30 Sep, 24

Weekly Crypto Market Wrap: 30th September 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

This is not financial advice. As always, do your own research.

Week in Review

- BlackRock identifies Bitcoin as a potential long-term “risk-off” asset.

- In September BlackRock Bitcoin ETF largest daily inflow was 180 million and MicroStrategy’s 2x leveraged ETF saw inflows of $72 million.

- Bitcoin hit $66,000 last week in reaction to positive inflation data.

- Binance founder CZ was released from prison.

- PayPal in the US now enables business accounts to buy, hold and sell Cryptocurrency within the app making it more accessible for businesses.

- $10 billion surge in stablecoin minting over the past weeks has flooded the crypto market with liquidity.

Technicals & Macro

BTCUSD

Key levels

53,000 / 55,000 / 66,000 / 72,000 / 73,794 (ATH!)

We are on the move!

Last week was spent digesting the Fed’s 50 bps cut, and markets are clearly bidding risk with equities and select meme coins jumping (and then reverting) on the cut, and slowly grinding higher after all the initial excitement. The star players are bitcoin and gold though, which are trading with some serious momentum behind them. Both have the scarcity premium that markets are beginning to pick up on as the Fed moves to soften monetary policy, and both are similarly benefitting on the repricing of bond returns and associated USD weakness.

Despite the core PCE inflation data (the Fed’s preferred metric) moderating below consensus on Friday, and subsequently Fed Funds futures repricing on whether the next cut is going to be another 50 bps (currently sitting at a 52% chance), markets are still taking to the streets and backing the start of the US rate cutting cycle with force.

We see BTCUSD hitting close to the 70,000 level this week, and gold continuing to break highs. Longer term, we are in the relative value camp – gold’s market cap is ~ USD $18T while bitcoin’s is ~ USD $1.3T. This represents close to a 14x gap to close – and our analysts believe we could get there in the next 10-years. This would represent a BTC price of ~925K USD.

Gold is taking no prisoners

Source: TradingView

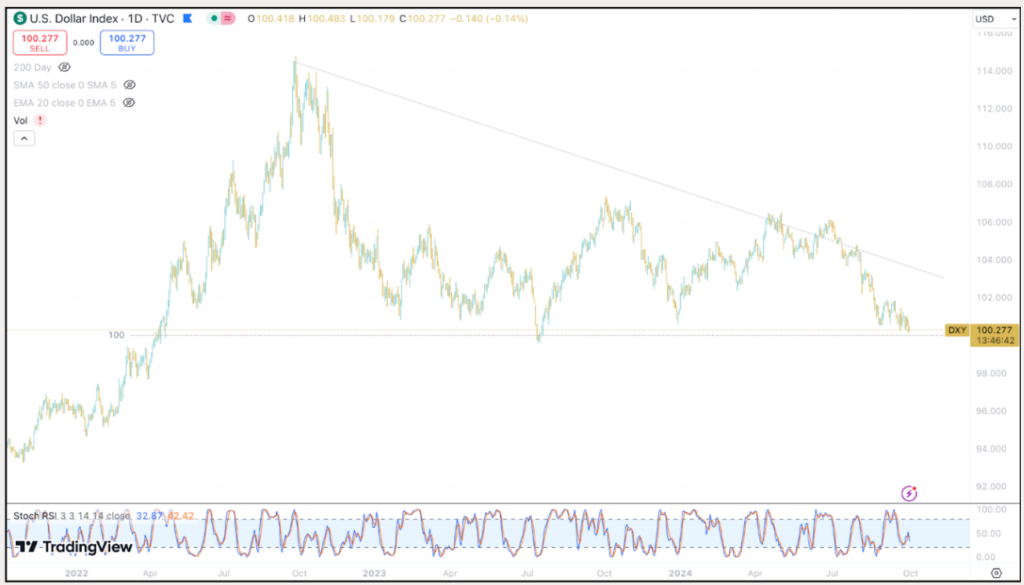

DXY basing, do we go lower?

Source: TradingView

The dollar index is at a critical juncture – the 100 level has not traded below here substantially since back in 2022. A break of this descending triangle makes sense on the back of the aggressive Fed moves, and a repricing of the bond curve.

ETHUSD

Source: TradingView

ETHBTC

Source: TradingView

Key levels

2,100 / 2,800 / 3,600 / 4,000

Ethereum getting some love on the back of risk, with meme coins helping – although Solana meme coins are taking poll position on inflows.

We have been short biased on ETHBTC for a while now. The rationale still holds, but there is the potential for meme coins to drive Ethereum higher. We would want to see some excess in the Fed’s response for this to really take hold. Keep an eye on blockchain flow data if you are holding a directional position here.

Longer-term, we still see short ETHBTC as a solid long BTC proxy trade.

Jon de Wet, CIO

Spot Desk

Soft inflation data from the US propelled the AUD/USD to a 19-month high of 0.6930, achieving its first weekly close above 69 cents since February 2023.

