4 Nov, 24

Weekly Crypto Market Wrap: 4th November 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

This is not financial advice. As always, do your own research.

Week in Review

- Democrat nominee Kamala Harris has eaten away at Republican rival Donald Trump’s lead on Polymarket, however the betting site still gives a significant premium to Trump’s odds of winning compared to polls.

- An options-based measure of expected price swings in bitcoin (BTC) has hit a three-month high amid indications from betting markets of a tightly contested U.S. presidential race in crucial swing states.

- Last week, from October 28 to November 1, Bitcoin spot ETF’s had a net inflow of $2.22 billion, the third largest weekly net inflow in history. BlackRock ETF IBIT had a weekly net inflow of $2.15 billion.

- Two weeks ago Stripe acquired Bridge, a stablecoin-focused payments platform, for an impressive $1.1 billion. Building on this momentum, Bridge itself acquired Triangle earlier this week — a web3 wallet-as-a-service platform.

- Investment bank UBS has launched its first tokenized investment fund, a money market fund on the Ethereum blockchain, joining BlackRock and Franklin Templeton in exploring tokenization of real world assets.

- Daily bitcoin (BTC) mining revenue and gross profit dropped in October for a fourth straight month, JPMorgan (JPM) said in a research report Friday.

Technicals & Macro

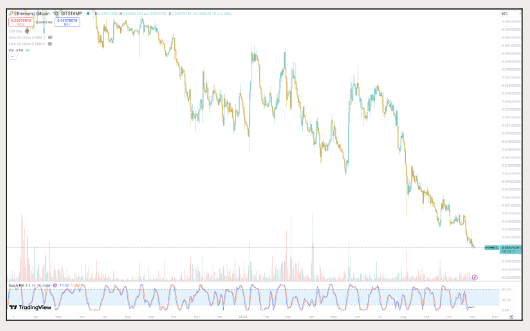

BTCUSD

Key levels

53,000 / 55,000 / 66,000 / 72,000 / 73,794 (ATH!)

We got mighty close to all-time highs last week, shy by a few hundred bucks. The 70 to 72K zone did provide a quick sweep through as we thought, but didn’t manage to break through the sell-wall above highs.

We are now one day away from the US election, and it is close to a coinflip. This has been an election campaign steeped in social media to capture the silent voters, and those that normally wouldn’t turn up to elections. Trump has been vying for the ‘bro’ vote, who as a cohort tend to vote less, but favourable toward Republicans. Harris has been gunning for the youth vote through connections to young musicians and influencers. Ultimately the voters in just seven swing states could decide who becomes the next US President. On November 3rd, the aggregated betting odds moved from Trump holding a slight lead, to Trump taking a convincing win in the race. The proprietary polls models (FiveThirtyEight, The Hill, Economist/Columbia) were less definitive – but were still supporting a Trump win.

How about the financial markets? The Nasdaq, S&P and crypto took some heat on the back of disappointing earnings figures with the “Magnificent Seven” tech group shedding nearly $500 billion in market cap. Despite this – if the early polling moves towards a clearer Trump win, the long energy, banks bitcoin trade would likely see some love and potentially buoy broader markets. If Harris manages to come through, we still believe we see a rally in stocks – simply because it provides certainty in the face of uncertainty, as markets crave certainty. Further to this the Harris administration is expected to grow debt by $3.5T, which is a boost for liquidity. Notably, under Trump the number is north of $7.5T

The caveat to a dual rally scenario is that if Trump calls a ‘stolen election’ or vote rigging, and does not concede – this would increase volatility and potentially blast the risk-on mood.

For crypto, in a Trump scenario, we see BTC breaking highs over the following weeks. Harris, a reversion into the range, with some buoyancy from broader risk markets.

Broader market downside risks are centred around further escalation in the Israel / Iran conflict. We are not out of the woods, and Iran is threatening ‘more powerful’ weaponry in the fight. The VIX is still historically less elevated given this impending risk, and the crisis does have the potential to escalate, and fast.

Gold continues to soar, with some recent reversion on USD strength

The triple whammy continues – rising geopolitical risk, repricing of bond yields and a general push to scarcity. We still think Gold goes higher, and with it, the relative value trade with BTC – sitting at about a 13x gap right now.

ETHBTC continuing to break down on BTC dominance

Watch your leverage over this period, it’s going to be volatile this week!

