23 Dec, 24

Weekly Crypto Market Wrap: 23rd December 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

This is not financial advice. As always, do your own research.

Week in Review

- Donald Trump appoints Bo Hines as the head of the Presidential Council of Advisers for Digital Assets

- Ripple officially launches $RLUSD stablecoin.

- US Bitcoin ETFs have surpassed Gold ETFs in AUM, flipping gold despite its 20 year lead.

- Cango Inc, a Chinese NYSE-listed auto trading platform, has quietly transformed into a top Bitcoin miner, matching the hashrate of the largest US miner, MARA.

- US Senator Cynthia Lummis says “2025 will be the year for Bitcoin & digital assets.”

- SEC approves first spot Bitcoin and Ethereum combo ETFs from Hashdex and Franklin Templeton

- Binance.US plans to resume USD services in early 2025, anticipating alleviations in U.S. crypto regulations.

- Deribit has partnered with Paxos to introduce trading for Pax Gold ($PAXG). $PAXG is an ERC-20 token by Paxos, pegged to the value of physical gold in a London LMBA certified vault.

Technicals & Macro

What a week, and what a year!

2024 has truly been something else. Of all the crypto milestones over the past 15-years, 2024 had something about it. The institutional adoption has been on another scale – we’ve seen the world’s largest asset manager launch a bitcoin spot ETF, opening up access to more of the world. Regulatory battles with the SEC saw the industry fighting back, and sometimes winning in the case of Ripple. South America, Africa, and Southeast Asia saw large adoption from emerging markets – driven by access and economic freedom. Stablecoins as a payment mechanism drove much higher market caps in fiat backed tokens, and we expect this to continue as the US ushers in crypto-friendly Donald Trump to his Presidency. Innovation was pursued, and Venture Capital is back with force backing the new blockchain disruptors. Of everything that happened this year, the most notable in our minds is the cementing of bitcoin as a true global asset. One that can be held by corporates and sovereigns alike to hedge their exposure to fiat based assets. We think you’ll be hearing a lot more about this ‘hedge’ in 2025.

So make sure to sit down with a whiskey or kombucha at some point over the next few weeks, and really reflect on the year that was. Thanks for joining us on the journey!

BTCUSD

Key levels

66,000 / 73,000 / 92,000 / ~108,364 (all-time high)

This week – we hit a new BTCUSD high yet again on the back of the seemingly unstoppable momentum, before the FOMC decided to take the wind out of the sails. The Fed went with the expected 25bps cut, but the market was hanging onto every word of Powell’s speech, which cautioned a measured approach into 2025. The new forecasts are now implying only two 25bps cuts next year – which saw markets adjust pricing across asset classes. AUDUSD hit 0.6198 – which for context was below what it traded at during the entire 2008 GFC. Combine the FOMC ‘surprise’ with the fact that we are entering a lower liquidity period, and we are seeing extensions on moves.

It’s a very interesting time for inflation and growth across the world, with the US economy still powering ahead of other countries. Combine this with positive market expectations around Trump’s fiscal policies, and it makes sense that assets like bitcoin are remaining relatively buoyant, even in risk-off moments. Trump’s policy platform – which favours energy, banks and bitcoin, is alive and well – and we view the current drawdown in BTCUSD as order flow driven after one helluva run. In normal market conditions, we’d expect bitcoin’s price to remain fairly resilient above U90,000, but the lower liquidity December period may have other ideas if we see a break lower. The gap extension and meteoric rise above 75,000 is exposed based solely on technical analysis, but fundamentally I think we have too much happening in the lead up to Trump’s inauguration to head that low. Just this week, he’s announced crypto friendly Stephen Miran as Chair of Council of Economic Advisers, and there could be more speculation in the lead up to Jan 20th.

In any event, we expect bitcoin to outperform other major cryptocurrencies and altcoins on a relative basis over the coming quarter on the back of a supportive US regulatory environment, a strong US economy, and Microstrategy in the Nasdaq 100 – which opens the door for passive capital to allocate via index ETFs.

