9 Dec, 24

Weekly Crypto Market Wrap: 9th December 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

This is not financial advice. As always, do your own research.

Week in Review

- The U.S. Treasury pointed out in a report that Bitcoin is mainly used as a value storage tool in DeFi and plays the role of “digital gold”.

- Amazon shareholders call on its Board to consider investing in Bitcoin

- Phantom Wallet to integrate $SUI blockchain, another L1 blockchain.

- President-elect Trump Appoints David O. Sacks as White House A.I. and Crypto Czar

- Solana’s memecoin factory Pump.fun shut off access to U.K. crypto traders Friday, citing “laws and regulations” affecting the runaway hit.

- Top NFT collection Pudgy Penguins is releasing a token called PENGU this year on Solana.

- Sushi CEO Jared Grey revealed an ambitious 2025 product roadmap, including Wara (a Solana-based trading platform), Susa (an on-chain perpetual DEX), Kubo (a market initiation platform using delta-neutral strategies), Blade (an LVR AMM solution), and an expanded SushiSwap aggregator.

- Solana-based decentralized exchange Jupiter Exchange has fully integrated RFQ (Request for Quote) into Jupiter Swap. Providing gasless swaps, 0% slippage, and access to combined on-chain and off-chain liquidity.

Technicals & Macro

BTCUSD

Source: TradingView

Key levels

66,000 / 73,000 / 77,000 / ~103,650 (all-time high)

The 100,000 level breaks with gusto!

