7 Apr, 25

Weekly Crypto Market Wrap: 7th April 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

This is not financial advice. As always, do your own research.

Week in Review

- Tether acquires 8,888 BTC in Q1, total holdings surpass 100,000 BTC, valued at $8.34 billion

- MicroStrategy acquires 22,048 Bitcoin for $1.92 billion, boosting holdings to 528,185 BTC

- VanEck files for first US BNB ETF, managing $115B in assets, targeting fifth-largest crypto

- Circle files for IPO with SEC – Circle’s valuation could top $5B post-roadshow, paid $210M in stock to acquire Coinbase’s stake in Centre

- BlackRock gains UK approval to launch Bitcoin ETP, registers as crypto asset firm

- Australia warns crypto ATM providers on missing anti-money laundering checks

- US House committee passes stablecoin-regulating STABLE Act and other stablecoin transparency bills.

- ARK Invest buys $13M worth of Coinbase shares during market rout

Technicals & Macro

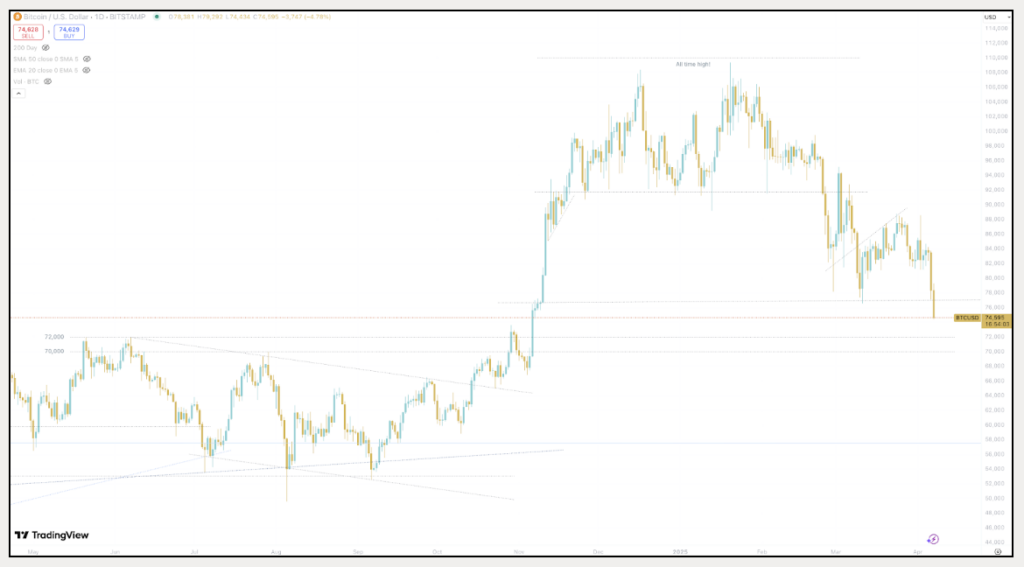

BTCUSD

Key levels

66,000 / 72,000 / 92,000 / ~110,000 (just north of the all-time high)

Bloodbath across markets picks up some steam.

