25 Nov, 24

Weekly Crypto Market Wrap: 25th November 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

This is not financial advice. As always, do your own research.

Week in Review

- Bitcoin ETF options begin trading, ushering in a new way for investors to hedge their bitcoin exposure.

- The first day of $IBIT options trading sees $1.9B in national exposure traded – 289k calls and 65k puts.

- The Trump administration plans to establish a Cryptocurrency Advisory Committee, with Ripple, Kraken, and Circle vying for seats, including discussions on a Bitcoin reserve strategy.

- XRP surges to hit a 3-year high as Gensler announces SEC departure in Jan 2025.

- Crypto market maker B2C2 taps PV01 to issue its first corporate bond on Ethereum.

- Trump Media is exploring a crypto payments service, as indicated by its trademark filing for “TruthFi.”

- Trump nominates pro-crypto hedge fund manager Scott Bessent as Treasury secretary; also preparing to name Kelly Loeffler, former CEO of crypto company Bakkt, to his cabinet to lead the Agriculture Department.

Technicals & Macro

BTCUSD

Source: TradingView

Key levels

66,000 / 73,000 / 77,000 / 99,800

It’s been a mind-bending week for the crypto space.

Every time it would make sense for some price reversion with some contrarian signals: over 99% of holders in profit right, increasing leverage, a one way market, real money buyers are there to scoop up the downside moves. It’s amazing to consider how bad the bear market felt when FTX, Celsius, Genesis and a host of other firms were going under. Bitcoin at $15K felt like it could be the end of the space – particularly as the venture firms were pulling out with such gusto, lacking investment from every corner. The naysayers were validated, and despite this, the builders kept building.

We are tapping on the 100,000 level, and it’s possible we will break this week. Trump’s convincing win across the Presidency, Congress and Senate is boosting the Trump trade, but particularly favouring bitcoin, and more broadly, the crypto space. Scott Bessent as Treasury pick this week has provided even more heat to the fire. Bessent runs macro hedge fund Key Square Group, and even though he will back Trump’s tax cut and tariff plans, he is expected to prioritise economic and market stability. A little more certainty for the future? The market is liking this – stocks and bonds up, crypto in the lead.

In other institutional news, Cantor Fitzgerald is buying 5% of Tether for US$600M. This is huge, particularly because Howard Lutnick – CEO of Cantor will take up his next role as Secretary of Commerce under President Trump. All of this is setting the scene for a more innovative and supportive environment for the US crypto industry, which should feed further into global sentiment.

Technically we are seeing higher lows, and staying above the short-term ascending trendline from earlier in the month, although at these levels, I would take all technicals with a grain of salt – this is a momentum driven market right now, that’s hanging onto every piece of Trump newsflow. It’s not surprising that Trump is gunning so hard early on – he has a two-years until the mid-term elections, and would want to make the big changes early on to manage support and rollout.

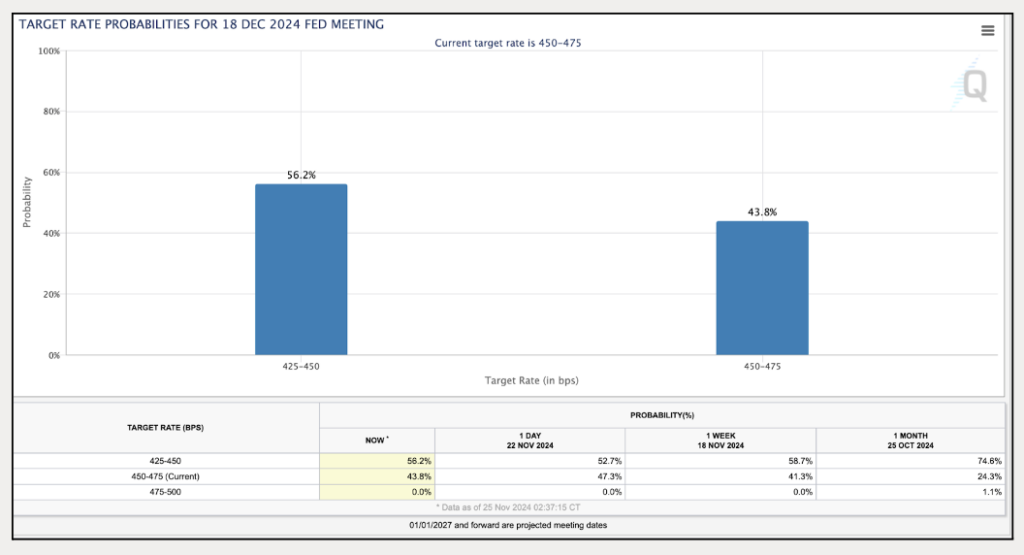

Rate cut probabilities sinking to 56% chance of 25bps Dec cut

The market’s response to this is.. Meh.