ETHBTC

ETHBTC continues to head South on risk aversion after the FOMC. It’s not a nice trade either way here – sure it’s come a long long way, but could it go further? Yes. Could it bounce convincingly? Yes.

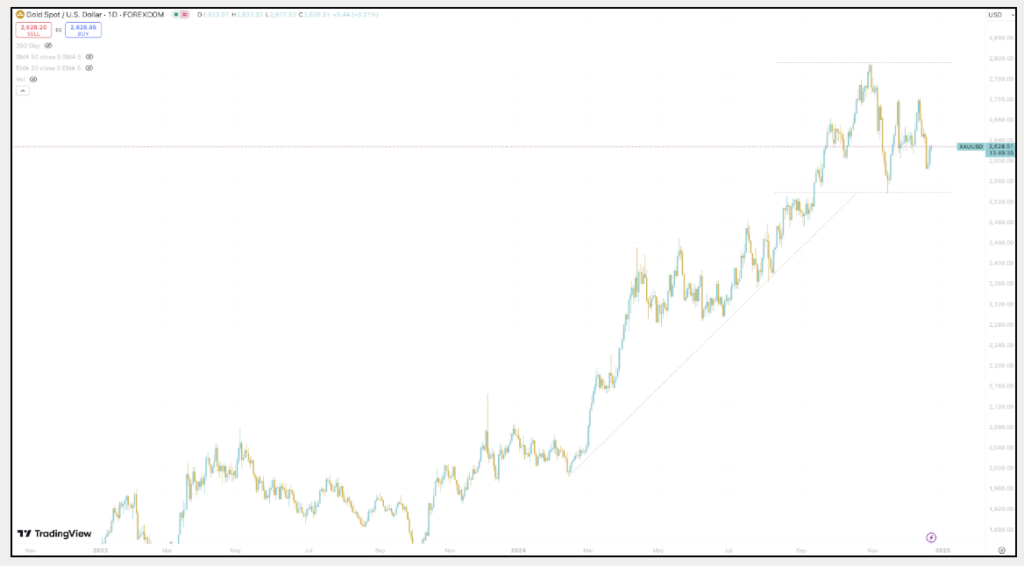

Gold finding its range

Macro, focused on interest rates in particular, will be the likely driver of this guy into 2025. Our favourite relative value trade right now is long BTC / short gold, as the market cap is still relatively very wide between these assets.

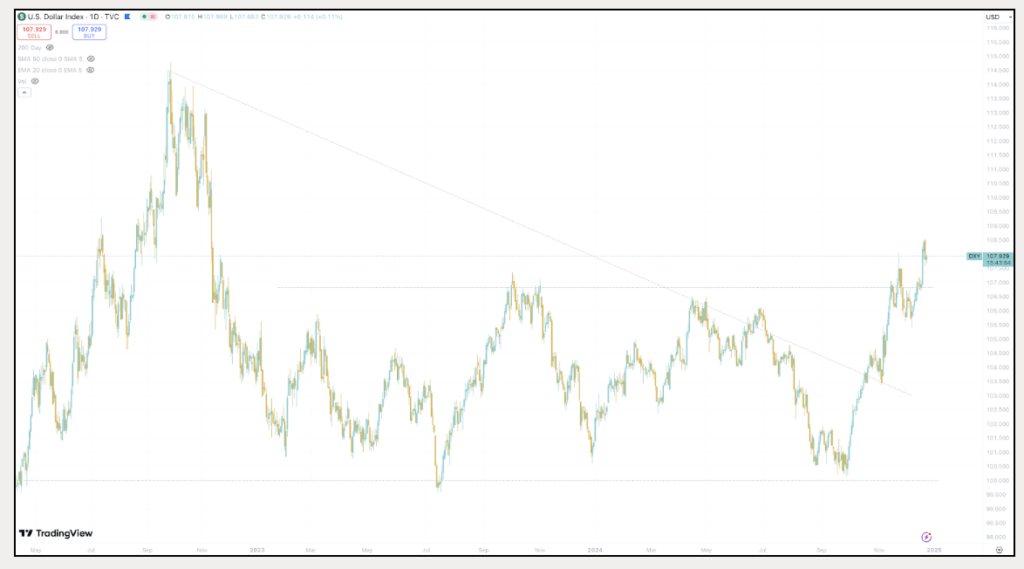

Dollar index hanging in the multi-year range

DXY breaking higher on the yield curve repricing. Some factors for 2025 include a resurgence in US manufacturing and further broad strength in the US economy, which could lead to a further bid USD on both growth and inflation expectations.