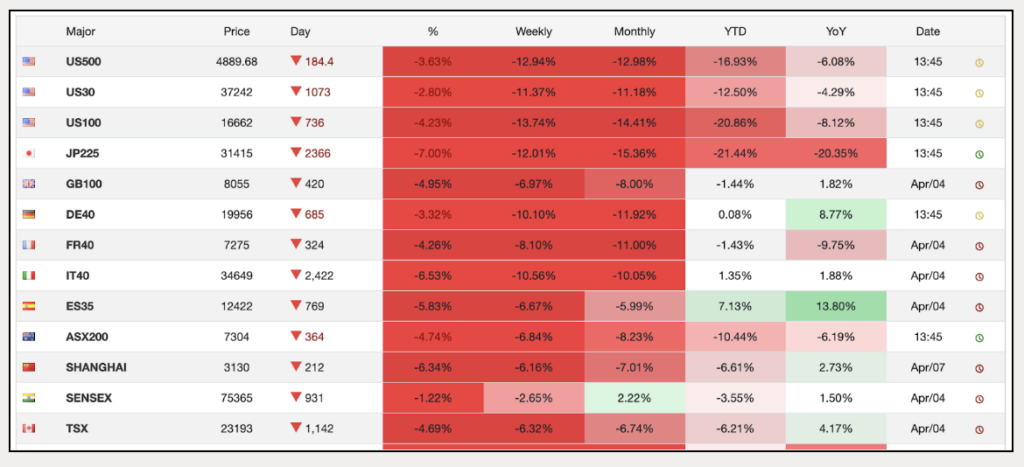

S&P 500 futures alone fell 5% pre-market just this morning, erasing $1.2 trillion in market cap. Fears of retaliatory tariffs from China and the EU are driving markets south, and Trump’s stoicism is holding firm on the US tariff policy, despite the market downturn. Virtually everything is dumping right now, and the capital is clearly flowing into US treasuries. Even gold is taking a hit. President Trump’s “Liberation Day” tariffs, a 25% levy on $300 billion of Chinese imports, triggered retaliatory measures from Beijing and Brussels. Activist hedge fund manager Bill Ackman likened the policy to “economic nuclear war,” estimating a 0.8% contraction in global GDP if sustained. Bill Ackman is not afraid of market influence as seen during the early Covid days. Keep an eye on his twitter feed for insights on their positioning.

Early signs of crypto correlation decoupling during early Asia emerged as U.S. equity futures plummeted 5%, while BTC’s decline moderated at 1.96%, aligning with bitcoin’s evolving role as a hybrid risk-on/risk-off hedge. However, as I write, BTC has slipped through key support and is heading toward the technical liquidity gap from November, 2024 that we’ve been mentioning over the past few months. The fact that BTC held up early is telling – the real money buyers are certainly there, and we’ve been seeing increased corporates buying on our desk.

This is a growth scare for markets, but more than this, it’s a signal to Trump that uncertainty in policy and implementation will be punished. Trump has always prided himself on market performance during his leadership, and this could ultimately test his resolve. For now, he’s holding strong which could see further falls as Europe and the US sessions open tonight.

In other (scaryish) news, a Bitcoin Core developer has proposed a hard fork to implement quantum-resistant signatures, addressing long-term security concerns with the advent of quantum computing. While not imminent, the proposal has sparked debate over blockchain’s preparedness for future computational threats.

Technically, price is looking to close the November, 24 gap as mentioned targeting 73,500, and we could get there as Europe gets going. Yet despite the potential for further downside in the US session, the fall has so far has been aggressive, and this is partly due to limited liquidity in early Asia. Bitcoin below 70,000 seems less possible, but as they say, be wary of catching a falling knife.

Interesting to chart the Nasdaq 100 over BTCUSD to track outperformance of BTC this year, even in downturns.