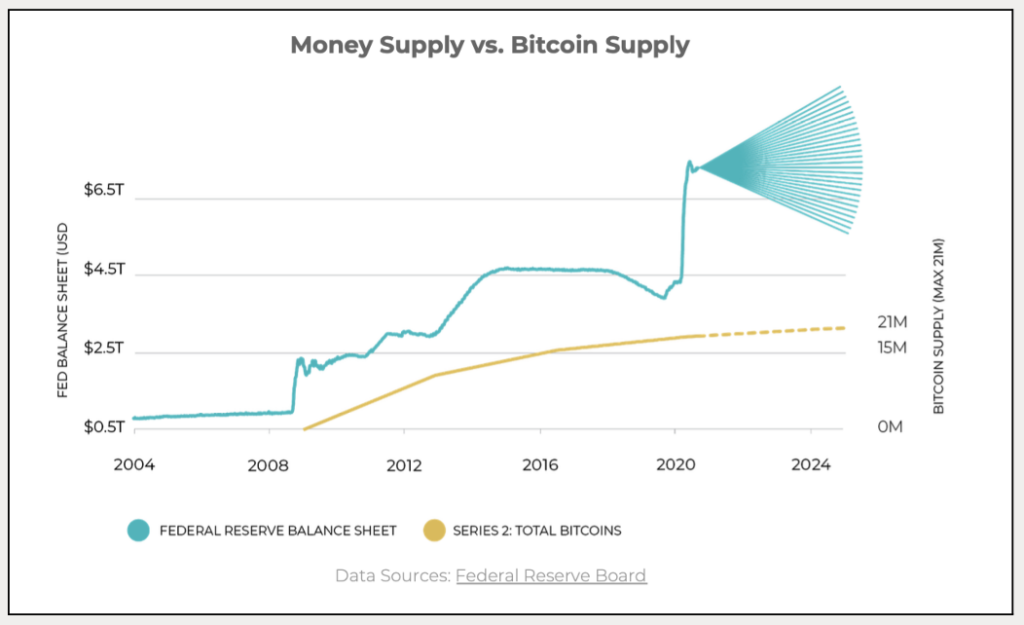

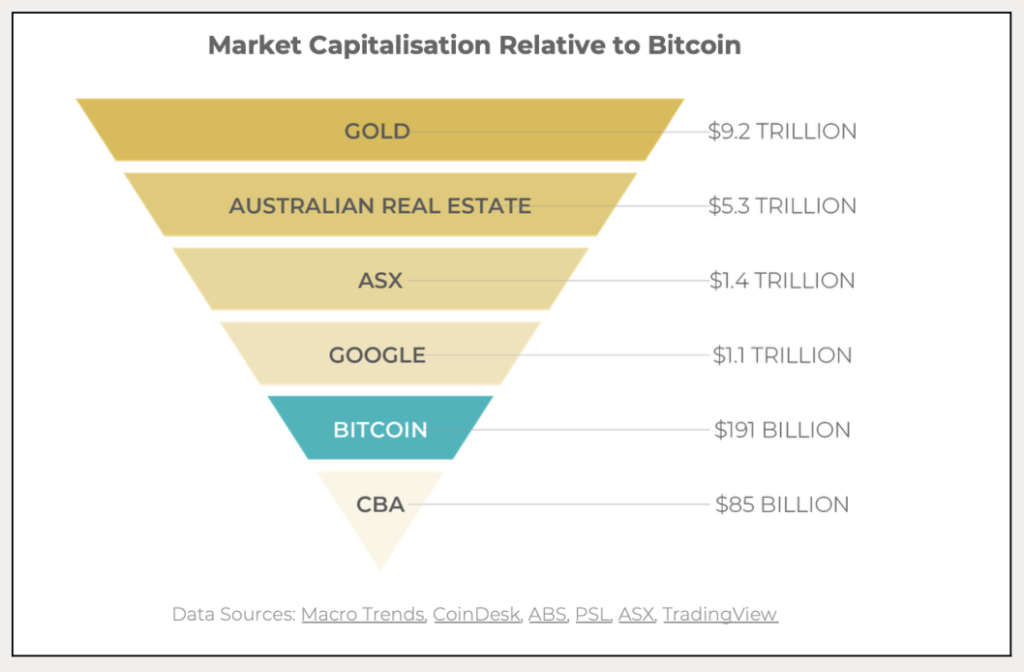

What a week – we managed to break out the office champagne as bitcoin broke the US $100K level. What a moment. To think just 14 years ago it was trading at 5 cents. An interesting question around context and pricing you one could ponder – was it a better risk/reward trade with BTC at 5 cents vs 100K USD? Most would argue the former, but there is an argument to be made that we are closer to mainstream adoption now than ever before – and therefore the risk curve is drastically different to what it was a few years ago. The spot ETFs are growing with force, Trump’s closest nominations are incredibly pro-crypto, and the the market is beginning to realise that no matter who the US voted for, we are likely going to see further debasement of currencies, with Harris’ camp planning to add US $3.5T, and Trump’s US $7.5T, to the balance sheet. The last point keeps bringing us back to the idea of relative value – if the market is bidding BTC over Gold, and the new generation of leaders are becoming more comfortable being digitally native as opposed to holding physical gold bars in vaults – could it make sense for BTC to continue closing the market cap gap between it and gold? The gap is currently sitting at around 7x.

In the oldish days (think 2020), this trade was not as clear. We didn’t have the institutional adoption, the access points, the custody options and the political environment to see bitcoin go mainstream. We certainly do now. We wrote a piece of analysis back then called “Bitcoin: This is the hedge”. Amongst other points, we argued that as the monetary supply increased, we would see scarce assets like bitcoin increase in value, and that there was a relative value trade against a basket of other assets given this phenomenon. We believe that this is what we are seeing play out now.

