9 Sep, 24

Weekly Crypto Market Wrap: 9th September 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

This is not financial advice. As always, do your own research.

Week in Review

- Ripple Co-Founder endorsed Kamala Harris to be the future US president.

- U.S. CFTC filed an emergency motion in an attempt to block prediction market Kalshi from listing election contracts for two weeks.

- Stablecoin supply reaches $162 billion with rising institutional demand

- Magic Eden’s multi-chain NFT trading volume surged.

- U.S. Bitcoin and Ethereum ETFs drop to new lows after a bearish week. Bitcoin ETF’s saw $211 million in outflows.

- Coinbase must face a shareholder lawsuit over SEC risks.

- Binance’s head of financial compliance has been detained in a Nigerian prison since February in a dispute with the Nigerian government, a decision on his bail will be made next month.

Technicals & Macro

BTCUSD

We saw equities play catch up to crypto last week, with the S&P and Nasdaq taking 3.5% and 5.5% knocks. We mentioned that technically for BTCUSD, the ascending channel from October 2023 is the next long-term level of support which intersects at around 55,000, before the 53,000 breaking point and range high from Feb 2024. We got down to 52,550 before trading back into the range to where we are now at 55,000. Our Head of Sales managed to get long at 53,000, which I’m sure we’ll hear about for the rest of the week, or month (ha!).

We said it the last time we were at these levels – given the institutional adoption curve we are seeing at the moment (stablecoin market cap at $162B!!?), the upcoming US election and the macroeconomic environment, it’s tough to see BTCUSD trade below the 50’s for any long period of time.

We’ve spoken at length about institutional adoption and recently on the US election. The shifting macro environment, however, is key to this week’s moves. Last week’s US jobs data was weak – and it has left traders at odds about what the Fed will do at the September FOMC. The futures market bounced around between a 25% probability of a 50 bps cut to a 35% chance, and back again. It’s looking more and more like a 25 bps cut on market pricing, but we are cautious on this. The weak job numbers could spur a signal from the Fed that they are indeed serious – and it wouldn’t be the first time the use of a surprise meeting outcome was used to cement the Fed’s stance.

Key to market pricing this week will be the US CPI and PPI figures. If these are elevated – we could begin to see the media jump on the stagflation narrative, which will frankly totally confuse markets. If these inflation numbers come in under expectation however – it could cement the 50 bps cut.

Risk assets could be all over the place this week, be warned!

BTCUSD is technically trading so well at the moment. We expect lower, or on expectation CPI and PPI numbers, to see BTCUSD trade back into the high 50’s, and potentially 60’s. Elevated numbers could see risk assets dump, and in the short-term, BTCUSD. Medium to long-term, we still believe the market will position to capture the scarcity premium in Bitcoin. The challenge with this thesis is time (how long?) and leverage (will you get wiped in the short term?)

The lesson? Hodl as the degens would say.

Source: TradingView

Key levels

53,000 / 55,000 / 66,000 / 72,000 / 73,794 (ATH!)

ETHUSD

We saw the ETHUSD move almost hit last week’s target of 2,100. Despite ETHBTC sitting at multi-year lows, we are still short-biased given the environment for BTC. Interestingly if you take into account ETH’s staking rewards, you get a better risk adjusted picture, but it still doesn’t compete on the bigger overall structure against BTC’s scarcity value heading into the end of the year.

Source: Tradingview

Key levels

2,100 / 2,800 / 3,600 / 4,000

Spot Desk

AUD retreated as the USD dollar rallied last week on the release of the unemployment figures. This buoyed demand for AUD off ramping.

Flows were balanced on the majors, with a buy skew towards SOL. Alts were lightly offered throughout the week.

Seems like the crowd is increasingly skewed towards quality, as altcoins in general have not been able to manage a decent bounce in recent weeks.

Looking ahead, the mid-week CPI release will be a big catalyst for volume as the Fed prepares to make its first rate cut decision. The desk remains strategically positioned to offer competitively priced stablecoin/AUD and USD pairs and T+0 settlement. Corporates, exchanges and other desks are encouraged to reach out with any interest.

