24 Feb, 25

Weekly Crypto Market Wrap: 24th February 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

This is not financial advice. As always, do your own research.

Week in Review

- Bybit suffers a $1.5bn heist, surpassing 2024’s biggest hacks- tripling scale of Mt. Gox *(Zerocap trading unaffected).

- Hong Kong (SFC) aims to become a global crypto hub with new token listings, derivatives, and staking, unveiling the ‘ASPIRe’ roadmap.

- FTX begins $1.2B repayments, marking a key moment in crypto recovery, with $16B worth of creditor repayments starting February 2025.

- Metaplanet increased Bitcoin holdings to 2,100 BTC with its recent purchase.

- Franklin Templeton launches Bitcoin and Ether index ETF.

- 2025 saw 22 crypto-sports deals averaging $4.3M, up from 18 deals at $2.6M last year.

- Coinbase has become the official sponsor of Aston Martin’s Formula One team, with the deal paid entirely in USDC stablecoins.

Technicals & Macro

BTCUSD

Key levels

66,000 / 72,000 / 92,000 / ~110,000 (just north of the all-time high)

The Bybit hack.. all eyes on the Bybit hack.

At this stage it looks to be Lazarus, the North Korean hacking group, who took close to $1.5B in ETH stocks from a Bybit controlled Safe wallet. Safe is a decentralized custody protocol that provides smart contract driven wallets. The total assets on the exchange plunged from around $16.9 billion to $11.2 billion according to on-chain data.

We’ve seen these kinds of bank runs before, and the market generally chooses to bank run first, and ask questions later. This weekend was no different, with a momentous amount of withdrawals. Co-founder and CEO Ben Zhou handled this crisis incredibly – in fact, of all the tail events and bear markets I’ve seen in this space, this was handled with the greatest poise. Zhou was holding livestream events during the chaos, reassuring the traders and firms that the exchange was working through all withdrawals and that Bybit was solvent throughout. No sugarcoating, just the reality of the event, and how they were dealing with it. Bybit’s networks are wide-reaching, and there were a number of sizable loans that came in to backstop ETH liquidity. What is truly mindblowing is just how profitable Bybit actually is, which is coming to light when taking into account the treasury that is ultimately backstopping net equity. In Zhou’s words, he would’ve been concerned if it was a $10B hack, but $1.5B – no stress.

There are a few voices, Arthur Hayes in particular, discussing the potential to rollback the Ethereum network to make the stolen funds unusable. This is akin to hitting the rewind button on the whole blockchain, which presents some pretty serious implications – the blockchain being truly “immutable” for one. Watch as this debate heats up in the coming weeks.

Price action around this event saw BTCUSD dump from 99,000 to ~95,000 on the back of expected ETH selling and broader contagion risks. It was actually a fairly measured move, which is a sign of an asset class that is truly growing up. We are seeing real money buyers at these levels, but with limited gusto.

It’s a quieter week on the macro front, but prelim US GDP and the PCE inflation numbers should bring some chatter on the Fed’s cutting cycle. Importantly equities have had a rough run over the past week – with Friday seeing Wall Street’s worst session for the year. Tariffs and questions around whether the US can maintain its position of hegemony, are leading to some repositioning of risk flows.

Back to crypto – we seem to be back in a sideways, yet buoyant market, waiting for the next spark.. again.

Dollar index continuing back into the multi-year range

DXY now in correction territory, with long-dated yields taking a breather on interest rate shifts.

Gold poking above highs (again)

As mentioned last week, given comments on DXY and risk flows, gold is yet again a natural benefactor. We mentioned the potential to go higher, and even though price is compressing here, grinding higher is the path of least resistance against global uncertainty.