This is the hedge (2020) chart snaps

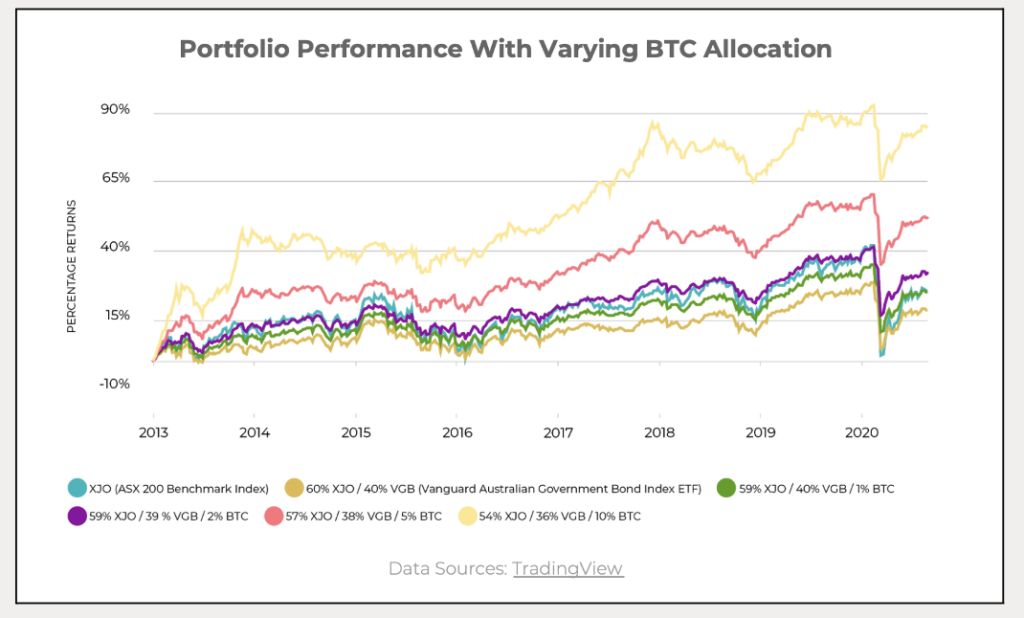

Most interesting to the piece is the (VanEck inspired) graph of how this “hedge” could improve risk adjusted returns in portfolios. The next frontier – the wall of retirement capital looking for a passive allocation. To this point, bitcoin allocation has largely been derived from active investors – ie, those who are actively looking to allocate to this asset class. With the rise of the spot ETF (access point), and a more favourable geopolitical environment, it could open the door to passive allocation from mutual and retirement funds. This could be the impetus, or extending factor, that takes bitcoin above gold’s market cap. As a first step, we are already seeing corporates vying to hedge. Just this week shareholders will vote on whether Amazon and Microsoft buy BTC as a hedge for their treasuries.

In the meantime, keep an eye on the new all-time highs. Price has come a long way – we’d expect some natural reversion at this point. Trump still needs to take office, and set his agenda more formally. The more radical stuff should come in early given the 2-year midterm elections – he’ll need the time to execute on the policy platforms. Therefore we position that Trump’s first 100-days are going to be exciting, volatile and filled with newsflow – keep an eye on leverage over this period.

Key levels are either side of the 92,000 to 100,000 range – which will no doubt be contested in the lead up to Jan 20th, when Trump takes office.

Altcoins such as XRP, Algorand, and Telcoin are outperforming as some investors are seeking higher returns on the back of major cryptocurrency momentum. Broader market downside risks are still centered around any policy hiccups in Trump’s unscripted speeches and further escalation in the Israel / Iran and Ukraine conflicts, and now of course, we have Syria in the mix – which is complicated to say the least. The VIX is still historically less elevated given the conflict risk, and these crises do have the potential to escalate fast.