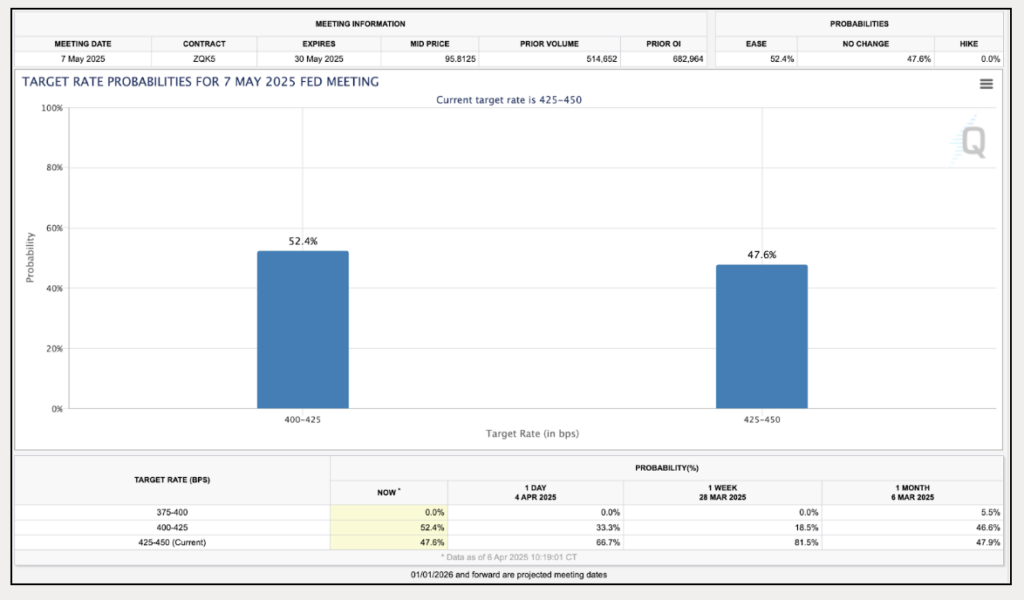

The next Fed meeting will be hanging on a wire – almost a 50/50 bet right now.

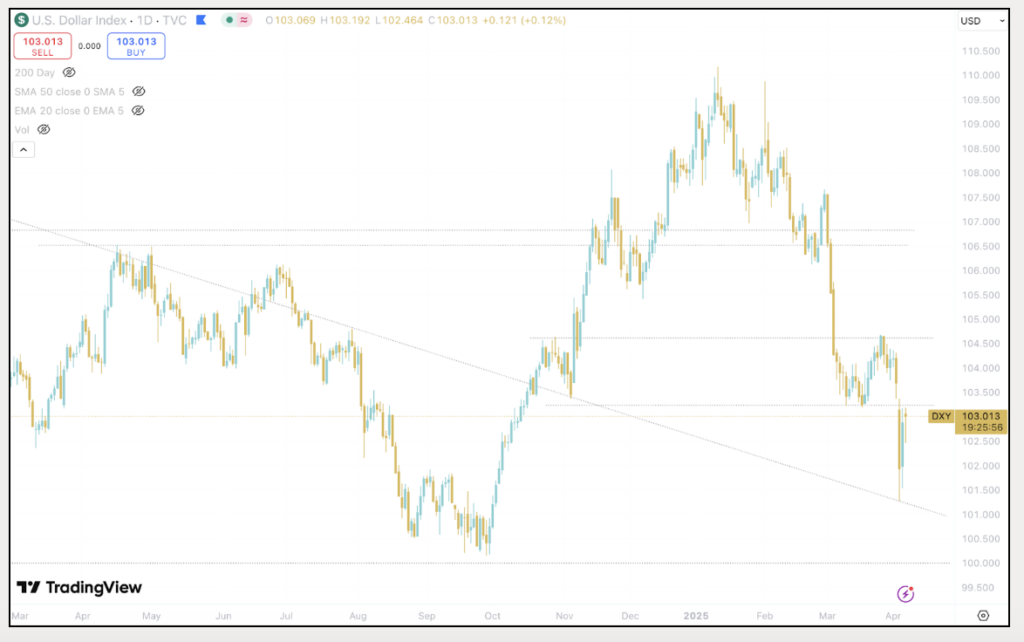

Dollar index bounce

An almost perfect bounce against the declining multi-year trendline. DXY is struggling for direction, and will be volatile.