Derivatives Desk

WHOLESALE INVESTORS ONLY

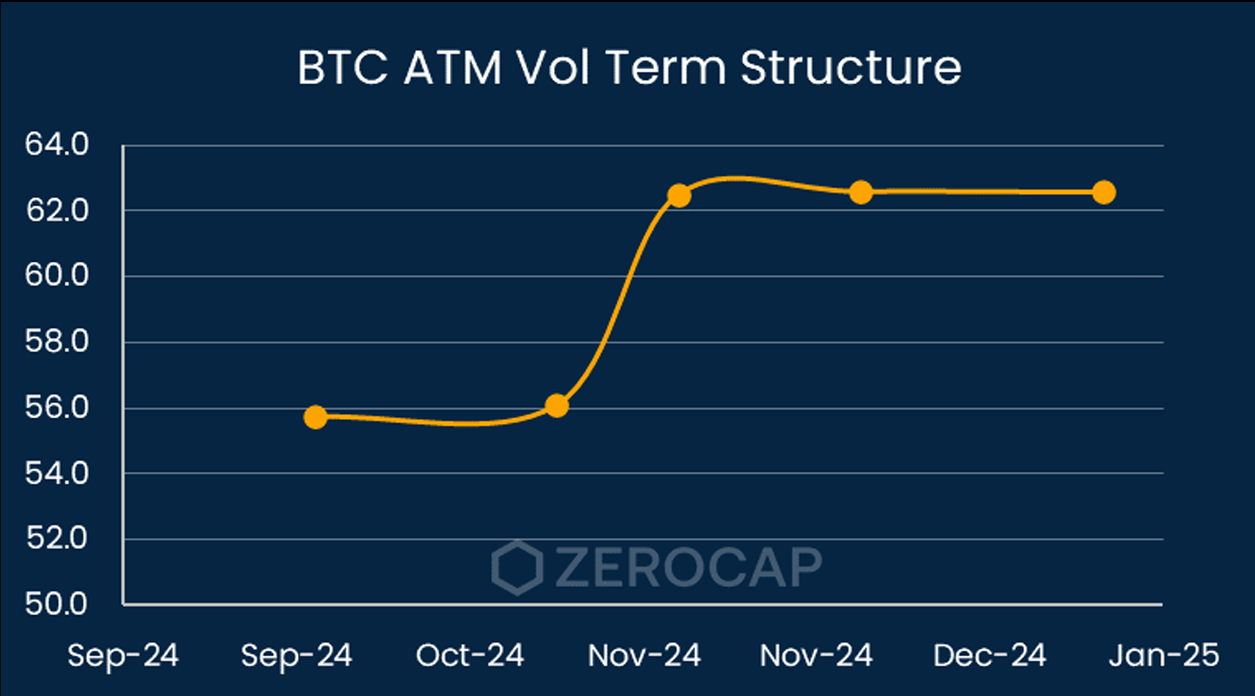

As the US election draws closer options markets are pricing in significant volatility over the first week of November, as can be seen in the kink of Implied Volatility (IV) between October and November expiries.

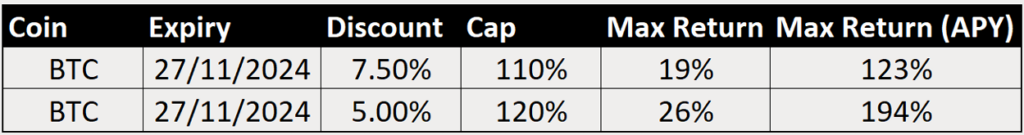

With the prospect of a Trump win, bullish for crypto, investors could take advantage of the election premium via discount notes. Discount Notes allow investors to take advantage of higher than usual upside option premiums by providing two predefined outcomes at expiry: if BTC is below the cap price then the investor gets to buy BTC Spot at a discount, and if it is above the cap price the investor receives a fixed USD return.

See the below table for current indicative payouts and hit up the derivatives desk for live pricing.

What to Watch

- Chinese CPI and PPI data, on Monday.

- UK unemployment change rate and average earnings index, on Tuesday.

- Bank of Canada Governor Tiff Macklem is due to speak at the Canada / UK Chamber of Commerce in London, on Tuesday.

- US CPI data, on Wednesday.

- US PPI and unemployment rate, on Thursday.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 11th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 4th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post