Jon de Wet, CIO

Spot Desk

The Australian dollar continued its decline for the fifth consecutive week, slipping another 1.3% against USD, as persistent geopolitical tensions and demand for safe-haven currencies keep the USD strong. The Australian quarterly CPI indicator came in slightly below forecast at 2.1%, down from 2.7% the previous month, which provided limited support in halting the AUD’s slide. In the US, Friday’s non-farm payrolls fell below expectations and registered the worst headline reading since 2020, causing brief volatility in USD. However, the greenback ultimately remained resilient.

The desk observed a heavy skew towards off-ramping, as AUD continued to fall against USD. Major cryptocurrencies – Bitcoin, Ether, and Solana – remained in demand, with clients continuing to show confidence in the broader crypto market.

Altcoin interest surged, with notable client activity in SAND, JUP and AAVE as clients positioned themselves for a potential market rally. With the US election fast approaching on Wednesday, November 6 (AEDT), and betting markets fluctuating, speculative buying in alts has increased.

Memecoins continued to see a strong demand, as clients sought quotes on DOGE, PEPE, WIF and MOCHI, exploring diverse trading strategies. The desk’s support for memecoin custody and OTC trading remains a key offering – please reach out for any specific inquiries.

The spot desk is well-positioned to offer competitive rates for major currencies, altcoins, memecoins and stablecoin pairs against major fiat currencies, with T+0 settlement available.

Reshad Nahimzada, Trading Analyst

Derivatives Desk

WHOLESALE INVESTORS ONLY

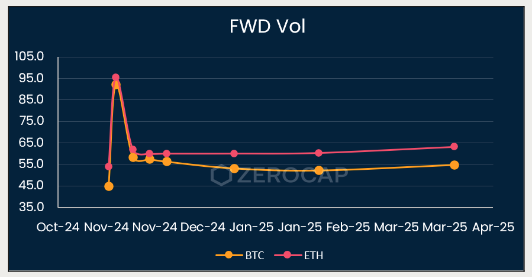

Basis rates on BTC and ETH retrace slightly:

- BTC’s 90-day annualised basis rate is down 60 bps (10.5%).

- ETH’s is also down 60 bps (9.1%).

Over the weekend Forward Vol baked into the Nov 8 options contracts has spiked to its highest point during the lead up to the election:

Trade ideas for the election next week:

Election Bull – 100k Binary Call Option

For investors anticipating a sustained bull market following the U.S. election and into the end of the year, a straightforward binary call option presents an appealing risk-reward profile. Purchase a binary call option for BTC at $100, set to expire on December 27, for an upfront cost of just 9.5% (with BTC currently priced at $72,500).

- Cost: $9.50 upfront for a potential $100 payout.

- Payout: If BTC is equal to or greater than $100,000 on December 27, you will receive $100; if BTC is below $100,000, you will receive nothing.

- Max Loss: Limited to the initial premium of $9.50.

- Max Return: 10.5 times your investment if BTC is at least $100,000 at expiration.

Election Bear – Protective Collar

With the markets being in “risk on” mode coming into the election, some traders have started to question if this will be a “sell the news” event. If you hold BTC directly and are interested in managing potential downside risk whilst keeping some upside exposure, you could consider a protective collar strategy – such as an 80/120 or 90/110 zero-cost collar.

Berkeley Cox, Derivatives Analyst

What to Watch

- US PRESIDENTIAL ELECTION (TUE): On Tuesday, November 5th, Americans will go to the polls to vote in the Presidential Election with the winner taking office in January 2025 for a four-year term.

- RBA POLICY ANNOUNCEMENT (TUE): The RBA is expected to keep the Cash Rate unchanged at 4.35% in its meeting next week with money markets pricing a 96% probability for the RBA to remain on hold and just a 4% chance for a 25 bps cut.

- ISM SERVICES PMI (TUE): Analysts expect the October ISM services PMI will ease to 53.3 from 54.9 in September.

- FOMC POLICY ANNOUNCEMENT (THU): The FOMC’s policy announcement will be on Thursday, November 7th, rather than the usual Wednesday update, given the Presidential elections on November 5th.

- BOE POLICY ANNOUNCEMENT (THU): Expectations are unanimous that the BoE will cut its Base Rate by 25bps to 4.75%.

- CANADIAN LABOUR MARKET REPORT (FRI): The BoC’s October statement noted that the labour market remains soft.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 23rd December 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

What are Liquidity Providers in Crypto

In the rapidly evolving world of cryptocurrencies, liquidity is a fundamental component that ensures the seamless exchange of digital assets. Liquidity providers (LPs) play a

Weekly Crypto Market Wrap: 16th December 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post