7 Oct, 24

Weekly Crypto Market Wrap: 7th October 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

This is not financial advice. As always, do your own research.

Week in Review

- The U.S. added 254K jobs in September in a notable data beat. Unemployment rate ticked down to 4.1%.

- AI tokens driving a crypto market rebound, supported by strong U.S. economic data.

- Bullish bets predicting Bitcoin could hit $100,000 by the end of the year attracted nearly $1 billion in open interest on Deribit.

- Bitcoin and Ether spot ETFs continue to bleed as geopolitical tensions weigh over risk assets. Bitcoin ETFs bled $54.2 million on Thursday.

- The UAE has announced that crypto transfers and conversions will be exempt from Value-Added Tax (VAT).

- Microstrategy may soon hold more Bitcoin than Grayscale in the next major purchase.

- A new HBO documentary claims to unmask the creator of Bitcoin, named as Len Sassaman who died in 2011

Technicals & Macro

BTCUSD

Key levels

53,000 / 55,000 / 66,000 / 72,000 / 73,794 (ATH!)

The US non-farm payroll report has cemented a 25 bps (vs 50 bps) cut at the next meeting, with Fed Funds futures pricing in a 93% probability. The payroll data came in better than the market expected across all fronts – unemployment rate, employment change and the average hourly earnings. The US is looking more and more like a soft landing, with some solid economic data coming through.. but not too hot, just enough to keep markets content as long as the goldilocks scenario lasts.

Downside risks persist in the Middle East though – with crude oil and the USD dollar climbing as Israel-Iran conflict remains elevated. We saw the initial dump in risk assets early last week as the conflict escalated, and Israel began ground attacks in Lebanon. Crypto, equities and high-yield corporate bonds came off, and whilst crypto and broader equities are on the recovery, the junk bonds are not – which is giving some early insight into the fragility beneath a seemingly orderly market.

In the absence of an escalating crisis, we see BTCUSD at 70,000 in the coming weeks, continuing off current downside support, with equities breaking further highs. If the crisis escalates, we see broader risk begin to come off with a little gusto, with a BTCUSD floor in the early 50Ks. In our opinion there is simply too much buoyancy on the back of the US rate cutting cycle for price to head much lower. Altcoins present an interesting relative value play in a moderating risk environment – it’s been late start for coins outside the majors, but if we see de-escalation in the Middle East combined with reaffirming goldilocks data, we could be off to the races across a few key thematics – real world assets, AI and bitcoin based blockchain innovations.

Hell, apparently they’ve found Satoshi, so this is reason enough for a rally right?

ETHUSD

Source: TradingView

Key levels

2,100 / 2,800 / 3,600 / 4,000

ETH in the range – nothing notable apart from the short ETHBTC proxy trade that still makes sense long-term.

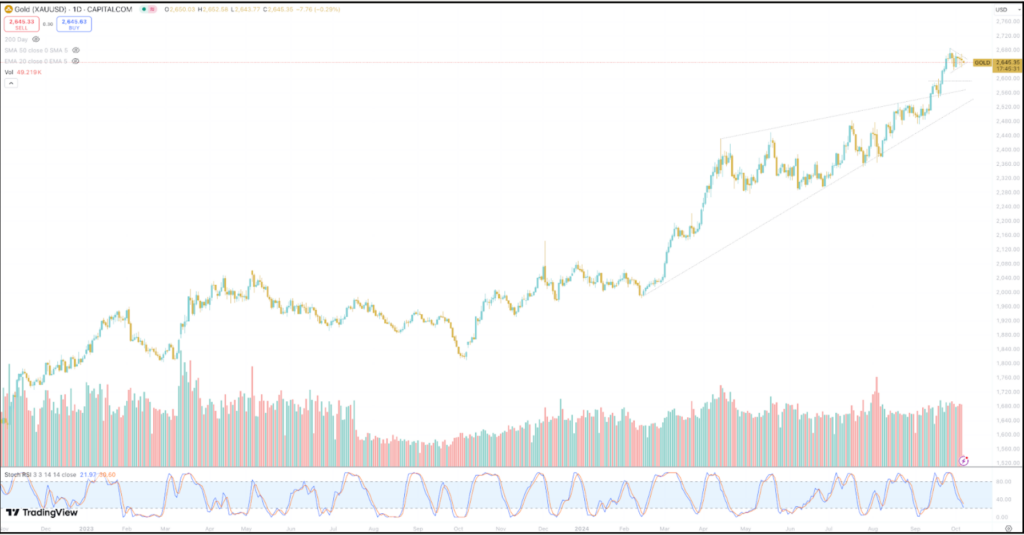

Gold is still strong – looking to break higher

Source: TradingView

Gold still on the mother of all runs, and looking for a break higher on the back of the Middle East crisis.