ETHUSD

ETHBTC

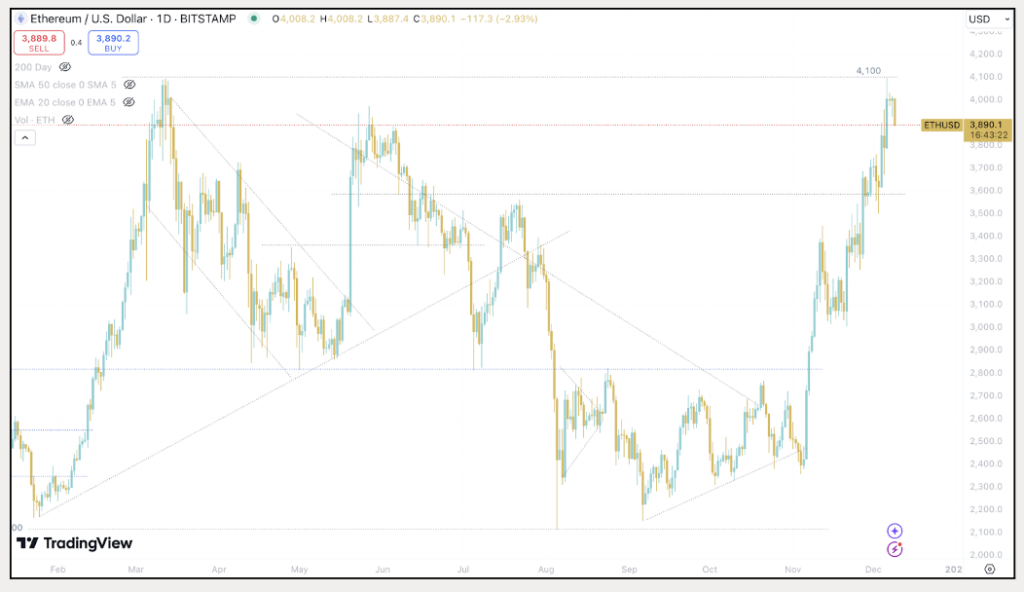

Last week we mentioned ETHUSD targeting the 3,950 level if bitcoin dominance continued to fall. We indeed tested that level, and then broke through toward the 4,100 level. Renewed interest in ETH could see the ETHBTC 0.04 level hold as support, and get some reversion into the range. On balance, BTC should still hold centre stage given the impending US Presidency.