During the week, the desk primarily engaged in on-ramping activities, seeing inflows into Bitcoin and Solana as Bitcoin spot prices reached $65,000, supported by positive sentiment from the recently announced Chinese stimulus program.

In altcoins, ARB, ORDI, ILV, and DYDX experienced selling pressure, while PEPE, STX, and RBX were actively bid.

Note that China’s markets will be closed from October 1st for National Day celebrations, which is expected to result in lower trading volumes and less predictable volatility during Asian hours. Looking ahead, increased volatility is anticipated as Q4 begins and the US elections approach, alongside lower interest rates that are expected to boost the economy.

Altcoin in focus

$SAGA (SAGA)

Saga is a Layer 1 protocol that enables developers to effortlessly create VM-agnostic, parallelized, and interoperable dedicated chains, known as “Chainlets.” These Chainlets offer applications with limitless horizontal scalability. Each Chainlet functions as a replica of the Saga Mainnet, sharing the same validator set and security framework.

SAGA has been on an upward trend and is currently forming a bull flag pattern. Over the past week, there has been a significant increase in volume alongside rising prices, suggesting a potential longer-term trend reversal. The price formed a double bottom around the $0.90 level and then broke out strongly after flipping $1.70 resistance. Dips in price could present buying opportunities, particularly within the $2 to $2.25 range, as the trend may continue. The RSI is in bullish territory, and the On-Balance Volume (OBV) indicates strong momentum, but beware that this will be volatile – and it should only be attempted with no leverage and a fundamental underlying belief in the token.

Source: TradingView

* Note that some Zerocap staff hold this token.

The spot desk is well-placed to provide attractive rates for majors, altcoins, stablecoin/Australian dollar and stablecoin/US dollar pairs, featuring T+0 settlement.

Arpit Beri, Operations Analyst

Derivatives Desk

WHOLESALE INVESTORS ONLY

Basis rates on BTC and ETH are edging higher (both up 70 bps from last week):

- BTC’s 90-day annualised basis rate is currently sitting at 8.2%.

- ETH’s is at 6.8%.

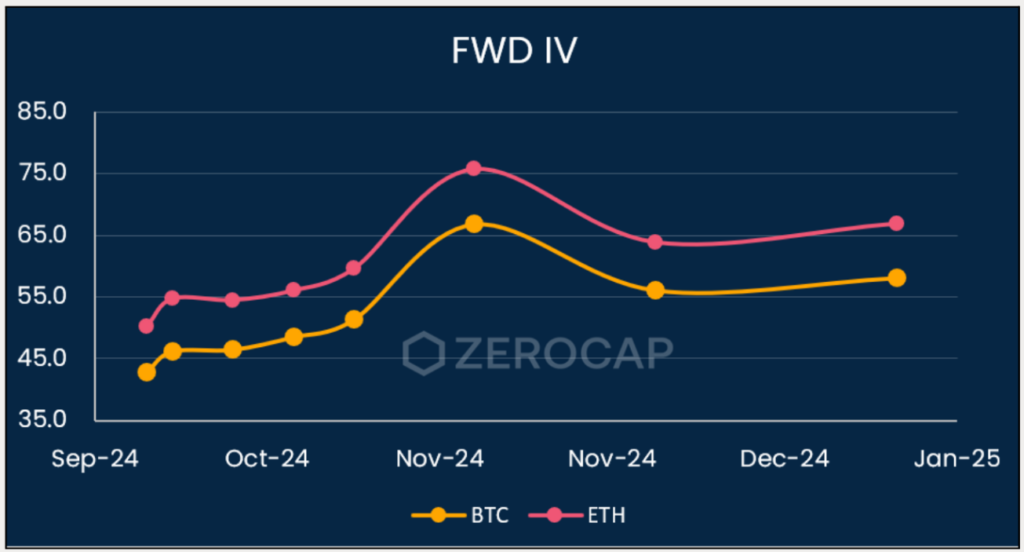

ATM IV has dribbled down across the curve on BTC and ETH since the FOMC interest rate decision. The focus now shifts towards the US elections with a clear spike in forward IV in November (see chart).

With a spike in volatility in November but declining volatility in the short term; structures involving short November 8th options look favourable. Covered calls expiring around the election are a solid way to capture some of the heightened yield premiums, particularly if you believe BTC finds and trades into its range over the coming months.

Berkeley Cox, Derivatives Analyst

What to Watch

- China’s PMI figures and German CPI figures, on Monday.

- US Fed Chair Powell is speaking on monetary policy, on Tuesday.

- The European CPI estimate, on Tuesday.

- US Manufacturing ISM report and labour turnover data, on Wednesday.

- Swiss CPI figures, on Thursday.

- US unemployment rate and PMI figures, on Friday.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

style=”border: 1px solid black;”

Like this article? Share

Latest Insights

What are Liquidity Providers in Crypto

In the rapidly evolving world of cryptocurrencies, liquidity is a fundamental component that ensures the seamless exchange of digital assets. Liquidity providers (LPs) play a

Weekly Crypto Market Wrap: 16th December 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 9th December 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post