Be safe out there, and have a wonderful break everyone.

Jon de Wet, CIO

Spot Desk

Last week was a pivotal one for global markets, driven by the Federal Reserve’s final policy meeting of the year. As mentioned, the FOMC was in the spotlight with their 25bps reduction to the federal funds rate. This marked the third consecutive rate cut of the year, lowering borrowing costs to the 4.25% – 4.5% range, as widely anticipated. The prepricing of the forward curve was also supported by expectations of higher “neutral” interest rates over the medium term. The Australian Dollar (AUD) responded in force by plummeting to 62 US cents, its lowest level since October 2022.

Federal Reserve Chair Jerome Powell made notable remarks about Bitcoin during his post-FOMC meeting press conference, highlighting regulatory concerns and the potential risks associated with the cryptocurrency’s growing prominence. Powell’s cautious tone rattled markets, leading to a sharp sell-off in Bitcoin, which dropped to a low of $92,175 just days after it reached an all time high of $108,268.

On the desk..

As we have seen previously when AUD/USD is trading below 0.65, clients heavily skew towards offramping USDT/AUD.

Altcoins were not spared from the FOMC fallout, with many experiencing significant declines as investor sentiment turned risk-averse. The total crypto market capitalisation dropped sharply from a high of $3.73 trillion on Tuesday, to a low of $3.05 trillion on Friday, reflecting widespread uncertainty and a flight to safety among traders.

As a result, the majority of our crypto flow was predominantly focused on clients selling. However, some saw the market decline as a buying opportunity, leading to accumulation in BTC, ETH and SOL, as well as smaller-cap coins including SEI, GRT, BASEDAI, INST, and AERO.

Zerocap’s OTC desk is committed to delivering tailored cryptocurrency liquidity solutions, offering competitive rates across major coins, altcoins, and memecoins, paired with key fiat currencies. We also ensure smooth trading experiences with T+0 settlement.

Please don’t hesitate to get in touch with us.

Reshad Nahimzada, Trading Analyst

Derivatives Desk

WHOLESALE INVESTORS ONLY*

Following a sharp downtick in ETH’s price, implied volatility for the January 31st expiry has increased significantly, rising by 5.5 weighted volatility points overnight.

We see this as an ideal opportunity to sell volatility, anticipating a reversion to the mean. This can be executed using Yield Entry Notes for those looking to buy if ETH dips further, or Yield Exit Notes for those willing to sell if ETH recovers. With the January 31st expiry, yields of 40%+ p.a are achievable.

For those uninterested in buying or selling ETH, and focused solely on trading volatility, selling straddles could be a suitable strategy. The January 31st expiry straddles are priced at 19.9%, meaning the breakeven points are 19.9% above and below the current spot price of ETH. If ETH’s price stays within this range by expiry, the position will yield a profit.

For example, if ETH is trading at $3,300, selling the straddle involves simultaneously selling the $3,300 strike call and the $3,300 strike put. The total premium received is 19.9% of the current spot price, or approximately $656. The breakeven points are:

- Upside breakeven: $3,300 + $656 = $3,956

- Downside breakeven: $3,300 – $656 = $2,644

Payoff Scenarios:

- If ETH closes between $2,644 and $3,956, the position is profitable. Any price movement within this range results in a smaller loss than the premium collected, leading to a net gain.

- If ETH closes above $3,956 or below $2,644, the position begins to incur losses beyond these breakeven points. Losses are theoretically unlimited on the upside and significant on the downside.

This strategy is ideal for traders expecting ETH to remain range-bound or implied volatility to revert. By selling the straddle, you’re effectively betting that ETH’s price will not make a significant move in either direction before expiry.

Contact the desk for more information if you qualify as a wholesale investor.