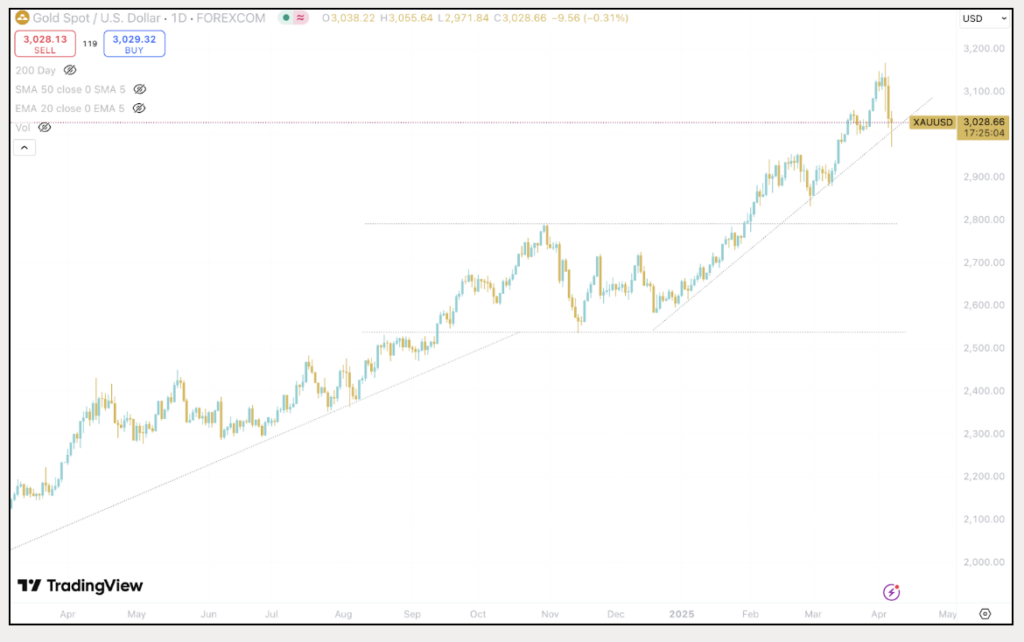

Gold takes a backseat to US treasuries

It’s all about a flight to US bonds, before the next leg?

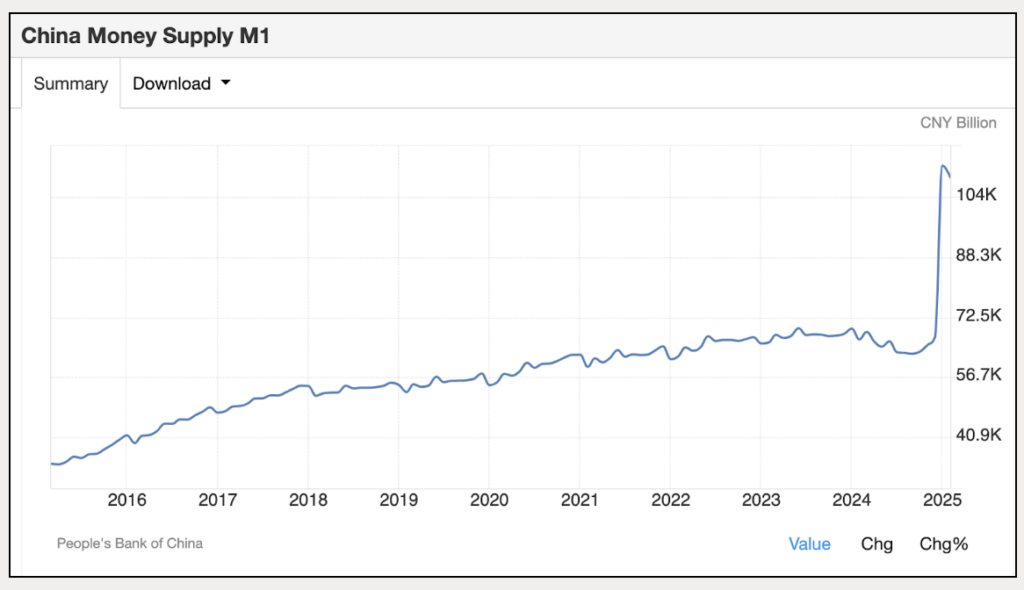

China’s stimulus will be very interesting to watch in terms of global liquidity, and where it lands up.

