23 Sep, 24

Weekly Crypto Market Wrap: 23rd September 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

This is not financial advice. As always, do your own research.

Week in Review

- Kamala Harris spoke publicly about digital assets for the first time.

- Gold hit a new all time high as bitcoin rallied to this month’s peak above $64K, and the US dollar strengthened against the yen.

- Altcoins pumped after the Fed lowered interest rates.

- SEC approved Nasdaq to list options on iShares Bitcoin Trust ETF, an important milestone in derivatives trading.

- US spot bitcoin ETFs recorded inflows worth $92 million on Friday.

- YouTube channel of the Supreme Court of India was compromised and used for streamed crypto ads.

Technicals & Macro

BTCUSD

Key levels

53,000 / 55,000 / 66,000 / 72,000 / 73,794 (ATH!)

We got the 50 bps cut last week from the Fed and are off the races. The Nasdaq and S&P equity indexes saw all-time highs, as did gold, and now BTCUSD is on the way to 65,000. We’ve now broken the technical descending wedge, and are heading higher with a little gusto. Feds Funds Futures are now pricing in a 50/50 chance of another 50 bps cut (vs 25 bps), which signals we are well into the rate cutting cycle.

Bitcoin has a lot going for it right now. The upcoming US election has been buoying, and then compressing prices, depending on the Trump/Harris polls. Trump’s stance is clearly long energy, banks and bitcoin. Harris’ crypto stance has been less forthcoming, however on Sunday (22 Sep) she indicated some positive sentiment with comments, “We will encourage innovative technologies like AI and digital assets, while protecting our consumers and investors.”. It’s not a slam dunk on policy like Trump, but she can clearly see voters’ desire for better free markets in emerging technologies.

The other key catalyst to BTCUSD upside is what we are seeing in risk markets and gold – which are up with some conviction. The gold thematic is rallying on the repricing of bond returns and USD weakness, but there is also the scarcity narrative that bitcoin shares. Easing monetary policy, more liquidity and a seemingly endless desire to quantitatively ease when times get tough is leading to more interest in assets that hold a scarcity premium. Gold’s market cap is ~ USD $17.8T while bitcoin’s is ~ USD $1.2T. This represents close to a 15x gap to close – and our analysts believe we could get there in the next 10-years. This would represent a BTC price of ~950K USD.

Michael Saylor’s latest assertions are that bitcoin currently accounts for 0.1% of global capital, but could eventually target 7%. This opens the possibility for some massive growth even if he is only partly right.

In any event, this week will be an interesting one to watch as the market digests the Fed cuts, and looks towards final GDP data and the Fed’s preferred inflation gauge – the Core PCE Price Index this week.

Gold continues to blast

Source: TradingView

ETHUSD

ETHBTC

Source: TradingView

Key levels

2,100 / 2,800 / 3,600 / 4,000

Last week we mentioned that we are still short biased on ETHBTC, despite it hitting multi-year lows and seeing levels not touched since 2021. We also mentioned that despite this, it was tough to make the case for a momentum trade when it’s already come this far on a short-term basis. We are now seeing some reversion on the back of orderflow – the ETHBTC ratio has come a long way, and at some point it needs to rebalance.

Longer-term, we still see short ETHBTC as a solid long BTC proxy trade.

Jon de Wet, CIO

Spot Desk

The Australian dollar strengthened this week, reaching its highest weekly close of the year. This was driven by anticipation for a hold by the Reserve Bank of Australia’s meeting on the back of inflation and monetary conditions.

The desk primarily facilitated on ramping during the week. Following the US Federal Reserve’s rate cut decision, the week saw an uptick in volume. There was a notable demand for major cryptocurrencies, especially bitcoin, ethereum, and solana.

Additionally, some altcoins, like OM and Sei, also attracted interest.

In the coming weeks, volatility is expected as the US elections approaches and lower interest rates help boost the economy.

Altcoin in focus

$TAO (Bittensor)

Bittensor is a system that uses blockchain technology to create a decentralised network for machine learning. Machine learning models in this network work together, and they are rewarded with a cryptocurrency called TAO based on how useful their information is to the whole network. Users can also access this network and get information from it, while also customising it to fit their specific needs.

TAO has exhibited a remarkable surge, gaining nearly 100% in just a week. This impressive rally has not only broken through key resistance levels but has also transformed them into solid support zones. RSI is well placed above 70+ on H12 time frame, depicting strong buying strength. Such a strong upward trend suggests that a momentum-based trading strategy could be effective, but beware that this will be volatile – and it should only be attempted with no leverage and a fundamental underlying belief in the token.