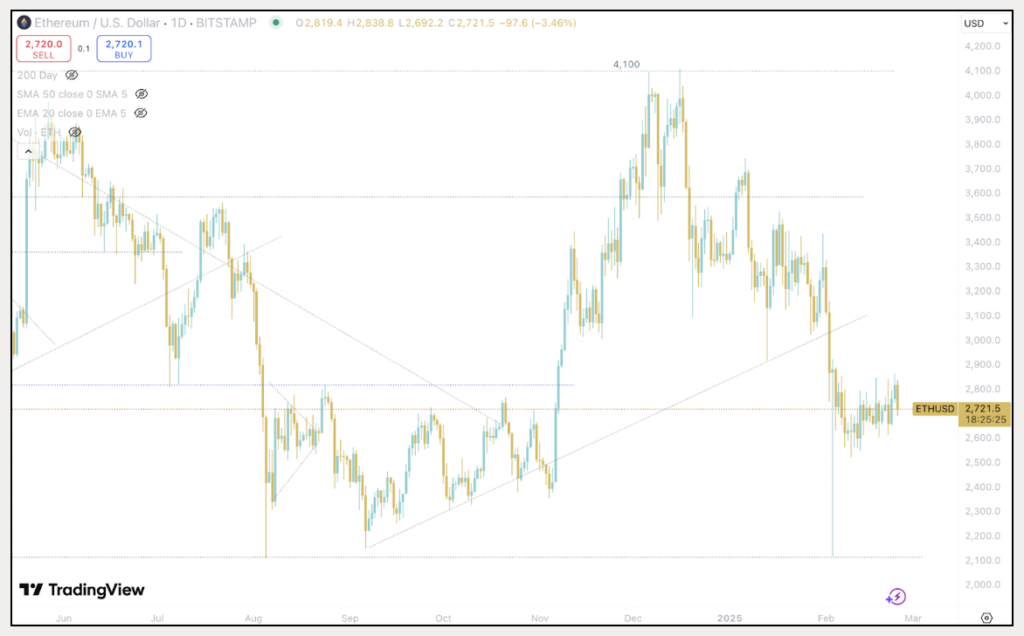

ETHUSD

ETH reverting on the Bybit hack, but not the violent move we’d expect in 2018/19 markets.

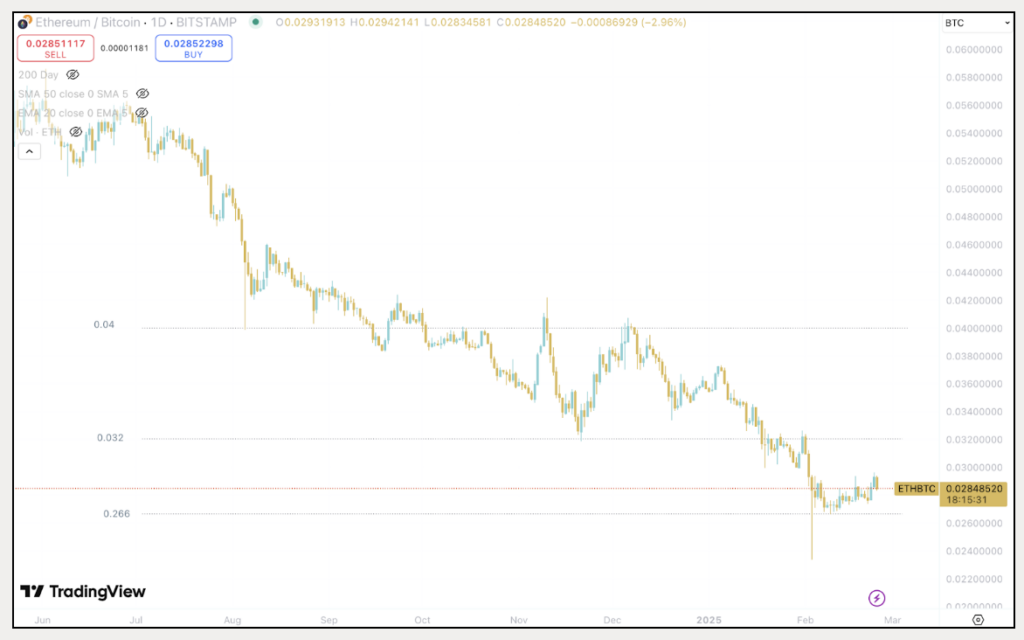

ETHBTC

ETHBTC consolidating, do we move to the top of the current range?

Safe trading out there!

Jon de Wet, CIO

Spot Desk

The Australian Dollar (AUD) posted another green week, climbing above $0.64, a level last seen in early December last year. This strength was supported by strong job numbers, amidst the Reserve Bank of Australia’s (RBA) interest rate decision, which came in at a benchmark 4.1%, Australia’s first cut since 2020.