Gold finding its legs again

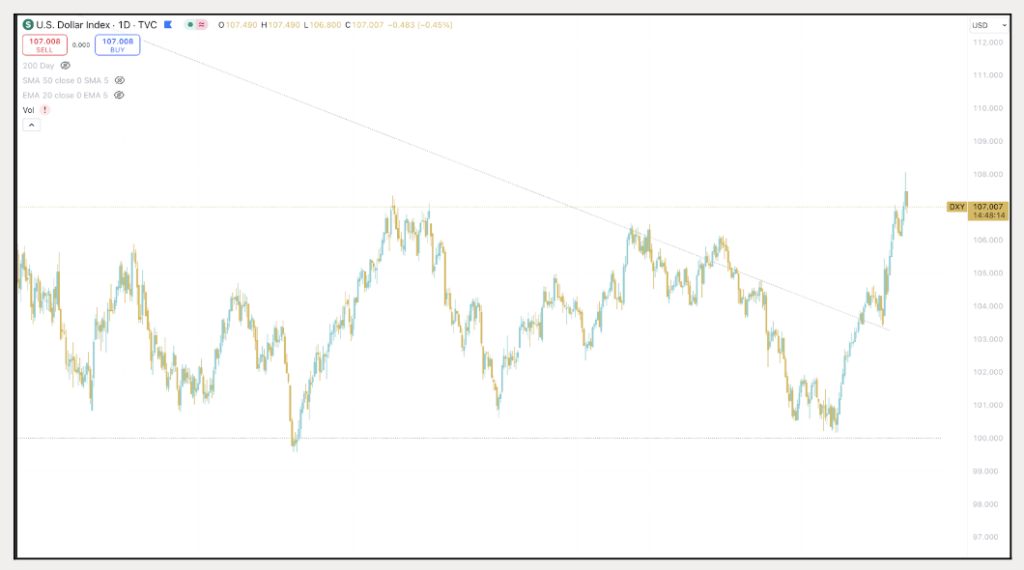

Despite a pumping USD Trump backed dollar

ETHBTC continues to the lower basement.. sorry Berks (our derivs trader who thinks ETH wildly undervalued)

I haven’t even touched on Microstrategy this week – I’m sure we’ll hear more from Saylor on the back of these moves. Microstrategy is trading at an increasing premium to its BTC holdings.. Could this Bitcoin Bank be a reality?

Be careful out there!

Jon de Wet, CIO

Spot Desk

The Australian Dollar (AUD) showed resilience this week, avoiding a further decline against the US Dollar (USD). This stabilisation followed weeks of downward pressure and reflected a modest recovery in market sentiment. The Australian monthly CPI indicator for November is scheduled for release on the 27th, with forecasts set for a 2.3% year-over-year increase. This will be closely watched, as it could provide further insights into inflationary trends within Australia. A higher-than-expected reading could reinforce the outlook for continued hawkish policy from the Reserve Bank of Australia (RBA), potentially offering some support to the AUD. On the other hand, a lower reading may allow the RBA to consider a more dovish stance into the end of 2024.

On the trading desk, activity remained focused on off-ramping as clients adjusted their strategies amidst a volatile market. Bitcoin approached the US$100k mark, prompting selling as traders sought to capitalise on profits. Meanwhile, Solana and Ethereum saw mixed trading behaviour, with both balanced flow, reflecting uncertainty in their near-term trajectories.

Altcoins gained prominence during the week, with notable client interest in SUI, POL, OP, and AVAX. This surge in activity may have been driven by the broader altcoin performance and a potential shift in market sentiment towards higher-growth opportunities. Memecoin activity slowed compared to previous weeks; however, there was still residual interest in PEPE!

Our desk remains committed to delivering tailored cryptocurrency liquidity solutions, offering competitive rates across major coins, altcoins, and memecoins, paired with key fiat currencies. Additionally, we provide T+0 settlement to ensure efficient and seamless trading experiences. For any questions or specific requirements, please feel free to reach out to us.

Reshad Nahimzada, Trading Analyst

What to Watch

- FOMC MINUTES (TUE): At its November meeting, the FOMC cut rates by 25bps to 4.50-4.75%, in line with market pricing and analyst expectations, and in a unanimous decision. The statement saw some changes: it removed language that it “has gained greater confidence that inflation is moving sustainably toward 2%”.

- US PCE (WED): US monthly PCE is due on the 27th November ahead of Thanksgiving. With the monthly CPI and PPI data released, analysts can track the expected Core PCE print, which is the Fed’s preferred gauge of inflation. The CPI report was largely in line with expectations but the PPI report was firmer-than-expected.

- RBNZ POLICY ANNOUNCEMENT (WED): The RBNZ is expected to continue cutting rates with money markets pricing a 70% likelihood for the central bank to lower the Official Cash Rate by 50bps to 4.25% from the current 4.75% level and less than a 30% chance of a greater 75bps move.

- AUSTRALIAN CPI (WED): Australia’s monthly CPI data for October will be eyed to see if there is further progress on bringing inflation down following the deceleration seen in the September monthly reading which saw the Weighted CPI YY print softer than expected at 2.10% vs. Exp. 2.40% (Prev. 2.70%).

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at hello@zerocap.com

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 11th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 4th August 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 28th July 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post