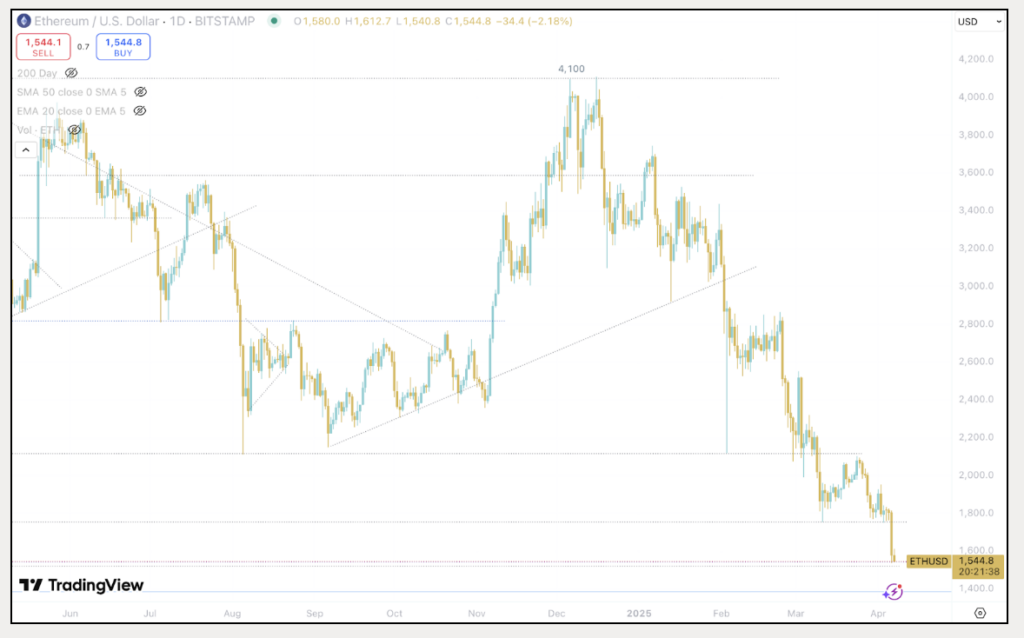

ETHUSD

Oh ETH.

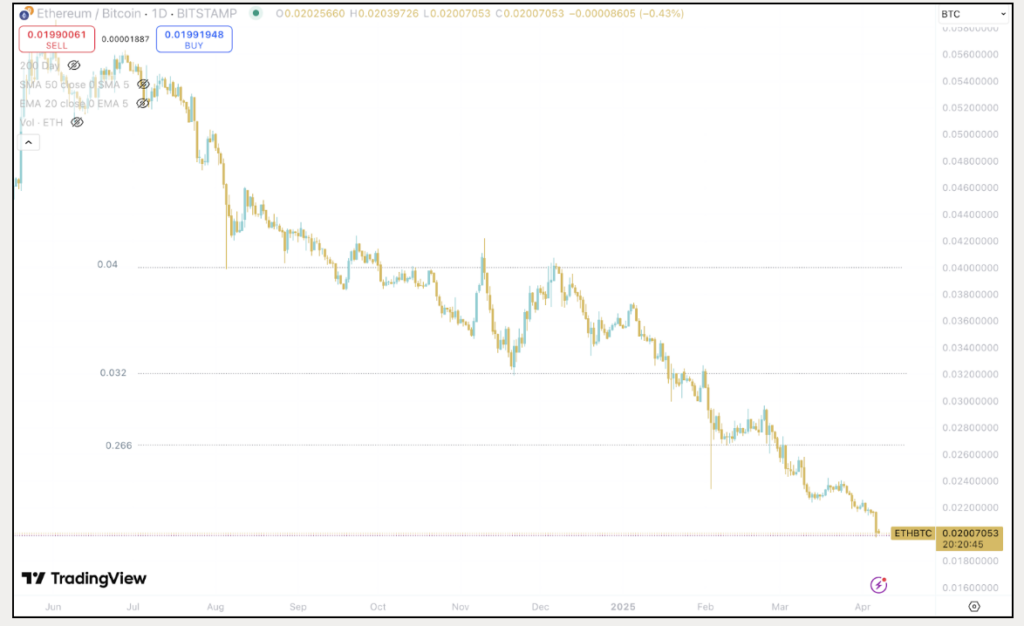

ETHBTC

ETHBTC – The pain doesn’t stop.

