and hardware isolation.

Like this article? Share

Latest Insights

Zerocap Launches Institutional OTC Desk for Tokenized Gold Trading

Zerocap’s institutional OTC desk enables investors to access tokenized gold efficiently, supporting portfolio diversification and inflation hedging strategies. The core objective is to provide seamless

Weekly Crypto Market Wrap: 23 February 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

InvestorDaily Spotlights Zerocap | Bitcoin to IBIT Swap: How Institutions Are Converting BTC Into ETF Exposure

Read more in a recent article in InvestorDaily. 18 February, 2026: Institutional sentiment toward Bitcoin remains constructive, but the way exposure is held is evolving. With

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post