Key levels

2,800 / 3,000 / 3,500 / 4,100

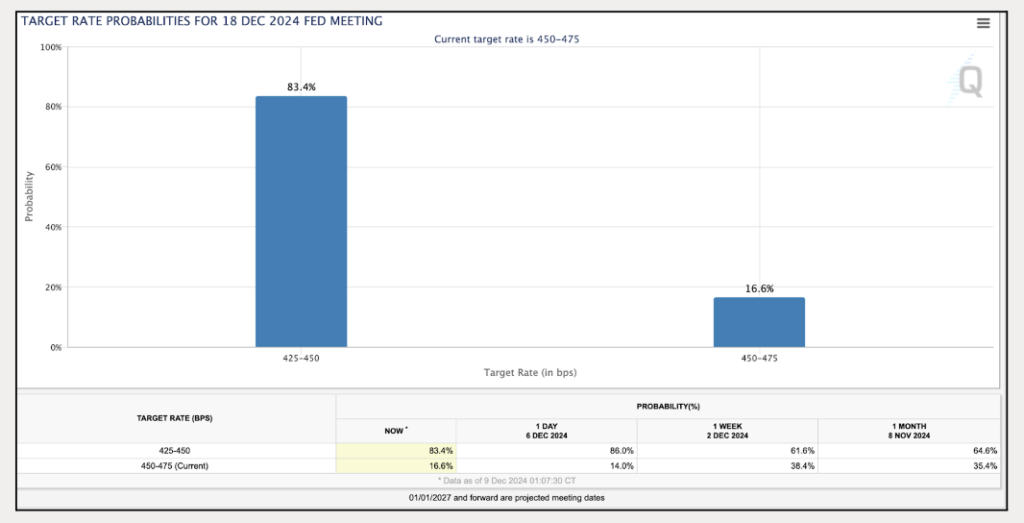

Dec rate probabilities now clearly in the cutting camp for Dec 18

Source: CME Fedwatch

Gold holding its range

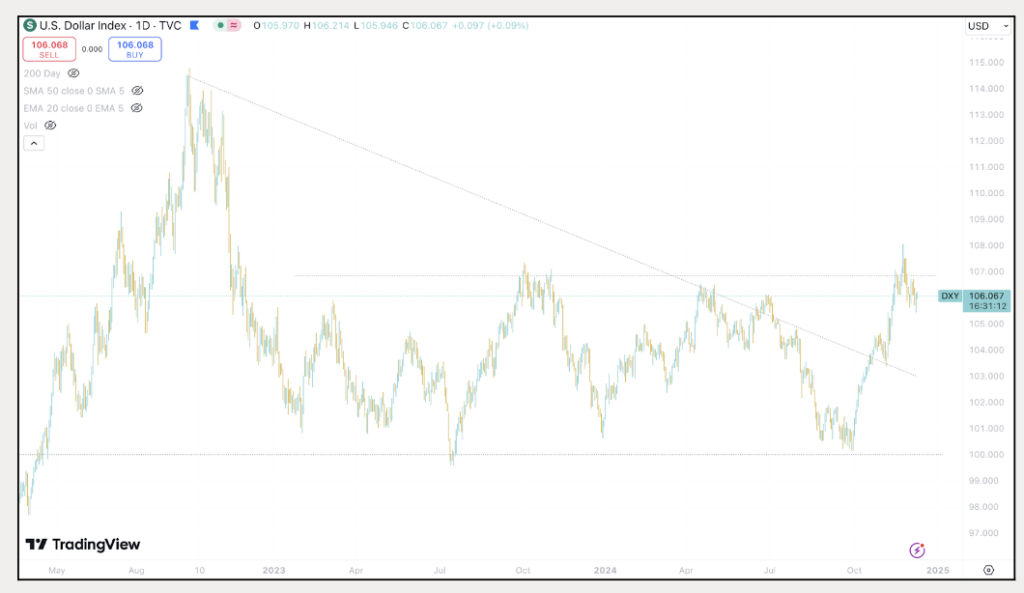

Dollar index back in the multi-year range

DXY trading back into the range. We are entering a lower liquidity period – and much of the USD’s moves will be dictated by the 2025 yield curve, and of course, fiscal policy that will become clearer as Trump takes office.

Be safe out there, and enjoy the silly period!

Jon de Wet, CIO

Spot Desk

The Australian dollar bled 2% against USD last week on the back of the Aussie GDP growth rate falling short of expectations. The Australian economy grew by 0.3% qoq following a 0.2% growth in the past 3 quarters, and although this is an improvement, it still fell short of the forecasted 0.4% growth rate. Meanwhile, US non farm payrolls and unemployment rates recorded results better than forecasted. This week, participants will be on the lookout for any surprises around the RBA interest rate decision on Tuesday at 3am UTC, and both the US inflation rate MoM and the US inflation rate YoY at 1:30pm UTC. The RBA interest rate decision is expected to remain flat, while the US inflation rate MoM and YoY are both expected to decrease by 10bps.

The desk noticed clients heavily favouring the bid on USDT/AUD last week following the 2% drop. Major cryptocurrencies BTC, ETH and SOL were dominated by profit-taking as clients sought to lock in gains. Although it was rare to see someone sell their full bag. We are seeing an uptick in activity surrounding EUR, NZD and GBP as clients around the world sought to take advantage of and trade using our global banking rails.

Altcoin activity is certainly ramping up, and it seems that there is growing interest each week. While some clients were selling their majors, altcoins were dominated by the offer as participants were notably adding HBAR, IMX, SUI, XRP, AERO, TAI and ONDO to their portfolios. The desk noticed an increase in limit orders as clients became optimistic where the altcoin market will go over the next few months.

Our desk is dedicated to providing customized cryptocurrency liquidity solutions, offering competitive rates across major coins, altcoins, and memecoins, paired with key fiat currencies. We also ensure seamless trading experiences with T+0 settlement. Please don’t hesitate to get in touch with us.

Oliver Davis, Trading Associate

What to Watch

- Dec. 11: The U.S. Bureau of Labor Statistics (BLS) releases November’s Consumer Price Index (CPI) data. Core Inflation Rate YoY Prev. 3.3%. Inflation Rate YoY Prev. 2.6%

- Dec. 11: The Bank of Canada announces its policy interest rate (also known as overnight target rate and overnight lending rate). Prev. 3.75%.

- Dec. 12: The European Central Bank (ECB) announces its latest monetary policy decision (three key interest rates). Deposit facility interest rate Prev. 3.25%. Main refinancing operations interest rate Prev. 3.4%. Marginal lending facility interest rate Prev. 3.65%.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 11th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 4th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post