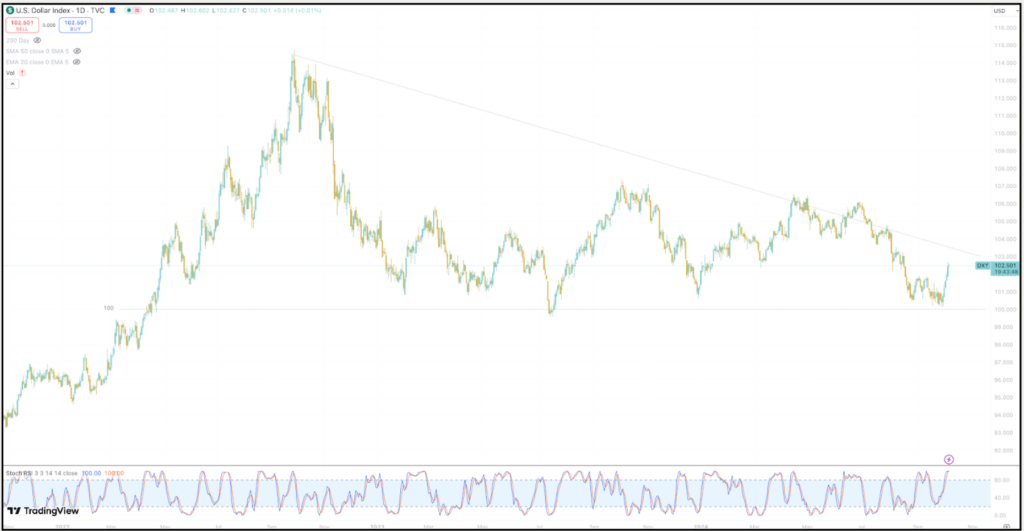

DXY rebound

Source: TradingView

DXY bouncing off the critical 100 level and firing back into the range on the back of the flight to safety. Despite this, equities and crypto are still moving higher presenting notable market dynamics.

Jon de Wet, CIO

Spot Desk

The Australian dollar has recently been strong, but last week’s US dollar strength led to a slight decline in the AUD/USD pair. This week, the focus shifts to the RBA meeting minutes along with US CPI and PPI data.

Desk trading activity has been largely centred around on-ramping, with minimal off-ramping from crypto to fiat for the last few weeks. A consistent buying trend has emerged in major cryptocurrencies, particularly Bitcoin and Solana. Positive sentiment from a newly announced Chinese stimulus program has triggered a sharp rebound in the crypto markets, with several altcoins now taking the lead.

Notably, POPCAT has surged approximately 43% over the week, surpassing a $1 billion market cap, while TAO experienced significant growth, jumping to around $670 for gains exceeding 30%. In the altcoin market, KARRAT, FLT, and LINK faced selling pressure, whereas SUI, AERO, SOL, and FTM attracted considerable buying interest. Additionally, STX saw noteworthy two-way trading activity.

The spot desk is well-positioned to offer attractive rates for major currencies, altcoins, and stablecoin pairs against major Fiat currencies, with T+0 settlement available.

Arpit Beri, Operations Analyst

Derivatives Desk

WHOLESALE INVESTORS ONLY

Basis rates on BTC and ETH are edging higher again (both up 40bps from last week):

- BTC’s 90-day annualised basis rate is up to 8.6%.

- ETH’s is up at 7.1%.

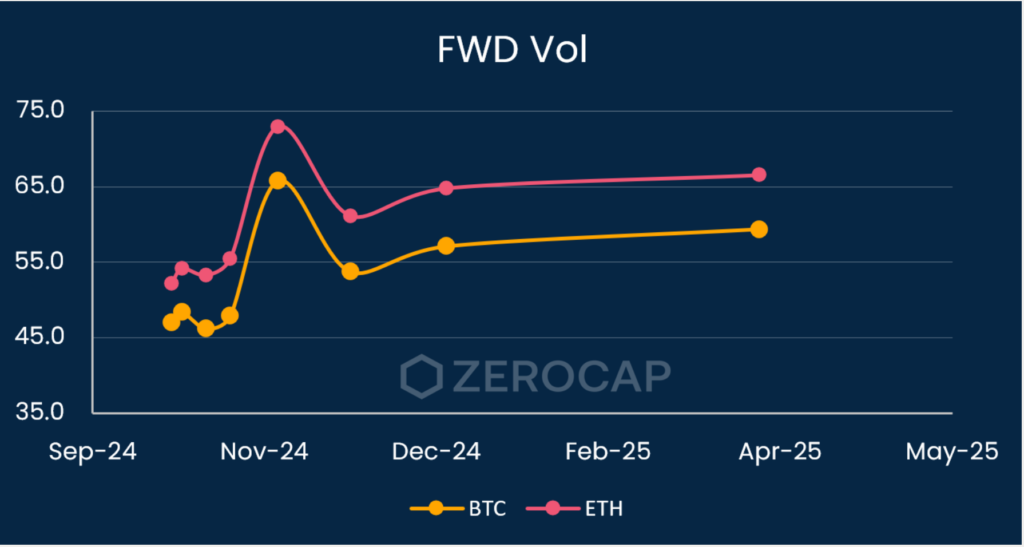

The ATM IV priced into the Nov 8 expiries (US election) has dropped slightly. Comparing the chart below to last week’s write-up, we can see that the spike in fwd vol has dropped since last week.

Fwd vol into the election is starting to be squeezed out. ATM IV has dropped nearly 10% on both BTC and ETH over the last month on this expiry. If one believes that this trend will continue, “selling the event” might be the play with regard to trading options around the election – given there is still some juice in ATM IV around this expiry.

One could look at selling 30-day upside options and buying upside options further out on the curve – a way to cheapen-up any bullish bets on price action towards the end of the year.

Berkeley Cox, Derivatives Analyst

What to Watch

- US FOMC meeting minutes, CPI figures and unemployment claims, on Thursday.

- Bank of Canada unemployment change and employment rate, on Friday.

- UK GDP data, on Friday.

- US PPI figures, on Friday.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 11th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 4th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post