Investors seeking to capitalise on TAO’s bullish momentum might consider buying on dips, assuming the overall trend remains intact. Levels between $450 and $480 could offer attractive entry points for accumulation.

The spot desk is strategically positioned to offer competitive rates for stablecoin/Australian dollar and stablecoin/US dollar pairs, along with T+0 settlement.

Arpit Beri, Operations Analyst

Derivatives Desk

WHOLESALE INVESTORS ONLY

Basis rates on BTC and ETH are relatively unchanged despite the rally in spot prices over the week:

- BTC’s 90-day annualised basis rate is currently sitting at 7.5%.

- ETH’s is 130 bps lower at 6.1%.

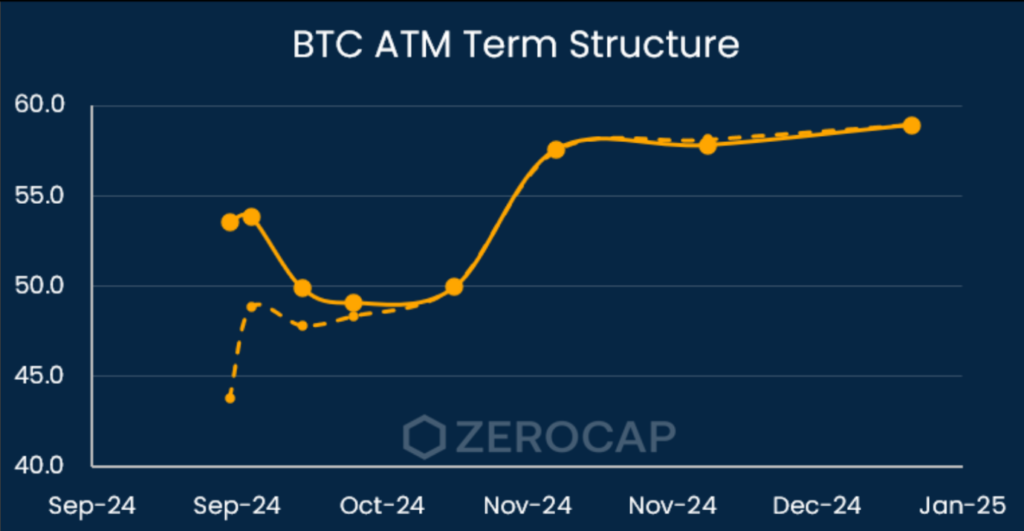

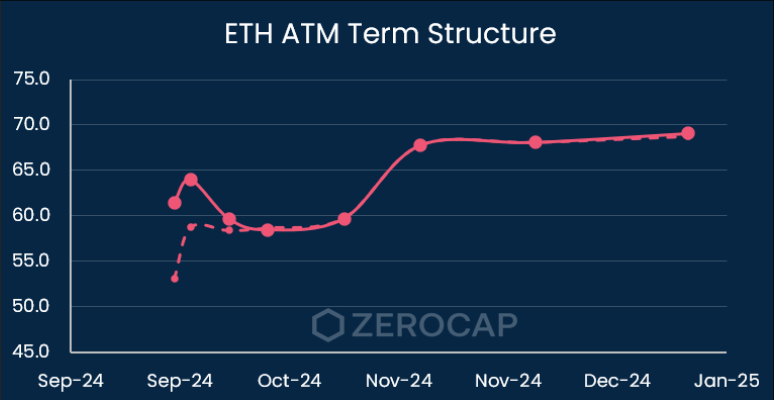

Recent spot moves are being reflected in the term structure with a slight spike in front-end ATM IV.

- One-week ATM IV on BTC and ETH is being priced roughly 4 vol points above one-month ATM IV.

7-day/30-day calendar spreads could be an interesting trade if one believes that the term structures on BTC and ETH will quickly revert back to the mean.

Berkeley Cox, Derivatives Analyst

What to Watch

- British, US, French & German PMI figures, on Monday.

- Australian Interest Rates, on Tuesday.

- US Consumer confidence report, out on Wednesday.

- Australian CPI figures, on Wednesday.

- Swiss Bank Interest Rates, on Thursday.

- The US Federal Chair is speaking and the US GDP and Unemployment Claim figures are out, on Thursday.

- Canadian GDP figures and CPI figures, on Friday.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

style=”border: 1px solid black;”

Like this article? Share

Latest Insights

Weekly Crypto Market Wrap: 1st December 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 24th November 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 17th November 2025

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post