Watch the 73,500 – 80,000 range, with intermarket dynamics (stocks, bonds, DXY) serving as critical leading indicators. As macroeconomic and regulatory clarity emerges (hopefully) this week, BTC’s role in diversified portfolios may deepen, albeit amid persistent volatility.

Safe trading out there!

Jon de Wet, CIO

Spot Desk

The Reserve Bank of Australia (RBA) held its cash rate steady at 4.1% during its April meeting, following a 25bps cut in February—an outcome widely anticipated by markets. However, the Australian dollar faced intense pressure, dropping below 60 US cents for the first time since the early stages of the COVID-19 pandemic.

The sharp decline—its largest daily fall in 17 years—was triggered by President Trump’s announcement of sweeping tariffs, which sparked fears of a global recession and prompted widespread risk-off sentiment across asset classes. JPMorgan raised the likelihood of a downturn to 60%, warning that the measures could reduce trade, increase prices, and lead to job losses.

Crypto markets were not spared from the turmoil. Bitcoin spiked to $88,466.95 on Liberation Day, but quickly reversed following Trump’s tariff news, closing at $82,485.71 and continuing its descent in the days following. The broader market saw a sharp correction, with over $1.35 trillion in value liquidated in the last 24 hours, highlighting the fragile sentiment and elevated leverage across digital assets. Ethereum prices plunged on Monday morning, hitting a two-year low of $1,500 per coin. Other major altcoins, including XRP and Solana (SOL), saw more pronounced declines in response to the escalating trade tensions.On our desk, activity reflected the risk-off environment. Off-ramping demand was notably high, with clients selling USDT for AUD, particularly as they looked to take advantage of the weakened Aussie dollar. Meanwhile, Bitcoin buying outpaced selling, as some clients viewed the dip as a buying opportunity. In contrast, ETH flows were quieter, with only a few notable sales observed, and altcoin activity remained subdued throughout the week.

The OTC desk continues to offer tailored cryptocurrency liquidity solutions, offering competitive pricing across major coins, altcoins, and memecoins, paired with key fiat currencies. With T+0 settlement, we ensure seamless trading and settlement.