Austin Sacks, Derivatives Analyst

What to Watch

- RBA Meeting Minutes (Tuesday): The minutes will provide insights into the Reserve Bank of Australia’s monetary policy outlook, potentially impacting the AUD, Australian equities, and global risk sentiment.

- US Consumer Confidence (Tuesday): This report reflects consumer optimism and spending patterns, influencing US equities, the USD, and expectations for Fed policy.

- US New Home Sales Change (MoM) (Wednesday): As a key indicator of housing market health, this data will affect homebuilder stocks, mortgage rates, and economic growth outlooks.

- US Initial Jobless Claims (Friday): The weekly claims data will offer a real-time view of labor market strength, shaping risk asset performance and influencing Federal Reserve policy discussions.

* Index used:

| Bitcoin | Ethereum | Gold | Equities | High Yield Corporate Bonds | Commodities | Treasury Yields |

| BTC | ETH | PAXG | S&P 500, ASX 200, VT | HYG | SPGSCI | U.S. 10Y |

Contact Us

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at [email protected]

DISCLAIMER

Zerocap Pty Ltd carries out regulated and unregulated activities.

Spot crypto-asset services and products offered by Zerocap are not regulated by ASIC. Zerocap Pty Ltd is registered with AUSTRAC as a DCE (digital currency exchange) service provider (DCE100635539-001).

Regulated services and products include structured products (derivatives) and funds (managed investment schemes) are available to Wholesale Clients only as per Sections 761GA and 708(10) of the Corporations Act 2001 (Cth) (Sophisticated/Wholesale Client). To serve these products, Zerocap Pty Ltd is a Corporate Authorised Representative (CAR: 001289130) of AFSL 340799

This material is intended solely for the information of the particular person to whom it was provided by Zerocap and should not be relied upon by any other person. The information contained in this material is general in nature and does not constitute advice, take into account financial objectives or situation of an investor; nor a recommendation to deal. . Any recipients of this material acknowledge and agree that they must conduct and have conducted their own due diligence investigation and have not relied upon any representations of Zerocap, its officers, employees, representatives or associates. Zerocap has not independently verified the information contained in this material. Zerocap assumes no responsibility for updating any information, views or opinions contained in this material or for correcting any error or omission which may become apparent after the material has been issued. Zerocap does not give any warranty as to the accuracy, reliability or completeness of advice or information which is contained in this material. Except insofar as liability under any statute cannot be excluded, Zerocap and its officers, employees, representatives or associates do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this material or any other person. This is a private communication and was not intended for public circulation or publication or for the use of any third party. This material must not be distributed or released in the United States. It may only be provided to persons who are outside the United States and are not acting for the account or benefit of, “US Persons” in connection with transactions that would be “offshore transactions” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”)). This material does not, and is not intended to, constitute an offer or invitation in the United States, or in any other place or jurisdiction in which, or to any person to whom, it would not be lawful to make such an offer or invitation. If you are not the intended recipient of this material, please notify Zerocap immediately and destroy all copies of this material, whether held in electronic or printed form or otherwise.

Disclosure of Interest: Zerocap, its officers, employees, representatives and associates within the meaning of Chapter 7 of the Corporations Act may receive commissions and management fees from transactions involving securities referred to in this material (which its representatives may directly share) and may from time to time hold interests in the assets referred to in this material. Investors should consider this material as only a single factor in making their investment decision.

Past performance is not indicative of future performance.

Like this article? Share

Latest Insights

What are Liquidity Providers in Crypto

In the rapidly evolving world of cryptocurrencies, liquidity is a fundamental component that ensures the seamless exchange of digital assets. Liquidity providers (LPs) play a

Weekly Crypto Market Wrap: 16th December 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Weekly Crypto Market Wrap: 9th December 2024

Zerocap is a market-leading digital asset firm, providing trading, liquidity and custody to forward-thinking institutions and investors globally. To learn more, contact the team at

Receive Our Insights

Subscribe to receive our publications in newsletter format — the best way to stay informed about crypto asset market trends and topics.

Share

Share  Tweet

Tweet  Post

Post