The Bybit hack news triggered a sharp sell-off, with Ethereum dropping nearly 8% before demonstrating a strong recovery. Bitcoin demonstrated strength prior to the hack, having increased from a low of $93,388 on Wednesday to a high of $99,497 on Friday. However, it failed to break the $100k mark. Following the hack, BTC reversed the earlier gains, dropping by around 4%, and while it demonstrated a slight recovery, it failed to break above $97,000 and has remained in a consolidation range since. Altcoins saw deeper declines, with Solana, XRP, and Dogecoin experiencing notable pullbacks.

On our desk, on-ramp demand for USDT continued to rise, reflecting sustained investor appetite for stablecoins. BTC and ETH trading was mixed, with clients both buying and selling. Interest in altcoins remained relatively subdued as traders focused on major assets amid the recent market turbulence.

Notably, institutional interest in Solana gained momentum after Franklin Templeton, a $1.46T asset manager, officially filed for a Solana (SOL) spot ETF. The ETF, set to be listed on the Cboe BZX Exchange with Coinbase as custodian, could drive significant capital inflows if approved. While Solana’s price has been on a downtrend for over a month, our spot desk has observed increased accumulation of SOL, reflecting continued demand despite recent price weakness.

The OTC desk continues to offer tailored cryptocurrency liquidity solutions, offering competitive pricing across major coins, altcoins, and memecoins, paired with key fiat currencies. With T+0 settlement, we ensure seamless trading and settlement.

Reshad Nahimzada, Trading Analyst

Derivatives Desk

WHOLESALE INVESTORS ONLY*

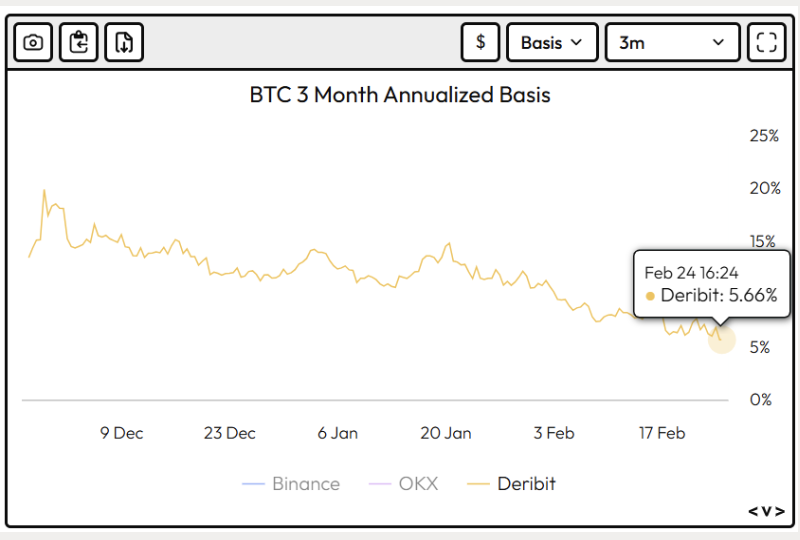

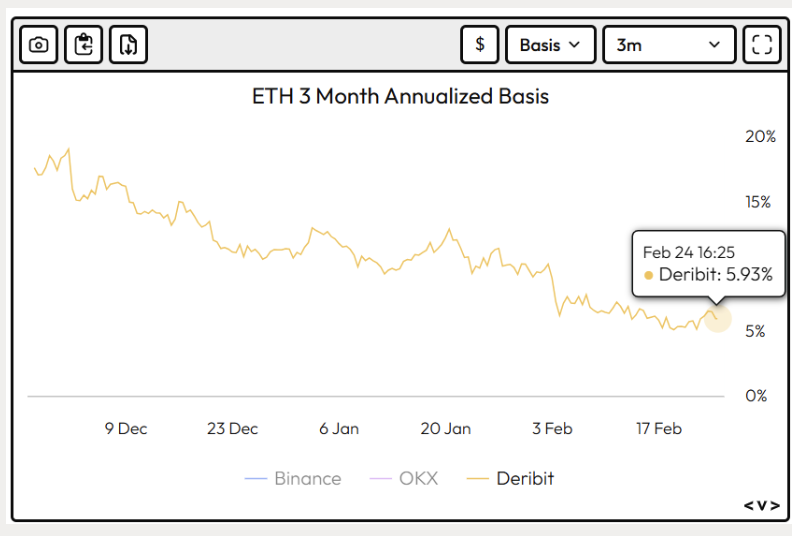

ETH Basis Rate is slightly higher on the week but BTC continues to move lower:

- ETH is up (5.93%).