Reshad Nahimzada, Trading Analyst

Derivatives Desk

WHOLESALE INVESTORS ONLY*

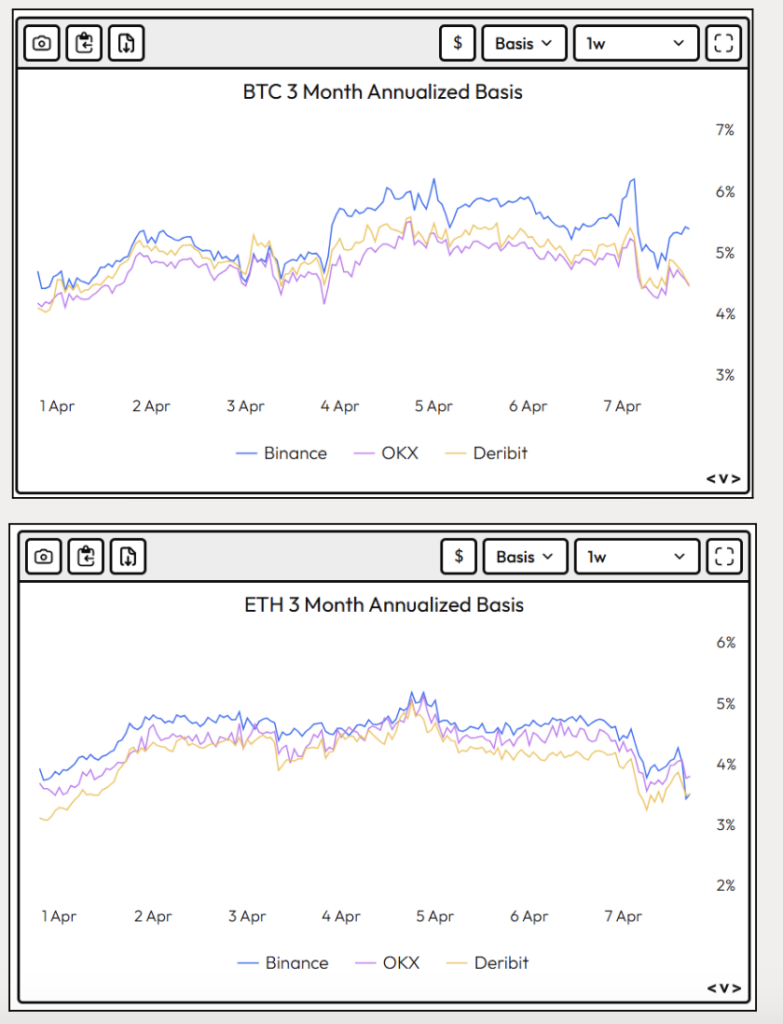

Despite a decline in spot price, basis rates on BTC and ETH are relatively flat over the week.

FWe like BTC Yield Entry Notes with strike prices below 70k, given support at last cycles all-time-high. If we get an extended price move lower, 70k is a level that you may be interested in buying BTCUSD at.

Yield Entry Note sample terms:

For a 3-month BTC Yield Entry Note with 70k Strike Price one can generate 5% absolute Yield (~20% annualised).

There are two possible outcomes at expiry

- BTC expires above 70k: investment paid back in cash + earns 5% yield (paid in cash).

- BTC expires below 70k: investment used to buy BTC at 70k + earns 5% yield (paid in BTC).

Get in front of the derivatives desk for info!

What to Watch

Monday, 7 April – Japanese Cash Earnings (Feb):

- No consensus forecast. February wage data will be assessed for signs of sustained wage growth after recent strong union-negotiated hikes. BoJ continues to monitor real wage trends post-liftoff.

Wednesday, 9 April – FOMC Minutes (March Meeting):

- The Fed held rates steady and maintained projections for two cuts in 2025. The minutes will offer insights into internal divisions on inflation risk, slower balance sheet runoff, and policy flexibility amid recent tariff announcements.

Wednesday, 9 April – RBNZ Rate Decision:

- A 25bps cut to 3.50% is widely expected in the RBNZ’s first post-Orr meeting. Despite recent GDP improvement, subdued inflation and growth data support continued easing.

Thursday, 10 April – Chinese CPI (Mar):

- No forecasts available. Inflation likely remains soft, but the data may be overshadowed by the recent US tariff moves. Markets will look to Beijing’s potential response amid continued domestic demand weakness.

Thursday, 10 April – US CPI (Mar):

- Headline CPI forecast at +0.2% MoM; core CPI at +0.3% MoM. Although inflation remains elevated, the data may carry less market weight due to anticipated tariff-related price effects later in the year.

Friday, 11 April – UK GDP (Feb):

- GDP expected at +0.1% MoM after a -0.1% decline in January. A small rebound is anticipated, driven by retail gains, though underlying growth remains weak.

Friday, 11 April – US PPI (Mar) & UoM Consumer Sentiment (Apr, Preliminary):

- PPI to complement CPI in gauging producer-side inflation pressures. UoM sentiment will provide a read on consumer confidence and inflation expectations heading into Q2.

Friday, 11 April – US Earnings Season Begins (Q1 2025):

Led by major US banks. S&P 500 earnings growth expected at +7.3% YoY. Attention will be on corporate guidance, especially in response to economic uncertainty and trade policy shifts.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 1st December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 24th November 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 17th November 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post