- 90-day annualised Basis Rates on BTC is down 80 bps to 5.66%

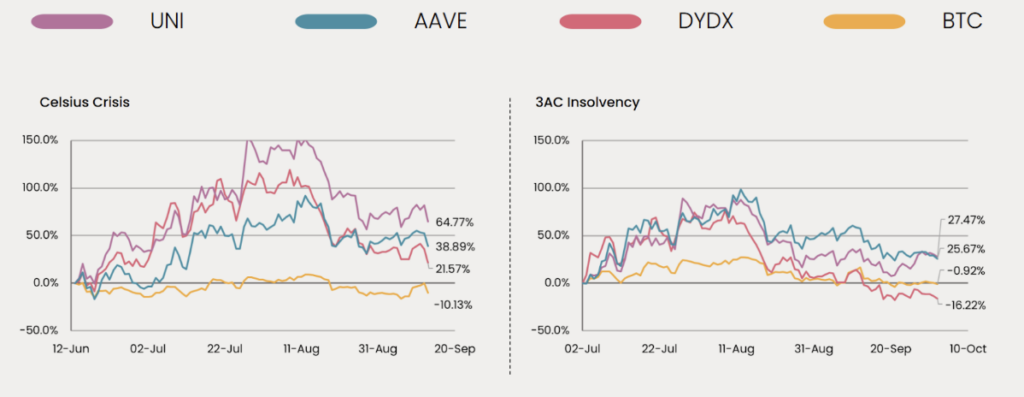

DeFi tokens have historically outperformed in the months after centralised (CEX) market contagion events in the crypto space. While the Bybit situation seems to be mostly resolved for now, market participants could sway towards decentralised protocols until all of the dust has settled – giving potential for upside in prices of DeFi governance tokens. We saw this pattern playout last cycle after the collapse of 3AC and Celsius.

If one believes that we could see a similar trend playout here, and is looking to enter a position in a DeFi Token at an optimised level, they could look at Discount Notes.

Trade idea: 6-Month DeFi Discount Note (e.g. AAVE)

OVERVIEW

The structure has a binary payout outcome depending on the price of AAVE observed at expiry. Payout for this options strategy depends on the price of AAVE at expiry with reference to the Strike Level – the two scenarios are:

Expiry Price above Strike Price (25% above current price)

- Maximum return of 39% – received in USD.

Expiry Price below Strike Price:

- 10% discounted purchase price at current levels into the AAVE token – received in Spot.

RISK PROFILE

Maximum loss for this product is the initial investment amount.

May suit investors with a stable to moderately bullish view on AAVE.

May not suit investors who think a major bull run in AAVE is likely before expiry.

May not suit investors who think AAVE will fall significantly before expiry.

What to Watch

Australian CPI (Jan) – Wednesday, 26 Feb: Markets watch for confirmation that inflation remains within the RBA’s 2-3% target, following the recent rate cut to 4.10% and Governor Bullock’s cautious stance on further easing.

US PCE (Jan) – Friday, 28 Feb: The Fed’s preferred inflation gauge is expected to edge lower, with investors assessing whether this supports the case for a mid-year rate cut.

ECB Minutes – Thursday, 27 Feb: Traders look for further clarity on how policymakers view inflation trends and whether recent economic weakness strengthens the case for earlier rate cuts.

Japanese Tokyo CPI (Feb) – Thursday, 27 Feb: Core inflation is expected to slow, with markets gauging its implications for the Bank of Japan’s tightening path later this year.

China NPC Standing Committee (Mon-Tue, 24-25 Feb): Lawmakers will discuss key economic policies, including potential stimulus measures, with focus on fiscal spending and private sector support.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 19 January 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 12 January 2026

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 22nd December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post